Readers Write: Return Data to Hospitals and Researchers for Patients

Return Data to Hospitals and Researchers for Patients

By Amanda Borens

Amanda Borens, MS is chief data officer of Aridhia Informatics of Glasgow, Scotland.

As a data scientist formerly working in global health, I have firsthand knowledge of how challenging it is to recruit patients for clinical trials and observational studies, and how transformational a culture of open collaboration and data sharing can be. I have cancer diagnoses in my history, accompanied by so much fatigue from being extensively examined and poked and prodded, but I’m also a scientist in the health technology industry with appreciation for the way that humans advance medical knowledge.

I have eagerly signed up for clinical studies and taken on extra burdens, such as blood draws and filling out forms, to help researchers as well as those in training. Even when that means being examined by a nervous medical student and then repeating myself to a physician.

Then why did I balk when my health system asked me to participate by openly sharing my EHR data for research?

I collaborated with renowned medical ethicists who taught me to embrace the idea that a patient owns their data. That idea was cemented in me when I became a participant in various studies that led to peer-reviewed publication. I had been working in my non-profit world to aggregate data from multiple sources to learn more about rare diseases. I became frustrated that companies would keep shareable data confidential to avoid letting competition find insights that they had missed. I was shocked to learn that many scientists in academic settings hoard data in the same way, fearing that someone might find something they missed in the data and publish it.

In all cases, the stewards of the data seemed to forget that patients sacrificed time, blood, energy, and more to help all humanity, not the personal careers of their physicians or the bottom lines of sponsoring drug companies. That intention matters, and is worth honoring.

This brings me to my personal hesitation when asked to share my EHR data for research. I’ve been to data science conferences where abstracts were presented by employees of this health system. I know the kinds of questions my data would answer. Those questions tend to be focused on how to keep hospitals profitable. While I know that this is a valid concern for administrators in hospitals, I want my personal health information to be used to help other patients like me have a better experience, and I don’t much care what that would cost.

I want to be a piece of data that led to a cure for this, a better treatment for that, an earlier detection of my cancer for others, a less-invasive surveillance journey, or a better experience with caregivers. I want to share my EHR data with my incredible team of oncologists and researchers so they can learn. I want my data to be compiled with that of others so that they can learn more and faster.

However, I know that my doctor won’t be able to access aggregated data that way in my clinic. I know he had to use an Excel spreadsheet to keep track of data in the landmark oncology study he recruited me to join.

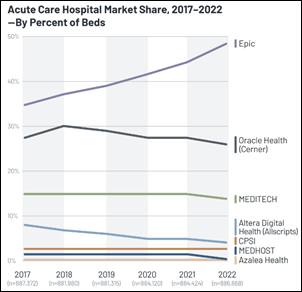

Conversely, aggregated claims databases can be used to answer questions about health economics. Some cost money to access, and sometimes researchers can access those external data sources with cost waived. Beyond payer-aggregated data sets, Epic has a respectable database and Cerner does too, both of which are valuable for review of de-identified patient data. But what about empowering researchers and clinicians in their unique patient communities? Shouldn’t we be honoring the patients’ commitment to advancing medical science by empowering clinicians and researchers to more easily use more data in their own hospitals? What does that look like?

The US government mandates that healthcare IT developers like Cerner and Epic provide their customer base with a certified FHIR API to support patient access to health information by December 31, 2022 as part of the 21st Century Cures Act Final Rule. This mandate requires that certified health IT developers publish “service base URLs” or “endpoints” for all customers in a machine-readable format at no charge. I hope this will be an inflection point.

Additionally, patient-focused drug development mandates are demanding greater listening to the voice of the patient, and that means tighter connection between pharmaceutical companies and real-world data from clinical settings. Hospitals with an investment in a next-generation research environment will be able to procure industry funding to collaborate in a secure, audited cloud environment that is dynamic and connected to anonymized EHR data alongside observational or interventional study data. A nice side benefit? That same (already funded) environment may provide a subset of hospital researchers with identifiable patient data that can be used to implement research findings into clinical practice in a timelier fashion.

As a patient, I’d donate my data to that hospital in a heartbeat.

Imagine a world where patients and clinicians collaborate to improve healthcare, then take a look at what Great Ormond Street Hospital for Children is doing with their research environment for a wonderful example. Pediatricians there have been studying precision dosing regimens and collaborating across continents to share dosing models where pediatric populations were excluded from clinical trials. This isn’t happening in one hospital’s data warehouse, and it isn’t happening with access to a single EHR or aggregated repository. It’s possible because of connecting different types of data of across borders and across time, but all in a next-generation research environment that connects people.

The transformative possibilities do not end there. What if a research hospital was able to collect clinical data from EHR and combine it with multiomics data from an academic research university where bioinformatics pipelines are optimized to provide a list of variants for each patient? How might they learn about patient subpopulations and disease progression or predict responses to interventions? That sort of collaboration should be the norm, but it requires us to think bigger than one data warehouse, one data type, or one organization at a time. Let’s make it happen.

I've figured it out. At first I was confused but now all is clear. You see, we ARE running the…