Lyle Berkowitz, MD is CEO of KeyCare of Chicago, IL.

Tell me about yourself and the company.

I’m a primary care physician. I spent 20-plus years at Northwestern Medicine as a practicing primary care doctor and as a system executive for a decade and in the classic IT informatics area in the next decade. I set up one of the earlier innovation programs. The whole time, I often had some involvement with telehealth, population health, and digital health in a variety of ways. I also often did some side hustles. I was working in entrepreneurial areas in a variety of ways as medical director and chief medical officer of a variety of companies . I eventually started creating and founding some companies, including Healthfinch. I left in 2017 and joined MDLive as a executive, overseeing operations and product strategy. I spent a few years helping them scale up and then exited that when the company sold.

I wound up meeting with my friends at Epic in deciding that the world needed a virtual care company that uses Epic as its base platform to more easily supply third-party virtualists to health systems that are using Epic in a way that is truly coordinated. That’s how we started KeyCare.

Why was it important that the virtual providers and the health system customers use Epic?

I’ve been involved in dozens and dozens of digital health companies. One of the biggest struggles has always been, how do you work with the big EMRs? With Healthfinch, we focused on looking at Epic and other EMRs as a platform that we would build on top of and within IT to support it. We were successful with that.

But the idea is understanding what being an Epic client is and everything that goes with that. I recognized that one of the ways to cut through the clutter — particularly in virtual care – was to say, what if we use the same underlying technology that 60-plus percent of the health systems are using and take away the interoperability issues? Epic has profound interoperability that allows us not only to share data, but to do cross-instance scheduling, messaging, ordering, referrals, et cetera.

I knew that they had built this technology and that we could take advantage of it to create a more seamless system. Much like we use Microsoft Word and Office, where we use those systems to create unique things that can then be more easily shared.

How did the conversation go with Epic when you approached them about becoming a customer and using that fact as a selling point?

As you can imagine, you don’t just go buy Epic off the shelf. I’ve had a long relationship working with Epic, from helping with our implementation at Northwestern, navigating Healthfinch, and being one of the early apps on Epic’s App Orchard.

In talking to a variety of folks at Epic, executives at telehealth, and others, we started out with general discussions about what’s going on in the telehealth industry. I then said, I have an idea I’d like to propose based on some of the things that you’ve been talking about, and we mutually came up with this concept. This is something that they really encouraged.

They of course approve who they are selling to and who they are working with. It was very much a mutual discussion and decision point that it made sense that we not only would become a new client, but we would also be doing it in service to patients and health systems out there using Epic. We can theoretically support non-Epic EHRs, but it just works so beautifully when we are connected to another Epic site.

Describe a typical use case of how a health system might use your services.

Our first use case is a classic one — on-demand virtual urgent care, 24×7, 50-state access. Most health systems fall in a couple of categories. If they don’t do anything, we become this extra option that they can offer. Patients who can’t get in with their doctor, or it’s after hours, or they’re traveling out of state, can go to the health system’s front door, its MyChart. As they request an on-demand visit, KeyCare shows up as an option that they can choose in a seamless manner. It’s handed off to our providers to handle that patient.

Whether the health system has been doing nothing, whether they do something and we’re supplementing it, whether they’re using another third-party provider and they prefer that they work with us, that workflow is seamless for the patient, and it’s through the health system’s own front door.

What’s your business model?

When we partner with health systems, we have some general maintenance fees, but the majority of our revenue is coming from doing visits. We are essentially getting paid like other physician services and provider service type companies. We’re getting paid to take care of patients. It can be done in a variety of ways. It can be per visit, hourly, or per-member per-month. But at the end of the day, we are providing access to healthcare services and we are getting paid in a variety of ways by the patient, their insurance, or some other sponsor who is at risk for the patient to pay for that type of care.

Do you contract or hire doctors directly or do you outsource your physician coverage to medical staffing companies?

We have two models. For urgent and primary care, we’ve set up a 50-state medical group, and we enroll doctors into that. We’re able to do that via either by contracting with large groups who provide the virtualists as well as being able to employ them directly if needed. We also are able to partner with other virtual care groups, so that they can put their providers onto our instance and make those available more easily to other Epic-based health systems.

How are you addressing somewhat restrictive state licensing requirements now that the public health emergency and its telehealth waivers have ended?

We have always stuck with the state licensing requirements so that we are able to make sure that we can connect a patient who is in a certain state with a provider who is licensed to work in that state. That hasn’t changed. There’s a lot of discussion and fanfare over how liberal those rules were. Most large telehealth companies stuck with state licensure to be on the safe side.

Do you white-label your service on MyChart or do patients see the KeyCare brand?

Unlike some other third parties, we are truly of service to the brand that we are working with. That said, legally patients have to be told that they may be seeing a provider from the KeyCare medical group. But it’s as white labeled as it can be. They come through the front door of the health system, which explains that this is our partner, but the patient doesn’t need to create a new username or password. They don’t need to re-enter their medical data for it to be available to the provider.

It’s a very seamless experience. Very white labeled. We minimize our branding. We are not looking to create our own brand. We very much are of service to the health system brand. Part of our philosophy is that we want to increase access to healthcare, but do it in coordination with our health systems, not in competition with them. We feel this creates a powerful hybrid approach, because when patients need to escalate their care, they will have a office-based option to go to, and they will know what happened in any virtual visit.

Is that less threatening to a health system that might not be comfortable sending patients off to a provider that wants to cultivate their own brand identity and customer loyalty?

That is certainly why we exist. That’s why we’ve gotten so much traction with health systems. Third-party vendors, in many cases, have come right out and said, we want to own the front door. No, the health systems want to own the front door. Why would they send it to a competitor? Why would they send patients to a company that has a completely different technology and a completely different brand?

We are very much in line with health systems. I’m a health system guy. I grew up in health systems. I believe in the importance and power and strength of health systems. Our job is to help health systems provide some of the online convenient care that they traditionally haven’t been great at, do it in a way that feels coordinated, and allow them to focus on the stuff that they are great at — complex care, heart attacks, cancer, broken bones, and major emergencies.

We want them to be able to tell their patients, look, come to us. We will be able to provide a full variety of care. You don’t need to go anywhere else for that. We can do it in a way that feels coordinated, which in the end, means higher quality for you.

How do you make the handoff to a higher level of care as compared to the typical urgent care center?

At a high level, on-demand, virtual urgent care is supposed to be able to handle everything. That doesn’t mean that we treat everything. Sometimes we have to redirect a patient. Most of the time, hopefully 90% of the time, we are able to take care of the patient and they don’t need follow up. But five or 10% of the time, maybe they need to go to an ER and or urgent care center, and our job is to redirect them.

Part of it is helping the patient understand. You cut your hand, we can’t do anything online, you need stitches. But sometimes they need reassurance and understanding. Sometimes they have to understand what time it is. Could I wait until tomorrow morning and go to an urgent care center, do I have to go to an emergency room tonight? One of the important things to understand is that virtual urgent care is not meant to take care of everything or cure everything, but it can certainly give you good advice and triage you appropriately.

One of the issues is third-party vendors that just say, go to the ER or to urgent care. We have a little leg up, in that when we tell the patient this, they are part of a health system. They are able to go to their health system, which has access to any of the notes that we have. We also are able to look at their past history and see their medications and problems, and that can help us better understand and let patients know if they really need to go in and see someone.

Over time, as we move into more primary care support, we will be able to send messages more directly into the health system, and maybe even pick up the phone and alert them, if appropriate, in the on-demand urgent care space.

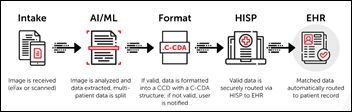

I should note that when we sign a note, the note not only goes to the health system in the appropriate place, but a message can get sent to the PCP that the patient was seen and alert them to review the note to see if they want to do any follow up. It could also be sent to a general in-basket message that can be monitored to decide if they want to follow up with the patient as well. Those are unique things that we are able to do.

How has the use of technology and support staff changed for virtual visits as compared to the early COVID days, when unprepared doctors had to wing it alone using Skype or FaceTime?

It’s important to understand that virtual care should not be looked at as simply an online version of an office-based visit. Similar to how we defined hospital care and hospitalists in the 1990s, we are clearly moving into an era when we have to differentiate virtualists from “office-ologists” in terms of how they provide care and what the focus of patients should be. I believe that office-ologists, the folks in the office, can and should be working at the height of their license to see the more complex patients that need longer, more intense visits in the office, or need some type of task or procedure that has to be done in the office.

Virtualists can focus on what I call the triple-R threat that overwhelms our health system — routine, repeatable, rules-based care, the type of common commoditized care that right now clogs up our offices. What if we can shift those to online that is more convenient for patients? It is routine enough that it can be handled, and we have virtualists who are trained, who are specialized, in handling things online. They understand more of the nuances of being good doctors online, of what type of physical exam you can do online, because you can do certain things to and provide some level of physical exam. We are looking at a variety of tools to capture vital signs, to analyze parts of a video and picture, et cetera.

We are starting to see this differentiation, where virtualists are taking advantage of being able to do something online that, instead of looking at it as a disadvantage, we have to think about what the advantages are, such as more timely access to care. We believe that over time, we will use certain technologies online that we won’t be able to use as easily in the office.

It’s going to be a fascinating era as we continue to differentiate what should be done in the office, what could be done online, and how we can help solve this whole burnout crisis by having virtualists who don’t simply see three or four patients an hour, but really scale up. How can a virtualist manage 10, 20, or 100 patients an hour, not by doing 100 video visits, but by using asynchronous care automation, delegation to other staff, et cetera? The virtualist should be taking care of the bulk of common stuff so that the office-ologist can take care of the more complex things that truly need to be seen in the office.

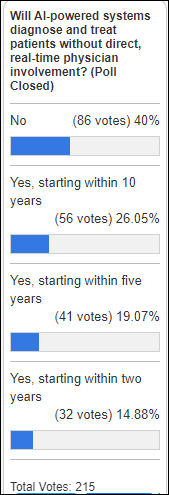

How will AI change healthcare, especially virtual care?

Unlike some folks, I do not look at AI as being important for diagnosing particularly common things. Where it’s really going to shine is in communication. We’ve seen that AI can often be more empathetic and more overall informational than a busy doctor, and that’s OK and that’s great. We are already looking how we use AI, chatbots, and other ways to communicate with patients to let them know what is going to be happening in their visit.

Maybe we’ll be able to capture information ahead of time. Maybe after the visit, we’ll be able to use AI to help explain things. Maybe AI can also be really good at detecting subtle things in a patient who looks like they have a simple cold, COVID, or UTI. Maybe there’s something else going on, and AI can surface that.

We are exploring a number of use cases to make the virtualists more efficient by helping automate pre- and post-, but also more effective in identifying things and communicating in better ways with the patient. It will be absolutely important to get us to a world where we can truly scale up virtual care to a big population.

What factors will influence the company over the next few years?

We are in growth mode now. We have signed 10 health systems in the past year, representing over 90 hospitals and 30,000 physicians. That’s a pretty quick product market fit. We are going to continue to grow that and expand the number of health systems that we can serve.

The next stage is, how do we make it as efficient as possible? That’s where we bring in technology. Our mission is to bring this tech-empowered virtual care team to be of service to health systems in a coordinated way. If our purpose is to improve healthcare access for all, and our vision is to be the best at virtual care, our mission of what we are really doing is not just bringing providers and staff, but tech-empowering them to make them more efficient and effective. Doing that at scale than any one health system can do, so that we can help health systems transform how they manage this population and do it at scale.

I often say that we don’t have a shortage of physicians as much as we have a shortage of using them efficiently. What we’re trying to do over time is help health systems rethink how they manage that population, how they split up who’s online versus who’s in the office, and how they pay their doctors. For this to work, we need them to think about compensation redesign and embrace team-based care and all that has to offer.

We are in growth mode and laying technology on top of that to make that as efficient and effective as possible. We are also expanding well beyond urgent care to primary care, behavioral health, and specialty care. Part of our job is to set up sort of a virtual care marketplace for health systems, where they know they can come to us and find a wide variety of virtual care options, but in a way that because we are on Epic, allows it to be done in a coordinated way. Whether they might need help with cardiology, rheumatology, GI, maternal care, or dieticians, the idea is that they can come to us and we’ll have them all available in a tech-enabled way, sitting on an Epic instance and being able to scale with them.

How can we do this in a way where it doesn’t feel threatening to the physicians in the offices? Part of what we do the end of the day, my personal dream, is that a health system could go in to their physicians, primary care physicians in particular, and say, what if we could increase your salary, but decrease how many patients you have to see in the office? How would you feel about that? Of course they are going to ask, how are you going to do that? We’re going to say that we will give you this virtual care team, you’re going to be really connected to them, and together you’re going to be able to double your panel size.

This is an opportunity truly to fix all those Quadruple Aim issues. We’re going to make it easier for patients to get care. Their experience gets better. We’re going to improve quality, mainly by improving access and making sure they can get in. We’re going to decrease costs, because we can do this at scale. We’re going to make life easier for doctors.

This isn’t going to happen overnight. This is a strategic transformation. It’s going to involve a combination of what I call the three Cs. One is having a care team that is connected and coordinated. KeyCare will provide that team to health systems. Second is compensation redesign. We have to rethink how we pay physicians and how might we pay them to manage a population, not simply be on an RVU treadmill, because that is deadly for physicians. Third is cultural and change management, educating and teaching our patients, our providers, and our staff that team-based care is not only effective, but is actually better in many ways to maintain a more consistent approach to monitoring patients in a coordinated way.

We didn’t invent the concept of population health or team-based care, but we believe that we can execute on it in a way that makes sense, is coordinated, is scalable, and makes life easier and better for providers, patients, and the health system as a whole.

I've figured it out. At first I was confused but now all is clear. You see, we ARE running the…