Amanda Sharp is CEO of AdvancedMD.

Tell me about yourself and the company.

AdvancedMD provides a comprehensive technology platform for independent physicians and providers to run their business on. It’s akin to Salesforce, a CRM for medical practices. It includes a practice management, a billing solution, electronic health record, patient engagement solutions, analytics, and payments. The business was founded more than a quarter century ago. It was built originally on the cloud.

I started at the company back in 2006 as an intern in our accounts receivable department. I progressively grew in the company with 15 different roles across finance, accounting, service, sales, strategy, business, and business development before being asked to lead the company in 2019. In December, Francisco Partners bought the company from Global Payments. It’s the second time that Francisco Partners has owned AdvancedMD. With that acquisition, I was named CEO of the company.

Our mission is to empower healthcare professionals to realize their full potential. We provide a platform that helps them do that.

How has the ambulatory software business changed in the past few years?

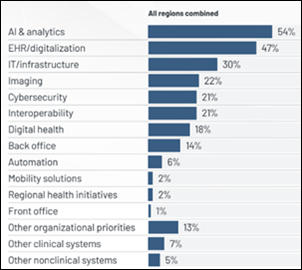

We’ve seen some consolidation in the past couple of years. We see replacement deals rather than greenfields. They are existing businesses that are looking to replace an electronic health record and a practice management system. We see much more sophistication in the buying process, where people know the gotchas that they experienced previously. We see much higher emphasis on things like cybersecurity, the introduction of AI, and ensuring that the technology solutions are fully integrated. There’s less of an appetite for point solutions, where you have to do a lot of integration work to connect them. That trend has worked in our favor.

Meaningful Use decreased the number of vendors from thousands to whatever it is today. How many can the market support and how much consolidation will occur?

Ambulatory care can support more that on the inpatient side. There are a lot of specialty-specific solutions out there. There are also a lot of solutions like ours that are configurable and customizable to meet the needs of many specialties. AdvancedMD serves 118 different specialties.

I think there’s room for plenty of vendors, but in terms of size and scale that are serving the ambulatory space, you’re at fewer than 10 right now. I expect to see further consolidation over the next several years, whether it’s us acquiring or someone else making some of those acquisitions.

How is the approach of specialty-specific software competitors different?

It depends on the specialty. When you look at something like dermatology, obviously Modernizing Medicine dominates in that space. They have a very anatomical EHR built by dermatologists. For us to compete in that space, we are partnering with other EHR solutions.

AdvancedMD works really, really well for primary care, behavioral health, physical therapy, and some of the specialties as well. But it really depends on if you need something that’s more anatomical in nature since AdvancedMD is more template based. Also, what systems you need to integrate with.

There’s room for both. The market is huge and there’s tons of opportunity. I don’t buy the notion that independent physicians or providers are going away any time soon. The market absolutely can sustain businesses like AdvancedMD, as well as those that are a little bit more specialty specific.

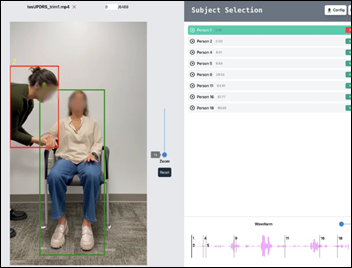

How has telehealth and the technology that is needed to support it evolved?

We expected to see our telehealth usage fall off as COVID subsided, but we’ve actually had tremendous growth. We were incredibly fortunate, whether it was was luck or truly great foresight, that we had built an integrated telehealth solution a couple years before 2020. We have seen that usage has grown, primarily in behavioral health. But we’ve seen the integration between behavioral health and primary care and bringing those two specialties together.

There’s a very strong demand for integrated telehealth in that space and we expect that to continue. Your mental health is just as important as your physical health. Being able to match patients with the appropriate talk therapy provider anywhere in the country is incredibly valuable. We’ve seen that continue to grow. We haven’t seen the growth as much in some of the specialties or in primary care.

What are the benefits of a cloud-based system?

One of the biggest opportunities is in understanding data and large data consolidation, which can help predict outcomes for people. Our ability to leverage technology to improve patient outcomes is absolutely enhanced because people are on the cloud.

Some systems are more ASP based and not a true cloud. Some require a thin client server download.

We’re incredibly grateful that AdvancedMD was architected for the cloud initially. You avoid some of those more technical components. You want a solution that you can access anywhere from any device at any time.

How much of your client base uses outside billing services?

In our client base, we have about 1,000 billers. They range in size from what we would call a bedroom biller serving one practice up to serving hundreds of practices.

Ultimately, it comes down to choice. Some people prefer to have total control and autonomy. They want to use software to do their own billing. They have expertise in coding, probably a medical coder on staff.

Some people want to leverage and use the capabilities of other people, so we have billing services. We actually have our own billing service, our own revenue cycle management team, where we offer that as well.

Then we have clients who just leverage our software. For us, about 30% of our total providers at AdvancedMD are using third-party billers.

How has consumerism affected medical practices?

There has definitely been a rise of retail and consumer-driven care. I can go to my local Walmart, Walgreens, or CVS and get care. We as healthcare IT leaders need to provide our physicians and providers with a frictionless experience so that they can provide a similar experience to their patients. As a healthcare IT provider, it’s our goal to equip our providers and our physicians with some of the same or similar tools and technologies so that patients will opt to see their primary care position instead of going to some of these other places. That could be things like the ability to schedule appointments online, have virtual visits, having mobile-friendly applications and portals to communicate with your provider, as well as real-time, fast communication.

How will AI change your business and your customers?

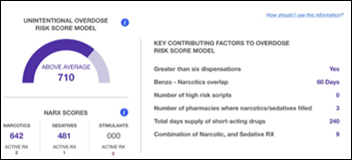

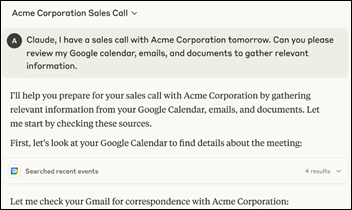

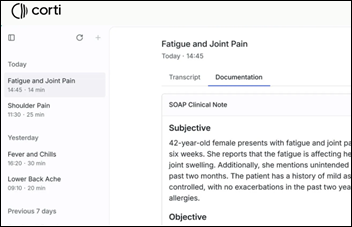

We’ve been working on an AI product suite for our clients. That would include things like improvements in documentation, where instead of spending an hour to two hours in the evening documenting and updating everyone’s patient charts, you could have it done with a couple of clicks.

Then you think about claims management processing , ensuring that the coding is correct and that you’ve included all of the right modifiers and everything is exactly where it needs to be. Leveraging AI in that is going to be incredibly helpful, too.

Internally for our business, we’ve uncovered multiple opportunities with AI in terms of our product, technology, release cycles, and how we QA the product to make sure that bugs don’t slip out. Using AI as a tool to help predict at-risk clients, figuring out where we need to have better communication, more transparency, and more connection with those clients.

In the right segments, AI will revolutionize this space. There’s always going to be a place for physicians, providers, nurses, MAs, and billers. But I believe that through AI, we will all be more efficient and will be able to focus on the things that are most important in our respective areas.

You’ve been at the same company for 19 years, intern to CEO, and most atypically to me, you’ve lived through several changes of ownership. What lessons have you learned?

The most important thing that I’ve learned is that people are the most important asset a business has. Starting as a company with 70 employees delivering service to 2,000 physicians and providers, to today, where we’re over 65,000 physicians and providers, doesn’t happen without incredibly talented people who are passionate and dedicated to what the organization is trying to accomplish.

Everything starts with the people. You have to take care of your people in the company. When you take care of your people, they’re more inclined to take care of your clients, and your clients provide for your shareholders.The financial results of the organization aren’t the objective, they’re the outcome.

By keeping that order of priority, AdvancedMD has been able to be more successful. I’ve been able to navigate throughout the organization for what has been a long tenure, but at the same time, it feels very short. I feel incredibly blessed to have worked and to continue to work with so many incredible people.

What factors will be most important to the company’s strategy over the next few years?

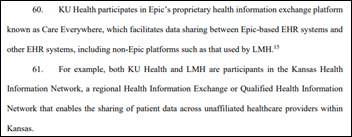

From a product and technology perspective, a few things. Simplifying our onboarding and service and introducing improved tools and resources for those who are learning the product. We will be enhancing our technology to reduce administrative time. We will be expanding interoperability and our healthcare connectivity. Delivering a best-in-class platform that ultimately helps independent positions and providers stay independent.

We’re excited about Francisco Partners. Like I said, it’s the second time that they invested in the business. We believe that they’re a tremendous private equity firm, especially in healthcare. I’m excited about the connections, the relationships, and the investment that they are enthusiastic to make in AdvancedMD.

Thank you for the mention, Dr. Jayne — we appreciate the callout, the kind words and learning more about the…