Neither of those sound like good news for Oracle Health. After the lofty proclamations of the last couple years. still…

News 5/24/23

Top News

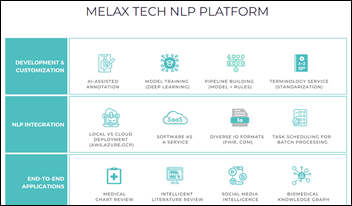

Clinical terminology management and data quality vendor Intelligent Medical Objects acquires Melax Technologies, which specializes in data extraction using AI and natural language processing.

The acquisition, IMO’s first, will help extend its market reach to payer, life science, and pharmaceutical companies.

HIStalk Announcements and Requests

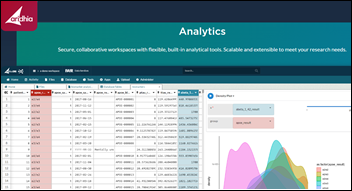

Welcome to new HIStalk Platinum Sponsor Aridhia Informatics. The Glasgow-based company offers the Aridhia Digital Research Environment (DRE), a combination PaaS/SaaS offering that addresses challenges that are associated with the scale and sustainability of biomedical data science. It is used by research hospitals, pharma, and global consortia across nearly 100 countries. Adherence to FAIR data principles gives researchers and innovators the ability to discover and understand data through dataset search, classification, and efficient metadata browsing capabilities. Researchers can request access to datasets, while data owners get access to configurable and orchestrated data governance while making approval decisions within their own specialized pipelines. Principal investigators can invite team members who can securely upload, access, and analyze project data while taking advantage of an audited environment that is furnished with analytical tools, scalable compute resources, and virtual desktops. All of this is underpinned by comprehensive auditing, secure data management, reliable infrastructure that scales to user needs, and world-class analytics capabilities. The company manages high-level security accreditation, leaving the team to focus on the science using a personalized, next-generation research environment. Thanks to Aridhia for supporting HIStalk.

YouTube has an intro video for the Aridhia DRE.

Webinars

None scheduled soon. Previous webinars are on our YouTube channel. Contact Lorre to present or promote your own.

Acquisitions, Funding, Business, and Stock

Nuance Communications CEO Mark Benjamin notifies employees of an unspecified number of layoffs as the Microsoft subsidiary adjusts to changing market conditions and a renewed focus on healthcare. Microsoft, which acquired Nuance in early 2022 for $20 billion, announced a separate round of 10,000 layoffs in January.

Sales

- Fifteen-bed Eureka Springs Hospital (AR) selects Oracle Cerner.

- Palouse Specialty Physicians (WA) will implement CureMD Oncology’s EHR and practice management software.

- Tampa General Hospital (FL) will roll out Navina’s AI-powered clinical data summary capabilities for primary care.

- Atlantic Health System selects NeuroFlow’s caseload management software to support behavioral health screenings within its ACO.

People

Zyter|TruCare names Joanne Berrios (Salesforce) VP and chief value officer.

Holly Urban, MD, MBA (Oracle Cerner) joins CliniComp as VP of clinical product design.

CRISP Shared Services promotes practicing pediatrician Marc Rabner, MD, MPH to chief medical officer.

Jordan Bazinsky (Cotiviti) joins Intelerad Medical Systems as CEO, replacing the newly retired Mike Lipps.

Telemetrix promotes Nancy Beale, RN to president.

Cynerio names Rasu B. Shrestha, MD, MBA (Advocate Health) as board chair.

Brooklyn Hospital Center promotes SVP/CMIO Sam Amirfar, MD, MS to chief medical officer.

Avalon Healthcare Solutions hires Pamela Stahl (Sidekick Health) as president.

Tegria hires Jen Morgan (Senta Partners) as CFO and Prasanna Gunjikar (HTC Global Services) as chief growth officer.

Aaron Green(Optum) joins OneMedNet as president.

Lanie Schenkelberg (Spring Health) joins Inovalon as VP of product marketing.

Announcements and Implementations

Gillette Children’s (MN) implements Notable’s automated Registration and Intake Assistant and Scheduling Assistant software across 11 multispecialty clinics.

Garden City Pediatric Associates (MA) implements EClinicalWorks.

Box Butte General Hospital (NE) goes live on Meditech.

Epic lists 26 of its customers that have pledged to join the TEFCA information sharing framework.

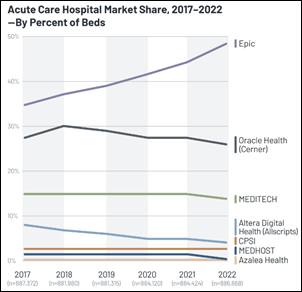

A new KLAS report on US EHR market share finds that Oracle Cerner saw its first double-digit net gain in hospitals since 2018, but 49 of its 50 wins were in under-200 bed facilities, giving it the biggest drop in total bed count of all vendors. Meditech gained 120 hospitals in 2022 via net-new sales and migrations, more than any other vendor, but still showed a decrease in total beds and total hospitals. Epic was the only vendor that gained both facilities and beds.

Government and Politics

Mann-Grandstaff VA Medical Center (WA) Director Robert Fischer says the facility will need to reduce staff by 15% over the next several years to make up for an anticipated $35 million budget deficit it attributes to the rollout and use of its Oracle Cerner system. The software’s well-documented deficiencies have hampered the facility’s ability to keep up with patient demand, resulting in decreased funding, while its billing inefficiencies have delayed payer reimbursements. Surges in staffing for the system and pay raises and bonuses to help with recruitment and retention have also contributed to the budget shortfall.

Privacy and Security

Norton Healthcare in Kentucky works to recover from a cyberattack two weeks ago that is still causing “delays in network-related capabilities” including patient portal messaging; imaging, lab and test results; and prescription fulfillment. Hackers reportedly sent a fax with threats and demands shortly after breaching the hospital network on May 9.

Amazon Pharmacy’s PillPack reports that an unauthorized person logged into its website using individual user credentials that were identical to those shared from other breaches, with 3,600 of those accounts containing prescription information.

Sponsor Updates

- AdvancedMD sponsors the Gratitude Gala in Chicago, benefiting The Bette D. Harris Family & Child Clinic.

- Princeton Brain, Spine & Sports Medicine transitions to EClinicalWorks Cloud.

- KeyCare pledges to adopt the TEFCA framework.

- InterSystems launches its HealthShare Health Connect Cloud in the AWS Marketplace.

- KLAS Research recognizes Availity as a co-recipient of the KLAS Points of Light Award.

- AvaSure establishes a chief nursing executive advisory board.

- Azara Healthcare publishes a new case study, “Improving Equity in Healthcare Access through Improved Data Exchange.”

- Nordic publishes a technical paper titled “A New Horizon for IT Strategy: Prioritizing the Patient Experience Through Digital Transformation.”

- Bamboo Health will exhibit at AHIP 2023 June 13-15 in Portland, OR.

- Black Book survey-takers give Xifin top customer and user satisfaction ratings in nine out of 18 RCM KPIs.

Blog Posts

- 2023 CHIME CIO Survey Results: Managed Services Opportunities? (CereCore)

- Documenting to Meet MEAT (AGS Health)

- Behavioral health providers face staffing and reimbursement challenges as demand grows for services (Baker Tilly)

- Workplace Injury Prevention: The Coach in Your Corner (Not the Boss Over Your Shoulder) (Bardavon)

- Advanced, affordable, accessible: Augmenting the patient experience with remote care at home (Biofourmis)

- Improve Your Patient Attribution Rates and Your ACO Performance (ChartSpan)

- What Are CIOs and ITSM Teams Looking For? ROI (Clearsense)

- What Healthcare CISOs Want to Know About Digital Health Technology Security (Clearwater)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

If you have the actual hospital or organization count for the respected EMR vendors would you consider posting that number versus the bed count?

The KLAS report gives total hospital count at the end of 2022 as a percentage of 5,472 acute care hospitals, which works out to:

Epic 1,964

Oracle Cerner 1,363

Meditech 891

CPSI 454

Altera (Allscripts) 202

Medhost 137

I am curious about why the number of sites listed above only totals 5,011 yet you list the number of hospitals as being 5,472. I realize that Azalea Health is not listed above but its share of the market would appear to be well under 100.

There are other vendors out there with even fewer hospitals, I think athenahealth has some. And then there are still homegrown systems in some places.

KLAS expressed the hospital count by rounded percentage, as follows including those I didn’t mention originally:

Epic 35.9

Oracle Cerner 24.9

Meditech 16.3

CPSI 8.2

Altera 3.7

Medhost 2.5

Azalea 0.4

Other 7.9

That KLAS Chart, tho. Yikes! Every vendor is flat to declining, with the exception of Epic.

At what point do we have to worry about this market becoming an oligopoly? Epic has done the things needed & necessary to merit their market-leading position. It sure doesn’t feel right to criticize them their success.