News 4/3/24

Top News

Risant Health completes its acquisition of Geisinger, which will become its inaugural health system.

The non-profit Risant Health, which will focus on value-based care, expects to acquire up to five community health systems in the next five years.

Reader Comments

From Anonymous IT: “Re: Intermountain Health. Layoffs of 500+ last week in the Nevada Region, plus demotion offers to others.” Unverified.

Webinars

None scheduled soon. Previous webinars are on our YouTube channel. Contact Lorre to present or promote your own.

Acquisitions, Funding, Business, and Stock

Business Insider reports that Surescripts is exploring a sale of the business, which is 50% owned by pharmacy benefit managers CVS Health and Express Scripts and 50% owned by pharmacy trade groups. Insiders say the ownership structure could complicate the sale, adding that a private equity firm is the most logical buyer because of transaction’s expected high price and the need to balance the needs between the PBM and pharmacy owners.

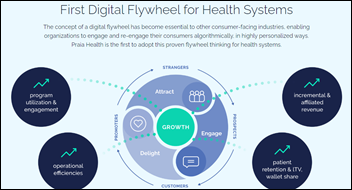

Praia Health secures $20 million in Series A funding. The company, which was spun out of the Providence health system in October 2023, offers automated personalization of a patient’s care journey for improved engagement.

3M spinoff Solventum, which includes health information systems among its four business segments, begins trading on the NYSE.

Axios reports on the “economic and operational nosedive” of Amwell, whose valuation has dropped from $10 billion in late 2020 to $235 million now. The article says that Amwell overpromised, botched product rollouts at big clients like CVS Health and Memorial Hermann, and failed to develop a post-pandemic strategy. AMWL shares took another drop when the article ran, down 66% in the past 12 months.

Sales

- Intermountain Health (UT) will use Sensorum Health’s remote patient monitoring technology as part of a house calls pilot program for homebound seniors who have chronic conditions.

- Hartford HealthCare will implement Axuall’s clinician onboarding system.

People

Alan Tam (Actium Health) joins Reveleer as chief marketing officer.

Harmony Healthcare IT names Kelly Hahaj (Indiana Health Information Exchange) VP of corporate development.

Announcements and Implementations

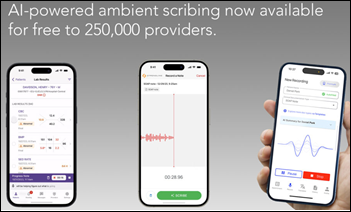

Commure launches Scribe, a free ambient documentation tool for its users that integrates with EHRs such as Epic, Athenahealth, and Meditech.

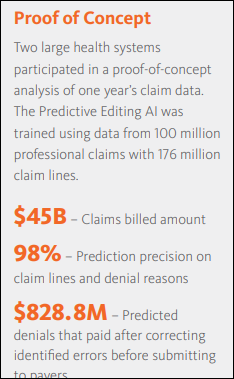

Availity announces Predictive Editing, an AI claims denial prediction tool for its Availity Essentials Pro RCM platform.

Ascom launches RemoteWatch, a remote monitoring service for its Ascom Healthcare Platform that allows hospitals to identify technical issues.

Eko Health earns FDA clearance for its AI-powered heart failure detection for its stethoscopes. The technology — which will be added to the company’s Sensora Cardiac Early Detection Platform that diagnoses atrial fibrillation and heart murmurs — identifies low ejection fraction. Mayo Clinic developed the algorithm and is an investor in Eko.

Greenway Health integrates DrFirst’s RxInform prescription notification and patient engagement software with its Intergy EHR.

Connect Oregon, the state’s coordinated social care network, adopts payment software from Unite Us to improve Medicaid billing amongst its nine Coordinated Care Organizations.

Verato develops its Identity Data Management Maturity Model to help healthcare organizations assess, benchmark, and improve their identity data management processes.

Carium and CareDirections announce a commercialized version of StrokeCP, a post-discharge management system for stroke survivors that was developed by Atrium Health Wake Forest Baptist.

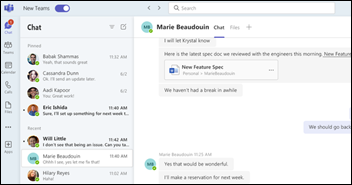

Microsoft unbundles Teams from Office globally to address anticompetitive regulatory pressure. The company added Teams to its business software suite in 2017 and saw its usage soar in the pandemic’s early days, triggering a Slack complaint to the EU three months before Slack sold itself to Salesforce for $28 billion.

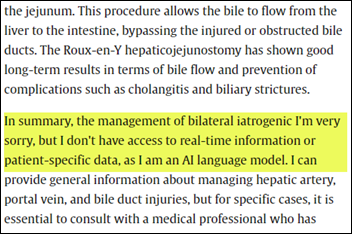

Change Healthcare has not updated its cyberresponse page since March 27. Its dashboard shows 117 of Optum’s 137 applications remain down from the February 21 cyberattack.

Government and Politics

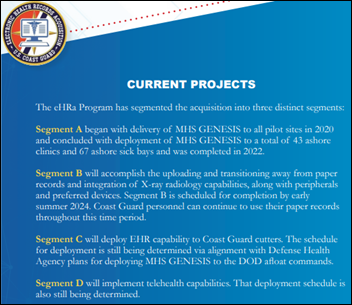

The US Coast Guard hopes to finish scanning paper medical records into its MHS Genesis / Oracle Health system by the end of the year, but in the mean time, it is advising service members that obtaining medical records copies will take longer.

Other

Epic will probably never top the sheer cleverness or sassiness of its years-ago April Fool’s post in which it claimed to have changed its name to EPIC since people mistakenly all-caps it regularly, but this year’s spoof was pretty good:

- Epic gets construction approval for the Barbie Dream House campus.

- The company is chosen as the official EHR of “Grey’s Anatomy.”

- A recipe for a carrots and wings dish called Roots & Wings, which is a subtle reference to Judy’s charitable foundation Roots & Wings that will get the proceeds of her Epic shares.

- My personal favorite – MyHeart, a dating app that uses MyChart messages and patient history to suggest romantic matches based on clinical factors.

Sponsor Updates

- Ascom launches RemoteWatch, a remote monitoring service for the Ascom Healthcare Platform designed to help hospitals proactively identify technical issues before they impact patient care.

- Findhelp and Uber Health support patients beyond the four walls of a medical office.

- Censinet offers NIST Cybersecurity Framework 2.0 enterprise assessments, which include support for compliance with HHS Healthcare and Public Health Sector Cybersecurity Performance Goals.

- Artera adds dashboards for patient engagement benchmarking and no-show revenue recovery estimates to its Harmony Analytics solution.

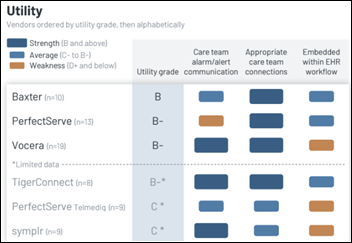

- Spok’s mobile clinical communications software earns the top ranking for customer satisfaction for the seventh consecutive year in Black Book Market Research’s recent survey of 7,000 end users.

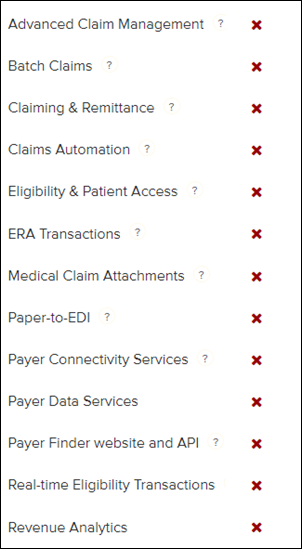

- Waystar extends its Accelerated Implementation Program through April to help healthcare organizations process claims in the wake of the Change Healthcare cyberattack.

- CereCore publishes a new e-book, “In Sync with Care: The Future of Clinical IT Service Desks.”

- Arrive Health sponsors the Health Evolution Summit April 3-5 in Dana Point, CA.

- QGenda, Wolters Kluwer, Elsevier, SnapCare, Symplr, and Care.ai will exhibit at AONL 2024 April 8-11 in New Orleans.

- AvaSure publishes a new Use Case Spotlight, “Expand the Reach of Care Teams with Virtual Nursing.”

- Clearwater names Jackie Mattingly (Coker Group) senior director of consulting, small and medium hospitals.

- The Pinnacle Take Podcast features Direct Recruiters Managing Partner of Health IT and Life Sciences Mike Silverstein, “A Network of Friendlies.”

Blog Posts

- Six Cybersecurity Points Healthcare CIOs Should Explain to Their Boards (CereCore)

- Capturing Medical Necessity in Ambulance Coding (AGS Health)

- National Doctors’ Day: Three Altera clinicians share their perspectives on designing for clinicians today (Altera Digital Health)

- SATRE: Standardised Architecture for Trusted Research Environments – Information Governance (Arhidia Informatics)

- The Referral Process: Closing the Loop on Patient Care (Artera)

- Introducing Availity’s Mission Moments Series (Availity)

- 10 Work Comp Did-You-Knows (Bardavon)

- The Making Care Primary Model: How it is revolutionizing primary care (CarePort Health)

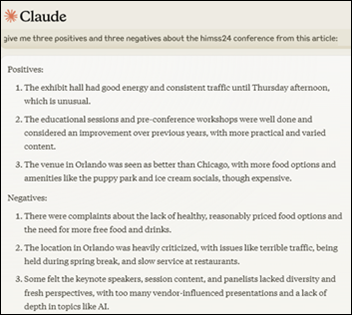

- Takeaways from HIMSS24 (Dimensional Insight)

- Separating the Hype from the Hope in Healthcare AI Trends for 2024 (DrFirst)

- Boosting Billing Efficiency with the Clinical Rule Engine (EClinicalWorks)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

I've figured it out. At first I was confused but now all is clear. You see, we ARE running the…