Curbside Consult with Dr. Jayne 7/8/24

I enjoyed having some time off around the recent Independence Day holiday. Costco’s holiday cake did not disappoint, although I’m not entirely sure why it had 61 stars. Kudos to the cake decorator who managed to fit them all on there, even though there were a few spares. I hope everyone had a safe holiday and is heading back to their respective work weeks without any injuries that were caused by heat or fireworks.

Since I had some downtime, I worked through some training assignments for a new clinical employer. It’s always interesting to start at a new company and find out how they handle all the mandatory training sessions for providers. It’s not just HIPAA, but also Medicare-related fraud, waste, and abuse training, controlled substance training, and more.

The organization that I’m contracted with also includes cultural competency sessions as well as those on diversity and inclusion, rolling those up under a larger curriculum on being an effective clinician. One would hope that we learned these things during our training, but I understand their need to cover all their bases and make sure that everyone in the organization is operating under the same expectations.

Along with many of my colleagues who work in emergency and urgent care settings, sometimes we aren’t employed by the facility where we’ll be working. Many of us work for staffing companies or third-party medical groups that have contracted with the facilities to provide physicians. In addition to doing the training required by the organization that is actually paying us, we also have to do the mandatory trainings for the facilities where we’ll be working, even though the content is often similar. There’s no reciprocity for these trainings, sometimes not even within the same health system, and it can be mind-numbing to sit through so many duplicate sessions of the same content published under the auspices of different medical staff offices.

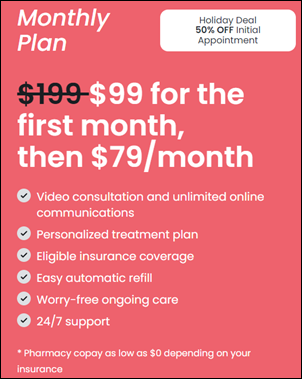

Depending on the situation, many physicians, especially those who are working for large, privately held telehealth providers, are considered independent contractors. The contracts are often heavily one-sided and physicians aren’t paid for the time spent in training, which is a bit of a double-edged sword as far as balancing attentiveness with the financial bottom line. I think most people would be more likely to pay attention if they’re being paid a fair rate for attending classes. However, when they’re asked to go through nearly a full day of training sessions without compensation, it seems like a recipe for people to multitask or otherwise not take the training seriously.

The training I completed this weekend had the added pain of misrepresenting the length of various modules, making it challenging to fit it into my allocated time frame. For example, a module that was advertised as “10 minutes” actually involved reading a densely formatted 40- page document, then attesting to having read and understood its contents. I’m no expert in reading comprehension, but I think that expecting someone to digest a full page of text in 15 seconds is unrealistic.

Even more concerning, that large document contained numerous links to other policies and procedures that we were also expected to attest to understanding, which is just ridiculous. I’m sure a good number of people just click through it and check the box, which isn’t going to serve them well if something bad happens. A couple of the links were broken, so I had to email the physician liaison team to get copies of the policies that I’m expected to read. I wonder how many of us are actually asking for the documents versus just going through the motions. Maybe asking for the documents from the broken links is a test to see if we actually read the pages.

Some of the other training sessions were sloppily constructed. For example, a 60-minute course contained three, 30-minute sessions. It feels like someone updated the training and threw something else into the course but didn’t update the learning management system with the correct information. The modules themselves had clearly been edited over time, and not with particular skill. Audio levels within a single recording ranged from virtually inaudible to painfully loud.

Some of the written materials were pretty humorous. You have to wonder when a slide spells out “E-H-R” with intervening hyphens if it’s because they really don’t know that it’s simply “EHR” or whether they haven’t figured out how to adjust their slideware’s dictionary to keep it from autocorrecting to “HER.” There were also a couple of places where the voiceover incorrectly pronounced common medical words, which didn’t’ give me a lot of confidence.

The next piece of the onboarding that raised concerns was the organization’s demand for adherence to its conflict of interest policy, which basically says I can’t practice medicine anywhere else but at this facility. That conflicts with the whole ideal of being an independent contractor, and the idea certainly wasn’t included in any of the initial contracting documents that I signed.

Asking someone to sign a restrictive agreement after you’ve already contracted them is sneaky, to say the least. Other words that come to mind are “deceitful” and “unethical.” Another email was fired off, because I’m definitely not signing it. I only wish I had come across that little nugget sooner, because I wouldn’t have sat through several hours of unpaid training if that piece had been at the front.

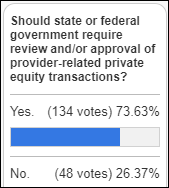

I’m also wondering if there’s a whistleblower opportunity here, because if they are blocking the ability for independent contractors to have other employment, that sure sounds like a problem to me.

It’s sad when you feel burned out before you even start. I’m questioning whether I want to work for these people at all, even if we can resolve the various issues. If you can’t get the basics right, I have little confidence in your ability to support me through unwarranted patient complaints or a nuisance lawsuit.

I haven’t even made it to the EHR part of the training yet, which I was actually looking forward to because it’s always nice to see how someone else has their system configured and whether there are any tips and tricks that you didn’t already know. I’ll certainly chime in if I make it to the EHR training and strike gold.

What’s the most disappointing onboarding experience you’ve had? How does your current organization do better? Leave a comment or email me.

Email Dr. Jayne.

I've figured it out. At first I was confused but now all is clear. You see, we ARE running the…