News 8/15/25

Top News

Oracle releases its Oracle Health EHR for ambulatory providers in the US.

The company says it will add hospital functionality to the cloud-based, voice-first system in 2026.

HIStalk Announcements and Requests

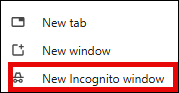

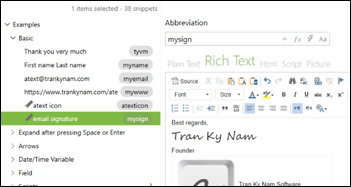

Browser tip: If you need to log in to multiple accounts on the same website, or if you want to test your password without logging out or resetting it, open a Chrome window in incognito mode. It ignores your cached data, cookies, and stored autofill data so you start fresh. You can also use incognito mode to avoid dynamic pricing (where the site knows it’s you and prices accordingly) or to read articles on sites that limit free views before showing a paywall. Bonus: it also hides profile and web history when Googling and thus can’t target ads or customize search results.

Sponsored Events and Resources

Instant Access Webinar: “Healthcare Data Strategies: Retire, Retain, and Ready for AI.” Sponsor: Triyam, an Access Company. Presenters: Sudhakar Mohanraj, founder and CTO, Triyam; Benjamin Cassity, director of research and strategy, KLAS; Jamie Greenstein, senior marketing manager, Access. The presenters deliver practical tactics to help IT leaders manage exploding data volumes — how to clean up legacy systems, craft smarter retention policies, and prepare historical data for analytics and AI.

Contact Lorre to have your resource listed.

Acquisitions, Funding, Business, and Stock

Abridge will use 80% of its available funds to expand beyond ambient documentation into claims, clinical decision support, and care management, with the remaining 20% reserved for acquisitions. Funding rounds in February and June 2025 value the company at over $5 billion.

Clearinghouse operator Stedi raises $70 million in a Series B funding round.

Personal health record vendor Citizen Health raises $30 million in Series A funding.

People

Adam Tallinger, RPh, MHA (Huron) joins Nordic as Epic managing director and practice lead.

Cotiviti hires Robert Kopanic (Oracle Health) as chief revenue officer.

Announcements and Implementations

Rhapsody announces GA of Image Director, an image orchestration solution that simplifies routing imaging data from CT, MRI, and X-ray to PACS, VNAs, AI models, and cloud archives.

The FDA grants De Novo authorization for ArteraAI Prostate, making the AI-powered digital pathology tool an FDA-regulated Software as a Medical Device. It predicts long-term outcomes for patients with non-metastatic prostate cancer.

Humana will use DrFirst’s prescription orchestration platform to close care gaps, starting with identifying patients who could benefit from statins and sending their providers prescription recommendations that they can approve with one click.

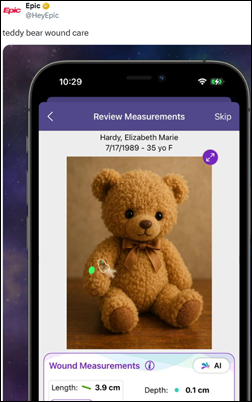

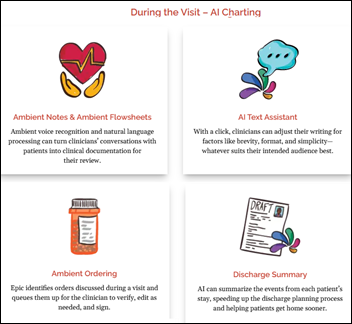

Epic enhances its wound care module with computer vision AI that calculates wound surface area and volume from a photo.

Athenahealth adds AI capabilities to its cloud-based AthenaOne that will eventually include fax processing, managing patient information from external sources, providing clinical summaries, and answering questions using all available clinical data.

Altera Digital Health launches an ambient documentation solution for its TouchWorks EHR.

Other

An entrepreneur couple who bought telemarketer-pitched health insurance to avoid the high cost of ACA premiums spends $20,000 on coverage that paid almost none of their medical bills. The plans are sold by a shell company that secretly lists each customer as a limited partner to evade state insurance regulation, which provides an exemption for employer-provided plans. One Atlanta mailbox serves as the employer address for 30,000 such “workers.” Telemarketing firms used deepfake ads featuring Taylor Swift and Dr. Phil promising cash payouts to lure callers into insurance pitches.

Sponsor Updates

- Health Data Movers sponsors the Northern Ohio HIMSS Charity Golf Classic & Collaboration Summit.

- Medicomp Systems releases a new episode of its “Tell Me Where IT Hurts” podcast featuring Hearst Health EVP and COO and FDB Executive Chairman Chuck Tuchinda, MD, MBA.

- Nordic and Clear partner to offer healthcare organizations a seamless, secure way to manage EHR accounts.

- Wolters Kluwer Health enhances its Lippincott platform to streamline author workflow and expedite vital research dissemination.

- Surescripts releases a new data brief based on the results of its latest survey titled “Healthcare Professionals Highlight Medication Prior Authorization Challenges & Solutions.”

- Black Book Research offers a new report titled “Cloud Momentum in Healthcare: Adoption, Economics, and Vendor Performance.”

- Healthcare IT Leaders will sponsor Workday Rising September 15-18 in San Francisco.

- Inbox Health partners with Empower Healthcare & Compliance Partners to bring together patient billing technology and industry-leading compliance expertise.

- Infinx releases a new episode of its “Revenue Cycle Optimized” podcast titled “Medicare Fee for Service Meets Prior Authorization.”

- Inovalon releases a new episode of its “Inovators” podcast titled “What Individuals, Corporations, and the Healthcare System Can Do to Address Mental Health.”

Blog Posts

- Realizing AI’s Promise: How Data Governance Supports AI Success (Tegria)

- Completing the circle of success: Debunking common myths about denials (Altera Digital Health)

- Analyst Kate Guffey on navigating a career pivot into health IT (Cardamom)

- Improving Medication Adherence for CHF Patients in Rural Communities: Lessons From Magnolia Regional (DrFirst)

- The role of data quality in building a robust health tech ecosystem (Wolters Kluwer Health)

- How GEHRIMED Supports Promoting Interoperability Compliance (Netsmart)

- Employee Engagement in Healthcare: The Hidden Revenue Strategy Healthcare Leaders Are Overlooking (Vyne Medical)

- What the Forrester TEI Study Says About the Real ROI of the Intelligent CX Platform (Five9)

- August 2025 CISO Brief: Policy, Funding, and the Path Forward (Fortified Health Security)

- How to Create Effective Patient Access Solutions: A Practical 3-Step Guide (Kyruus Health)

- Identifying & Fixing The “True Root Cause” of Epic Hyperdrive Slowness (Goliath Technologies)

- Improving efficiency and patient care with analytics dashboards at Fulton County Health Center (Meditech)

- From Frustration to Functionality: Reducing Burnout Through EHR Optimization (Med Tech Solutions)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Follow on X, Bluesky, and LinkedIn.

Sponsorship information.

Contact us.

Thank you for the mention, Dr. Jayne — we appreciate the callout, the kind words and learning more about the…