Agfa HealthCare

Booth 641

Contact: Hannah McFadden, marketing communications specialist

hannah.mcfadden@agfa.com

518.796.0908

Harness innovation to elevate your radiology practice with Agfa HealthCare’s Enterprise Imaging solutions. Designed for rapid growth and seamless integration, our platform empowers faster reading, exceptional image fidelity, and enhanced efficiency – without burnout. With Enterprise Imaging Cloud, Streaming Client enabling blazing fast image access, and Workflow Orchestration, Agfa EI helps you grow, work, and live in balance. Step into the future and redefine what’s possible with Agfa HealthCare.

Altera Digital Health

Booth 2307

Contact: Shawn Sayeed, events marketing specialist

shawn.sayeed@alterahealth.com

708.275.1885

A global healthcare IT leader, Altera Digital Health develops and elevates technology to bring next-level healthcare within reach. Altera’s approach to our solutions is changing the way healthcare is delivered – we see the summit of what healthcare can be, but rather than total transformation, we’re focused on helping organizations take the steps they need to get there.

At ViVE, we’re excited to showcase how Altera is addressing the challenges healthcare providers are facing today by enabling system interoperability and data sharing, ensuring financial stability, and leveraging AI to help alleviate clinical and administrative burden. Stop by our booth to meet with our experts and learn more about how Altera can help you deliver next-level care. For more, visit www.alterahealth.com

Artera

Viosk 2038

Contact: Elyssa Jaffe, senior director, growth marketing

elyssa.jaffe@artera.io

904.536.7790

Artera is a SaaS digital health leader redefining patient communications. Founded in 2015 and headquartered in Santa Barbara, CA, the company is trusted by 800+ healthcare systems and federal agencies to facilitate more than 2 billion communications annually, reaching over 100 million patients.

The Artera platform integrates across a healthcare organization’s tech stack, EHRs, and third-party vendors to unify, simplify, and orchestrate digital communications into the patient’s preferred channel (texting, email, voice, and secure chat) in 109+ languages. The Artera impact: more efficient staff, more profitable organizations, and a more harmonious patient experience.

At ViVE: Our team will be available throughout ViVE 2025 to share patient engagement best practices, product demonstrations, and to answer your questions. Schedule and attend a meeting with an Artera team member and earn a $25 Amazon card. As an added bonus, you’ll be entered to win an iPad Pro in our post-event raffle.

Schedule a meeting with our team.

AvaSure

Booth 2232

Contact: Nicole Douglas, product marketing manager

nicole.douglas@avasure.com

614.315.8112

AvaSure is an intelligent virtual care platform that healthcare providers use to engage with patients, optimize staffing, and seamlessly blend remote and in-person care at scale, addressing critical challenges in staffing shortages, rising patient complexity, and increased costs.

Join us at ViVE in booth 2232

Experience Innovation: Explore the next generation of AI-powered care and discover how AvaSure is leading the charge in creating the smart room of the future.

Interactive Demos: See our latest advancements in virtual care technology, including new devices designed to outfit every hospital room with virtual care and AI-enabled workflows.

Expert Insights: Don’t miss us live on the CHIME stage on Tuesday, February 18, at 1:35 pm to hear from industry leaders on how to scale virtual care beyond pilots.

Visit AvaSure at ViVE and discover how we’re shaping the future of healthcare. We look forward to connecting with you and sharing our vision for transforming patient care.

Cardamom

Contact Bridget Bell to schedule a meeting.

Contact: Bridget Bell, VP, business development

bridget@cardamom.health

608.658.3461

Cardamom is a minority-owned, healthcare technology services company specializing in data, analytics, AI, and applications with a strong focus on EHRs – particularly Epic. With expertise in revenue cycle optimization, managed services, implementation, and flexible AI solutions, we help healthcare organizations maximize the value of their data and technology to reduce costs, enhance care quality, and improve patient engagement. Learn more at www.Cardamom.Health.

Censinet

Booth 1218

Contact: Mark Gaudet, director, market development

markg@censinet.com

Censinet, based in Boston, takes the risk out of healthcare with Censinet RiskOps, the industry’s first and only cloud-based risk exchange of healthcare organizations working together to manage and mitigate cyber risk. Purpose-built for healthcare, Censinet RiskOps delivers total automation across all third party and enterprise risk-management workflows and best practices. Censinet transforms cyber risk management by leveraging network scale and efficiencies, providing actionable insight, and improving overall operational effectiveness while eliminating risks to patient safety, data, and care delivery. Censinet is an American Hospital Association (AHA) Preferred Cybersecurity Provider. Find out more about Censinet and its RiskOps platform at censinet.com.

Visit Censinet at booth 1218 at ViVE 2025 for information on early findings from the landmark Healthcare Cybersecurity Benchmarking Study 2025 and see live demonstrations of new AI product releases that transform how healthcare organizations assess, manage, and mitigate third-party and enterprise risk.

CereCore

Booth 856 (within Club CHIME)

Contact: Emily Scott, business development

emily.scott@cerecore.net

270.799.8115

CereCore works behind the scenes to empower hospitals and health systems with IT services around the nation and globe. Looking for IT and application support, technical professional and managed services, strategic IT consulting and advisory services, or EHR consulting? Let’s meet so we can help you find EHR experts to maximize your investment, tap into support desk solutions that will result in happier users and providers, supplement your technical and support teams, and connect you with the right talent so you can better manage IT operations. Find meaningful change with CereCore’s healthcare IT managed services.

CereCore is a proud sponsor of Club CHIME, so drop by the Club CHIME Lounge for some refreshments, swag, and to connect with our experts. Schedule a meeting with us. See you in the Club CHIME Lounge at ViVE 2025.

Clearsense

Booth 1602

Contact: Heather MacNeill, head of marketing

heather@hmadvance.com

602.400.8651

Clearsense, a leader in active data archiving and clinical trial matching solutions, transforms how health systems access and utilize critical health and operational data. With the scalable 1Clearsense Platform, health systems of all sizes can achieve faster time to value and streamline workflows for a more efficient organization.

Clearwater

Booth 2925 (in the Cybersecurity Pavilion)

Contact: John Howlett, SVP and chief marketing officer

john.howlett@clearwatersecurity.com

773.636.6449

Clearwater will be leading the conversation about strengthening cybersecurity practices in healthcare again this year, including a presentation by our corporate CISO and CTO of our Clearwater Managed Security & Managed Cloud Services, Steve Akers, that will share insights on the state of vulnerability management in healthcare. Be sure to catch Steve’s presentation in the Cybersecurity Pavilion at 2 pm on Monday, February 17, and stop by our booth to receive a copy of our analysis.

And for healthcare investors wrestling with how to manage cybersecurity risk in their portfolios, we will have insights on the areas where emerging companies need to focus most based on dozens of assessments we have conducted over the past two years.

Clinical Architecture

Booth 1133 (in the InteropNow! Pavilion)

Contact: Jaime Lira, VP, marketing

jaime_lira@clinicalarchitecture.com

317.580.8400

Visit Clinical Architecture at ViVE at booth 1133 and be sure to attend “Measuring Patient Data Quality with PIQI” Tuesday, February 18 at 10:20 am in the InteropNow! Pavilion, Stage 2. Charlie Harp, CEO of Clinical Architecture, and Ryan Howells, principal at Leavitt Partners, will present a 20-minute case study about the Patient Information Quality Improvement (PIQI) framework, an emerging standard for assessing patient data quality.

Consensus Cloud Solutions

Booth 1610

Contact: Alyssa Beard, associate director, events

alyssa.beard@consensus.com

319.325.2389

Visit us in booth 1610 for live demos and engaging discussions. Find out how we’re modernizing Fax with AI and join the healthcare providers and payers who have achieved:

– Reduced costs with scalable, cloud-based solutions.

– Improved accuracy and efficiency when receiving faxed records into the EHR.

– Faster prior authorizations and improved workflows.

– Enhanced reliability, data security, and HIPAA compliance.

Cordea Consulting

Booth 2534

Contact: Sara Braner, VP of sales

sara.braner@cordeaconsulting.com

816.510.5792

Cordea Consulting provides expert IT advisory services, digital health and cloud leadership, and contemporary staffing support to hospitals and health systems globally. Healthcare IT is all we do. We use proven tools and methodologies to help organizations build and optimize EHR/ERP/EIS systems and evolve their technology portfolios. Organizations partner with us to unlock funding, accelerate innovation, and grow more competitive in their market. Please stop by booth 2534 for some insightful demos or register to attend one of our after-hours events here.

CTG

Booth 819

Contact: Sarah Blafer, marketing business partner

sarah.blafer@ctg.com

860.942.2180

With over 35 years of expertise, CTG leads the healthcare IT consulting market by delivering innovative solutions and technologies tailored to the industry’s unique challenges, requirements, and regulations. Our range of services includes EHR managed services (including activation, go-live, and training support), cybersecurity, ERP, cloud and infrastructure, application management, support and development, and IT support. Visit booth 819 to explore how CTG can help your organization transform.

Direct Recruiters

Contact Emily Baron to schedule a meeting.

Contact: Emily Baron, client engagement and operations manager

ebaron@directrecruiters.com

Direct Recruiters builds unique partnerships with organizations to not only recruit and retain their valued human capital, but also to provide them with strategic growth solutions, as well as opportunities to partner with other successful organizations and/or PE/VC investment firms. DRI provides retained, contingency, and contract search options, in addition to partnership consulting, tailored to fit clients’ unique organizational needs.

Divurgent

Divurgent booth at Club CHIME

Contact: Joe Grinstead, chief of US operations

joe.grinstead@divurgent.com

214.533.9313

Divurgent is a leading healthcare IT consulting firm dedicated to transforming organizations through innovative solutions and exceptional service. Since 2007, we’ve specialized in strategic healthcare advisory services, digital transformation, and operational efficiency. As a 100% privately-owned company, we’re accountable only to our clients, ensuring they achieve measurable improvements in patient care and organizational performance.

Divurgent has led more than 700 projects across the US and Canada, drawing from a team of over 22,000 experienced subject matter experts. We collaborate closely with clients to deliver tailored solutions that drive success in an ever-evolving healthcare landscape, from EHR implementation and go-lives to managed services, analytics, talent augmentation, and total experience (TX). Our team has seen it all, drawing on years of experience to learn what works and help clients get the most out of their investments in healthcare technology.

At Divurgent, we’re committed to helping our clients achieve their vision and build a healthier, happier tomorrow.

Ellkay

Booth 1518

Contact: Auna Emery, VP, marketing

auna.emery@ellkay.com

520.481.2862

Experience healthcare connectivity in action with Ellkay at ViVE At ViVE 2025, Ellkay is bringing seamless interoperability to life. Visit our booth to see live demos of our cutting-edge data management solutions and discover how we empower hospitals, labs, payers, and healthcare IT vendors with effortless data exchange and connectivity. With integrations spanning 750+ EHR/PM systems and 1,100+ versions, we help organizations optimize workflows, fuel value-based care, and make smarter decisions.

Why Stop By?

– Live Demos – See our powerful platforms in action.

– Expert Insights – Learn why the industry is choosing Ellkay and chat with our team about your data challenges.

– Fun and Treats – Network while enjoying our exclusive booth events.

Don’t Miss These Special Events

– Monday, February 17 (3:30-5:30 pm): Milkshakes and floats.

– Tuesday, February 18 (3:30-5:30 pm): Espresso martinis

– Wednesday, February 19 (8:30-10:30 am): Fresh-baked donuts

Let’s talk about how Ellkay can power your healthcare data connectivity. Stop by and see interoperability in action. Learn more at Ellkay.com or connect with us on YouTube, LinkedIn, X/Twitter, or via TeamEllkay@Ellkay.com.

Elsevier

Booth 745 (in the AI Pavilion)

Elsevier is excited to exhibit at ViVE 2025! Visit booth 745 in the AI Pavilion to learn more about Elsevier’s solutions, including ClinicalKey AI and PatientPass. Interested in learning more about an evaluation methodology for AI in clinical decision-making? Mark your calendars to attend Elsevier’s session, “Evaluation of Generative AI for Clinical Decision Support,” on February 18 at the InteropNow! and AI Pavilion – Stage 1 at 10:25 am. You’ll hear insights from Elsevier’s Generative AI Evaluation Team’s experience establishing and implementing a framework for assessing clinical priorities such as correctness, completeness, and helpfulness of responses generated by AI-powered clinical decision support.

Findhelp

Contact Art Lopez to schedule a meeting.

Contact: Art Lopez, VP of business development

alopez@findhelp.com

Building healthier and happier communities starts with supporting the whole person. That’s why Findhelp was founded in 2010 – to connect all people in need to the programs that serve them with dignity and ease. Our software platform enables community organizations, governments, and businesses across industries to easily manage and coordinate care. From screening and closed-loop referrals to outcomes tracking and actionable health equity insights, Findhelp is leading the modernization of the social safety net.

At ViVE, be sure to attend “Community Health Centers: Making America Healthy One Community At A Time” on Wednesday, February 19 from 9:00-10:00 am on the Blues Stage. Findhelp COO Jaffer Traish will join panelists from San Francisco Community Clinic Consortium and Neighborhood Health to discuss the the innovative ways CHCs integrate primary care and promote healthy behaviors through ‘”food pharmacies,” community gardens, nutrition counseling, cooking and exercise classes, career counseling, and more.

Visit company.findhelp.com to learn more.

FinThrive

Meeting Pod MP2467

Contact: Lindsey LaMotta, senior events manager

lindsey.lamotta@finthrive.com

708.738.3242

FinThrive is advancing the healthcare economy by addressing every transaction and patient experience holistically with advanced, scalable solutions that integrate seamlessly with EHRs, enabling your organization to focus on growth, efficiency, and delivering an outstanding patient experience. Backed by decades of expertise, our comprehensive suite of RCM tools — powered by AI, automation, and analytics — unlock efficiency, boost satisfaction, and accelerate revenue growth. By removing the limitations of fragmented systems, we help you realize your full revenue potential. Our solutions give finance teams and stakeholders greater reliability and control to drive better outcomes while increasing revenue, reducing costs, expanding cash collections, and ensuring regulatory compliance. When finance becomes effortless, the possibilities for care expand. With over $10 billion in net revenue and cash delivered to more than 3,245 customers worldwide, that’s healthcare finance done right. Visit FinThrive.com to learn more.

Five9

Booth 526 (near the Provider and Payer Connect Lounge)

Contact: Roni Jamesmeyer, senior healthcare marketing manager

roni.jamesmeyer@five9.com

972.768.6554

Please come by our booth and see how AI is used in the healthcare contact center space! Five9 has a HIPAA-compliant healthcare cloud contact center solution that lets you seamlessly monitor and report call volumes in real-time across critical areas such as patient access, scheduling, prescription refills, and revenue cycle management, thus enhancing your staff’s efficiency. We integrate with Epic natively, as well as EHRs and back-end systems like Salesforce, serving as a central hub to facilitate your patients’ digital engagement journeys. AI governance in healthcare is top of mind at Five9 – let us show you how we do it.

Get-to-Market Health

Contact: Steve Shihadeh, founder and CEO

steve@gettomarkethealth.net

610.613.407

The continued pace of transformation in healthcare creates enormous pressure on technology companies to adapt and deliver clear value. Get-to-Market Health (GTMH) was formed to address this challenge. Whether a company needs to accelerate its top-line growth following an investment round or is bringing new products to market, GTMH helps healthcare technology leaders market, sell, and create sustainable, long-term relationships with their customers.

Health Data Movers

Contact Brooke Foster to schedule a meeting.

Contact: Brooke Foster, marketing coordinator

brooke@healthdatamovers.com

847.404.0326

Join us on February 17 at 8:00 pm and rock the AC Hotel rooftop RTB with Health Data Movers at ViVE! Jam out to some live music, enjoy a beverage, soak in the view! RSVP here, space is limited!

Also find us at our focus group on Sunday at 3:00 pm: “Unlocking M&A Success: Merging Systems for Seamless Integration and Maximum Impact,” with Curtis Cole, MD chief global information officer at Cornell University, Nitu Kashyap, MD VP and chief health informatics officer at Emory Healthcare, and Mehul Malhotra, director of delivery at Health Data Movers.

Health Data Movers (HDM) is a healthcare technology services firm. We are trusted partners to healthcare organizations, biotechnology companies, and digital health enterprises through our Services – Data Management, Integration, Project Management, and Clinical and Business Applications. We are the smart choice for creating unique solutions that empower patients and providers by unleashing the potential of healthcare data and technology. We Make IT Happen! Visit www.healthdatamovers.com.

Healthcare IT Leaders

Booth 1217

Contact: Peter Sfraga, VP, marketing

peter.sfraga@healthcareitleaders.com

A few days in Nashville is music to our ears! Come say howdy to the Healthcare IT Leaders team at booth 1217 and enter to win a gen-u-ine Stetson hat. Here are some other happenings we’re cooking up for you at ViVE:

- Mosey over to meet our Managed Services team and ask us how we’re delivering savings and higher customer satisfaction at health systems like yours.

- Sit a spell with our EHR Advisory experts to learn how we can help with everything from system selection to integration, optimization, data migration, and the latest in AI.

- Giddy up to our happy hour for cocktails and conversation with your peers and a chance to win a pair of authentic Tecovas cowboy boots. We’re at The Hampton Social – Rosé Lounge, Monday, February 17, from 6:30-8:30 pm.

Impact Advisors

Contact John Stanley to schedule a meeting.

Contact: John Stanley, chief growth officer

john.stanley@impact-advisors.com

562.243.4937

Impact Advisors is a leading healthcare management consulting firm committed to solving the industry’s emerging and evolving challenges. Our high-performing team of clinical, financial, operations, and technology experts collaborate to architect quality solutions and deliver measurable value for our clients. We are the most awarded consulting firm in healthcare, with services recognized among Best in KLAS for 17 consecutive years, including 2024 Best in KLAS #1 Overall IT Services Firm, and a culture deemed a “Best Place to Work” by Modern Healthcare.

Med Tech Solutions / Stoltenberg Consulting

Contact Kaitlyn Nelson to schedule a meeting.

Contact: Kaitlyn Nelson, director of account solutions and development

knelson@medtechsolutions.com

412.854.5688

Stoltenberg Consulting – a Med Tech Solutions company – exclusively serves the healthcare industry by providing customizable IT support solutions. FlexSourcing, Stoltenberg Consulting’s three-time Best in KLAS Partial IT Outsourcing program, delivers EHR system ROI through a versatile, on-demand health IT support workforce – including Tier 1+ help desk services – that can scale up at any time. Averaging 15 years of experience, Stoltenberg’s vendor-certified analysts are skilled in both financial and clinical systems with best practice expertise for Epic, Oracle Cerner, Meditech, NextGen, Veradigm (Allscripts), Altera, and EClinicalWorks systems. Turn to Stoltenberg and MTS as your partners through your EHR journey – from legacy system support, to go-live call command and ATE support, to EHR-certified staffing and EHR help desk support.

Medicomp Systems

Booth 2007

Contact: James Aita, director, strategy and business development

jaita@medicomp.com

703.803.8080

A leading provider of evidence-based, clinical AI-powered solutions, Medicomp Systems makes clinical data usable for enhanced decision-making and better outcomes. Medicomp works with physicians to deliver trusted, diagnostically relevant, actionable information to the point of care. The Quippe Clinical Intelligence Engine works with EHRs and health tech, driving intelligent clinical workflows that support the way clinicians think and work.

At ViVE 2025, Medicomp is excited to introduce new technologies available to healthcare organizations to make clinicians’ lives easier, and to extend AI with interactive multi-modal workflows. Specifically, Medicomp will be showing cutting-edge capabilities that convert dictation to trusted, structured, reportable data to drive billing, interoperability, and compliance. Medicomp will also introduce support for USCDI v3 and v4 along with SDOH compliance tools.

For more, visit medicomp.com.

Meditech

Booth 2126

Contact: Rachel Wilkes, director of marketing

rwilkes@meditech.com

781.774.4555

Discover what makes Expanse the intelligent EHR platform for an interconnected world at ViVE 2025. Meditech will showcase its groundbreaking advancements in interoperability, including the new Traverse Exchange network, which empowers organizations to maintain their independence by removing barriers to care through an open exchange of discrete patient information across all participating care networks and vendor solutions. Traverse Exchange allows for the secure and effortless sharing of meaningful health data through intelligent and intuitive workflows. This network provides embedded QHIN services to support TEFCA, while also looking beyond TEFCA at new use cases — from genomics to clinical trials — driven through timely adoption of the latest FHIR-based standards.

Meditech leaders will also be available to discuss how the latest features in Expanse deliver targeted, patient-centered care while reducing staff burnout. Solutions include:

– AI tools to reduce documentation time and increase face time, intelligently search the chart and summarize patient conditions, determine missed appointment risk, and more.

– Precision medicine solutions that integrate actionable genetic data into Expanse to enable targeted treatments for cancer care and clinical trials.

– A cloud-based subscription model, Meditech as a Service (MaaS), enables organizations to deploy a modern Expanse EHR at a sustainable cost while maintaining their autonomy.

– Expanded care models, including behavioral health, virtual care, virtual nursing, and home care.

– Mobile solutions that connect to the entire patient journey, wherever you are.

Meditech invites guests to an in-booth networking reception on Monday, February 17, from 4:45- 5:45 pm in booth 2126.

Visit Meditech’s ViVE 2025 event page for the latest updates and additional information, including Meditech customer leaders participating in ViVE educational sessions, and a special customer appreciation event.

MRO Corp.

Booth 1246

Contact: Brad Hawkins, national director, sales

bhawkins@mrocorp.com

610.994.7500

MRO is accelerating the exchange of clinical data throughout the healthcare ecosystem on behalf of providers, payers, and users of clinical data. By utilizing industry-leading solutions and incorporating the latest technology, MRO facilitates the efficient management and exchange of clinical data for all stakeholders. With a 20-year legacy, MRO brings a technology-driven mindset built upon a client-first service foundation and a relentless focus on client excellence. For more information on how MRO is empowering healthcare organizations of every type and scale with proven, enterprise-wide clinical data solutions, visit www.mrocorp.com.

Navina

Booth 1326

Contact: Dana Naim, director of marketing

dana.naim@navina.ai

Navina’s AI copilot for value-based care empowers clinicians and care teams to master workflows and enhance patient care without the admin burden. Navina’s powerful AI transforms fragmented patient data into a concise patient profile with actionable insights at every clinical touchpoint. Designed for and loved by physicians, Navina enables proactive patient care, increasing satisfaction, reducing administrative burden, and improving clinical and economic outcomes.

Stop by booth 1326 to see how Navina’s AI copilot is empowering clinicians and care teams to deliver proactive, personalized care while driving clinical and value-based outcomes. Book a meeting or learn more here.

Be sure to join us for:

– Live demos running all day.

– Guided meditation and massage chair.

– Fireside chat: “Transforming patient care: How Privia Health leverages AI and partnerships for value-based success,” February 18 at 12 pm on the Cybersecurity Stage.

– Fireside chat: “Transforming specialty value-based care with AI (featuring Upperline Health),” February 18 at 3 pm on the Cybersecurity Stage.

– Booth meet and greet with Hospitalogy’s Blake Madden, February 18 at 4:30 pm at booth 1326.

Optimum Healthcare IT

Booth 1008

Contact: Larry Kaiser, chief marketing officer

lkaiser@optimumhit.com

516.978.5487

Optimum Healthcare IT is a Best in KLAS healthcare IT digital transformation and consulting firm based in Jacksonville Beach, Florida. Optimum’s comprehensive service offerings include Enterprise Application Services; Digital Transformation; and Workforce Management, which features our skill development program, Optimum CareerPath. At booth 1008, we will showcase our Digital Transformation services such as ServiceNow and Cloud. Stop by our booth to meet our experts and learn more about how Optimum can help you achieve your digital transformation goals.

Praia Health

Contact Jared Johnson to schedule a meeting.

Contact: Jared Johnson, chief marketing officer

jared.johnson@praiahealth.com

Praia Health is the first consumer experience orchestration platform for healthcare, revolutionizing the way health systems engage and retain patients. Praia provides a digital flywheel, connecting all of the ways that a consumer interacts with a health system before, during, and after care visits based on actual data across an entire ecosystem — not just on segments, models, or clinical records. This allows health systems to provide consumers with truly personalized recommendations that reduce friction, increase engagement, and drive system loyalty.

Prominence Advisors

Contact Mark Ostendorf to schedule a meeting.

Contact: Mark Ostendorf, chief revenue officer

mark.ostendorf@prominenceadvisors.com

573.579.6992

Founded in 2011 by former Epic leaders, Prominence empowers healthcare organizations to execute strategic data initiatives with confidence. We’ve led the way in automating data pipelines and facilitating cloud migrations, delivering governed data products that enable self-service analytics, real-time insights, AI, machine learning, de-identification, and visualization. By seamlessly embedding analytics into workflows, we transform data into frictionless insights that drive action.

Recognized as the 2023 Best in KLAS for Technical Services and the 2024 Best in KLAS for HIT Staffing, our team brings unmatched expertise in maximizing your existing investments and upskilling your workforce. Our strong partnerships with leading cloud, lakehouse, analytics, AI, visualization, and governance vendors make Prominence the only firm capable of supporting every step of your data journey. Let’s unlock the full potential of your data and make healthcare smarter — together.

Rhapsody

Booth 950 (in the AI Pavilion)

Contact: Purvi Thakur, director, growth marketing

purvi.thakur@rhapsody.health

214.727.8981

Rhapsody is a digital health enablement platform, providing Best in KLAS integration and identity management solutions for health tech builders and care providers. We’re in booth 950 in the AI Pavilion, right by the stage! BioIntelliSense Founder and CEO James Mault, MD will share how they use Rhapsody to achieve their innovation goals. Drew Ivan, our chief architect, will speak about using the right AI for the job. Get a demo of our newly launched EMPI with Autopilot, designed to help you overcome resource challenges.

SmarterDx

Booth 1012

Contact: Marisa Johnson, head of marketing

marisa.johnson@smarterdx.com

701.370.9907

SmarterDx builds clinical AI that empowers hospitals to analyze the complete patient record to fully capture the value of care delivered. Our proprietary AI platform understands the nuances of clinical reasoning, enabling hospitals to true the patient record and recover millions in earned revenue, enhance quality metrics, and overturn denials.

Plus, stop by for out-of-this-world swag, like Smartian piggy banks (our lovable mascot!) and personalized mini Etch a Sketch portraits.

Sonifi Health

Viosk 2430

Contact: Mindy Cooper, VP sales, strategic accounts

mcooper@sonifihealth.com

704.277.7770

Sonifi Health provides industry-leading, interactive patient engagement technology proven to improve patient outcomes and staff productivity. The EHR-integrated platform is designed to anticipate the needs of patients and clinicians, infusing the principles of hospitality into care experiences. As part of Sonifi Solutions Inc., the company supports more than 300 million end user experiences annually. Learn more at sonifihealth.com.

Surescripts

Booth 1245

Contact: Kate Giaquinto, PR manager

kate.giaquinto@surescripts.com

603.548.5273

Connect with Surescripts at ViVE in Nashville, February 16-19, anytime at booth 1245. And be sure to join Surescripts’ Lynne Nowak, MD, chief data and analytics officer, for a presentation, “Transforming Prior Authorization,” on Monday, February 17 at 10:45-11:05 am at the InteropNow! Pavilion – Data Innovation Theater. She will share results of a recent partnership to reimagine the prior authorization workflow for greater efficiency, a better experience for prescribers, and faster speed to therapy for patients.

Symplr

Booth 1348

Contact: Ann Joyal, VP, marketing communications

ajoyal@symplr.com

617.791.5066

Symplr, a leading provider of enterprise healthcare operations software, will be unveiling the Symplr Operations Platform (SOP) live at ViVE! Symplr is also hosting a PGA Ambassador event and happy hour with pro golfers Russ Hunley and Seep Straka on Monday, February 17 at 4:30 pm. Stop by booth 1348 for more information, and don’t miss Symplr’s executive panels:

- Monday, February 17, 10:55 am | Live from the CHIME stage – Don’t miss this session on digital health platform strategy featuring Symplr CEO BJ Schaknowski and CHIME CEO Russ Branzell, with Baptist Health CIO Aaron Miri, Advocate Health CIO Andy Crowder, and Cook Children CIO Theresa Meadows.

- Tuesday, February 18, 10:55 am | “I’ve Got 99 Problems, but Tech Ain’t One” – Check out this panel at the Jazz Stage on data quality and organizational readiness for successful AI integration, featuring Symplr CMO Dr. Angel Mena.

- Tuesday, February 18, 2:55 pm | InteropNOW! stage presentation – Symplr CEO BJ Schaknowski will discuss healthcare transformation and platform thinking.

TeamBuilder

Booth 426

Contact: Taylor Bockweg, VP, sales

taylor@teambuilder.io

TeamBuilder is the first smart staff scheduling platform that utilizes real-time volume data, specifically designed to address today’s most pressing workforce challenges in the ambulatory care setting.

What Makes Us Different?

Move Beyond Traditional Staffing Ratios: Leverage predictive analytics to staff based on actual demand, ensuring you have the right people in the right place at the right time.

Increase Operational Agility: Quickly adjust staffing levels to accommodate unexpected changes in volume or last-minute callouts.

Improve Access to Outcomes: Streamline staffing to enhance patient access and overall care quality, leading to better health outcomes.

Enhance Staff Satisfaction: Provide your team with the flexibility they need to excel, resulting in a more engaged workforce.

We’re thrilled to be part of the ViVE 2025 conference and invite you to visit us at booth 426 to:

– Discover how our data-driven schedules guarantee optimal staffing.

– Book a demo and receive a free AirTag.

– RSVP to our happy hour event and unwind with great conversations and drinks!

Trust Commerce, A Sphere Company

Booth 1220

Contact: Ryne Natzke, chief revenue officer

rynen@spherecommerce.com

Transform the way you process payments with TrustCommerce’s 25+ years of expertise in healthcare provider support. Experience secure and compliant payment processing, anytime and anywhere – all while being seamlessly connected to leading EHRs like Epic, Veradigm, and AthenaIDX.

Stop by our booth and learn about TrustCommerce’s next generation, card-present solution Cloud Payments.

Not able to make it? Schedule a meeting.

Vyne Medical

Booth 744

Contact: Jen Fontanella, marketing director

jen.fontanella@vynecorp.com

949.300.8200

Vyne Medical is revolutionizing healthcare by streamlining operations with AI and automation. Join us at ViVE 2025 to discover how our innovative solutions can enhance efficiency, reduce clinician burden, and improve patient care.

Why visit Vyne Medical? AI-powered solutions to automate document management and revenue cycle workflows. Smarter, faster processes that increase accuracy and reduce manual effort. Scalable technologies designed to support long-term growth.

Featured Sessions

“Automation in Action: How VHC Health is Shaping the Future of Document Management”

Explore how VHC Health has reduced document processing times by automating incoming orders.

Speakers: Jess Czelusniak (VHC Health) and Tim Hoskins (Vyne Medical)

Date/Time: February 18, 11:40 am–12 pm

Location: Data Innovation Theater – 944

“Smarter Workflows, Better Care: How AI is Revolutionizing Healthcare Operations”

Discover how AI is transforming healthcare workflows to improve efficiency and patient care.

Speaker: Caleb Manscill (Vyne Medical)

Date/Time: February 17, 2:35-2:55 pm

Location: Data Innovation Theater – 944

Join us to see how Vyne Medical can help you achieve smarter workflows and better outcomes.

Comments Off on HIStalk’s Guide to ViVE 2025

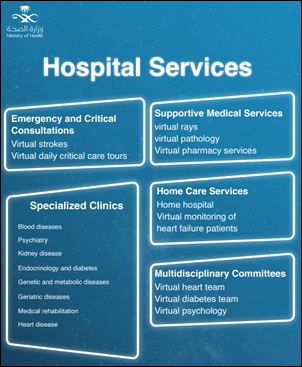

Today's post contains the phoenixes rising from the ashes of the post COVID telehealth era. There's two things that destroy…