Monday Morning Update 11/28/11

From Ganglion: “Re: Franciscan Health System (WA) going to Epic. An internal memo referenced ‘a major payer’s requirement for providers to be on the Epic platform’ was unusual. I wasn’t aware that payers had that much say in such matters.” I found the item below by Googling. Maybe the major payer in question is the federal government and the ‘requirement’ involves earning MU bonuses / avoiding MU penalties.

Franciscan Health System (FHS), Tacoma, WA, along with CHI’s ITS and clinical leaders, has recommended that FHS work directly with Epic to purchase and implement Epic’s Enterprise Suite as its electronic health record solution. The project plan and budget will be presented to President’s Council in February for approval. CHI’s decision for FHS to implement Epic is based on several factors that have the potential to significantly affect the organization’s ability to remain competitive and accelerate growth, including a major payer’s requirement for providers to be on the Epic platform and Epic being the pervasive clinical IT platform in western Washington. The project will include a fully integrated electronic health record, a revenue cycle application and other applications for inpatient and ambulatory centers and employed physician practices. The Oregon facilities in the same CHI Division as FHS will implement Meditech 6.0 and Allscripts. The project is expected to begin in early 2012 and to be complete in mid to late 2013. As part of OneCare, the project will have full leadership, ITS and project management support from CHI’s national office.

From Is3Mreallyafriend?: “Re: 3M interfaces letter to customers. Looks like a desperate attempt to protect a market. You decide.” The purported e-mail from 3M was attached, with some relevant snips below. It says that the company is merely enforcing agreements already approved by customers in their contracts and that 3M will issue licenses at no charge for interfaces that meet those requirements.

The rapid transition to digitized records and expanding use of “machine learning” capabilities make it possible for some software applications to utilize 3M intellectual property in ways it was not intended nor authorized to be used … We are reviewing our current vendor relationships to verify that all existing interface license agreements include provisions that protect 3M intellectual property and ensure the compliance and validity of the output produced by our products …. If 3M agrees to enable an interface and an interface license agreement is finalized with a vendor, we will provide the vendor, at no cost to the vendor or to you, 3M confidential interface specifications … We can assure customers there will be no impact until the July 2012 3M software release, at which point direct interfacing from any vendor application not covered under an interface license agreement will be disabled.”

From BadgerMom: “Re: Martin Memorial announcement. How many times do we have to say it’s Epic, not EPIC?” I noticed that and let it slide since it seems so be a hopeless cause to expect customers sending dozens to hundreds of millions of dollars to a four-letter-word vendor to know how to spell its name. It’s annoying when vendor marketing people insist on capitalizing a company’s name for no apparent reason in press releases, but they’re innocent in this case since even Epic spells its own name correctly, as clearly shown in its logo.

From Ken Lawonn: “Re: Epic at Alegent Health. I can confirm your reader’s post.” Ken, who is SVP of strategy and technology at the Omaha-based Alegent, provided the following information:

I am the CIO at Alegent Health and wanted to confirm the post today by Nikita that the Alegent Health Board has approved a recommendation to move into due diligence with Epic. This recommendation was the result of an high level evaluation done by an IT Evaluation Committee made up of board members, physician leaders, and system executives that considered the future needs of the organization and the best platform to support us. In the end, this was about an integrated solution across the continuum of care as we move to a future where our success will be based on our ability to effectively manage a population and our need to be as clinically integrated as possible. In our evaluation, we believed Epic would provide us with the best platform for success. It was a tough decision as we have been partners with Siemens for many years, have enjoyed many great successes with the Soarian product, and Siemens is aggressively working to build out their platform to support this future environment. And while I personally believe they will be successful, the overall Committee felt Epic’s proven record was too much of an advantage. Our final decision will come in March, but we are entering full evaluation of Epic at this time.

From Pretty Patty: “Re: ViaTrack Systems. Acquired by NextGen.” Unverified. I’ve seen no announcement about the Augusta, GA claims and eligibility transactions vendor. I would have expected publicly traded parent company Quality Systems to have filed an 8K if the rumor is true, but I don’t claim to be an expert in that area.

From Wally LG: “Re: HCA. Has chosen Epic, or so I’ve heard. Heard from Epic staff that top implementation positions have been staffed even though no official announcement has been made.” Unverified.

From Reverend of Funk: “Re: whole hog vs. best-of-breed. I’ve worked at three HIT shops. One implemented everything that Cerner ever created, the second did the same with Epic, and the third (my current employer) is an academic system with a Cerner backbone and lots of best-of-breed extremities. Is #3 an oddity among most new Cerner and Epic implementations? Things are so confusing here that people don’t even know where data comes from, and just putting together data for basic purposes involves tweaking interfaces or creating new ones.” My limited, anecdotal experience is that Epic implementations usually involve replacing everything with Epic except for its obviously weak systems like lab (although with Epic, it rarely takes long to progress from new/weak to slightly less new/best available, so we’ll see if Beaker LIS makes the usual quick climb to the top of the heap.) Epic is often chosen as the solution to a hospital’s data-chasing problem and the company isn’t known for its friendly integration cooperation with competitors, but I would say both issues are less true of Cerner. That’s a cue for readers to chime in with a description of their own experience.

From DW: “Re: Patty Vogel. You may want to let people know of her passing. She was CEO of Barrow Neuro in Phoenix, but earlier in her career was a pioneer in the MSO market in North Carolina. A fine person with a long and successful career in the HIT business.” Patty Vogel died on November 4 at 68.

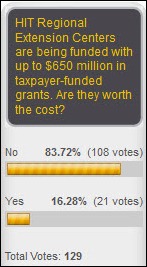

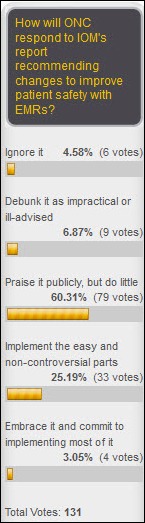

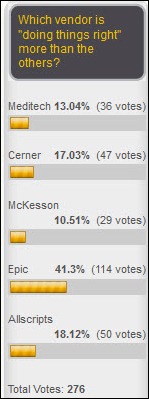

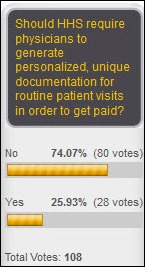

HITREC’s aren’t worth the $650 million in taxpayer money that’s funding them, so say 84% of poll respondents. New poll to your right, from a reader’s earlier comment and just in time for holiday-related food binging: would you discount the opinions of a healthcare-related speaker or author who appears to be significantly overweight?

Listening: new from White Wizzard, LA-based retro-metal that isn’t all that original or interesting, but serviceable in a pinch for someone feeling nostalgia for Rocklahoma-type 80s hair band music that could pass at times for Whitesnake, Dio, Iron Maiden, or Rush. I don’t love it, but I don’t hate it.

Weird News Andy worked busily through the Thanksgiving holiday to locate this tasty morsel, which captions as, “At least this man has some skin in the game.” The former world’s fattest man, who has lost almost 500 pounds after costing British taxpayers over $1.5 million in medical care over the past 15 years, is demanding that the British government pay for a $10,000 skin-tightening operation. NHS says that’s not happening until his weight stabilizes. The former letter carrier had gained so much weight that he was transferred to the letter sorting department, where he was fired for stealing money from the envelopes. He wasn’t just big boned: he was scarfing down 20,000 calories per day until taxpayers provided him with gastric bypass surgery.

WNA also contributes this story, in which a male nurse says he was fired from the health department of Dearborn, MI for disobeying a Muslim supervisor’s orders to not treat women wearing Islam garments and instead take those patients to the supervisor. He stopped doing that when a doctor complained about the treatment delays caused by that practice. The 63-year-old nurse, a former Army medic in Vietnam, has filed a sex discrimination lawsuit. WNA ponders whether the families of those patients would have sued the nurse if he had followed the rules and detrimentally delayed the care of their their relatives.

An Alaskan chiropractor whose patient information was found to be wide open on the Internet says a EMR4Doctors.com, a Las Vegas-based EMR vendor he used for a short period in 2008, is responsible. He says the vendor stored his patient information in an unsecured text file that a patient found when Googling his own name. The chiropractor thanked the patient, notified HHS, and says he’ll sue the vendor if there’s anything left to sue (he thinks the company is defunct.) An Internet search suggests that EM4Doctors is run by a chiropractor named Don Lewis, who uses the address of a small house in Las Vegas (above.) Its Web page is still active and the 1-800 number brought up a PBX message when I called it Sunday afternoon.

CMS Administrator Don Berwick says he’ll resign effective December 2, four weeks before his appointment would have expired anyway. President Obama, who gave Berwick the job in July 2010 using his “recess appointment” authority to avoid Senate confirmation hearings, says he will nominate Marilyn Tavenner (above), a nurse and Berwick’s second in command, as his replacement. Most of her career was spent at Hospital Corporation of America, ironic given that she worked as an executive of the for-profit hospital operator during the time it (as her previous employer) earned a record $1.7 billion fine for Medicare fraud (against her current employer.)

Vince Ciotti provides HIS-tory Episode # 32, the third part of his HIS, Inc. coverage. This one reads like a novel, full of intrigue and unpredictable twists and turns. Very enjoyable.

A doctor in Canada runs afoul of a peer review group over her practice’s use of an EMR. Her practice manager (also her husband, who is also the developer of the MedScribbler EMR she uses) asks for a peer review assessor who has EMR experience since her practice is paperless, but also advises the peer review group that the practice will bill them $150 per page for completing its questionnaire and $400 per hour for providing access to the practice’s records. The peer review group files a complaint and the doctor is advised that her medical license will be suspended immediately. The husband agrees to complete the forms at no charge, but tells the assessor to bring his own computer on which to install a copy of MedScribbler for reviewing the records. The assessor has installation problems and the husband says the assessor can call his company’s support line to get help for the usual $100 charge. The assessor walks out and files a complaint saying the doctor was uncooperative, resulting in another threat to revoke the her license. The husband says it’s not his fault that assessors aren’t tech savvy enough to review electronic medical records, he wouldn’t have been expected to provide free tech support if he didn’t coincidentally happen to be the software developer, and assessors should not have unrestricted access to the non-clinical part of patient records.

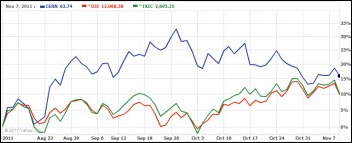

Nuance announces Q4 numbers: revenue up 18.5%, EPS –$0.02 vs. $0.01. Excluding one-time acquisition costs, the company beat expectations with earnings of $0.42.

In England, University Hospitals of Leicester issues a $930 million (USD) tender notice for a vendor to help it deliver electronic patient records and technology-related benefits over a 15-year period and then help it commercialize its knowledge as an IT services provider.

A Wisconsin technical college plans to discontinue its programs for medical transcription and health unit coordinator, saying the medical transcription program isn’t attracting very many students and graduates aren’t getting jobs because speech recognition technology has reduced the need for their services. It says HUC program graduates can’t find jobs because CPOE requires doctors to enter their own orders.

Fast Company runs a fun (but sadly accurate) article called How to Commit Medicare Fraud In Six Easy Steps. A key element: focus on quantity rather than quality since CMS doesn’t have the resources to check rejected claims, so a fake provider can just keep shot-gunning claims and some will eventually go through.

A woman being treated in a Scotland hospital’s ED for broken fingers starts receiving Facebook messages from someone who said he was “checkin u out” and asking about her hand. Her unknown admirer admits to being a hospital maintenance worker who saw her in the ED and looked up her information in the hospital’s computer system. The contract maintenance employee has been suspended by his employer, the police are involved, and privacy practices are being reviewed.

There was a time when my company went through multiple rebrands. These were relatively minor shifts, but completely unnecessary. It…