Justin Dearborn is founder and CEO of Praia Health.

Tell me about yourself and the company.

Praia Health is celebrating our one-year anniversary of our spinout of the Providence health system and their incubation group. We are carving out a new space around consumer orchestration within health systems. Our primary customer is a health system that wants to improve their patient- and consumer-facing experiences, whether it be an app, web, or call center. We help with orchestrating all the touchpoints and coordinating those. It looks similar to how most consumers are used to interacting on the internet, being very personalized and removing friction where we can. It’s a new space of consumer orchestration.

Prior to coming to Praia, I was the CEO of another patient engagement company called Patient Bond that is now a part of Health Catalyst. Before that, I spent eight years at Merge Healthcare as CEO. They’re a publicly-traded medical imaging company that was acquired by IBM.

How much attention are health systems paying to the digital consumer experience compared to other industries?

There is interest and discussions. A lot is going on at the macro level that has maybe defocused some of those projects, but we’re still definitely in the early adopter phase of the market. Always good conversations with the chief strategy, chief digital, or chief transformational officer. Most of the meetings are very receptive.

There’s a lot that sometimes needs to happen on the back end to allow for a very elegant front-end experience. There’s some organizational change, some change management that is probably responsible for longer sales cycles, but we see receptivity to the message and everyone gets it and nods their head. We want a better consumer-patient experience. We want it to mirror Amazon, which is a tried and true analogy that everyone uses it because it’s a good analogy and it works.

It’s hard to say you wouldn’t want to deliver for your patients a very personalized experience at scale. If you and I were both using the Providence app, for instance, we could each open up our apps and we would have a different set of calls to action and information based on what they know that we want to see and don’t want to see. It expedites that and keeps you engaged. I don’t recall ever hearing, “I’m not interested, it doesn’t make sense.” It’s more about, do we have budget this year? Do we have resources? Is it on the roadmap? And now we’re going to try to figure out what’s going to happen with Medicaid and how that impacts our system. That’s not unique to Praia, of course, but just a little bit of distraction to start 2025.

How do you approach the return on investment questions?

This could fall into marketing, and not that those projects don’t need a tangible ROI, but absolutely, this is an ROI sale. We approach it that way. If something’s already been approved in a new project, a new website design, we could fold into that and enhance that. But overall, it is an ROI sale. We have incredible data from Providence that we released a few months ago that shows a really compelling ROI. The ROI tool we use can scale up and down. Every system is not going to have the scale of Providence, but the same levers are in place across the board.

We’re very bullish on the ROI. We’ll actually contract around that, do some gain share and take some risks because we’re confident in the return. We definitely approach every opportunity or engagement that it has to have an ROI to get to the starting block.

What lessons have been learned from big companies in healthcare, such as chain drug stores or insurers, that could be applied to a health system?

We think it’s across verticals. It’s just loyalty and driving engagement. It’s been proven by some great research that’s out there that nudges within an app work. You have to be cognizant not to over message, which some industries have been guilty of, but keeping a patient or consumer engaged.

One of the theses for Providence, where this was designed five years ago, was that they were seeing only about 1.7 visits a year per adult, and the average adult has five different interactions with the health system. They found that most health systems don’t have compelling reasons for you to go back and visit the health system in between episodes of care. They can deliver up content that’s relevant to you. Every health system has a plethora of health and wellness data, but how does it get served up to you? How do you know about it? It could even be spiritual in Providence’s case. They have a great library of material and they know who want to engage with that and who won’t.

It’s really just serving up content and making it relevant for you. When you have a health and wellness concern, go to the Providence app first, there might be something there for you even if they don’t deliver the service. They might have a network of providers. It could be physical therapy, it could be through a medicine partner. They can deliver you into that experience through the Providence app in a frictionless way. You don’t have to create another ID, log in, or manage 18 or 20 different apps. It can all be delivered within the Providence app, even if it’s not a Providence service, per se.

Do consumers feel aligned with a health system that is attempting to market to them or engage them between encounters with what might feel like a sales pitch?

There’s definitely that risk. But great data suggests that patients trust their health system, whether it be big brands like Cleveland Clinic, Mayo, and Providence. Maybe to the same extent, for independent pharmacists. Depending on where you live, there still are some independent pharmacies where you get to know your pharmacist and have a trusting relationship .

But otherwise, the research would suggest that people do want to get content a from a health system. I think that’s well earned. Over half of the health systems are non-profits and a lot of them are faith-based, so they are mission driven. They have to run businesses, but they really do have the patient’s benefit in mind. You can draw comparisons to some that are purely profit-driven and you could tell the difference in experience. I think they are a trusted source.

Some maybe have been a little bit complacent with that status, and they are getting channeled into some new business models. One Medical is a great example. They do a great job, but they are forcing some systems to start moving and focusing on digital, because One Medical is a great digital experience. It’s only going to get better with Amazon owning them. That’s creating some pressure, and that’s sometimes what is needed to force some innovation. But health systems are trusted sources in the community, and they are more and more starting to leverage that.

A business would target those consumers who have the potential to be the most profitable. Do health systems look at providing services such as population health or do they focus on selling profitable services?

I’m sure that goes on. I would say that a lot of the non-profits we’re working with do focus on top of funnel. Once they are in this system, so to speak, and they’re a digital user, they will interact with them around knowing that a care gap is coming up. I haven’t seen, “Let’s go target this audience because we need to fill up the ortho schedule for knee replacements,” but they will absolutely do a great job with tools like Praia targeting, “ You’re overdue for your colonoscopy” or “you’re overdue for your mammography exam.”

The click-throughs and actions are taken when it’s delivered through an app, and Providence has allowed us to publish on this, it’s three and four acts of a text message and email, et cetera. Phone calls are great as well, but they don’t scale as well, of course, and most people don’t answer their phone. It’s more targeted around care gap closures, I will say that some more nimble systems, if they know that they’re having a couple of open days, will reach out to folks that in the past who needs a knee replacement but didn’t schedule for whatever reason. Maybe nudging those along. There’s some incentive to do it because there’s going to be some openings in the schedule. But what we see predominantly is more around care gap closures. There’s enough of that to keep them busy.

What are the challenges in communicating with people who prefer texting or emailing to a phone call or vice versa?

You would naturally think that it’s going to be age driven, but we’re definitely seeing that it’s not. My grandmother was 92 and she was texting her clinician. It’s going to be more pronounced as everyone ages into it and has grown up texting and using email and app communications. It’s definitely a split.

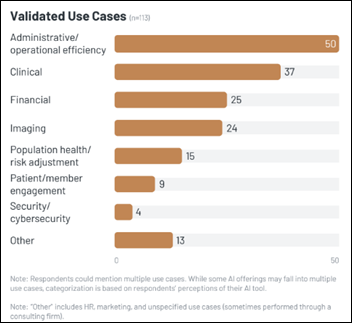

AI comes up in every conversation, so every health system is analyzing how to use it, more on the back office side and the first line of interaction. But because it’s healthcare and it’s personal, a good mix should be available. There are people that want to talk to an empathetic caregiver and somebody who’s going to actually walk them through something and hold their hand, so to speak, over the phone. But they are more routine communication for sure.

Providence has another product they built internally around email. They analyzed the number of emails that their physicians get and it can be hours a day of cleaning out your inbox. They found is 80% were more routine and could be handled by a front office person or a password reset or something like that. Trying to make the clinicians more efficient, because they all recognize — especially the faith-based and non-profits — this is personal. Most people, when it comes down to something life threatening, want to talk to a human being.

What other data sources outside the EHR might be useful for a health system that is trying to address consumers rather than just episodic patients?

That is the key selling attribute of Praia. We leverage all the great work that the EHRs do. We see MyChart and they do a great job, but it’s really designed and focused on the clinical interaction. Even some of that could be done a little.

In a Praia experience, and I’ll use Epic again, MyChart will be will show up. At every screen, you can punch out and click through to MyChart if you want to look at your lab work. Depending on the system and the health system, you could schedule through Epic, but there’s a lot of other scheduling applications as well. We definitely leverage that and enhance the value, because more digital users in a system are better for the health system, better for the EHR, better for us. We absolutely drive adoption there.

Rock Health did a great paper on this last year. About 80% of health and wellness happens outside the clinical visit. How do you get into more of that? We have a couple of partners on the Praia platform, Foodsmart being one of more food is medicine. That’s a very rightfully popular area right now. That’s a separate company. But Providence has a relationship and we can serve that up in the Praia app, make it seamless for a consumer-patient within Providence app to leverage that. There are other companies like Rosarium, where if you’re qualified from your insurance or Medicaid and will be using a wheelchair for six months, they will build a ramp and make it accessible in other areas. The ecosystem of partners is unlimited, but that’s outside the clinical interaction. Providence and forward-thinking systems want to be a part of that and keep you engaged with them to make your life easier with just one application.

Amazon is using AI in its health assistant to push specific products based on a user’s profile and their use of its website. Could AI be misused in an attempt to personalize the healthcare consumer experience?

The systems we’ve interacted with are very cognizant of overreaching there. Providence, for example, has a governance committee. They are focused on AI in the background. Administratively looking at whether the bill’s coded correctly. Can we answer some of these questions around like password reset, or what’s my insurance deductible? They use AI for that, but as far as interacting, anything touching clinical, anything that could be seen as practicing medicine, systems haven’t, for the most part, taken that leap. I think they are conscious of what you just said.

Another example is Abridge. It has been in the news a lot and they’ve done a great job with ambient listening, which is making the physicians more efficient. Most systems and patients are comfortable with things like that. They do a lot of voice of customer, voice of patients research around this and are comfortable. Does anyone want to interact directly with an AI bot yet? Not for clinical. Where’s my bill, or I have a question about it, maybe. They are being methodical about how AI interacts.

On the Praia side, our platform can ingest any AI agent or application that a system has built and deliver that. But we’re also taking a very measured approach around that. Hype is probably unprecedented, but there’s not a lot of tangible ROI yet. Every health system is experimenting and piloting, but there’s not a ton of great use cases outside of the couple that I mentioned.

What factors will be most important to the company over the next couple of years?

More customer input, and customer being the health system. This was built at Providence. It was intended to be commercially facing me, not solving a Providence-only problem. We just need more data points, more customers on the platform.

Unfortunately for first half of the year, a lot of systems have been reluctant for systems to move forward, which is not just a Praia concern. With the potential cuts in Medicaid, and other grants have been cut, we’ve been interacting with a lot of systems and we’re pretty far down the road. Then budgets have been frozen because of the some of the NIH grants that roll downhill.

But I think there will be a tipping point where a couple of big, notoriously skeptical, hard-to-hard-to-get-on-board health systems will come on board with Praia. Then it will be like what happens with a lot of startups, where the momentum will move fast from there. But really, it’s it’s around knocking down those next group of health systems so we can continue to increase the the R&D spend and get additional perspectives on what will be helpful.

What we’ve found so far is that once the platform is in place, a lot of use cases come up. We’re trying to be careful to only bring to market use cases that have applicability across every health system. Like it can be vaccine scheduling with Walgreens, or we announced a partnership and investment from Labcorp streamlining the way lab ordering works from the physician pen, so to speak, to the patient and making sure they show up knowing what’s expected of them so they show up at the right facility at the right time and have done the right preparation in advance. Things like that will continue drive use cases and, frankly, value from the platform. But really, for us, the focus is just onboarding more customers in 2025 so we can continue to build that knowledge base.

Comments Off on HIStalk Interviews Justin Dearborn, CEO, Praia Health

"The US Immigration and Customs Enforcement (ICE) posts an anticipated future contracting opportunity for a correctional EHR for ICE detainees,…