Darren Sommer, DO, MBA, MPH is founder and CEO of Innovator Health of Jonesboro, AR. He is also an assistant professor in the Department of Clinical Medicine at NYIT at Arkansas State University, a lieutenant colonel in the US Army Reserves, and served two combat tours in Afghanistan in Operation Enduring Freedom as brigade surgeon for the US Army’s 82nd Airborne Division, 2nd Brigade Combat Team, where he earned the Bronze Star, Combat Medic Badge, and Combat Action Badge.

Tell me about yourself and the company.

I’m an internal medicine physician. My origins in the telemedicine space came after deploying to Afghanistan in 2007. I had trained at a suburban hospital in the Tampa Bay area, but was then exposed to some unique pathologies being in a third-world country. The Army had a very good communications infrastructure that allowed me to connect with people around the world.

I used that as the foundation for thinking about how we can use telemedicine to serve and support our rural communities here in the United States. It was a glaring gap for me that the main telemedicine systems that are in existence today, and definitely those at that time, were created for another purpose and then repurposed for healthcare. It was difficult enough to have a conversation in the room with a patient about a diagnosis of cancer, HIV, or Mom’s dementia. It was almost impossible to do that with the existing technology.

We set out to create a platform that would allow us to be at the patient’s bedside, in life-sized form, in 3D, and with direct eye contact, so that the patients felt like we were there with them. That was the origin of Innovator Health.

Now that we’ve quickly broadened experience with telehealth, how can doctors approach video visits in a way that is more acceptable to patients?

It’s funny, because if you ask 10 doctors how they define telemedicine, you’ll probably get 11 different answers. Most physicians look at telemedicine as just a two-way video conversation. Many of the health systems during COVID used basic Zoom-like technologies to connect with patients. When I talk about telemedicine, I talk about patients in a hospital environment, using medical instruments for diagnosis and treatment, access to the electronic health records, and sophisticated care delivery for telemedicine services. It’s different than how the rest of the market is looking at it.

Does clinician personality type play a role in their success in virtually connecting with their patients?

Good bedside manner is important, regardless of where you are in relation to the patient. I can be physically present in the room with a patient, not look them in the eye, not answer their questions, look at my watch, not allow them to feel at ease, all while being physically present. That’s not going to be a good experience for the patient.

On the contrary, I can be on the screen, be attentive, focus on their questions and answers, interact with their families, provide them the help they need, and have a great interaction. I’ve had many patients provide exceptional comments on the satisfaction that they’ve received from the care we’ve delivered through the telemedicine system in ways that I’ve rarely seen colleagues get in person. So I think it’s much more about how you interact with the patient as opposed to where you’re interacting from.

How do rural areas address the issues of having few doctors and limited connectivity?

My interest in the rural community is because it’s the area that has the greatest need. Look at the evolution of healthcare over the last 40 or 50 years. If I had graduated from residency in 1970 and moved to rural community, I most likely would have been able to do almost anything in that community — minor surgeries, delivering babies, primary care, and a host of things. Over the last 40 or 50 years, as we’ve evolved clinically as a profession, we’ve gone from just a few specialties to almost 100 specialties, and the ability to provide a broad range of services has become more limited. Hospitals don’t have the range of services they did 20 or 30 years ago. That means people in rural communities have to actually physically leave the local community and drive to an urban area to receive care from a specialist.

Many of these services could be provided virtually. Even take surgery as an example. You could have a preoperative visit, where the surgeon talks you to them about your case. You could make a trip into the city, let them examine you, figure out exactly what’s going on, have a follow-up visit before your surgery, have your surgery in the city, and then do post-op visits back in the local community. I look at it as a spectrum of capabilities that exist in combination.

These rural community hospitals are extraordinarily important. They are typically the largest employers. They bring in a lot of revenue. From an economic perspective, most businesses are not going to invest in putting plants or businesses in rural communities if there’s not access to healthcare for their employees.

We have about 1,500 of them across the United States. They make up about 25% of all the hospitals in the US. Without them, our healthcare would be in a worse shape than it is today. Having access to these hospitals is important. I feel like it’s our mission see what we can do to bring high-quality healthcare.

From a strategy perspective, as it relates to the low bandwidth, we understood early on that bandwidth is going to be limited regardless of where you are. There are always limits in bandwidth. It’s less of an issue in big cities and big hospitals, but if we’re going to make a difference in communities, we had to make sure that the communications interactions are going to be good.

We focused on creating a low-bandwidth system, and the team at Metova was excellent in helping us create that. That has served us well, because as we have conversations with health systems, some outside of the geographic United States, one of their main issues in being unable to provide telemedicine services for COVID patients is limited bandwidth. That’s as much a part of what we do as the interpersonal parts.

The patient’s experience is also driven by factors that are outside the provider’s control, such as the device form factor, bandwidth, their location, and falling back on audio-only visits because of technical limitations. How can those be managed?

Anybody who is looking at setting up a telemedicine program that will serve rural communities or people in their home has to take that into account. They have to recognize that you may go into a 75-year-old widow’s home in a rural community that doesn’t have fiber broadband connection and that may have only one cell phone provider in their community. Recognize that if you really want to make a difference for that patient in that community, you’re going to have to take those things into account. Hopefully the vendor partner that they work with will help them to work through those types of ideas and thoughts.

One of the things I noticed very early on in this industry was that there are a lot of telemedicine systems out in rural hospitals that aren’t being used. It was like a treadmill. Someone says, I want to get in shape, so I’m going to buy a treadmill. They take it home, set it up, put on their athletic clothes, and they start walking or jogging. They got hot, sweaty, and tired and they realize it was a lot more work than they thought. They fold the treadmill up, and then a year from now, it’s a clothing rack. Many hospitals have dusty telemedicine systems sitting around that have not been used since they were rolled into the room. A lot of it has to do with not being aware of some of the challenges that exist, which include bandwidth for providing these services to patients.

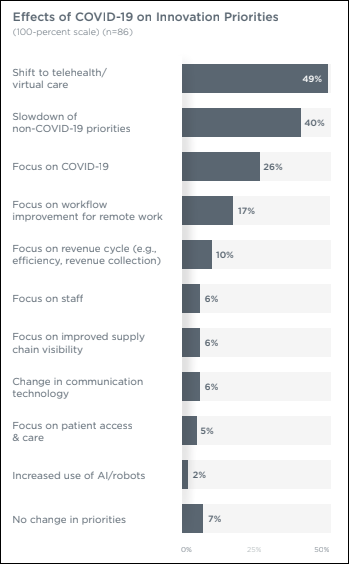

Why have telemedicine visit volumes dropped after lockdowns ended?

A lot of the telemedicine that was being done during the lockdowns was really just Zoom calls. They were not full-fledged telemedicine exams. I think a lot of it has to do with the fact that physicians still want to be able to not only see their patients, but be able to take vital signs, do exams, and listen to heart and lung sounds. That really wasn’t in play a whole lot during COVID. The other part of it is that there is still some lack of clarity as to the volume of visits that are being done today. I’ve seen varying numbers.

People are still trying to learn and figure out how best to do it. They’ve made some headway in using telemedicine, but there’s still a lot of resistance. If we talked about telemedicine last year at this time, only about 25% of physicians in the United States were doing any form of telemedicine, and less than 1% of all visits in the US healthcare system done last year were done by telemedicine. So there is still a strong lack of real knowledge and understanding about how to put a program together, and what we are really saying when we say we’re doing a telemedicine visit, going back to whether it involves full diagnostic capabilities or just two people talking about their health issues.

What is your reaction to investor enthusiasm about telemedicine-related vendors?

Telemedicine was first listed in the medical literature in 1974, if I remember correctly. It has been around a lot longer than people think. Companies like Teladoc and Doctor On Demand have been able to commoditize a service that has always been available to most people. Ten years ago, if you had a family doctor and weren’t feeling well on a Friday night, you had the ability to call the office. The on-call doctor would talk to you, ask you about your symptoms, and call you in a prescription for an antibiotic. If you didn’t have a doctor, you didn’t have access to that service.

Having a Teladoc or Doctor On Demand allows everybody to have that capability, so that when they need something, they can make that phone call. They found a way to turn that into a business, but that’s a very small percentage of all the healthcare service that we are providing today. Acute care is about 20 to 25% of the total visits being provided in the US healthcare system, and there’s only so much you can do when you’re just having a conversation with a patient about their healthcare. You can’t get vital signs. You can use the camera to look at a rash or at the back of somebody’s throat, but there’s a lot of variability in lighting, motion, and distance.

If we’re being honest, most visits, even through those types of companies, are probably being done without the use of video. The vast majority of those are done just by having a conversation with the patient, understanding what their complaints are, and then talking about how to manage it.

Are you concerned as a physician that primary care, especially in young adults, has turned into episodic, as-needed encounters via video or urgent care centers?

The market will have to correct itself on that. People will overuse this capability, bad outcomes and customer dissatisfaction will result, and people will steer away from it or demand a better service or outcome. That will drive the change. That’s probably natural and inherent in all types of businesses and economies.

For me personally, I’ve always tried to focus on the clinical standard of care. If we can provide that through telemedicine technology, then we will, and if we can’t, then we won’t. We’re not going to do anything that won’t deliver the same level of care and service virtually that we would expect in person. Having that as a standard has served us well.

For quite a long time, we were the only physician-led telemedicine company in the country. Most all of these other companies are led by some type of executive that’s not healthcare oriented. In many companies, if you go and you look at their “about us” page, even in the telemedicine space, you’ll scroll down quite a way until you find an actual physician on their leadership team. That has a big part of the problem that we’re seeing

I was struck by a statement you made to an interviewer in which you said, “”In the Airborne, they drop you in behind enemy lines and you find a way to succeed or you expect to die.” How does the Army select or train soldiers who can succeed in that paradigm, and how has that influenced how you practice medicine and business?

The Airborne has evolved since its founding right before World War II. It created a legacy for itself about who and what they did that has extended through generations. Not everybody who’s in has the same mindset, and sometimes somebody is assigned to a unit who may not want to be there. But for the most part, the esprit de corps that exists within the 82nd Airborne Division is of the mindset that they understand that that’s their mission. Either you go in behind enemy lines and you succeed , or you face death. Having that experience and having the opportunity to work with warriors that have that same mindset changes the way that you focus and look at managing problems.

Now in my life, failure is not really an option. I focus on what the mission at hand is, and then any way that I need to go about it to succeed. Starting a company six years ago … you hear the stories of how hard it is and how challenging it is. I don’t think there’s any way to help anybody understand what that really means, because it’s a personal journey, but it is one of the hardest things I’ve ever had to do in my life. If it wasn’t for that experience and training in that mindset, I might have given up. I’m very thankful for having the tenacity to tackle this without any thoughts of giving up.

Where do you want the company to be in the next 3-5 years?

We are not focused on gratuitous growth. We are completely privately funded. We have very deep relationships with our clients. We help them. Most of our growth has come internally from existing clients, doing a good job and then growing the company.

I still think the market is very immature. Although COVID has pushed us towards an acceptance of telemedicine, I see a lot of people still doing it incorrectly. We are in a phase right now where people are going to get the opportunity to try to do some telemedicine and they’re going to fail. They’re going to look to companies like Innovator Health to say, we hadn’t done telemedicine before COVID. We tried it during and after COVID. It hasn’t gone really well. We see the success that you’re having with a lot of these other health systems. Can you help us? We will be right where we want to be during that time to help them.

I’m quite comfortable being the biggest company that nobody’s ever heard of. Our focus is on making sure that health systems have the ability to reach out and connect with communities. We don’t want it to be about us. We want it to be about the relationship between the patient and the provider.

Do you have any final thoughts?

I appreciate the opportunity to share what we’re doing. People really don’t understand the capacity of what we have the ability to do until they actually see it. If someone says, this is interesting but I don’t think it’s right for us, then I would say they should definitely reach out and let’s talk.

From a “if I knew then what I know now” perspective about telemedicine, I always encourage people to try to do something. People talk about doing a telemedicine program, they try to set something up, then they try to do too much at once and they don’t wind up doing anything. Start a small project, learn and grow from that. You’ll see that in time, small projects will turn into something large and successful, as long as you take the leap of going out there and trying to get something done.

Comments Off on HIStalk Interviews Darren Sommer, DO, CEO, Innovator Health

I generally follow AP Stylebook style guidelines: Do not use all-capital-letter names unless the letters are individually pronounced: BMW. Others…