EPtalk by Dr. Jayne 3/28/24

I attended a recent online forum focused on a telehealth topic. I was surprised to find that some of the participants really didn’t understand the idea of a virtual-first practice. The only way they could conceptualize it was as part of a brick and mortar organization. When I started talking about ordering labs from services that would come to the patient’s home or using patient-provided data from connected devices, I got some blank stares.

The participants were from large health systems and other well-established organizations. I wonder if they’re outliers in their organizations or whether there is really a lack of interest in trying to deliver care outside of traditional office-based settings. Being able to offer services like that isn’t just about convenience. It’s also about serving patients in remote areas and helping those who have other reasons they can’t leave their homes. I hope they take the ideas back to their organizations for discussion.

I receive a ton of marketing emails and spammy-sounding connection requests on LinkedIn. It’s guaranteed that I won’t accept your request if you use made-up words to try to sound cutesy about the serious problems facing physicians today. Case in point: one vendor positioned their product as “the cure for documentitis and physician burnout.” It went on to further define “documentitis” as “inflammation caused by burdensome documentation requirements imposed by EMRs, billing systems, etc.” I’m sure their marketing folks thought it was amusing, but it shows a complete lack of regard for the true causes of documentation fatigue, including out of control regulatory requirements, expanding quality measurement, and lack of regard for the professionals in the system. As someone making purchasing decisions, this kind of messaging takes a company to the bottom of my round file.

Another one of my pet peeves seemed to be everywhere this week — the presence of large microphones in front of the participants on conference calls. I sympathize with the need to have clear audio and to want to use nice equipment, but when you’re a healthcare professional communicating with other healthcare professionals, it’s important to remember that you’re not a DJ and this is not a podcast. The majority of people I take calls with use integrated laptop microphones, earbuds, or something higher tech but unobtrusive, and they sound just fine. I’m hoping this was just a freak occurrence this week and it’s not a new trend. However, as a licensed amateur radio operator, I’ve got some solid options to put into play if it does become the hot new thing.

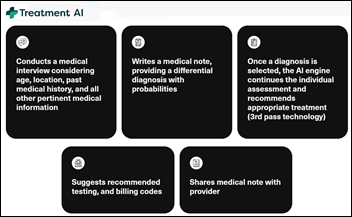

One of my favorite readers sent me an article about AI nurses, referring to the idea as “cray-cray.” The phrase has been added to the Oxford Dictionary, so I’m not afraid to quote it. The premise on AI nurses is that they’re designed to deliver non-diagnostic nursing care, such as education, which would help mitigate the ongoing nationwide nursing shortage. The idea was dissected recently in The Hustle, which offered some interesting commentary, including the fact that the hardware needed to run such an offering isn’t cheap.

I would add to that the fact that nursing is regulated by the states and licensure is required, so it’s going to be a hard sell that this is actually nursing care versus something else. Organizations will have to look closely at quality metrics that have been shown to be improved through effective nursing education, such as readmission rates, and understand whether AI-delivered education will meet the mark or cause other downstream consequences.

Speaking of potential unintended consequences, I was glad to see a recent article that looked at whether the hospital at home movement could be a double-edged sword. Although positive outcomes have been reported in the literature, such as reduced costs and improved patient experience, some areas haven’t been fully researched. I’ve talked about some of these in the past, including equity and the fact that patients with lower socioeconomic status might not have a caregiver in the home or a safe home environment compared to those in higher socioeconomic categories. The article brings up the idea of safe storage of medications, availability of food particularly in areas that are food deserts, and the ability to safely store meals that may be delivered in advance. Reliable and cost-effective utilities may also be an issue in some situations, as is the presence of broadband for communications and device connectivity.

The comments section on the article brings up additional points. One commenter who used RN in her name described it as “just a fancy earlier discharge scenario. We already have post-ops shoved out the door half awake, unable to dress themselves and throwing up the whole way home. What a crazy, cruel system we have created.” Another referred to the concept as “quite the pipe dream given today’s realities and limited resources.” Another commenter with experience as a home health RN noted, “I have been in extremely low income homes that were kept in immaculate condition and were exceptionally clean and have been in other homes that were in extremely well to do neighborhoods that were so dirty on the inside that I had concerns with even placing my bag on the floor.” That’s an interesting point and creates an additional burden on organizations to ensure suitability of the environment regardless of its ZIP code or other identifiers. I’d be interested to hear from organizations who are already managing hospital at home to understand how they assess potential care environments and what percentage of candidates are deemed suitable once there is a deeper dive.

I’ve always been interested in public health, so I was glad to see the US Food and Drug Administration publish information on egg safety for those who celebrate spring religious holidays such as Easter and Passover. Salmonella is always a concern where eggs are involved, and the press release offers tips on safe handling, cooking, and storage. Deviled eggs are a staple for family gatherings in our family, but I do enjoy the holiday clearance aisle at Target for all my post-Easter cravings.

What’s your favorite springtime food? Leave a comment or email me.

Email Dr. Jayne.

The ruling does seem to actually touch on things like UserWeb access "...the final rule applies to terms and conditions…