News 7/10/15

Top News

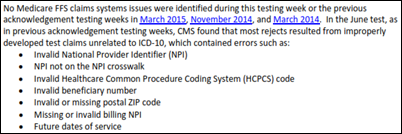

CMS reports zero ICD-10-related errors in its latest round of testing that was conducted June 1-5 using claims from volunteer submitters. The 10 percent of rejected ICD-10 claims had unrelated errors that wouldn’t have made it even with ICD-9, such as missing or invalid provider information. CMS concludes that it will be fully prepared for the October 1, 2015 switchover, 12 weeks from now. However, they said the same thing about Healthcare.gov’s go-live.

Reader Comments

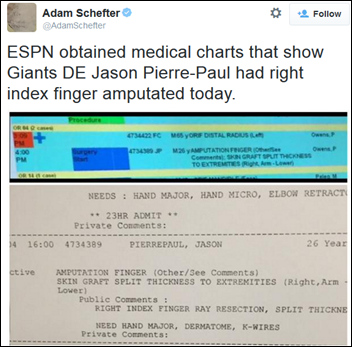

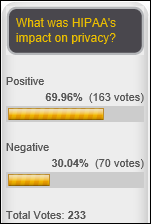

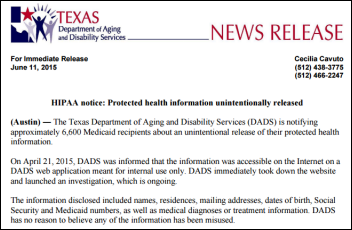

From Jo Momma: “Re: ESPN. Tweeted an image of Giants DE Jason Pierre-Paul’s OR schedule, which shows his medical info.” The tweet – which elicited a barrage of “breaching his privacy isn’t cool” Twitter responses – is still up, so ESPN must feel that it is legally safe, although it should be wondering why its jock journalist couldn’t just cite the usual “sources say” without putting up a screen shot. ESPN isn’t covered by HIPAA, but they could be sued by the patient, but probably has First Amendment protection. Pierre-Paul’s injury came from shooting off a U-Haul full of illegal fireworks in Florida on July 4, the second NFL’er who blew off a finger with fireworks over the weekend, setting off panic among fans, coaches, and bookies whose identity hinges on the health of 20-somethings who play games while they watch from afar. Jackson Memorial Hospital, whose surgery schedule photo was featured, is likely to earn a HIPAA fine, probably because the reporter convinced a gullible employee or star-struck doctor to give him a quick peek. The hospital CEO has launched an investigation.

HIStalk Announcements and Requests

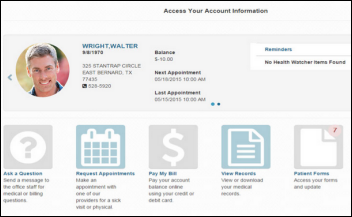

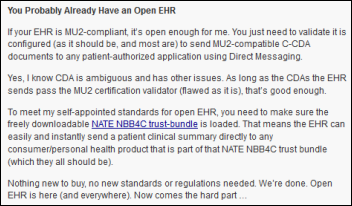

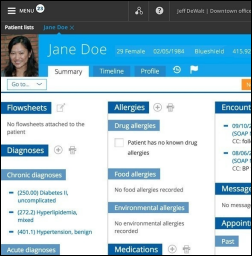

My attempts to get an electronic copy of my medical record finally failed (maybe I should ask ESPN for help). The hospital’s HIM supervisor repeated that they aren’t required to give patients electronic copies. I filed a complaint with the Office for Civil Rights. I then talked to the hospital’s Epic MyChart support tech to see why my visit isn’t listed and she couldn’t figure it out. A reader asked me to provide a chronology, so I’ll do that in this weekend’s post. Government and hospitals tend to be equally bureaucratic, so I’m not holding my breath for a quick or satisfying response from either.

Welcome to new HIStalk Gold Sponsor Point-of-Care Partners. The Coral Springs, FL management consulting firm helps healthcare organizations (life sciences, payers, health IT vendors, accountable care, HIEs) evaluate, develop, and implement health information strategies, specializing in e-prescribing and electronic prior authorization. Clients include the AMA, AHRQ, the Department of Defense, Merck, Athenahealth, and Cigna. The company produces a nicely polished newsletter edited by CEO Tony Schueth, who I interviewed last month. Thanks to Point-of-Care Partners for supporting HIStalk.

The software I used to love that I now hate: WinZip, which I’ve used since it was just a graphical front end for the DOS-based PK-Zip. It has turned from polished little utility into a cumbersome piece of upgrade-bugging nagware. It always had a ton of free competitors, but it must be a tough business now that cheap disk and fast broadband makes zipping files mostly unnecessary and Windows has built-in unzip support anyway. WinZip is owned by Corel, where mediocre me-too products (WordPerfect, CorelDRAW) go to die slowly.

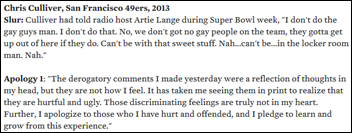

Also bugging me: barely literate celebrities and athletes who say or do something stupid, then issue a self-serving apology statement clearly written by a paid hack, as though nobody would notice the jarring difference in eloquence.

I love reading John Halamka’s farming blog posts as guilty escapism, including his latest agrarian strategic plan. Only a MD/engineer/CIO would refer to household pets in the form of, “Recognizing that their lifespan may not exceed 10 years, we’ll have to plan for replacement/possible overlap of young/old but will only keep two dogs at steady state.”

Listening: Close to the Edge, honoring Yes co-founder, bassist, singer, songwriter, and now Starship Trooper Chris Squire, who died last week of leukemia at 67. His thundering Rickenbacker made him the lead instrumentalist even among the stellar talents that were his Yes bandmates.

This week on HIStalk Practice: AOA Chief Public Health Officer Michael Dueñas, OD outlines the benefits of the new MORE registry for optometrists. EVisit wins the Arizona Innovation Challenge. Fajardo Imaging selects new healthcare IT from IDS. Renal Ventures Management implements remote patient monitoring tech from Authentidate. Agapé Physical Therapy implements Clinicient technology. The Medical Memory raises $2.1 million. MeMD CEO John Shufeldt, MD details the telemedicine company’s plans to advance care in Indiana.

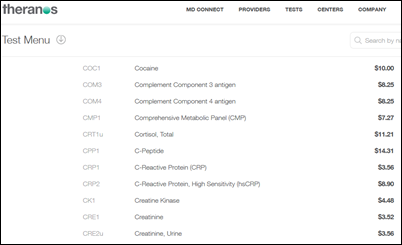

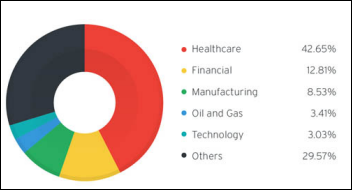

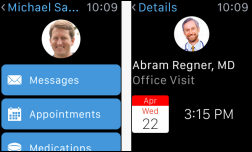

This week on HIStalk Connect: digital health startup funding tops $2.1 billion during the first half of the year. Silicon Valley-based lab test vendor Theranos receives FDA approval of its specimen collection and analysis process. Representative Mike Thompson introduces the Medicare Telehealth Parity Act of 2015, legislation aimed at expanding access to telehealth and remote patient monitoring services for Medicare patients. Direct-to-consumer genetics testing vendor 23andMe raises $79 million of a planned $150 million funding round, its first since 2012.

Webinars

July 14 (Tuesday) noon ET. “What Health Care Can Learn from Silicon Valley.” Sponsored by Athenahealth. Presenter: Ed Park, EVP/COO, Athenahealth. Ed will discuss how an open business structure and strong customer focus have helped fuel success among the most prominent tech companies and what health care can learn from their strategies.

July 22 (Wednesday) 1:00 ET. “Achieve Your Quality Objectives Before 2018.” Sponsored by CitiusTech. Presenters: Jeffrey Springer, VP of product management, CitiusTech; Dennis Swarup, VP of corporate development, CitiusTech. The presenters will address best practices for building and managing CQMs and reports, especially as their complexity increases over time. They will also cover quality improvement initiatives that can help healthcare systems simplify their journey to value-based care. The webinar will conclude with an overview of how CitiusTech’s hosted BI-Clinical analytics platform, which supports over 600 regulatory and disease-specific CQMs, supports clients in their CQM strategies.

Previous webinars are on the YouTube channel. Contact Lorre for webinar services including discounts for signing up by July 31.

Sales

Catholic Health Initiatives chooses the One by Ingenious Med patient encounter platform (care plan sharing, identifying and tracking high-risk patients, charge capture, and analytics).

Lenoir Memorial Hospital (NC) will use Access for integrating electronic patient signature into Meditech.

Summa Health (OH) chooses Merge Healthcare’s cardiology and hemodynamic solutions.

Carilion Clinic (VA) selects Sectra PACS.

UNC Health Care (NC) chooses the Infor Cloverleaf Integration Suite.

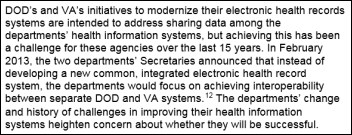

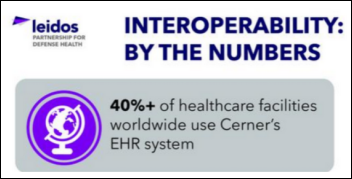

The Defense Health Agency chooses Cerner CoPathPlus over an unnamed single competitor for anatomic pathology in a $16 million deal, which I think is an upgrade since DoD has been using Cerner CoPath for 20 years (CoPath, as I reported recently, has a messy family tree, having changed hands via acquisition from CoMed to Dynamic Healthcare Technologies to Cerner while being sold simultaneously by Sunquest). I doubt this is an early indication that Cerner is the DoD EHR front-runner since DoD’s motivation is probably that it’s already using Cerner Millennium PathNet, although that 10-year deal was signed in 2005 and the LIS may be rolled into the EHR bid (I’m trying to find out). Epic developed its own LIS and AP systems (Beaker), while the other DoD candidate Allscripts does not offer either product.

People

The local paper profiles the retiring William Davis, MD, family medicine practitioner and CMIO of Winona Health (MN), who was presented with the Lifetime Achievement Award at the Cerner Physician Conference a few weeks ago.

Leidos Health hires Michele Behme, RN (Clinovations) as managing director of its Epic practice.

T-System promotes Hank Hikspoors to CTO.

West Health CEO Nick Valeriani will retire in September, to be replaced by the promoted Shelley Lyford. I haven’t seen the well-funded organization do a whole lot despite its occasional projects in aging, home monitoring, and price transparency.

Announcements and Implementations

InterSystems will resell Capsule Technologie’s SmartLinx Medical Device Information System.

Capital BlueCross of Pennsylvania will roll out low-cost laboratory services from Silicon Valley vendor Theranos. Theranos offers great pricing, but its billions of dollars of valuation presumes it can climb the steep scalability hill while stepping over LabCorp and Quest Diagnostics, which are huge companies with a presence, contracts, and influence everywhere. Theranos needs to grow quickly beyond California and Arizona and its best bet is probably chain drugstores, which have no particular loyalty to either of the big lab dogs.

Park Place International’s OpSusLive – a cloud-based Infrastructure-as-a-Service for Meditech and enterprise applications — earns a “Best Practice” five-start rating.

Akron General Hospital (OH) will implement Epic as part of its recent affiliation with Cleveland Clinic.

FDA gives 510(k) Class II marketing approval to Lexmark’s NilRead zero-footprint diagnostic viewer, which the company acquired along with Claron Technology in January 2015.

Government and Politics

CMS proposes to pay providers for talking to Medicare patients about end-of-life care, reviving a 2009 proposal that became the centerpiece of anti-Obamacare “death panel” political mudslinging. It’s probably a big money-saver since a huge portion of Medicare spending happens in the last few weeks of life when patients and family are confused and default to the “do everything humanly possible” option that often doesn’t change the quality-of-life outcome positively.

The draft of Spain’s healthcare strategic plan calls for doctors throughout the country to be able to view a given patient’s medical history regardless of their treatment location.

An analysis by Jamie Stockton of Wells Fargo Securities finds that only 27 percent of EPs who needed to achieve MU Stage 2 in 2014 actually did so, with Athenahealth and Epic leading the pack in overall percentage. Or as their conclusion states, “If you take out Athena, Epic, and eCW, the rest of the market was in the ballpark of a 10 percent success rate (including vendors like Allscripts, Cerner, and Quality Systems).”

Technology

Startups are offering technology that provides smartphone-controlled puffs of scent, such as issuing the smell of a particular perfume when an email arrives. I was disappointed since I thought they might have the capability to analyze a scent on one smartphone, then re-create it on the recipient’s end, as in, “Smell this oyster bar on the wharf.” I suppose the technology is lacking, especially since smells aren’t as simple as mixing a few basic colors to create an exact match of a given shade.

Other

I griped last time that CoverMyMeds blew a great PR opportunity by not including a photo of the huge “A Better Cup of Coffee” banner that its press release touted as the Columbus, OH company recruits web developers willing to learn Ruby on Rails. They sent this one over.

Industry long-timer Justin Barnes explains to Metro Atlanta CEO why the city is known as the “Healthcare Capital of America.”

Gary Fingerhut, executive director of Cleveland Clinic Innovations, quits after the FBI implicates him in financial irregularities involving one of Cleveland Clinic’s spinoffs.

A London newspaper points out that striking subway drivers, who make up $76,000 per year for a 36-hour work week and get 43 paid days off, earn much more than many doctors.

Sponsor Updates

- ESD offers a free demo of its automated testing solution and testing script services.

- Anthelio Healthcare Solutions will provide coders to MModal and use its products for customer documentation needs.

- GE Healthcare partners with the NBA to promote orthopedic and sports medicine research.

- Medicomp Systems offers “Addiction vs. Innovation.”

- Navicure VP of Product Marketing Jim Wharton is recognized as a Product Launch Champion during the 2015 TAG Product Management Awards.

- The New York eHealth Collaborative offers “Streamlined Access Among Benefits of New SHIN-NY Network.”

- Nordic offers the latest episode of its “Making the Cut” video series on Epic conversion planning.

- PatientSafe Solutions offers “4 Ways Clinical Mobility Protects Patients at Your Hospital.”

- Hayes Management Consulting posts “Understanding Referral Leakage: Identifying Preventable versus Expected.”

- PatientKeeper offers “ICD-10 ‘Floaties’.”

- PDS IT posts “Components of Software-Defined Data Center: Compute Virtualization.”

- PMD offers an “ICD-10 Preparation Countdown.”

- Qpid Health publishes “Are quality reporting requirements turning clinicians into clerks?”

- Sagacious Consultants previews its events at the Epic UGM August 30-31 in Madison, WI.

Contacts

Mr. H, Lorre, Jennifer, Dr. Jayne, Dr. Gregg, Lt. Dan.

More news: HIStalk Practice, HIStalk Connect.

Get HIStalk updates.

Contact us online.

Thank you for the mention, Dr. Jayne — we appreciate the callout, the kind words and learning more about the…