Top News

Walgreens will buy the remaining shares of care coordination and benefit management platform vendor CareCentrix for $392 million.

The total acquisition cost, including the previous investment by Walgreens, is $722 million.

CareCentrix CEO John Driscoll, MBA, MPhil will take a Walgreens role as EVP and president of US healthcare. He has previously served as a top leader of Surescripts, Castlight Health, and Waystar.

HIStalk Announcements and Requests

Welcome to new HIStalk Platinum Sponsor Synapse Medicine. The France-based company believes in medication success and is dedicated to making it possible for everyone. To achieve this goal, it has built an extensive, global medication knowledge base using algorithms to ensure the most reliable, up-to-date data. On the front end, Synapse Medicine provides a SaaS platform and UI components that are used to prescribe, dispense, and manage medications across the entire patient journey. The company is working with world-leading hospitals and digital health companies in the United States, Europe, and Japan to transform today’s medication regimens into tomorrow’s medication success. The company offers a webinar titled “Optimizing Prescription Safety for Your Health Tech Product.” Thanks to Synapse Medicine for supporting HIStalk.

Mrs. H insisted that I take a COVID-19 test before we went out to dinner with higher-risk friends Wednesday since I had mild nasal congestion, a bit of fatigue, and a scratchy throat after our recent travels. I did a swab test just to humor her and to make sure I wasn’t a risk to our friends and it turns out that her concerns were well founded – I tested positive (it felt odd to tell them, “We can’t come because I have COVID.”) The mild initial symptoms have eased and no new ones have emerged, so I’m hoping my vaxxed-to-the-max immune system is repelling the viral siege and protecting me from long COVID. I can only imagine how I would have felt – literally and figuratively – had I been infected in the pre-vaccine dark ages of 2020. Mrs. H, who tested negative and whom I see only from a masked distance as I isolate, masked up and went to Walgreens to buy a couple of $20 boxes of rapid tests for follow-up, where she learned from the helpful clerk that people with insurance can get four boxes of rapid antigen tests (two tests per box) per family member every 30 days at no charge. I don’t want to know who is ultimately picking up that tab.

Webinars

October 18 (Tuesday) 2 ET. “Patient Payment Trends 2022: Learn All The Secrets.” Sponsor: Mend. Presenter: Matt McBride, MBA, co-founder and CEO, Mend. Many industries offer frictionless payments, but healthcare still sends paper bills to patients who are demanding modern conveniences. This webinar will review consumer sentiment on healthcare payments, recent changes to the Telephone Consumer Protection Act that create opportunities for new patient financial engagement, and new tactics to collect more payments faster from patients.

Previous webinars are on our YouTube channel. Contact Lorre to present your own.

Acquisitions, Funding, Business, and Stock

Well Health will acquire CloudMD’s Cloud Practice Canada-focused business — which includes the Juno EMR, billing software, and three primary care clinic – for just under $6 million.

Specialty EHR/PM vendor Nextech acquires TouchMD, which sells patient visualization and marketing systems to plastic surgery and dermatology practices.

Property and casualty EDI vendor Data Dimensions acquires Providerflow, whose platform manages electronic claims attachments and requests from patients and third parties.

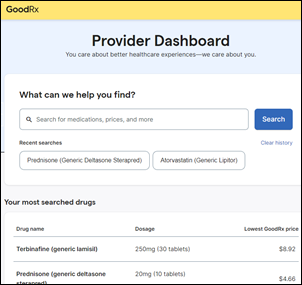

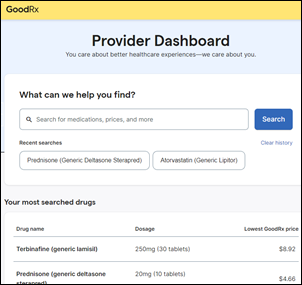

Prescription discount platform GoodRx launches Provider Mode, which allows providers to compare costs, send coupons to patients, and repeat searches via their own dashboard.

Weight loss coaching app vendor Noom lays off another 10% of its employees, mostly from its coaching team, as it attempts to transition into enterprise sales and a broader, more personalized mind-body platform. The company has raised $650 million and was planning a 2022 IPO at a $10 billion valuation. An Insider review found that the company doesn’t offer the personalized support it claims, and instead cranks out canned calorie-counting plans for a high subscription price with little evidence of long-term weight loss success. The company has generated thousands of Better Business Bureau and FTC complaints for billing users without their consent and making it hard for them to cancel subscriptions.

Behavioral health assessment and triaging platform vendor NeuroFlow secures a $25 million growth investment. I interviewed CEO Chris Molaro in March 2022.

The Private Equity Stakeholder Project calls out the former ownership of safety net hospital system Prospect Medical Holdings by private equity firm Leonard Green & Partners. They say that the PE firm reaped $658 million in fees and dividends over its 10-year ownership by burying the hospital chain in debt and slashing costs to the detriment of patient care. The PE firm sold the chain last year, releasing it from responsibility for the chain’s $3.1 billion of debt. LGP’s investment portfolio also includes health IT-related business MultiPlan (cost management), Press Ganey (hospital patient and employee analytics), WCG (clinical trials), and WellSky (post-acute care software).

Investment firm Francisco Partners the BSwift benefits technology business from CVS Health.

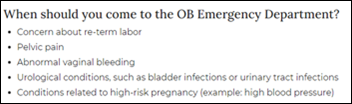

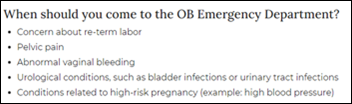

KHN reports that private equity firms are creating and running hospital obstetrics emergency departments – often consisting of a single small room — which allows patients who have pregnancy or post-partum medical concerns to be seen quickly and then billed at high ED rates. Few interviewed patients were told that they were about to incur ED services as they entered the unmarked rooms, often the same triage rooms as before. A physician researcher concludes, “To have people get an emergency room charge when they don’t even know they’re in an emergency room — I mean, that doesn’t meet the laugh test,” while UCSF professor Bob Wachter, MD says that hospitals “will always have a rationale for why income maximization is a reasonable and moral strategy.”

Sales

- CDC awards Accenture Federal Services a three-year, $189 million contract to for cloud migration services.

- ConvergeOne chooses Redox for EHR integration.

People

John Hallock (Transarent) joins Quantum Health as chief communications officer.

Diligent Robotics hires Gregg Springan, RN, MSN (Epic) as head of clinical informatics and Nicholas Bloom, MPH (Cedars-Sinai Accelerator) as head of client success.

Christopher Kunney, MSMOT (DSS) joins Divurgent as SVP of digital acceleration.

Announcements and Implementations

Walmart launches the Walmart Healthcare Research Institute and a related app to increase community access to clinical trials. The My Health Journey app helps patients find studies and send their medical and insurance records to investigators. FDA data suggests that studies are not representative of the entire US population because they recruit participants from their own urban locations who have the time and money to participate.

A Relatient poll of provider group executives finds that while most of them believe that online patient scheduling is critical for patient satisfaction, they are still using phone calls or automated phone messages to communicate with patients before their appointment, partly because that’s what patients prefer. The authors conclude that provider groups understand the importance of automation and digital tools and their associated reduction in staffing requirements, but need to choose the services that patients will actually use.

Campbell County Health (WY) kicks off its year-long, $8 million project to replace Meditech with Epic in an affiliation with UCHealth. An HIStalk search finds several references to the health system – it sent employee W-2s to a hacker who impersonated a hospital executive in 2017, lost $200,000 in Medicaid payments due to billing system failures in its acquisition of a private surgery center in 2018, and went on diversion due to a ransomware attack in 2019.

A Dubai health system goes live with a Metaverse-based hospital, which it says will eventually replace traditional telemedicine services and support its medical tourism program.

Florida-based AdventHealth University and Full Sail University launch a virtual reality research center that will focus on healthcare employee training and patient safety technologies.

Providence spinoff DexCare, which offers system capacity and appointment booking software, acquires Womp Inc., which offers digital front door systems and mobile optimization technology.

CHIME appoints three CIO members to its board of trustees – Daniel Barchi, MS (New York Presyterian), Terri Couts, RN, MHA (Guthrie Clinic), and Tressa Springmann, MAS (LifeBridge Health). Named as director of the CHIME Foundation Board is Sean Kelly, MD of Well Health.

Government and Politics

Forbes updates its article on North Carolina’s sole-source choice of Unite Us’s social services integration platform. A recap:

- The state chose Unite Us for a federal Medicaid social services pilot without having its product reviewed by IT teams. Reports suggest that it will require modification to meet federal privacy requirements.

- Former state HHS Secretary Mandy Cohen, MD, MPH, who is now CEO of Aledade Care Solutions, intervened to get Unite Us the business even though state health systems preferred that of competitor Findhelp.

- Unite Us President and Co-Founder Taylor Justice complained to Cohen that UNC Health was about to choose a different vendor. She promised to call UNC Health CEO Wesley Burks, MD to get him to reconsider. Emails obtained under the Freedom of Information Act indicate that Justice told Cohen, “I shouldn’t have let this happen and it will never happen again.”

- State lawmakers met Wednesday to ask the governor’s administration to explain why it used an non-competitive technology selection process and why, after three years and $27 million of federal Healthy Opportunities Pilot money spent, the only tangible result is that 10 families are receiving food deliveries.

Nebraska’s corrections department OIG says that a female inmate who was incarcerated for life died of cervical cancer because its Excel-based chronic care tracking system allowed her to go 10 years without having a Pap smear performed. OIG notes:

- A seven-year-old state statute requires keeping inmate medical records in an EHR, but NDCS still uses only paper charts like the ones above.

- The Nebraska Department of Correctional Services department spent a $150,000 EHR study grant in 2017 to buy an electronic medication administration record system instead.

- NDCS was appropriated $1.4 million to implement a commercial EHR in 2019, but never opened an RFP.

- In 2021, NDCS received another $745,000 to implement a commercial EHR, but then decided to develop a system internally. Nothing has gone live except for a behavioral health module and an intake form.

- Employees say they waste a lot of time phoning and faxing information that could be easily shared via a commercial EHR and that the lack of an EHR hinders the hiring of medical personnel.

- Among OIG’s recommendations is that if the homegrown system isn’t fully live by 2025, NDCS should abandon the effort and again seek the money to buy a commercial EHR.

Privacy and Security

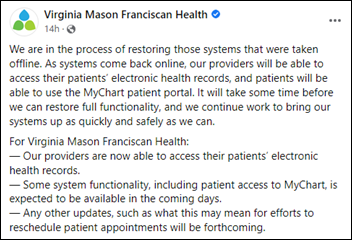

CommonSpirit Health, which operates 142 hospitals in 21 states, confirms that its continued downtime that started October 3 was caused by a ransomware attack.

Other

An interesting post by Cyrus Bahrassa, founder and CEO of healthcare integration consulting firm Ashavan, opines that OAuth rather than FHIR is the most important interoperability standard. He provides a straightforward definition of OAuth, which is how “log in with Google” or “login in with Facebook” works without exposing App 1’s user account information to App 2.

Two NHS trusts move to downtime paper recordkeeping after an apparent database error in Oracle Cerner required most of a day to resolve. During the downtime, Royal Free London, which was ironically in the middle of a “go paperless” campaign, nearly ran out of paper.

In the UK, the doctor of a 12-year-old girl who died by suicide after being bullied online says she was not able to see the girl’s history of self-harm because her practice’s EHR could not access that of the girl’s previous doctor.

Sponsor Updates

- An InterSystems charity walk event on Thursday included music from an all-company band that features industry long-timer and VP Don Woodlock on drums.

- Nordic posts a new episode of its DocTalk video series called “The Impact of Long COVID.”

- Healthcare Growth Partners advises blood and biologics supply chain automation company BloodHub during its sale to InVita Healthcare Technologies.

- Intelligent Medical Objects will exhibit at the OR Manager Conference October 17-19 in Denver.

- Meditech Greenfield expands to include new collaborative environments – Greenfield Alliance and Greenfield Workspace.

- Baker Tilly US and Artisight launch a strategic implementation collaboration for AI-enhanced workflow automation.

- Netsmart will exhibit at LeadingAge October 16-19 in Denver.

- Nordic joins the Microsoft Cloud Partner Program.

Blog Posts

Black Book Market Research’s latest ranking of health IT and management advisory firms includes the following HIStalk sponsors:

- Allscripts/Altera Implementation – ReMedi Health Solutions

- Blockchain – Healthcare Triangle

- Compliance, HIPAA, Risk Management, Regulatory – Clearwater

- Epic Implementation – Tegria, Bluetree Network

- HIT Staffing – Tegria

- Interoperability & Integration – Zen Healthcare IT

- Value-Based Care Hospitals – Premier

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

This is a great point—many discussions about patient wait times still focus on staffing or technology, while the real issue…