News 9/3/10

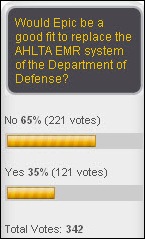

From Bobby Orr: “Re: the new Allscripts. They rang the Nasdaq bell. Hopefully it’s not too late to have a real challenger to the mighty Epic.” Glen has rung that bell a few times, I found by Googling. Since I couldn’t find a picture from this week and their Web site seems to be down, the one above is from one of the several previous “new Allscripts”, this one from 2008. I’d like to think it’s not too late to compete with Epic either, but I think it is, at least if the goal is to match up head to head. The Eclipsys clinical apps are better in some ways, but prospects are eating up Epic’s “one record” pitch and looking that the avalanche of new Epic business compared to long, slow decline of the Eclipsys Sunrise customer base. On the other hand, those Eclipsys apps have never been in better management hands than they are today now that the acquisition is finished, so maybe Glen can turn it around. When I asked him about that, he was pretty confident that Epic is vulnerable, but then again, former Eclipsys SVP (now Allscripts president) John Gomez said the same thing right before a stunning string of Eclipsys showcase accounts announced plans to displace Sunrise with Epic.

Speaking of Allscripts, here’s an insightful comment from quadwatch on the Yahoo stock board: “We are seeing what drove this merger — Eclipsys’ inability to compete with a weak ambulatory product and Allscripts’ lack of a hospital system. Given MU requirements for hospitals (in particular, CPOE adoption) the reality is you have only three products with proven adoption rates that don’t make a new purchase a crap shoot for the CIO: Epic, Cerner, and Eclipsys. It becomes a Epic-Cerner race if the facility has employed MDs or is looking to establish a community model. This one of the most logical mergers that I have seen in this segment.”

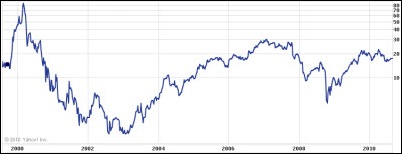

And while I’m quoting from stock boards, here’s another excellent one from my favorite industry analyst, sonomaca, on Glen’s bell-ringing: “Not surprised he decided to go and ring the bell. This is his triumphant return to control of MDRX. He’s proven himself to be a master of the game, starting with the secondary offering back in 2000 which ultimately saved the company. You’ve got to marvel at how he took a near-bankrupt MDRX in 2002/2003 to the top of the heap in 2010. Amazing. My guess is that, in the end, ECLP will be integrated without too much trouble. In the next couple of years, US market share will be pretty well divvied up between Epic, Cerner, Allscripts, and some of the lumbering giants like McKesson. No doubt, GT is already thinking ahead. And, what’s ahead are myriad tuck-in acquisitions and, most importantly, overseas.” Above is the ten-year share price, peaking at something like $80 in 2000 and bottoming out at less than $2 just three years later, now back to $17. Glen was CEO that whole time and before. He’s got $19 million worth.

From Price Checker: “Re: UPMC. I love this creative, airline-like a la carte approach to paying for the EHR at this paperless hospital.” UPMC, like other hospitals, is charging patients a “facility fee” for being seen in a physician practice it owns, even though patients may not even know that UPMC is involved. The patient profiled in the article noted that the reception area bears a plaque thanking the donor who paid for it, making her wonder why she has to pay again. She had no choice since UPMC threatened to turn her account over to a collection agency, but she vows to steer clear of that doctor and building for her future medical needs.

From The PACS Designer: “Re: Apple TV. Apple has announced their latest Apple TV configuration containing a faster custom built processor called the ARM A4. With a hookup to an HDTV, could medical image viewing find a place in the home viewing schedule? Only time will tell if it catches on with practitioners! This iTV device also has an Ethernet port and 802.11B/G/N Wi-Fi for streaming.” I’ll say that my Roku box was a game-changer for me. I haven’t watched a minute of DirecTV or even DVRed stuff since I got it – everything else seems so primitive compared to free, on-demand Netflix streaming. I’ve discovered great TV shows and movies I would never have found otherwise. I think I saw there’s some kind of medical channel on there.

From Mya: “Re: weird medical news stories. Did you hear about this one?” Sad: a female doctor, apparently drunk, tries to break into her former boyfriend’s house while he is there. He leaves out the back door to avoid a big fight, but in the meantime, she climbs on his roof and tries to slide down his chimney. Three days later, someone checking on the man’s fish notices a smell coming from the fireplace and finds her dead a couple of feet up the chimney, where she had died of asphyxia.

From Irving R. Levine: “Re: EHR vendor. We’re converting from [vendor name omitted]. They don’t understand why an IT shop needs access to clinical data in the SQL tables, so we can’t access our clinical data on our servers on our network without using their UI. They also don’t understand why we want to do our own backups instead of using their service.” This kind of issue is going to pick up steam as people starting switching out EMRs. Small practice vendors don’t usually understand clients with real IT people on board, so they distrust their intentions in a rather parochial manner. Like Bill O’Toole said in his HITlaw, if it’s important to you, get it into the contract.

The proposed Healthcare IT site on Area 51 (geeks know what that means) needs reader commitment to move ahead, being 15% of the way there so far. If you’d like to see an place to have HIT-related questions answered by experts (or to answer questions if you’re the expert), then sign up.

Marty Larson is named executive director of the Greater Dayton (OH) HIE.

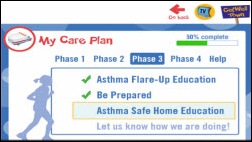

GetWellNetwork will announce that it has developed the first digital care plan for reducing admissions for pediatric asthma, including multimedia patient and family education covering triggers, medications, and equipment.

Jobs on the sponsor job page: Technology Account Executive, Epic Certified Consultants, Account Manager, Eclipsys Orders/Results Analyst. On Healthcare IT Jobs: Cerner SurgiNet and Power Orders PMs, McKesson HEO I-forms Consultants, Development Manager, Epic Report Writer/Programmer Analyst.

Listening: reader-recommended The Sensational Alex Harvey Band, 70s glam rockers from Scotland. The namesake died 28 years ago, but even though he hasn’t been reincarnated, the band has. He was quite a showman.

HIStalk stats for August: 102,047 visits, 145,694 page views, and 6,114 verified subscribers. All are new highs. Thank you for reading.

Metropolitan Health Networks and Senior Bridge start a year-long pilot project to evaluate the use of telephone-based telemedicine and specially trained staff to manage 100 Medicare Advantage patients who require frequent hospitalization. Each individual is assigned a nurse and a social worker to work with the patient’s physician to develop a care plan and to conduct in-home assessments for safety and patient evaluation.

This is ingenious: Kerry from Network Management Solutions of Garner, NC e-mailed to tell me he’s figured out a cool way to use his iPad. He downloaded the free Remote Desktop Lite app (which also works with the iPhone) and remotes into his home PC, meaning he can run all of his Windows apps on an iPad from anywhere. That sounds like it might have some possibilities for small-scale hospital or practice apps, as long as each iPad user has a dedicated PC to remote into (it’s like a poor man’s Citrix farm, although the non-poor man might run Citrix Receiver to run apps directly from a Citrix server). I bet the wheels are spinning in the heads of some readers even as we speak.

Why haven’t EHR vendors done this? A chiropractic software vendor partners with the creator of the Facebook Fan Page Generator to get its customers into social networking and promotion, or as the press release says, to create “an automatic new patient referral generating machine.”

The Community College of Allegheny County (PA) will offer free, non-credit HIT classes to qualified applicants, courtesy of $16 million of federal taxpayer money.

The presentation was from an Australian HIT executive, but the message is familiar when it comes to IT challenges in hospitals: IT gets heat to finish projects even with insufficient resources, they patch old systems together instead of buying new ones, and the IT people don’t have the clinical knowledge to run the systems used by clinicians. But it was an audience member who got big applause for describing health department IT procurement practices: “[It’s like] taking a 17-year-old and letting them buy any car they want, with any sized engine. We get clinicians to dream up what they want, then they go and buy it without even thinking about whether it will or won’t work. We have people who don’t know what should and shouldn’t be used, who have the power to make the decisions on buying".”

Odd lawsuit: a surfer hospitalized in Hawaii after a shark bite claims the hospital posted his picture of his leg wound on the Internet. He’s filed a suit alleging HIPAA violations and several more potentially lucrative charges.

More iSoft struggles: the company’s major shareholder says it will decide in April 2011 whether to unload its shares.

I haven’t quite decided whether to do a Monday Morning Update. If I don’t, or if you won’t be around to read it even if I do, have a wonderful end-of-summer holiday (just my US readers, I keep having to remind myself since that’s not all of them). I will be laboring on Labor Day in any case since I am extremely behind, so as Inga suggests below, you can always send us a Facebook or e-mail message if you are feeling lonely, unappreciated, or unfulfilled.

HERtalk by Inga

From KP Duty: “Re: Sutter’s iTriage app. Looks like a great tool for consumers, except for one thing (disclosure: I’m with Kaiser Permanente). When I clicked on the Find Emergency Department link to see the EDs closest to my house, is it a coincidence that the largest Kaiser Medical Center in Northern California is absent? I would have to drive by this large and well-established facility with its gigantic emergency department to get to the one listed. To be fair, I put in the address of one of the other Kaiser hospitals and it came up in the right order.” Is it a conspiracy or a bug? I’ll go with bug since I did a spot check on a couple addresses and KP sites definitely popped up prominently.

In what may be the first of similar announcements, ChartLogic reports it has applied for EMR certification with Drummond Group. I reached out to ChartLogic and asked them why Drummond was selected over CCHIT. Here’s the reply from Eric Sorenson, ChartLogic’s VP of marketing:

Our choice for Drummond over CCHIT came down to timing. We believe we are ready to be certified today. CCHIT has indicated that they will launch their program on September 20, and begin receiving applications then. Additionally, they’ve previously indicated that they will give certification priority to their CCHIT 2011 and their “Preliminary ARRA” certified products. We believe this would push our testing date and certification to a date much later than desired. Conversely, Drummond has indicated that they are taking applications immediately, and can begin testing within a few weeks. They have no backlog. We believe this will give us the best opportunity to be certified immediately. CCHIT has a 5 year head start on marketing their products and services, so we weighed the value of a certification with CCHIT vs. Drummond and felt we could overcome any of possible difference in marketing value by being one of the first companies certified, if not THE FIRST. Additionally, Drummond has been certifying other software for a longer time than CCHIT, so we agree with ONC and don’t believe their lack of EHR certification experience is likely to cause us problems in the certification process.

Southwestern Vermont Medical Center says it spent $1 million on its Picis periop system.

Valley View Hospital (CO) goes live on Meditech 6.0.

Actor Michael J. Fox will provide a keynote at HIMSS11, sharing his experiences as a patient and telling healthcare IT experts how IT impacts healthcare. Sadly, he’s got the dreaded Thursday a.m. slot, which means only 200 people will be in the audience. What I want to know is whether Jonathan Bush will try to schedule a meet-and-greet with his look-alike.

Memorial Hermann (TX) selects FairWarning to monitor patient privacy.

Former Streamline Health and Misys VP Scott Boyden takes over as VP of new client sales at TSI Healthcare. Kermit Copley also joins the company as CFO.

Hoag Hospital (CA) opens its new $84 million, 154-bed facility in Irvine. That’s $545,000 a bed if you are the calculating type.

HHS names its final two Beacon Communities: Greater Cincinnati HealthBridge and Southeastern Michigan Health Association. HealthBridge will focus on pediatric asthma and adult diabetic care, while Southeastern Michigan will concentrate on diabetes care and prevention.

UnitedHealth Group is loaning $10 million and donating another $1 million to help rural hospitals improve their HIT and add EHRs. Between this program and the recent Ingenix acquisitions, it sounds like UnitedHealth is trying to unload some cash.

This week on HIStalk Practice: Dr. Gregg Alexander shares the EHR-laced lyrics of some of his soon-to-be-hit tunes; Jonathan Bush tames an octopus; and an Iowa REC shares the cost of their consulting services (between $300 and $2,000 for two years’ worth.)

Stanford Hospital and Clinics commits to a seven-year agreement with Accenture to take over some of Stanford’s IT functions. Accenture will manage applications and infrastructure and provide data centers, network, help desk, and device support. We said this was happening a couple of weeks ago, courtesy of a reader rumor from Scatman Crothers.

Memorial Hospital at Gulfport (MS) lays off 47 workers, including 10 nurses. The staff reductions are part of cost-cutting measures to offset an $11 million budget shortfall.

The Massachusetts attorney general recommends that the board of Beth Israel Deaconess Medical Center do “some soul-searching” about CEO Paul Levy’s ability to lead the hospital.This follows her office’s conclusion that his long-time personal relationship with a female employee “clearly endangered the reputation of the institution and its management.” Board chair Stephen Kay responded by saying, “We are having a great year. We have more patients than we’ve ever had before. He’s made some wonderful alliances with some quality places. He has great credibility. He’s a national leader.” I’ll bite my tongue as it relates to this toxic topic.

Sponsor News

- Enterprise Software Deployment (ESD) ranks #561 on Inc.’s list of the 5,000 fastest-growing companies. ESD, by the way, just hired former maxIT director David Tucker as its national VP of sales.

- MetroSouth Medical Center (IL) goes live with iSirona’s medical device integration solution, transmitting data from over 100 GE Unity Network devices.

If you have a three-day weekend, I hope you are not in Earl’s way and are able to enjoy the fruits of your labor. And if you are laboring, remember you can always sneak into Facebook and drop us a note.

There was a time when my company went through multiple rebrands. These were relatively minor shifts, but completely unnecessary. It…