News 10/20/23

Top News

OptumInsight CEO Neil de Crescenzo leaves the company a year after it acquired Change Healthcare in a $13 billion deal, according to a LinkedIn post. He had been CEO of Change since 2013.

OptumInsight’s new CEO is Roger Connor, who will also continue his role as EVP of enterprise operations and services for parent company UnitedHealth Group.

A reader tipped me off to de Crescenzo’s s departure in mid-September, but the company did not respond to my inquiries.

OptumInsight offers transaction processing, technology, analytics, and revenue cycle management. Its annual revenue is nearly $5 billion.

HIStalk Announcements and Requests

Welcome to new HIStalk Platinum Sponsor FinThrive. The Plano, TX-based company helps 3,200 healthcare organizations increase revenue, reduce costs, improve patients financial experience, and ensure regulatory compliance across their entire revenue cycle continuum. Its SaaS-based RCM Platform delivers the industry’s widest breadth of capabilities, including integrated workflows supporting patient access, revenue integrity, claims management, contract management, and collections management teams within a centralized work environment. The company helps its customers bring modern digital experiences to their patients, including self-scheduling, virtual check-in, price estimations, patient payments and payment plans, and ongoing SMS-based secure communications – with no app downloads required. Its platform also leverages machine learning, robotic process automation, end-to-end RCM analytics, and billing and coding education resources to increase efficiency and drive sustained ROI. Thanks to FinThrive for supporting HIStalk.

Here’s a FinThrive explainer that I found on YouTube.

Webinars

October 25 (Wednesday) 2 ET. “Q&A: What’s new with the NSA? A No Surprises Act update.” Sponsor: Waystar. Presenters: Joseph Mercer, JD, managing director, Marwood Group; Heather Kawamoto, VP of product strategy, Waystar. The No Surprises Act created a lot of change, and those changes are still coming. A panel of revenue cycle experts answer frequently asked questions and offer a concise update on the NSA, including legislative developments, FAQs, and tips for navigating changes.

October 25 (Wednesday) 2 ET. “AMA: The Power of Data Completeness.” Sponsor: Particle Health. Presenters: Jason Prestinario, MSME, CEO, Particle Health; Carolyn Ward, MD, director of clinical strategy, Particle Health. Is your healthcare organization looking to drive profitability and scale quickly? Our experts will explore how comprehensive clinical data can revolutionize the health tech landscape. This engaging discussion will cover trending topics such as leveraging AI and data innovation to enhance patient care and outcomes, real-world examples of organizations leading the charge in data-driven healthcare, overcoming challenges in data completeness and interoperability, and visionary perspectives on the future of care delivery.

Previous webinars are on our YouTube channel. Contact Lorre to present or promote your own.

Acquisitions, Funding, Business, and Stock

Audience engagement platform vendor Uniquest acquires PCare, which offers interactive patient systems.

Henry Ford Health and Ascension Michigan form a joint venture to combine their Detroit-area operations, with the combined $10.5 billion business giving them 44% of the Detroit area hospital market by revenue.

Private equity firm Ardian will increase its stake in Europe-focused healthcare software vendor Dedalus to 92%. Board member Albert Calcagno, who has no healthcare or software experience, has been appointed CEO, with Andrea Fiumicelli moved to board chair.

Sales

-

Medicare Advantage insurer EternalHealth will implement Inovalon’s Converged suite for quality measurement and risk scoring.

-

USA Health Children’s and Women’s Hospital goes live on AdaptX’s Obstetric Advisor to improve maternal health equity.

-

Culbertson Memorial Hospital will go live on Oracle Health CommunityWorks next month.

-

Virtua Health will allow its doctors to prescribe Woebot Health’s mental health support app to people who are waiting for behavioral health provider appointments.

People

Bamboo Health hires Jeff Smith, MBA (Lumeris) as CEO. He replaces interim CEO Jay Desai, MBA, who will continue as executive board chair. Former CEO Rob Cohen, MBA left the company in July 2023 to join Livara as CEO.

Adrian Agostini (Booster) joins Experity as chief revenue officer.

Industry long-timer Rob Titemore, most recently with Sonifi Health, died August 13 in a motorcycle accident. He was 52. Visitation will be November 18 in Burlington, MA.

Announcements and Implementations

Insurer Oscar Health describes in an excellent “Continuous Hackathon” website how it is using large language models in pursuit of three goals: creating better client experiences, impacting behavior to generate better outcomes, and automating processes to reduce cost. Some of its ideas for using AI to move care delivery outside of the medical office:

- Assign members to virtual primary care doctors.

- Use AI to interpret EHR lab results as an initial draft for the virtual care provider. Co-founder and CTO Mario Schlosser says in an X post that the response of providers is binary – either they delete the summary immediately or they accept it with minimal changes.

- Automate the creation of care summaries. Schlosser says that providers modify the AI-written summary often, adding their own personal style or adding context.

- Collect patient information before starting a virtual patient visit.

In Japan, Fujitsu and Toppan Holdings will collaborate to create research databases from de-identified EHR data and apply analytics to improve the efficiency of drug development and care delivery.

Ronin and MD Anderson experts describe the development of an AI-powered digital tool that identifies cancer patients who are likely to require an unscheduled ED visit within 30 days due to treatment side effects, concluding that 50% of those visits as well as 19% of hospitalizations are avoidable.

Prudential’s implementation of NeuroFlow’s technology for conducting remote clinical assessments of disability claimants triggered 4,200 self-harm or suicide alerts from 24% of the monitored population, enabling the insurer to promptly connect them with mental wellness resources and resulting in a 34% reduction in their symptoms of depression.

Government and Politics

HHS OCR publishes a checklist covering “Telehealth Privacy and Security Tips for Patients.”

Other

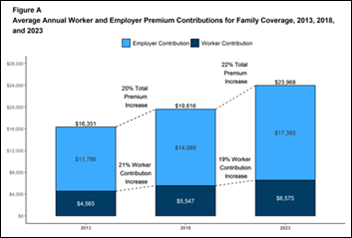

A survey of employers finds that health insurance premiums increased 7% in 2023, outpacing worker wage increases and inflation as family coverage averaged $23,968 per year. Employers paid an average of 71% of the cost, although 65% of workers were enrolled in self-funded plans in which the employer pays for health services directly. Employers say that the key health benefits concerns of their employees involve the high cost-sharing that they bear, their ability to schedule timely appointments, and the complexity of prior authorization. More than half of employers think that telemedicine will be important or very important for providing access to behavioral health services and primary care.

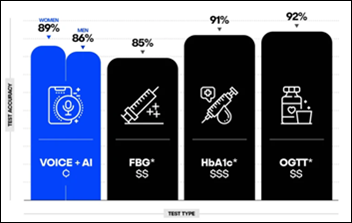

An interesting series of tweets from Science.io co-founder and CEO Will Manidis makes these observations in predicting healthcare’s “top deck of the Titanic” moment as consumers abandon the existing system and create their own:

- The status quo is that costs have increased constantly and clinic waitlists remained full because: (a) clinicians are in limited supply; (b) insurers pay rather than patients; (c) demand is inelastic and trust is high; and (d) regulatory capture.

- He says that all four factors are shifting as (a) LLM-assisted doctors will gain technology leverage; (b) the payer-PCP model will shift to online services that treat individual conditions; (c) patients who are disillusioned by the opioid epidemic and by poor treatment at physician offices will exit the system instead of calling for it to be improved; and (d) FDA’s healthcare regulation doesn’t reflect patient desires and instead rewards incumbents.

- Technology will allow new companies to be more efficient than incumbents as vendor overpromising fades.

- Amazon, Walmart, and CVS are building a cash-pay, free-market parallel care system.

- Margins on low-acuity care will increase due to telemedicine and consumerization, which will also offer cross-selling opportunities for high-margin lifestyle management plans.

A fascinating and potentially HIT-adjacent article in The Atlantic ponders the “failed experiment” of retail self-checkout, which mentions but does not primarily blame customer dishonesty as its main challenge. The initial promise of quick checkout and the ability to deploy freed-up cashiers to offer more customer assistance never materialized, as finicky technology, purchases such as alcohol that require employee review, and assigning a single staff member to oversee the enter kiosk area have diminished the technology’s potential. Snips:

- Self-checkout allows cutting back on low-wage cashiers, but the problem-prone technology requires a lot of expensive IT resources to keep running.

- It hasn’t been proven to be faster or more convenient, but customers are fooled because instead of just waiting in line, they fumble through the scanning and bagging process in doing the cashier’s job with a small fraction of their efficiency.

- Retail store owners used self-checkout as a reason to cut staff in general, resulting in messier stores, poorly stocked shelves, and lack of employees to assist customers.

- Retailers aren’t likely to abandon the concept because they spent fortunes installing the technology, but they will likely need to provide more human assistance.

- The article concludes, “A familiar limitation of many grand tech-industry promises endures: At the bottom of all the supposed convenience, you do actually just need a lot of people to operate a store.”

Sponsor Updates

- Divurgent releases a new The Vurge Podcast, “From Operations to IT: An Inside Look.”

- Ellkay will present at the CommonWell Health Alliance 2023 Annual Meeting and Fall Summit November 6-8 in Kansas City, MO.

- HealthMark Group employees volunteer at Operation Kindness.

- Optimum Healthcare IT posts a case study titled “Sentara: Strategic Portfolio Management with ServiceNow.”

- Censinet and First Health Advisory will partner to offer cybersecurity risk assurance solutions, including the Censinet RiskOps platform for managing and mitigating third-party and enterprise risk.

- Nordic releases a video titled “The Download | Restart, refuel, or hang tight: The EHR dilemma.”

- Inovalon collaborates with Amazon Web Services to develop software to support better healthcare outcomes and economics.

- MRO will exhibit at the NCQA Health Innovation Summit October 23-25 in Orlando.

- Heart of Florida Health Center realizes a 21% increase in payment collections with EHR and Healow Payment Services software from EClinicalWorks.

- Redox partners with healthcare-focused digital transformation consultancy Productive Edge to offer the Healthcare Data Strategy Accelerator and Healthcare Data Integration Accelerator programs.

Blog Posts

- Using Data to Champion Hospital Workers and Prevent Strikes (Dimensional Insight)

- The Role of Emotional Intelligence in the Hiring Process (Direct Recruiters)

- How Healow Self-Scheduling Helped a New Practice Fill 400 Appointment Slots (EClinicalWorks)

- Creating Effective Warnings for All (Everbridge)

- Supporting Colorado’s Drug User Health Hub (Findhelp)

- Navigating the Future with Contact Center AI Solutions (Five9)

- How to make cybersecurity training part of your healthcare culture (Fortified Health Security)

- The future is now: Healthcare IT needs a rapid evolution (HCTec)

- 4 time-saving features of an integrated RCM solution (Inovalon)

- Bridging a Legacy LIS to Epic Beaker: JTG Consulting Group’s Collaborative Effort with Atrium Health (JTG Consulting Group)

- Healthcare Orchestration Needs a Conductor (Lumeon)

- How to Deal with Angry Patients in Urgent Care (Experity)

- 3 Ways Hospitals Can Foster Exceptional Patient Experiences in the ED (Medhost)

- How an EHR partnership can improve efficiency, person-centered care and outcomes (Meditech)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

This is a great point—many discussions about patient wait times still focus on staffing or technology, while the real issue…