HIStalk Interviews Clay Ritchey, CEO, Verato

Clay Ritchey, MBA is CEO of Verato of McLean, VA.

Tell me about yourself and the company.

At Verato, we are identity experts that enable better care everywhere by solving the problem that we believe drives everything else, which is knowing who is who. Our mission is to be the single source of truth for identity that provides healthcare a complete and trusted 360-degree, longitudinal view of the people that they serve. I’ve spent the last 20 years in healthcare technology, with a passion for helping people leverage technology to deliver better care, better outcomes, and better patient experiences. I’m excited about Verato’s ability to do just that with identity resolution.

What is the extent of mismatched patient records in an average health system?

It is not atypical to have 8% to 10% of medical records be mismatched, either as duplicate medical records or overlays. That’s very common. That problem has been exacerbated as we move into digital health. The ecosystem is more complex and the information is even more inaccurate as you try to aggregate that data and those identities across not just one or more EHRs, but over 20 to 30 different inputs or data sources that are collecting data on patients.

Is patient identity harder to manage with hospital acquisitions and increased interoperability?

Yes. Unfortunately, we’re still in a world where most health systems are thinking about how to drive interoperability inside their own physical enterprise and virtual enterprise. Even in that scenario, mergers and acquisitions create a challenge with how you take a patient census that is sitting in different EHRs and combine them into one so that the patient experience isn’t harmed or important information is missing so that I can’t treat the whole patient. That’s a key driver as health systems think about expanding and need to welcome these new patients and deliver the service they expect.

How well do EHRs detect patient matching problems, especially now that using Social Security number as an identifier has been eliminated?

There’s two significant challenges with the EHR’s ability to prevent identity mismatching. One is the fact that most EHRs only have visibility into the data that they house themselves. As you start thinking about all these additional channels of data and data sources outside of the EHR, they don’t have the ability to reconcile those data sets from an enterprise perspective.

The second challenge is that the typical EHR identity matching technology is driven by probabilistic matching or algorithms, looking at information that you have physically about the patient. We think a better approach is using referential matching, where we have data that might not be sitting in the EHR about that person and we can connect the data points and fill in the gaps with that information to provide better matching.

Have you seen interest in uniquely identifying people who aren’t necessarily patients, such as public health organizations that try to match vaccination data to their medical records?

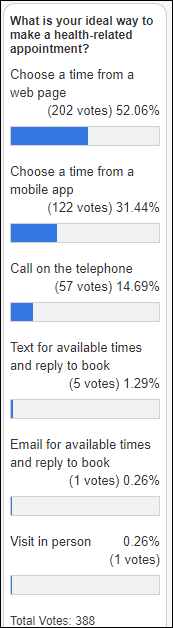

The pandemic drove a lot of wonderful things for the future of healthcare. One of the most important is that it created a reimbursement model for telehealth. We are seeing 38 times as many telehealth visits as we had before, and it is stabilizing at around 17% to 20% of all outpatients. With that is a change in the mindset around how consumers want to be treated. Consumers who plan to make an important purchase go online 85% of the time to find information first. In a post-pandemic world, healthcare is seeing that number upwards of 90%, where people consult online resources about their symptoms before they talk to their doctor.

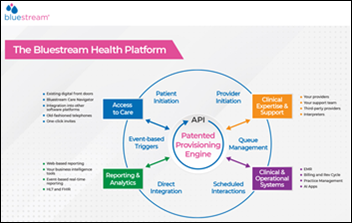

Because of all these different channels and digital engagement around the consumer, health systems have to understand who is who. How can I create a 360-degree view of all those interactions to create an experience for that patient, showing them that I know who they are, I have empathy for them, and I can solve their problem holistically?

What are the competitive advantages of accurate patient identification?

Forward-looking health systems are committed to offering a patient experience that is based on a simple premise – you have to show them that you know them. They are using an identity management platform to create and curate an experience for the consumer who is thinking about consuming a service from them. It might be somebody doing research about a knee or hip knee replacement. You need to understand who they are and be able to tailor your communications with them, so that as they continue to interact with the health system, that health system already knows that they have been on the website, downloaded a white paper on hip replacement, and are now calling in. Can I help you find a doctor who can help you answer questions around those types of things? Accelerating the acquisition of patients requires understanding the identity of the patient and then being able to deliver better care.

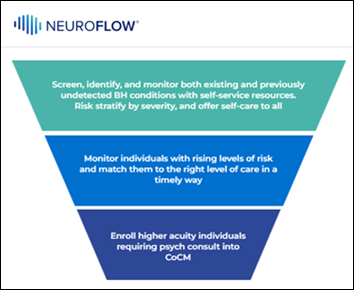

Finally, as health systems are moving from fee-for-service to fee-for-value, population health, and social determinants of health — and being able to manage both in-hospital and out-of-hospital concerns — it becomes critical to understand the patient identity, to proactively identify them as having risk factors, and to proactively give them a care plan to prevent a chronic condition or to better manage their chronic condition. All of those things contribute to happier customers, happier patients, lower cost of treatment, and overall better outcomes.

Outside of healthcare, customers uniquely identify themselves via a loyalty card or a website login that allows a business to then understand their behaviors. Can we learn from those industries?

Yes. Healthcare doesn’t have to look far at all to figure out how to delight the patient and deliver an exceptional patient experience. Loyalty programs, being able to know who you are as you’ve logged into their website, and from there to present them with information that is relevant to what we know about them. If we know that you are a cancer survivor, we should be delivering content to you that can help with your journey.

There are many examples across other industries that you can draw from. One of my favorite airlines is Delta Airlines. They seem to be able to anticipate my needs as a traveler even before I have them. If there’s a delayed flight, they are already thinking ahead about giving me options for rescheduling. We are starting to see forward-looking healthcare systems think about embracing consumerism and applying these types of technologies. Over 50% of millennials today don’t have a primary care provider, so they will be looking for experiences similar to how they buy something from Walmart or Amazon. To do that, we have to transform the way that we engage them.

Health systems experimented years ago with patient loyalty cards that also allowed medical records lookup. Why hasn’t that been adopted more widely?

The reporting from a year go on Ascension and Google Health showed a lot of privacy concerns that exist in America with respect to healthcare, our privacy rights, and protecting information about our health. I believe those basic concerns around privacy are pervasive. There’s a lot of conversations going on about universal patient identifier. That would be helpful and necessary, but we don’t believe that it alone will ever be sufficient. There’s just so many ways for patients to engage with the health system and so many front doors they come in, whether physical or digital. The idea that that patient will always have that identifier with them and present it in a confirmed way is challenging.

That’s where you’re seeing this pervasive, long-term need for additional technologies on the back end that continue to piece together these stories and be able to help us identify them. That being said, I do believe that we’re going to see the industry move towards a more trusted identifier. That may be through a trusted private sector opportunity versus the government. We have to work through how to get something that is safe, secure, and trusted before we can break those barriers.

What problems would arise or remain unsolved with the implementation of a universal patient identifier?

You mentioned Social Security number. Isn’t it already a universal patient identifier? Why hasn’t that been sufficient? The idea of using a universal identifier as a key into a lock that it gets you access to a health system, your health records, and information about yourself has a lot of goodness, but you’ll still find that it’s not practical to have a key that can be trusted and validated everywhere it would be used. Our own experience on the consumer side is that we have to find ways to create that experience that don’t rely on that type of unique key. I believe that a universal patient identifier will move forward, but while it is necessary, it won’t be sufficient for delivering the value proposition that we all hope for.

Where do you see the company in three to five years?

We see Verato continuing to enable this idea of better care everywhere by focusing on enabling the interoperability of digital health and the digital health transformation that is happening across the health system. Today, it’s health systems themselves. Tomorrow, it’s going to be across the care continuum. Being able to make that information portable, so that a patient can visit a health system in Pennsylvania and then while traveling on vacation to Florida and being able to visit the health system there, having that type of interoperability across health systems. I believe that Verato will be a part of that transformation as we move from interoperability within a health system to interoperability across the care continuum.

We’re also working on partnerships. We believe that having a common view across the care continuum — pharmacy, pharmaceuticals and biotech, medical devices, HIEs, providers, and payers – that trusted, protected, secure common view will help us eventually get to liquidity of data so that it gets to the right place at the right time to deliver a better outcome.

With McGraw’s new position at Transcarent, it seems like Glen Tullman might be getting the Allscripts band back together.