Steve Shihadeh is founder of Get-to-Market Health of Malvern, PA.

Tell me about yourself and the company.

I have spent my whole career at the intersection of healthcare and technology. I worked for SMS, Shared Medical Systems, right out of college. I grew with that company and ended up running sales for them when Siemens took over. I did that for a few years, then went to Microsoft and ran their US healthcare business. I got involved with the Health Solutions Group through Amalga and HealthVault products. I then went to Caradigm and was their chief commercial officer.

I started to Get-to-Market Health about almost five years ago to help healthcare technology companies improve their go-to-market activities.

Does the number of recent eye-popping funding announcements mean that the old rules have changed, or is it more of a situation where those companies, who may be new to healthcare, need to learn some hard lessons about carving out a niche?

They are eye-popping to everybody. I see good that comes from it and also some challenges. When the right company gets funding, it helps them go faster. We’ve been working with a company in the medical device space that is well funded, on a really solid track, and they are just able go faster than they would be. The investor is betting on a long-term bigger return by letting them go faster now. We have seen examples of telehealth companies that just got incredible valuations. Whether they hold up over time is the question.

Every company we talk to or work with is in the middle of some sort of funding discussions. It’s healthy overall that entrepreneurs can get capital to build a business, but there are some messy spots to it. Think about Practice Fusion, which ended up being worth maybe a fifth of what people thought. Allscripts had to pick up the pieces. Theranos is still in the news every day. So there certainly are some not-pretty pictures, but on balance, equity investors, private equity investors, venture investors, and hospital-backed venture funds are trying to do their due diligence. They are evaluating companies. Saying that it is spawning a renaissance is maybe a little strong, but it is certainly spawning a lot of interesting companies.

The Silicon Valley model involves grabbing market share and chasing growth at all cost. Is the healthcare investment model still valid that assumes that companies need to be able to improve outcomes or reduce cost?

It’s no surprise to anyone that healthcare is slow. Nobody is imagining that they are going to build a real, honest, billion-dollar business in three years. There’s no confusion that healthcare takes time and it’s a complicated business. What is encouraging is that most of the investors we see today are people who only invest in healthcare. They understand it, they get it, and they know the successes and the horror stories.

Providence has a fund. I think Jefferson has a fund near me. Hopkins has a fund and has launched an interesting company. Those folks clearly get healthcare and they are pretty long-cycle investors. They have more patience than some pure private equity company that maybe spend its mornings in manufacturing and its afternoons in healthcare. You have a little smarter investor than you had even a few years ago.

Is it good or bad that the line between investor-funded companies and providers is blurring as providers start funds and companies and companies are opening clinics and telehealth practices?

There are certain things that a for-profit hospital can do a good job on. I’m not sure you or I would want to go get the most complicated surgery ever at a for-profit hospital. They have different niches. For-profit investors have a different horizon in terms of when they want their money back, and their tolerance is low for any hiccups. There will be a fair amount of appeal to the hospital-backed venture and maybe growth equity funds, because the entrepreneur will look at them and say, they get healthcare. They know how hard it is to get things going. I think they will be pretty successful.

They have a lot of work to do to become as capable of investors as the private firms. Whatever you say about the private firms, they know how to crunch the numbers. They know how to value companies. So probably there’s room for both, and I don’t think it’s bad to have them both in the space. If I was an entrepreneur, I would consider both. There’s going to be a better fit depending on what the business is, the model and how much money you need, and how long you’re going to take to build your business.

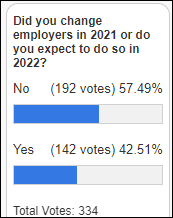

How will executive job changes affect the plans of companies?

I wonder if what’s behind that is new investment or a need for new investment. Companies that are taking a round of money or have just taken a round have to demonstrate that they are making changes. A lot of times, the investor comes up and says, let’s build a big go-to-market plan, let’s go to three countries instead of one, or let’s go into some new markets. That is probably a big part of the exodus that you see — there’s a financial transaction coming or has happened, and for whatever reason, they decide they want to bring in a new regime to help steer things, or there’s an exit and those folks move on.

We’ve gotten called in several times to help people build go-to-market plans for a new market because they are anticipating some investment and they want to be able to demonstrate to the investment community where they’re going and how they’re going to get there.

Private equity companies are rolling up companies and acquisitions to earn rich returns, with Athenahealth being a recent example. Will that trend continue?

Five years ago, private equity was somewhat of a novel thing in this space. They were able to buy multiple companies, invest in them, and grow them. They are finding out that it’s not so novel. An alternative to buying lots of companies is to buy one and then buy some smaller adjacencies around it to build a bigger, more complete company. HBOC tried to do that, but had trouble integrating all those pieces. I suspect there may be some issues around the corner for those companies. You can buy companies and put a common brand in front of them, but getting them to work together is a big challenge.

Does a successful exit require customers to be satisfied?

It should 100% matter. If I’m an investor and I’m buying a business that has a bunch of unhappy customers, I’m sure not going to pay $17 billion for it. Either there are a bunch of happy customers that the investor found or they didn’t look carefully enough. My thesis is that a company is only worth as much as its customers are willing to stay with them and willing to pay. Happy customers that are renewing, adding on, and buying new things are worth a lot of money. But you look at some of these companies that have disgruntled customers, it’s hard to imagine that the math works. I would think that investors have figured that out and are taking that into account.

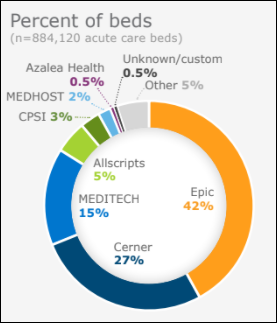

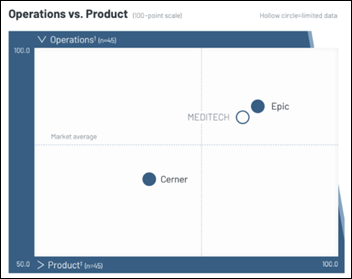

Epic would be worth so much money because they have a loyal, happy, renewing, expanding, and growing customers. They are worth more than another EMR company that might not have happy customers and might have lots of negative press. In our experience, the companies that are doing well are worried about taking care of the customers. It’s not all math. They can’t just think that just because they sold 10 systems, they are a valuable company. They have to have happy customers who are going to renew and buy more stuff or else their future value isn’t what they think.

What kind of help do companies need to support their intention to do more than just make short-term sales and instead to position themselves for long-term success?

Getting your product and your company to be viable in the market includes making sure you have a product that customers can understand, value that they can understand, and that you are serious about a happy, successful deployment and an ongoing relationship. We spend a ton of time in that area, because maybe the investor or CEO who doesn’t have a ton of experience in healthcare may not grasp all that.

If you’ve been around healthcare, you know how important it is to ensure that you have happy customers, that you invest the time and money, and that you have an empathetic viewpoint about what it takes to make customers happy. An unhappy customer is far more important than 10 happy customers. You have to focus on it, and we absolutely get pulled into those discussions all the time.

I had responsibility for our overall customer satisfaction at SMS, Siemens, Microsoft, and Caradigm. I appreciate it. It’s hard. It’s hard to keep them all happy. But if you take care of your customers, even if you have tough times, they reward you for it. They get how hard it is. When Epic or Cerner fixes a rough customer situation, those customers are loyal to them for a long time.

Do you think HIMSS and RSNA exhibitors were as happy as those organizations claimed that professional in-person conference attendance was down two-thirds?

Those conferences are like a stock market that gets overblown and it takes a drop. It’s actually healthy in the long term. RSNA and HIMSS are doing what they have to do, which is putting on as good a face on as possible. But I’ve talked to enough people who were at both shows to know that there was a real lack of potential buyers. If you were interested in meeting with vendor partners, it was helpful, but it was out of balance between what the vendors would have hoped and expected to see in terms of potential buyers and who was there. The shows have gotten too big and too full of themselves and they need to reorient.

I thought the HLTH conference was pretty good. They had a better balance.They didn’t have a ton of buyers there, but it didn’t feel as out of balance as HIMSS and RSNA have felt to me of late.

They are putting a good face on it, but it wasn’t the show that everyone hoped. I talked to some vendors who had a great show at RSNA, generally the newer entrants that had something exciting, innovative, and disruptive. I don’t think the big mainstream players in any of those shows felt good about them.

How have health IT sales and marketing changed as the pandemic approaches the two-year mark?

We have one client that has never had the luxury of a attending HIMSS or a trade show. They have built their business on having connected advisors who can make introductions for them. They built a comprehensive easy way to showcase and demo their product remotely. They figured out a low-cost way to deploy it and even trial it. They never knew the old way since they are pretty new, and they have seen tremendous growth.

The old model was to get ready for product announcements in the fall, release them in January or February, go to HIMSS, show them, do a couple of events for customers during the year, and then go back to HIMSS. That model was broken and is broken.

We have clients that have done a phenomenal job with social media. They are on every day and they are using customers and third parties to help promote and educate people about their product. We have one client that has done a great job with social, and as we have helped them go to other countries, people in those other countries are already aware of them. They haven’t spent any energy or time yet in those countries because social is global and they’re on their LinkedIn or Instagram pages learning more about them.

When I was at Siemens, I think we had 600 people at RSNA. Clearly HIMSS and RSNA were multi multi-million dollar investments for those big companies. That model is going to change for sure. After RSNA, most of those companies are going to say, OK, next year we’re going to do something different. They will be at at RSNA, but they probably can’t justify as much space.

I did hear from one client at RSNA that there weren’t a lot of middle- and lower-level people at RSNA. The company sent fewer people. They were able to connect with executives who they wanted to see to talk about a product or an issue or something they had. They felt better about that. I don’t think it was all bad, just not a home run.

How will the vendor-CIO dynamic and conference focus change as health systems create more C-level roles that carry IT and digital responsibilities?

The CIO and IT department are as critical as they’ve ever been, but I don’t think they are the front line any more. The front line is the ultimate end user of the product. Then you have to persuade and educate the CIO, CISO, and the IT department and make sure your product fits in with their protocol around security and IT tech and that you meet whatever their criteria are. I still think that there is benefit for IT folks, including the CIO, to attend HIMSS, especially if they want to get a quick look at 10 different companies, if that’s really the best part about it.

There was a day not that long ago where you would sell an EMR or a piece of medical equipment to IT. Now the CIO defers and says, who’s the champion within the health system who wants and needs this product? Then, how do you help that end user understand the product? What’s the market fit for it? How’s the price? Then the CIO has to judge it and figure out whether it fits in their environment.

What industry changes will we see in 2022?

I’m impressed by companies that meet three key things that separate them. They have an innovative product and an innovative pricing approach. They are disruptive, in a good way, to what has been done before. They have a compelling story behind them.

Every company that has done well in this business has a compelling story. Think about Judy building Epic from one scheduling app at University of Wisconsin into a giant, successful company. Her attention on customer satisfaction and all that. There’s a compelling story there and in other companies where the entrepreneur has believed in his or her niche and built the business.

Successful companies are thoughtful about the business, have a disruptive product and/or pricing model — because people just can’t spend unlimited money — and they have a compelling story that people can latch onto. When I was at SMS, the two founders had put together a business that met a key need, people could understand it, and there was a compelling story. That helped people buy it. That’s still very true today.

Comments Off on HIStalk Interviews Steve Shihadeh, Founder, Get-to-Market Health

Look, I want to support the author's message, but something is holding me back. Mr. Devarakonda hasn't said anything that…