RE: Change HC/RansomHub, now that the data is for sale, what is the federal govt. or DOD doing to protect…

Weekender 11/5/21

Weekly News Recap

- Allscripts and Change Healthcare report quarterly results that beat earnings expectations but fall short on revenue.

- EverCommerce announces that it will acquire DrChrono.

- Worklfow automation vendor Notable raises $100 million in a Series B funding round.

- CMS will increase the minimum penalty for hospitals that don’t comply with pricing transparency requirements to $10 per bed, per day starting on January 1, 2022.

- 23andMe says it hasn’t decided how to integrate its recent acquisition of telehealth provider Lemonaid Health, but expects to incorporate genetic risk factors into its primary care prescribing.

- A VA survey of employees at its initial Cerner implementation site find widespread worsening of morale, burnout, and lack of confidence in performing their jobs using Cerner, leading to the VA’s pledge to add executive oversight to the project.

- Kareo and PatientPop merge to form Tebra.

- Cerner and NextGen report quarterly results that beat expectations for revenue and earnings.

- Cerner CEO David Feinberg addresses EHR usability and a tightening of less-profitable company products and partnerships in its quarterly earnings call.

Best Reader Comments

ECW is done, no group of size will consider them given their history with the ONC and DOJ. Ambulatory is a three headed race: NextGen, Allscripts, and Athena. And if you don’t want to outsource your billing and/or you want complete control over your data then Athena is out and it’s a two-headed race: Allscripts and NextGen. Yes, smaller market has a lot more competitors. Yes, when part of a hospital those deals automatically go to Epic / Cerner / Meditech / Allscripts. NextGen and Allscripts sitting pretty with cash, decades of data, and way less comp then three years ago. (Allscripts OUTSIDER)

Not sure why the Jonathan Bush post created that much “wake” this week (pardon the boat terminology). HIMSS isn’t any different from any large industry conference gathering including RSNA. Both are still dwarfed by the Consumer Electronics Show, too. HLTH is very well funded, run by experienced conference organizers, and benefited from a market right now (digital health) that is dealing with record inflows of funding. It isn’t some guerilla or boot-strapped effort run by industry outsiders. Probably rivals J.P. Morgan Healthcare Conference in SF right now for industry buzz and appeal to healthcare insiders. Just adding dental benefits to Medicare though would have a much more substantial and immediate impact than anything that comes out of the HLTH conference the next few years. (Lazlo Hollyfeld)

Telehealth is most likely to benefit patients by allowing patients to sidestep their local large medical groups and health systems. That really gets the hairs up on the medical establishment. The telehealth convenience aspects you discussed are very similar to how retail clinics shook out in the 2010s; consumer perceive retail clinics and telehealth to be strictly lower quality but the lower cost and convenience sometimes win out, especially within certain populations / conditions. There is only room for a couple players in this space who will have to have comparatively large scale and potentially with operations subsidized by another line of business. I don’t think any of the pandemic era entrants will survive long enough to challenge the existing participants.

I think what the money people are really interested in now is whether they can shake another business model innovation out of this tree. One model could be your insurance company employs your primary care provider who is readily available remotely. You trust this provider and they direct you to lower waste, lower cost, higher quality care. (IANAL)

Upcoding will always be a problem in the current payment model. Whatever is in the contract between the healthcare facility and the insurer will always trump short lived media attention. Whether it be state-owned hospitals sicking collections agents on their patients, massive hospital groups gobbling up competitors and driving prices up, or ruthlessly upcoding to extract as much revenue from the patient encounter as possible, the system financially rewards all of these behaviors. The hospitals give some discounts to patients exposed in the media, then quietly go about continuing mostly the same practices. (Elizabeth H. H. Holmes)

Watercooler Talk Tidbits

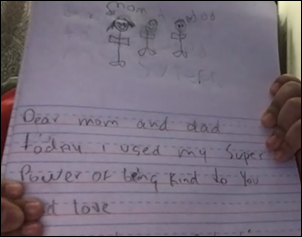

Readers funded the Donors Choose teacher grant request of Ms. S in New York, who asked for supplies to allow her first grade class to write letters and journal to offset all the time in front of Zoom and staying at home without siblings. She reports, “Thank you for the boost in letter writing! The children have been talking about their feelings, how they can be a good friend (while in COVID and at home), and have been excited by these extra materials that they have received. As you can see by their letters, they have been writing about how they can be kind, brave, responsible, honest, just to name a few. They are learning about making good choices and how to be great brothers, sisters, nieces, nephews, friends, and children. I have been teaching remotely to students via Zoom and I have to share with you how rewarding it is. They have been reading, writing, and wearing their capes to show their superpower! All of these activities are helping with expressing themselves. The families are so appreciative of all that we do and that YOU do! Thank you for your generosity and for enriching the lives of my children.”

A 65-year-old Utah man faces charges of posing as a doctor in selling medications and surgical procedures out of the basement of his house, which he limited to people who are in the US illegally. He diagnosed an undercover agent with multiple sclerosis, then offered to cure the condition for thousands of dollars in cash.

A New York Times article describes how tribe-operated Alaska Native Medical Center (AK) offers patients native fare items such as moose, herring roe, and seal, all donated and prepared as an exception to USDA guidelines since commercial sale is not allowed. Natives weren’t raised on chicken noodle soup and sandwiches, so the hospital added dishes made with traditional ingredient as a connection to the patients it serves. Food Services Manager Cynthia Davis says, “I do not believe that people go into a hospital for a gastronomic experience. I believe that they’re in a hospital because they’re sick or in pain, and they need care. They want comfort foods, foods that someone made for them when they were younger, someone who loved them and made it with love. And that is our role.”

In Case You Missed It

- News 11/5/21

- EPtalk by Dr. Jayne 11/4/21

- Readers Write: Creating a More Equitable Health System

- News 11/3/21

- Curbside Consult with Dr. Jayne 11/1/21

- Readers Write: The Rise in Health IT Valuations and Deal Flow

- HIStalk Interviews Stephan Landsman, JD, Emeritus Professor of Law, DePaul University College of Law

- Monday Morning Update 11/1/21

Get Involved

Sponsor

Report a news item or rumor (anonymous or not)

Sign up for email updates

Connect on LinkedIn

Contact Mr. H

I wish we had more reliable data on the ambulatory market since the end of MU gov reporting. There was an Allscripts investor presentation with a slide and some questionable data. From what I’ve seen, ECW hasn’t suffered any sales losses due to the lawsuit. It is still growing and dominates the cheapest option segment which is at least a quarter or a third of the market. The Centricity acquisition by Athena increased the number of very large practices and Athena still does well in the smaller size market in competition with Kareo – Practicefusion doesn’t seem to be around as much. Nextgen does comparatively well and has competition from modmed, athena,ecw resulting in slow growth. At this point I think nextgen has shed all the orgs it is going to lose to Epic or Cerner. On a net basic, Allscripts continues to lose ambulatory providers and still has a ways to go before hitting the bottom. Nextgen and Allscripts do seem to have good cash flow but mostly spend the cash on share buybacks to increase their stock price and return the cash flow to investors. Athena and ECW still have a good percentage, maybe a majority, of their developers based in the US. Allscripts has some US developers, Nextgen has a much smaller percentage of their development in the US. OF the independent ambulatory market I think market share is highest to lowest ECW, Allscripts, Athena, Nextgen while growth is ECW, Athena, Nextgen, then Allscripts. Those numbers are heavily influenced by what providers you include in the market.

Direct link to PDF download

https://investor.allscripts.com/static-files/9864d2ae-0469-433a-b5a1-86d6e23db96b

Fifth page, Ambulatory EHR Vendor Market Share, Source: IQVIA EHR market share data as of June 2019