Readers Write: The Rise in Health IT Valuations and Deal Flow

The Rise in Health IT Valuations and Deal Flow

By Chris McCord

Chris McCord, MBA is managing director at Healthcare Growth Partners of Houston, TX.

In this post-pandemic era, the world is changing at a pace that is nearly impossible to process, which makes decision-making harder and seemingly riskier than ever. With limited data to inform our decisions and understanding of reality, instincts become crucial as we attempt to navigate and make sense of the world. So, let’s take a moment and unpack some of the data so we don’t have to take a leap of faith.

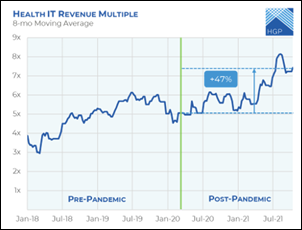

To begin, you aren’t fooling yourself if you think that health IT valuations have risen since the pandemic. Using an eight-month average (the shortest period to capture statistically significant data), average health IT revenue multiples in control M&A and buyout transactions increased from 5.1x immediately prior to the pandemic to 7.4x today. The data imply that the exact same company is now worth 47% more today than before the pandemic, an extraordinary realization that highlights the paradox that is the raging bull market amidst the unrelenting pandemic.

While the 47% increase certainly feels like a head-scratcher, we see key drivers behind the madness, one being the mirror-image trend in the Nasdaq, which has risen an astounding 50% in the same time period. The surge we’ve seen in multiples in this post-pandemic period magnifies an almost uninterrupted decade-long expansion of multiples.

It’s important to note that M&A multiples are influenced by survivorship bias, which creates a bias toward the valuations of deals that close versus those that don’t. The deals that close may have characteristics, such as overall higher quality, that make them superior to those that don’t close. In other words, one can’t necessarily extrapolate value simply from multiples without taking many factors into account.

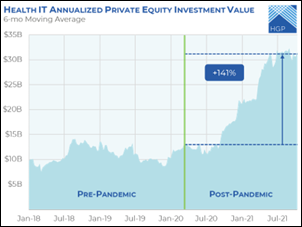

From a health IT perspective, equally pronounced is the spike in investment value. US-based health IT private equity investment historically hovered around $10-15 billion. During the pandemic, this rate increased 141% to more than $30 billion and is just now showing signs of leveling.

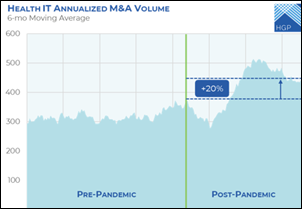

US-based health IT M&A, based on deal volume, also surged during the pandemic, peaking at a rate nearly 50% higher than pre-pandemic levels and settling back to a 20% increase. Low interest rates, excess liquidity, and an indisputable digital health investment thesis are all factors driving these surges in M&A volume and investment value. Further, M&A has been fueled by the threat of the capital gains tax hikes, which has motivated sellers to race to an exit by the end of 2021.

What goes up must come down? Barring extenuating circumstances, we may see a leveling, but most likely health IT has entered a new normal. Anecdotally, we see growth equity investment valuations typically priced higher than control M&A transactions (higher than our 7.4x revenue average), and the amount of capital being deployed at these valuations is represented by the 141% increase in private equity investment in our data.

Put another way, there is a substantial amount of capital flowing into the health IT market at historically high valuations. Certainly the investors who are putting capital to work at these high multiples do not expect valuations to drop precipitously, and one could make the argument — albeit a dangerous one because it detaches from fundamentals — that expectations perpetuate themselves.

We will continue monitoring these trends, particularly as we enter 2022 with looming tax hikes, spending plans which significantly impact healthcare, and midterm elections, not to mention the always-uncertain pandemic. Trusting both our instincts and data analysis, we can feel more confident in the direction health IT is taking.

Is this HIStalk or Reddit? Hard to tell the difference with the comments being posted.