Top News

Surescripts acquires ActiveRadar, a prescription drug benefits data company that identifies therapeutic alternatives.

ActiveRadar’s original iteration was launched by Safeway Food Stores to help its union employees save money on prescription drugs. It was later sold to a private equity firm and rebranded as RxTE, ultimately becoming a standalone company ActiveRadar in 2017.

Reader Comments

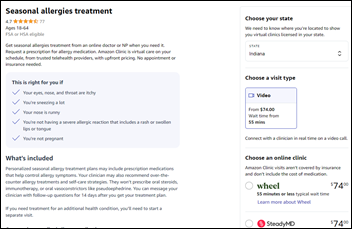

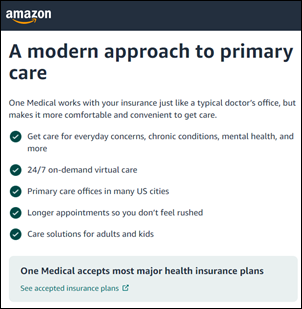

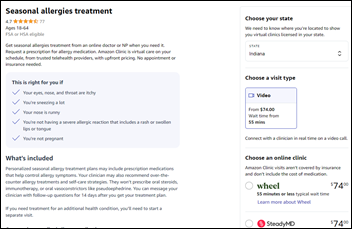

From Poindexter: “Re: Amazon Clinic. I received this email. It’s a big step for Amazon.” The service, which recently expended to cover all 50 states, is not all that innovative since it’s just a virtual marketplace for Amazon’s telehealth partners. Still, Amazon’s reach and experience standardization should boost the business of those participating companies and make telehealth a more widely known option. Amazon sells $50 billion worth of ads each year with high margins, renting online space to feature “sponsored products,” company stores, and display ads within its store pages that steer Amazon customers to bigger-spending vendors, so this aligns with their strategy. Amazon says that 60% of its sales come from independent sellers, and some experts think its ad business will even surpass its cloud revenue.

From Chief Pixel Herder: “Re: chief digital officer. I read that the health system job title is being phased out just about as fast as it was phased in.” It’s probably not a good time to hold a newly created C-level position in money-challenged health systems whose primary expense is labor. I wouldn’t expect them to revert back to old titles for chief digital officers and chief innovation officers, but I can see eliminating those folks who occupy newly created positions. Health systems love chasing trends like making everybody and their brother a VP and now a C-leveler, but at some point the suit proliferation becomes embarrassing when pleading poverty from atop extravagant buildings.

From Sveltese: “Re: Olive. A friend worked for them, his job being to automate the denial of prior authorization requests.” That wouldn’t surprise me, in the vein of the brightest minds of a generation spending their days getting people to click on ads. Put your money on insurers versus patients and doctors in choosing a prior authorization winner.

HIStalk Announcements and Requests

Welcome to new HIStalk Platinum Sponsor QGenda. The Atlanta-based company revolutionizes healthcare workforce management everywhere that care is delivered. QGenda ProviderCloud, a purpose-built healthcare platform that empowers customers to effectively deploy workforce resources, includes solutions for scheduling, credentialing, on-call scheduling, room and capacity management, time tracking, compensation management, and workforce analytics. In 2022 and 2023, QGenda won Best in KLAS for Physician Scheduling, as well as Nurse and Staff Scheduling. More than 4,500 organizations, including leading physician groups, hospitals, academic medical centers, and enterprise health systems, use QGenda to advance workforce scheduling, optimize capacity, and improve access to care. Thanks to QGenda for supporting HIStalk.

Lorre’s email has been on the fritz for a few weeks, we belatedly discovered, as emails to her histalk.com address were being delivered to the server but failed to complete the final leg of their journey to her Gmail account. I checked the server to find those that were stuck and set up an auto-forwarder as a backup, but email her again if she didn’t respond since she doesn’t just ignore emails. Email problems are never-ending and reliability has gone way down with the proliferation of complex setups, spam filters, and black lists.

Was Olive a scam, and if so, who are the victims?

The abrupt shutdown of one-time unicorn Olive have led to declarations that the company was an obvious scam all along. I agree that expectations were inflated with the encouragement of the company’s executives, but I don’t think it meets the definition of “scam” given that savvy customers and private investors voluntarily gave the company money without complaint.

Olive has sold off the remaining pieces of its business for an unreported and likely unimpressive price. Waystar has acquired most of it, but the buyer of its prior authorization business is Humata Health, which was founded in February 2023, presumably with the specific purpose of buying that business. Humata’s company’s founder is Jeremy Friese, MD, MBA, who was co-founder and CEO of Verata Health, which Olive acquired in December 2020 to form the business that he is now buying back.

Olive reported annual revenue of $49 million. It had raised $856 million, most recently a July 2021 Series H round with investors Vista Equity Partners, Tiger Global Management, and Base10 Partners that valued the company at $4 billion.

An Axios article quoted former employees and other sources who said that despite calling itself Olive AI, the company was actually using primitive screen-scraping and bot tools that frequently broke when vendors of the EHR and claims software they communicated with changed their systems.

The Axios article questioned the company’s cost savings projections, which rarely materialized. Olive’s sales executives knew that overpromises would still get its foot in the door, where health systems would then reassign employees and make it hard for them to change course and kick Olive out. Olive claimed to have 200 enterprise customers, although Axios reviewed internal documents that showed only 80.

Olive’s KLAS reviews are mostly bad overall, although it scored pretty well in the prior authorization business that it had acquired from Verata. Customers reported some successes, but complained of high executive turnover, lack of focus on customers, and layoffs that caught customers by surprise and reduced the company’s responsiveness. Still, the company featured testimonials from Gundersen, WVU Healthcare, Allegheny Health Network, Renown Health, and others.

I would argue that customers were not scammed. They could have demanded Olive’s full customer list and contacted them before buying. Poor KLAS scores were a lagging indicator, but a big red flag. Customer contracts should have included penalties for failing to hit cost-saving goals.

Public investors weren’t scammed because the company dismantled itself before it could rush an IPO or SPAC merger, which might suggest that the wheels had been coming off for some time. Its reputable, experienced investors had access to internal information that would have revealed warts and all, although the investment environment encouraged big bets of the “greater fool” variety rather than a forensic analysis of whether the company was blowing smoke in claiming to have invented “the Internet of Healthcare” and its ability to “deliver a new healthcare experience for humankind.”

Those who don’t know health IT history and thus are doomed to repeat it should note these lessons:

- Investors, prospects, or a prospective employees need to look beyond the glad-handers and perform due diligence.

- Customers should contractually obligate their vendor to meet whatever results and metric led them to buy in the first place. Cover the items that you need and fear most.

- Companies brag on their use of AI in hopes of commanding a higher valuation as a tech company, as did their late 1990s predecessors in appending .com to their names, but customers shouldn’t care whether a vendor uses AI or an army of offshore workers as long as they receive the expected benefits.

- Sketchy companies generate a lot of hype that is rarely echoed by their actual customers.

- Companies can be wheezing their last even as they pay big money for impressive exhibits and sponsored events at conferences.

- Rapid company expansion, acquisitions that look like an attention-diverting shell game, and a product line that is too confusing to summarize in a single “what does your company do” sentence are reasons for skepticism.

- All companies and investors look smart when the economy is booming.

Webinars

None scheduled soon. Previous webinars are on our YouTube channel. Contact Lorre to present or promote your own.

Acquisitions, Funding, Business, and Stock

Health Catalyst acquires Electronic Registry Systems, which specializes in cancer registry services and software.

Bain Capital will acquire consulting firm Guidehouse for $5.3 billion from Veritas Capital. Modern Healthcare says that Guidehouse is the second-largest healthcare consulting firm.

Sales

- Accountable Health Partners, a clinically integrated network based in Rochester, NY, selects Health Catalyst’s Data Operating System, enterprise analytics, and professional services.

- NorthShore-Edward-Elmhurst Health (IL) will implement population health software from Lumeris.

- Emory Healthcare (GA) will roll out Andor Health’s ThinkAndor virtual sitter technology, initially piloting it at two hospitals.

People

Direct Recruiters hires Huntsville Magazine owner Christian Byrd, MA (BC Executive Search Firm) as leader of its medical device practice.

Ovation Healthcare names John Mason, MBA (OakHorn Solutions) president of Tempo Technology Services.

Kali Durgampudi, MS (Zelis) joins Apprio as president and CEO of its healthcare automation division.

Announcements and Implementations

Glacial Ridge Health System (MN) will swap out its Healthland EHR for Meditech Expanse on December 1.

Midwestern University Clinics in Illinois and Arizona replace four EHRs with Epic.

A majority of hospitals will turn to outsourcing certain services over the next five years, according to a Black Book poll of management representatives from 1,428 healthcare organizations.

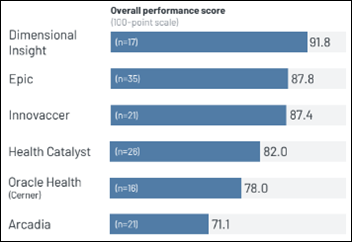

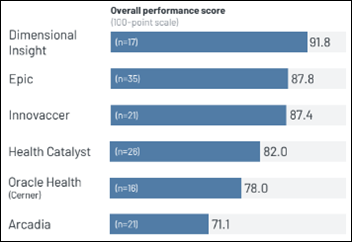

A new KLAS report on data and analytics platforms finds that Dimensional Insight leads the category with an easy-to-use platform that creates digestible metrics that drive outcomes, while Epic and Oracle Health customers struggle with ease of use.

Government and Politics

NSW Health in Australia will spend $640 million to replace nine systems, predominantly Cerner solutions, with Epic over the next 10 years. The decision to make the switch was first announced in 2020 with an initial deployment goal of 2026.

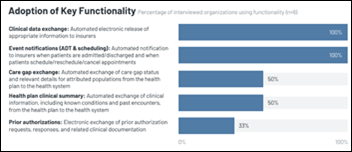

A watchdog agency reports that the bankrupt Idaho Health Data Exchange spent $92 million in federal funds with little oversight or accountability because the state created it as a private, non-profit corporation.

Privacy and Security

Duke University researchers find that it costs less than $0.50 to buy data about a military service member from a data broker, including their fully identifiable health and financial information. The authors note that the availability of such information could compromise national security and also note that the US lacks privacy regulation that would prohibit the practice elsewhere.

Other

Virginia Mason Franciscan Health launches an enhanced care registered nursing program at St. Anne Hospital (WA), its second this year. The ECRN virtual nursing program was developed to help combat staffing shortages and help prevent burnout. ECRNs joins bedside shift huddles via Zoom and then typically visit patients virtually twice per shift, largely focusing on home medication lists, care plans, and discharge details.

Sponsor Updates

- Consensus Cloud Solutions sponsors Cognosante’s charity golf tournament benefiting Final Salute.

- Southern Endocrinology Associates increases collections by more than 200% using EClinicalWorks and Healow.

- Netsmart showcases advancements driving value-based care success for senior living providers at LeadingAge 2023 through November 8 in Chicago.

- AdvancedMD receives the 2023 ISV Builder Partner of the Year Award from Zoom Video Communications.

- A Geek Leader Podcast features Arrive Health CEO Kyle Kiser.

- Symplr will host a happy hour at the CHIME Fall Forum on Friday, November 10 at the JW Marriott.

- Artera achieves SOC 2 Type 2 compliance for data security, availability, and privacy.

- AvaSure will sponsor the Insights Summit on Virtual Nursing November 15-16 in Washington, DC.

- Baker Tilly releases a new Healthy Outcomes Podcast, “Navigating the healthcare financial landscape in 2024.”

- Bardavon publishes a new injury prevention case study on insurance carriers and brokers, “Reduce Musculoskeletal Claims Volume Using Wearable Technology and Data Analysis.”

- Censinet releases a new Risk Never Sleeps Podcast, “Bridging the Education Gap in War-Torn Ukraine.”

- Current Health will host its US customer summit, This Way Home, November 15-16 in Boston.

Black Book’s top-ranked Q3 2023 managed services vendors include the following HIStalk sponsors:

- Symplr – credentialing and privileging

- Cloudwave – cybersecurity

- Dimensional Insight – data analytics

- Healthcare IT Leaders – ERP support

- Ellkay – integration and interoperability

- Clearwater – privacy, HIPAA, and compliance

- Experity – teleradiology and diagnostic imaging / urgent care

- Tegria – IT outsourcing/partial services

Blog Posts

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

Give ophthalmology a break. There aren’t many specialties that can do most of their diagnosis with physical examination in the…