Top News

AHA and four hospital systems file suit against HHS, claiming Medicare isn’t paying for reasonable and necessary care as required by the Medicare Act. The issue: Recovery Audit Contractors are second-guessing physicians long after an inpatient stay, claiming that patients should have been treated as outpatients and demanding that payment be returned. The RAC gets a nice bounty for denying the hospital’s payment, the hospital gets next to nothing.

Reader Comments

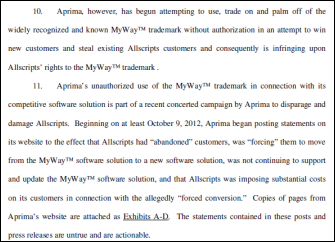

From Lee Shapiro’s Shoe Lifts: “Re: Allscripts General Counsel Jackie Studer. Has she left? Her pic and bio are gone.” She’s gone, sources tell me. Unrelated to her departure, the company announces results next week, and I have this feeling that they’re trying hard to get a PE deal ready to announce before then for reasons you might speculate.

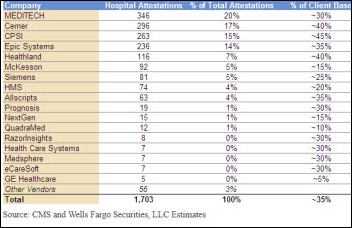

From Michael: “Re: RazorInsights. Thanks for the mention. I wanted to confirm our customer attestation numbers – 83 percent have achieved Stage 1 Meaningful Use as of today and several outstanding filings are being finished up by clients.”

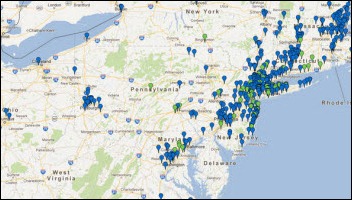

From Bucket Head: “Re: Sandy. We have about 50 clients in private practices on the East Coast without power and/or Internet. In our world, the big deal for them was finding a safe home for vaccines. If you have $50K (or more!) of stock in your fridge, it’s not like the milk. A couple of our customers will be without power for five to 10 days at least, so we’re expecting to turn on virtual servers in our offices for them to access. We have three or four customers on the Jersey shore from whom we’ve heard nothing and haven’t returned a call, text, or e-mail.”

From Evan Steele: “Re: Temporary command center, post-Sandy. We are settled into our ‘MCC’ (Marriott Control Center) and everyone not at the MCC is working virtually from home, a friend or relative’s house, or office with Internet access. We have 42 servers (physical and virtual) in a co-location facility, so everything is available and every SRS’er with an Internet connection has access. We are doing a great job keeping pace with support requests considering our less than ideal circumstances.” Evan, who is CEO of the Montvale, NJ-based SRS, reports that his company’s headquarters remains without power. Access to remote servers and a cloud-based phone system has enabled staff to continue working, either from a local Marriott hotel conference room or from home. Thumbs up to technology and adaptability.

From Millerbarber: “Re: Infinitt. The NJ-based PACS vendor has been down for two days.” Unverified.

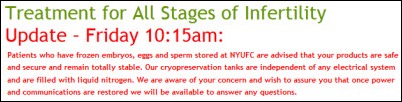

From Lead Sinker: “Re: NYU. Servers are down, basically underwater. We have an enormous go-live scheduled for 12/2 – not sure how this will affect that date.”

From Capo Crusader: “Re: NYU Langone admitting that its generator was old and poorly located. I hope everyone is OK, but I smell lawsuits with this admission. With all that has been written about Katrina, how can a hospital this size not be better prepared?” The hospital says it spent millions of dollars after Hurricane Irene on backup power improvements that included a flood-resistant pump house, sealed fuel tanks, and rooftop generators, but they apparently overlooked the fact that the electronic system driving it is located in the basement that flooded. At least the staff behaved admirably: four NICU respirator babies were carried down a nine-flight stairwell in the dark while a nurse manually bagged them to keep them breathing as volunteers and medical students lit their way with flashlights.

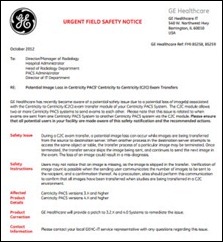

From Ex-McK: “Re: McKesson. Moral compass broken at the top. We highlight to the company that employees are breaking the law to ensure that the bottom line is met, renting ambulances to ensure we can sneak our profits through.” A purported e-mail from McKesson Chairman and CEO John Hammergren lauds employees of one of the company’s distribution centers for renting ambulances to make deliveries to New York, which prohibited non-emergency vehicles from using bridges.

HIStalk Announcements and Requests

Wondering what you may have missed on HIStalk Practice over the last week? Highlights: an AHIMA-published article suggests that cloud-based computing and smart mobile platforms are making ambulatory EHRs more affordable and attractive to physicians. CMS names 24 qualified vendors for the 2013 PQRS program year. Digichart’s founder and CEO assumes title of chairman emeritus. An Impact Advisors consultant provides recommendations to measure EHR success. NYeC Executive Director David Whitlinger gives an overview of his organization, its goals, and current success. Dr. Gregg (and his dog) fantasize what the world would be like if HIT had started with a grand plan. All I have to say is that if you aren’t reading HIStalk Practice, your HIT news world is incomplete. Thanks for reading.

We have a new contributor on HIStalk Mobile who I’m calling Lt. Dan since he (like me) works full time in the industry and probably wouldn’t find his employer to be receptive to the idea of his writing potentially controversial material under his own name. Lt. Dan is and industry pro who will be posting several news items each day, adding to the excellent analysis and commentary from Dr. Travis. We’ll also be revamping the site’s design shortly with a more modern look, and most likely renaming it to indicate broader coverage than I originally anticipated (we’re now writing about telehealth, startups, consumer health, and social media). In addition to the expanded coverage, Travis will be on the ground at the mHealth Summit December 3-5 in the DC area, of which HIStalk Mobile is a media partner, so you can expect lots of information from there. How you can get involved with HIStalk Mobile: subscribe to the spam-free e-mail updates, follow our tweets, write a guest post, and tell us who we should interview. Most of all, read HIStalk Mobile and participate by sending us interesting news and rumors.

Speaking of HIStalk Mobile, thanks to new Founding Sponsor Imprivata, which offers Cortext, an easy-to-use mobile app that replaces outdated texting and paging with HIPAA-compliant messaging for smartphones (Android and iOS) and PCs. Imprivata now supports both HIStalk and HIStalk Mobile at the highest levels that I had available, which I appreciate.

On the Jobs Board: Senior Certified Epic Analyst, Healthcare Analyst – Security Tester, Community Health Center Sales Executive, System Software Engineer.

A lot of readers dropped by in October, in fact more than in any month in the almost 10 years HIStalk has been around, for reasons unknown: HIStalk had 130,254 visitors and 241,599 page views.

The weather’s cooling down, leading to the bane of the cubicle dweller: where are you supposed to hang your coat?

Acquisitions, Funding, Business, and Stock

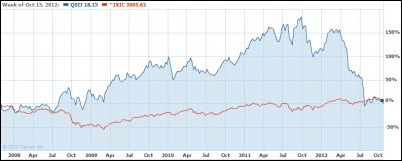

Merge Healthcare announces Q2 results: revenue up five percent, EPS $0.01 vs. $0.06 a year ago, missing analyst estimates by $0.02.

Carestream Health acquires Genesis Digital Imaging, a developer of software for diagnostic imaging systems.

Meditech’s Q3 numbers: revenue up 7.8 percent, net income up 4.6 percent.

Greenway announces Q1 results: revenue up 28 percent, EPS $0.00.

Sales

Intermountain Healthcare (ID) selects SA Ignite’s MU Assistant for EP Meaningful Use automate attestation of EPs using Intermountain’s proprietary EHR.

Medical Mutual of Ohio chooses the mobile application development platform and Mobile Health Plan application from Kony Solutions to provide members with account management, access to physicians, electronic ID cards, and claims information.

Health Fidelity will use the terminology solution of Intelligent Medical Objects in its Reveal natural language processing service for extracting data from unstructured medical narrative information. IMO will use Reveal for its solutions.

Alameda County Medical Center (CA) engages MedAssets to oversee several cost reduction projects involving physician preference items, supply and services sourcing, and workforce management.

People

Cerner appoints Justin Whatling, MBBS (BT Health) senior director of strategic consulting for its European advisory practice.

The US Chamber of Commerce names Peter Tippett, MD, CMO of Verizon and VP of its incubator, as the recipient of its first Leadership in Health Care Award for his efforts to advance health HIT innovation.

As a reader leaked to us a couple weeks ago, Pulse Systems co-founders and brothers Basil and Alif Hourani resign their posts as CEO and CTO, respectively. CFO Jeff Burton takes over as president and CEO. The French technology company Cegedim purchased the company two years ago for $61 million.

PerfectServe names Cary Smith (Allscripts) as VP of sales for the western region.

Avalere Health names Protima Advani (The Advisory Board Company) as VP of its healthcare networks practice.

CHIME President and CEO Rich Correll will move to a COO role with the organization, saying CHIME’s board worked with him to develop an operational management role required by its growth. They’re seeking an experienced CIO to replace Correll as “ambassador to the industry.”

Announcements and Implementations

UPMC expands its telemedicine services to rural hospitals.

Sparrow Hospital (MI) rolls out Epic’s MyChart for patient use on mobile devices.

Wellcentive announces the release of Proactive Data Quality, which allows healthcare organizations using its population health management system to detect data delivery and mapping issues.

Siemens Healthcare expands its relationship with TIBCO Software, which provides the business process management technology used by Soarian. Siemens says it will use TIBCO’s next-generation technology to provide Soarian customers with on-the-fly analysis of current and historical data to allow them to become what TIBCO calls the Event-Enabled Enterprise.

Brown & Tolan Physicians (CA), a Medicare Pioneer ACO, goes live with Humedica’s MinedShare analytics platform.

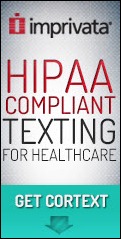

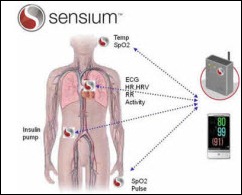

UK sensor vendor Toumaz starts the first US pilot of its disposable, continuous wireless vital signs sensor at St. John’s Health Center (CA). Patients in any location can be monitored with the Sensium system, eliminating the need for them to be kept immobile in the ICU.

In Michigan, Beaumont Health System and Henry Ford Health System announced months ago that they expected to merge in some fashion. They’ve signed the papers to start discussions on the merger details, which would create an organization with $6.4 billion in annual revenue and 42,000 employees. Both use Epic.

MMRGlobal, which always puts out bizarre press releases that make it sound like a big company instead of a minimally known PHR vendor, decides that lawsuits pay better than trying to sell a personal health record. The company was awarded a vague patent for a method of giving patients access to their electronic medical records. That was on Wednesday. By Thursday, the company was sending threatening letters to hundreds of EHR vendors, demanding that they start paying licensing fees.

Innovation and Research

MIT researchers develop a system for disambiguating the senses of words used in physicians’ freeform notes in EHRs. The researchers say their method, which identifies relationships between words while also drawing correlations between words and syntax, is 75 percent accurate and thus markedly better than previous methods.

A study in Ireland finds that 40 percent of handwritten ICU orders contain an error, although “error” was loosely defined to include missing pager numbers and illegible signatures. Articles like this always alarm laypeople who can’t distinguish between “preventing an error” vs. “preventing patient harm.” It’s like saying that 99 percent of drivers make at least one error per day while intentionally not mentioning that most of those are of no consequence whatsoever and are thus not worth a prevention effort.

Technology

Researchers from the engineering and media arts schools of Drexel University design the Belly Band, which contains an antenna that allows remote monitoring of pregnant patients. The band, which does not require batteries or electricity, transmits radio signals to indicate changes in the shape of the uterus and can be picked up with an ultrasound. Maybe once they complete work on all the functional aspects Dr. Jayne and I can advise on the fashion design.

Researchers from the engineering and media arts schools of Drexel University design the Belly Band, which contains an antenna that allows remote monitoring of pregnant patients. The band, which does not require batteries or electricity, transmits radio signals to indicate changes in the shape of the uterus and can be picked up with an ultrasound. Maybe once they complete work on all the functional aspects Dr. Jayne and I can advise on the fashion design.

Other

The National Health Information Sharing and Analysis Center (NH-ISAC) activates a 24/7 emergency response system to support healthcare critical infrastructure protection, mitigation, response, and recovery. The response system is intended to address situational awareness, facilitate information system, and provide incident response support.

Lake Health (OH) performs a routine EMR audit and subsequently fires several employees for inappropriately accessing a patient’s health information.

Cleveland Clinic and GE Healthcare join 25 companies that have committed to lease space at Cleveland Medical Mart, raising the building’s committed tenancy to 50,000 of its 95,000 leasable square feet.

Exeter Hospital (NH) is denied a court order that would have prevented the state HHS from accessing the hospital’s electronic medical records as part of an investigation into a hepatitis C outbreak. The hospital argued that such access would violate state and federal laws, but the court said the state proved its need to review the records and has proven it will do so in a professional manner. The cause of the outbreak is suspected to be a contract radiology technician who is accused of stealing fentanyl syringes and replacing them with ones contaminated with his blood. After being fired from UPMC for exactly that offense, he went on to work in 10 hospitals, including Exeter, since UPMC didn’t report him for fear of not being able to prove he did it even though they had caught him red-handed.

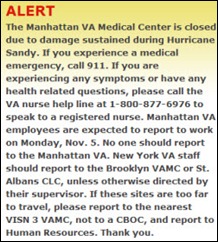

Bellevue Hospital Center (NY) evacuated about 500 patients Wednesday after fuel pumps for its backup generators failed. Despite pumping out 17 million gallons of water, the basement remained covered in two and a half feet of water.

British Medical Journal institutes a new policy that require researchers and drug companies who submit drug clinical trials articles to make all patient-specific data used in the study available to individual researchers on request. Drug companies are notorious for shining the most favorable light possible on questionable data, so this change will allow independent researchers to double-check their conclusions. BMJ hopes other journals follow suit.

Weird News Andy captions this article as “Starving for Cash.” Two-thirds of NHS hospitals in the UK have earned bonuses for following the Liverpool Care Pathway, which can require them to stop providing food and water to terminally ill patients. The Department of Health says the protocol ensures that dying patients are treated with dignity, while opponents say the practice is “euthanasia by the back door” that is sometimes employed without involving the patient’s doctor or family.

Sponsor Updates

- Allscripts CMO Toby Samo, MD discusses improving public health with EHRs in a blog post.

- East Bay Eye Specialists (CA) will implement the SRS EHR.

- ICSA Labs seeks qualified candidates to help pilot test the test procedures and test tools for the 2014 Edition Certification.

- Greater Baltimore Medical Center (MD) creates a paperless admission and consent process using Access e-Signature and signature tablets.

- Huron Consulting Group releases a case study that highlights how it helped the University of Arizona Health Network improve its RCM operations.

- OTTR Chronic Care Solutions will participate in the National Marrow Donor Program Council Meeting next week in Minneapolis.

- The Nashville Technology Council recognizes Passport Health Communications as Technology Company of the Year for 2012.

- MedVentive hosts a November 15 Webinar on critical technology needed to support ACOs.

- Intelligent InSites will host the InSites Build 2012 conference on November 14-15 in Fargo, ND. Speakers include President and CEO Margaret Laub and AMIA President Kevin Fickenscher, MD,

EPtalk by Dr. Jayne

The HIMSS/AMDIS Physician Community issues a call for posters for the 3rd annual Physicians’ IT Symposium to be held Sunday, March 3, 2013 at HIMSS in New Orleans. The deadline is November 30. Selected presenters must also submit a 5-7 page technical paper after the conference.

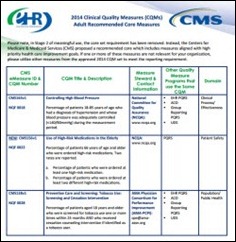

CMS offers a second chance to physicians who missed the June 30 deadline to file for a Medicare ePrescribing hardship exemption to avoid the 2013 penalty. They will now have until January 31, 2013.

I’m always having issues with Medicare patients who don’t want their insurance information on lab requisitions and other key paperwork because CMS still uses the Social Security number as its patient identifier. CMS is seeking provider input on new Medicare ID cards that would remove the SSN to reduce the risk of identity theft. Its survey will be available until November 7.

Nashville-based Entrada raises $1M in new equity. Its products, which integrate with a variety of EHR platforms, allow dictation into the EHR through synchronization to the appointment list. I heard some buzz at MGMA that they also have a fax-related product, but I haven’t seen it yet (hint, hint).

Physician Edward Pullen MD shares his frustration with the Washington State Electronic Death Registry System.

Dr. Travis from HIStalk Mobile shared this story about Walmart boosting domestic medical tourism. As of the New Year, its employees will have access to heart and spine surgeries at health systems like Cleveland Clinic, Geisinger Medical Center, Mayo Clinic, and others. Additional companies that are negotiating bundled rates for employees include Boeing Co., PepsiCo, Lowe’s Companies, and HCR ManorCare. Personally I’d like my employer to negotiate a deal here.

Contacts

Mr. H, Inga, Dr. Jayne, Dr. Gregg.

More news: HIStalk Practice, HIStalk Mobile.

I initially questioned the profile's authenticity because all of the headshots in the profile are clearly generated or enhanced by…