Steve House is managing director of Baker Tilly US of Chicago, IL.

Tell me about yourself and the company.

I realized the other day that I have entered my 40th year in healthcare. I started back in the early 1980s as a biomedical engineer for Phillips Medical for a decade, and then GE for a decade. I did work for Aetna building ACOs and then Kaiser as a senior director of data. I’ve been around in different spaces around the healthcare environment for a while.

I joined Baker Tilly a year ago. I am a subject matter expert in healthcare. My official title is managing director. I go out and do a lot of strategic work for hospitals, doctors, insurance companies, things like that.

Baker Tilly is fundamentally a tax and audit firm that was started back in the 1930s. It has expanded into all kinds of areas. We have a digital division that does ERP implementation. We have a robust Oracle team. We have an EHR team that was an acquisition of Orchestrate Healthcare. We do strategy service line analysis. We do all types of financial, technical, and clinical sustainability type programs. It’s 6,600 people, almost a billion and a half dollars in revenue, so it is pretty good sized, I think about #9 on the overall consulting size list.

How has health system C-suite leadership changed its thinking about health IT?

It has been a pretty big change and it’s going to be bigger going forward. We have a big labor problem. You have technology like the EHR and work that augments it. That technology is great to have, but it can’t slow doctors down significantly. We have big shortages in primary care, internal medicine, and obviously mass shortages in nursing, so the technology needs to be enabling.

We went through a phase of nearly 20 years where we were getting a handle on the data and making sure that we made it interoperable. It’s not all the way there, but certainly all those things were factors. Now we have to put doctors and nurses in a cockpit of a jet fighter-like concept, where they get the data they need and can make quick, accurate decisions and move them forward. We are in the midst of that transition, and I think it’s absolutely necessary.

Will technology-enabled telehealth and virtual monitoring allow healthcare to become more scalable and then more affordable or more accessible?

Yes. I’m in charge of our hospital-at-home programs. Plenty of people are looking at programs like that, where you are distributing healthcare services differently, in which patients and caregivers become more engaged. You have tools, technologies, social determinants, and an ability to look at it in simplified media formats, like a mobile phone. Suddenly, some of the labor that you need for delivering healthcare services is going to come on behalf of patients and their caregivers themselves as they invest and get engaged in the process. That has the potential to give us the greatest improvement and maybe put us on a path where we can actually succeed in this.

How will patient perceptions of the healthcare system change as more and more physicians become employees of entities whose primary objective is profit?

It’s always going to come down to access first for patients. When you need the system, is it available to you? We have significant access problems because of labor issues. Physicians being employed is, on the face of it, OK as long as you don’t lose productivity and therefore reduce patient access to the system.

But there’s also the other factor, which is that around the world, cost and outcomes — outcomes being lifespan and quality of life — have significant patient incentives. If you’re going to employ doctors and you’re going to have an issue with access because of labor pool problems, the most important next thing you can do is to make sure patients are incentivized to help themselves. You’ve got to make it comfortable and possible for them to manage their own healthcare at some level, and they must be incentivized to do it. Otherwise, it will just become a growing burden cause of aging.

What will happen as ever-larger health systems and insurers encroach on each other’s turf?

A debate has been running in the areas that I travel around the United States about the difference between medical care and healthcare, healthcare being population health, preventative medicine, the things that we do in that category versus, medical care that hospitals and doctors are fundamentally trained to do. If the insurance companies creep into this space in a significant way, the question is, should we think about splitting healthcare and medical care?

In other words, are hospitals and doctors the best places to do preventative medicine, nutrition, counseling, fitness, and weight management? Or did insurance companies find a way to do that part themselves? They try to pay for it, although I don’t think it is always paid for it at a level it should be. But the bottom line is that as they creep in, hopefully they take their biggest incentive — which is reducing variability and outlying costs because people get sick quickly or they’re not maintaining their health — and address that issue directly. If they did that, the system would work better for the patients.

Is it reasonable to expect most people to monitor their own health and use wearables, or is that just a nice idea that will impact only the few people who are willing?

I saw a statistic recently that of all the people who have a gym membership in the United States, somewhere around 4.5% actually use it. I don’t think that’s an indicator that we have got it figured out. Not everybody has to go to the gym, but I was on a task force during COVID and we determined that the average 80-year-old has lost 80% of their lung capacity. That’s obviously a huge danger sign for people with respiratory viruses. The bottom line is no, we have not done a great job of it.

If you take a system like Singapore, they use HSAs, and if you maintain your health and you meet criteria for blood pressure and weight and things like that, many of the dollars that go into your HSA that you’ve saved automatically become your retirement fund, and you don’t pay taxes on it. Those folks over there using that type of system, and they’re not the only ones, do a tremendous job of maintaining their health and staying in shape because they really want to retire. It’s that simple.

What are the technical priorities of health systems?

There’s still a lot of work to be done on the EHR side. Integration work needs to be done to finalize systems. We talk sometimes about a post-EHR implementation world. I don’t think we’re there yet. You have to go from gathering data, stewarding it, and placing governance around it to actually making it more usable. That’s the next phase and hospitals are looking at that.

The other side of healthcare is whether CFOs, CEOs, CMOs, et cetera have enough information to understand how to compete effectively in their own markets. It is still competitive marketing. Competition in healthcare is good for all of us because it drives better and lower costs. We must do a lot better job on financial reporting and cost accounting. We must do better on issues surrounding the data that we provide people so they can make better decisions in their markets.

What parts of health system digital innovation will stick?

Anything that can allow a patient to make a good decision when they need healthcare. If you’re at the mall, start to feel sick, and don’t know what it is, is there’s a kiosk there that gets you good information or provides contact with somebody who can answer your question on whether you should go home and take an NSAID or go to a hospital urgent care? We still haven’t gotten that figured out and we need to. On the patient engagement side, it’s making information available to patients so that they know how to make routine decisions. It’s all online, but not as functionally usable for patients as it needs to be.

As someone who ran for Congress, what do you expect to see from a political standpoint that will make US healthcare different in 10 years?

The one thing that you get when you are in Congress, or are running for Congress, is that there are 10 lobbyists for every member of Congress on the healthcare side. Political will is butting up against the lobbying process that goes on.

There’s a lot of things that should change, including how we manage PBMs, what safe harbor was intended to be back in the 1980s when it was passed, to how we pay for it. Even the fact that Medicare itself is both a payer and a regulator, and when you’re a payer and a regulator, that’s a disconnected process structure and it should change.

Will it change? We’re sitting at 20 or 21% of GDP. A point will come where if it doesn’t change one way or the other, the system is going to break. Some people want single payer, some people want more competition. I’m not a fan of the single-payer idea. I don’t think that’s going to work. But the bottom line is that if something doesn’t change soon, the sheer weight of the cost is going to become a problem that breaks healthcare down.

What factors will be important to the company and the US health system in general over the next few years?

I think it’s process change culture. There’s a lot of cultural issues in healthcare. The first question I ask any healthcare executive these days is, how is your culture? Are you capable of changing? Have you imagined a different environment? Do you have the information and reporting to give you enough decision-making capability?

Some organizations in healthcare have spent a decade or more just training their own leadership on how to make decisions and do it quickly. Healthcare needs to get faster, a lot faster, on the diagnosis side. A lot faster on the change management side. A lot faster on the decision-making side. That’s probably the area where we need to do the most work. Baker Tilly, as a strategic consultant and someone who does operational work, is focused on those areas.

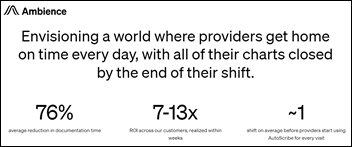

After spending so long in healthcare in my career, I cannot wait to see this next phase, where data use rather than data aggregation and interoperability becomes our priority. What we can do with tools, devices, and modern concepts of how doctors will interact. The average doctor has 16 minutes to spend with their patient, and 11.3 minutes of that is used to input and take data out of an EHR. That’s not an equation that works in the long run. I have confidence that we’re going to see massive quantities of new technology and ideas come up to help solve that problem.

Comments Off on HIStalk Interviews Steve House, Managing Director, Baker Tilly US

Thank you for the mention, Dr. Jayne — we appreciate the callout, the kind words and learning more about the…