Monday Morning Update 11/12/12

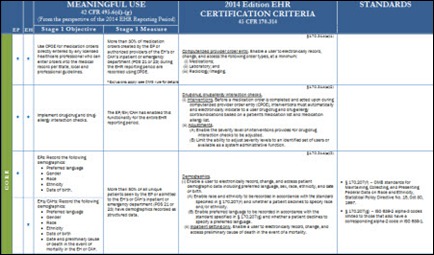

From Winston Zeddemore: “Re: EHR incentive program. Purely from the perspective of economic stimulus, by any measure, the EHR incentive program is a complete failure. After nearly four years since the bill was signed, they’ve paid out only a third ($8.36B) of the $25B set aside for EHR adoption.” Thanks to our recalcitrant and justifiably skeptical doctors for finally forcing government to stop making it rain like a defensive back in a strip club. Economically, we now know that EMRs are even a tougher sell than we thought – thousands of dollars in bribes still isn’t enough to convince doctors to spend more of the one resource they have (time) to benefit everybody but themselves. However, it’s fairly early in HITECH and the money is flowing freely now, so eventual success aside, your argument holds true – HITECH as a quick-jolt stimulus program hasn’t worked out, but for a positive reason — its intended recipients were held to high standards before the taxpayer-written checks were mailed out. That’s another good thing – the biggest concern about a stimulus-funded EHR program was that it would move too fast, causing doctor headaches and possibly harming patients along the way because of shoddy implementations of historically poor-selling products as everybody elbowed their way to the feed trough. As distasteful as HITECH is to many (me included), it’s working better than many other ARRA-funded boondoggles.

From Geek Chic: “Re: open source code for integration. Have any of your readers used an open source engine for HL7?” Leave a comment if you can help our inquisitor. Readers have mentioned using the Mirth engine in the past.

From The PACS Designer: “Re: RIS-teria. TPD has coined a new name for problems surrounding radiology information systems. While a RIS does a reasonable job of scheduling patients for studies, it is less efficient in dealing with the subsequent information flow. With the increased demand for better information to improve efficiencies, the RIS is lagging behind other systems due to the lack of adequate application programming interfaces (APIs). RIS-teria results from department managements quarreling on where to place new API’s, and who is going to provide the necessary funding. One solution is to do an upgrade to a RIS/PACS from the same vendor who can provide the necessary API software to communicate with other systems.”

From RIP_IDX: “Re: GE Healthcare. Significant layoffs coming to GE Healthcare in Burlington this week (probably Wednesday). Not sure if it is going to be limited to just the BTV office or across GE-HCIT. Rumor is Centricity Business will be hit hard. Haven’t heard if imaging (also based in Burlington) will be impacted. In a completely coincidental move, employees have been reminded of the corporate policy prohibiting them from talking to the media.” Unverified and hopefully untrue. We’re getting close to that Thanksgiving to New Year’s period where companies show their hand as desperate, cold, and clueless by sending employees packing during the holidays.

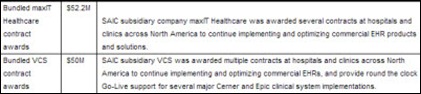

From MaxIT Numbers: “Re: MaxIT. Bought by SAIC for $473 million. Last quarter’s revenues were $52 million, or $208 million analyzed. That’s a buyout multiple of 2.3 times yearly revenue. How many consulting firms saw this number and are considering selling? Does this multiple seem off to anyone besides me? They must be generating huge margins at the expense of their customers.”

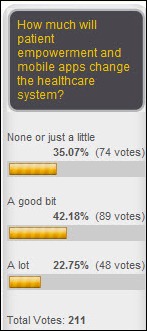

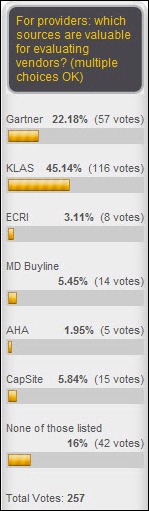

Two-thirds of respondents believe that patient empowerment and mobile apps can will change the healthcare system. New poll to your right, requested by a reader: what’s your general opinion of the College of Healthcare Information Management Executives (CHIME)?

Here’s my latest Spotify playlist in case you’re interested exploring new music (although some of the “new” music is actually old but little appreciated). Examples of what’s on it: Metric, Chevelle, Hammers of Misfortune, Fitz and the Tantrums, The Czars, Curved Air, Marmalade, Hole, and After Forever. It spans more than 40 years and several genres, connected only by the thin thread of my common appreciation.

Some nuggets from the Allscripts earnings call Thursday:

- Glen Tullman said drastically reduced earnings were caused by prospects delaying decisions because of the rumors that Allscripts was trying to sell itself, and also because of clients were waiting for new product releases. Ambulatory sales were hurt by the acquisition rumors and MyWay announcement. Professional services revenue slipped due to fewer sales and upgrades, but maintenance revenue increased. He repeatedly referred to the sales-impacting issues as “noise.”

- The company had one new Sunrise sale in the quarter. The buyer was a three-hospital, 214-bed system.

- Reaction to the MyWay announcement was “pretty positive.” Glen declined to give the MyWay customer count, but said it’s in the thousands.

- Glen: “You’ve got some old systems out there that are harder to connect and harder to upgrade, and you’ve got a slew of new technologies starting to hit the market. That’s when whole sectors change. I think that’s our opportunity.”

- Allscripts hasn’t seen lengthening sales cycles in ambulatory as other companies have said they’re experiencing.

- The company expects “the vast majority” of MyWay users to move to Professional by the October 13, 2013 signup deadline.

- Glen: “I think this is a big focus for us whether it be analytics, whether it be care coordination, whether it be interoperability, connectivity, and mobility. All of those will absorb a higher and higher percentage of our R&D budget, which continues to grow. And we think that we will have significant advantage. Some of our competitors are locked into architectures that don’t allow for the kind of innovation that we can bring. And with our open ecosystem that we’re creating, with all the third parties starting to develop on that platform, we think we can extend significant competitive advantage as those folks developed for us.”

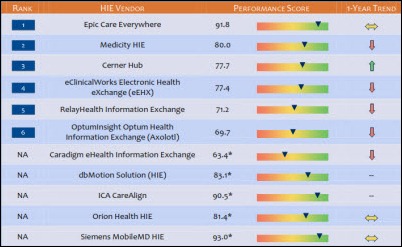

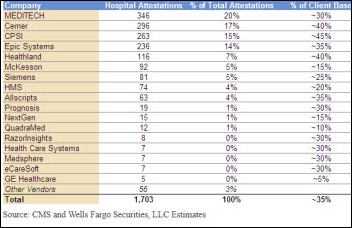

A survey of “digital health entrepreneurs” by venture capital firm InterWest finds that the top three barriers to healthcare innovation are reimbursement (27 percent), government (19 percent), and Epic and Cerner (14 percent). The heel-nippers may pout that well-established and successful vendors won’t voluntarily move out of their way, but they’re also envious: companies they wish they had founded include AirStrip, Castlight, ZocDoc, Epic, and Google. The graphic above is their prediction of which of their brethren will be the next to go public.

A wood products company becomes the first business in Maine to use telemedicine in the workplace, offering its diabetic employees video consultations with the co-director of the diabetes center at Tufts Medical Center. The program gives employees access to specialists who aren’t available in the company’s rural location and eliminates the high co-pays that most employees couldn’t afford.

Massachusetts-based hospital drug supplier Ameridose, a sister company to the compounding pharmacy whose products have been linked to a national outbreak of fungal meningitis, lays off its 800 employees as the FDA reviews the company’s sterility practices. The director of the Massachusetts Board of Pharmacy has been fired for failing to investigate a sterility complaint against the compounding pharmacy. It’s an interesting juxtaposition of headlines on Ameridose’s site (above).

Nashville-based Dalcom Communications Systems, which sells a wireless patient communication and nurse alarm system, renames itself to Amplion Clinical Communications after raising $3.75 million in financing to expand sales.

Sen. Orrin Hatch (R-UT) raises concerns with HHS Secretary Kathleen Sebelius that Quality Software Services, Inc., which was awarded a contract worth up to $145 million to create an eligibility system for the federal health insurance exchange, has since been acquired by Optum, part of UnitedHealth Group. QSSI’s annual sales were $13 million before the deal. The federal official overseeing implementation of the health insurance exchanges resigned in June to take an Optum EVP job.

Release of information vendor HealthPort merges with competitor Discovery Health Records Solutions. The Atlanta-area companies will operate under the HealthPort name. HealthPort sold its IT-related businesses, which included the former Noteworthy Medical Systems, to Germany’s CompuGROUP for $24 million in November 2010.

Sponsor Updates

- A four-part series by Karen Baker, MHS of the nonprofit Healthwise celebrates National Health Literacy Month with a discussion about how to engage patients in healthcare decisions. The organization took a team of 18 of its content producers to a scriptwriting camp led by an advertising copywriter, an actor, and a filmmaker to encourage them to break the rules in developing material that not only supports evidence-based medicine and behavioral change theory, but in a way that gets patients involved using plain language and taking the patient’s point of view. According to Healthwise Founder and CEO Don Kemper, “Medical gobbledygook robs people of their autonomy. Without understanding, they have no real say in their care. Plain language gives them back their say.”

- Besler Consulting will exhibit at HFMA’s Region 9 conference in New Orleans this week, demonstrating its cloud-based BVerified solutions for transfer DRG, IME, excluded provider screening, and revenue integrity auditing.

- CSI Healthcare IT revamps its job portal, which lists its several dozen open positions (direct hire, consultant, and contract to hire) for candidates with expertise in Cerner, Epic, McKesson, and Meditech.

- An interesting blog post by Henry Sabia of Software Testing Solutions on the changing no-man’s land between the EHR and laboratory information system: “It seemed to me the consensus was that ‘LIS’ won’t be about one system doing everything. Thought leadership sees it as a spectrum of systems working together. Ironically, GenLab and Microbiology functions may leave the typical LIS applications to become part of the general EMR, but Blood Bank and Anatomic Path will most likely fall under the ‘specialty’ category and will require standalone systems. Seems to me that we will always have separate systems, but a game of Red Rover is happening with some of our functionality. The EMR/CPOE has called GenLab and Micro over. Will be interesting to see if/how they make it to the other side. Regardless of where GenLab and Micro may live, the need for functional and volume testing will be more demanding than ever. EHRs, EMRs, interfaces, and data integration are here to stay. Add new acronyms like LOINC and HIE, and the picture only increases in complexity.”

- Velocity Data Centers President Steve Jacobs offers four concerns about healthcare IT moving to the cloud: data security, service levels, performance, and energy efficiency.

Contacts

Mr. H, Inga, Dr. Jayne, Dr. Gregg.

More news: HIStalk Practice, HIStalk Mobile.

I'm not sure these two camps are anything new, or should be lumped into "Real time systems" vs "Epic-first". These…