Top News

Healthcare data vendor IMS acquires six-year-old, 60-employee Seattle startup Appature, which sells software for tracking drug company marketing activities to physicians. Rumored price was more than $100 million.

Reader Comments

From IT Dad: “Re: porno nurse. The company was Onyx. I’m a 50-year-old male and I was shocked when I saw it and shocked that someone thought this would be a good idea. I just kept on walking. I was insulted that they would treat women that way and immediately though of my daughter and my female co-workers. I would not even consider stopping at their booth as I did not want to be seen there.” I e-mailed an Onyx contact for a comment and received no response. I was torn whether to run the reader-submitted photo above (taken by a real nurse, I might add) since that might seem equally chauvinistic, but decided readers need to see at least a small-scale version to understand what the fuss is about. The China-based Onyx sells medical displays, of which the scantily clad phony nurse appears to be one.

From Odla: “Re: Neal Patterson. Funny that Neal was seen at several booths at HIMSS. He was at the Optum booth for a bit until an exec recognized him and politely suggested he might want to return to the Cerner booth.”

From The PACS Designer: “Re: ECM. TPD will be posting interesting apps that address Big Data concerns in our path to enterprise content management (ECM). As a lover of what Hadoop can bring to healthcare, there’s an app that employs Hadoop called Platfora.”

From Captain Ron: “Re: HIMSS. I witnessed a classic moment at HIMSS last week that I had to share. I visited the QlikView booth to watch CHOP present on self-service analytics. Very impressive stuff and they’ve integrated QlikView in Radar. So the funny part … multiple folks there from Epic and one guy in particular decided he should interrupt and share how Epic can help solve this problem. I wonder how Epic would feel if QlikView came and interrupted their customer presentation? #BOUniversesarenottheanswer.”

From PartyReviews: “Re: HIMSS parties. Hit a few parties at HIMSS. Yours was the best of the bunch. Funny how a blog is out partying the big vendors. Consulting firms all had more of a reception format. Deloitte was kinda stiff as you’d expect, Impact Advisors and a few others were OK. Encore had their traditional and apparently popular Pub Night which I hit two times during the week. Each night there were over 300 people there. Guess people really like the free beer, wine, and mixed drinks. No vendors were over the top as has been normal in the past. I got into bed Mon-Wed at 2 a.m., 1 a.m., and 3 a.m. respectively. Only in New Orleans. And we wonder why HIMSS is a burn out?”

Acquisitions, Funding, Business, and Stock

Athenahealth completes its acquisition of Epocrates.

TeleTracking Technologies reports a 42 percent increased in booked revenue in the 2012 fiscal year.

ISirona announces revenue growth of 172 percent for 2012.

A proxy advisor firm urges HP shareholders to give the boot to two of the company’s directors at its upcoming annual meeting for their role in the disastrous acquisition of Autonomy in 2011, one of them being McKesson Chairman, President, and CEO John Hammergren. A group of New York City pension funds also urges voting against the re-election of Hammergren and G. Kennedy Thompson for their involvement in acquisitions that caused HP to lose $17 billion in the past year and for the quick hiring of CEO Leo Apotheker, who was then fired less than a year later.

Ireland-based bedside computing vendor Lincor Solutions receives a $9.5 million investment from Edison Ventures, which it will use to relaunch the company in the US by moving its headquarters to Nashville, TN and creating 30 jobs. The MediVista platform offers access to clinical applications, bed status management, patient entertainment and education, and communications.

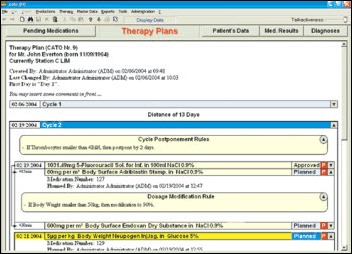

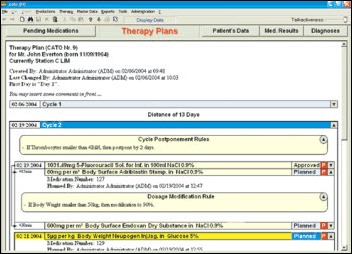

Medical supply vendor Becton Dickinson & Company acquires Austria-based Cato Software Solutions, which offers oncology planning, monitoring, and drug preparation software.

Lexmark acquires two companies that will be rolled into its Perceptive Software unit. AccessVia sells software that allows stores to print electronic shelf tags, while Twistage provides media management software that its CEO says could be used to distribute medical images and attach video to a patient’s EMR.

Sales

East Texas Regional Healthcare System selects Siemens MobileMD HIE to coordinate care among its 15 facilities.

The Salisbury, Wight and South Hampshire Domain NHS Trust Consortium (UK) awards its VNA and data migration contract to Acuo Technologies.

Coastal Medical (RI) adds the eClinicalWorks Care Coordination Medical Record to advance its ACO-related objectives.

Iowa Health System will implement a suite of Infor applications, including Infor Lawson Supply Chain Management and Enterprise Financial Management.

The Virginia Department of Behavioral Health and Development Services selects Siemens Healthcare’s Soarian clinicals and financials and the MobileMD HIE platform.

People

Suzanne Cogan (Shareable Ink) joins Orion Health as VP of sales.

Conifer Health Solutions names Allen Hobbs (MedAssets) chief client officer.

The AAFP’s TransforMED subsidiary names Russell Kohl, MD (OU School of Community Medicine / Oklahoma College of Medicine) medical director.

Infor names Barry P. Chaiken, MD (DocsNetwork) CMIO.

Ping Identity hires Michael J. Sullivan (IHS) as CFO.

HHS Secretary Kathleen Sebelius names new and continuing members to the US Technology Standards Committee including Jeremy Delinsky (athenahealth) and Eric Rose, MD (Intelligent Medical Objects).

Announcements and Implementations

CareCloud opens a Boston office, where it expects to house 35 to 40 employees by the end of the year.

Johnson County Healthcare (WY) goes live this week with CPSI.

PatientKeeper deployed its CPOE solution at 19 community hospitals during the first 60 days of 2013.

Eight vendors participated in the inaugural IHE 2013 North American Connectathon, which performed testing to specified requirements for the IHE USA Certification pilot conducted by ICSA Labs.

Final HIMSS conference stats: 34,696 total attendees, 13,985 professional attendees, 1,158 exhibiting companies.

The New Orleans airport warned travelers last Wednesday of expected delays on Thursday due to the conclusion of the HIMSS conference and sequester-driven TSA staffing reductions.

e-MDs launches a cloud-based EHR/PM solution and introduces Solution Series 7.2.2, an updated version of its client-server suite of EHR/PM products.

Government and Politics

HHS Secretary Kathleen Sebelius fires up her Twitter.

Lt. Dan called this perfectly. Internal VA documents reveal that the agency is taking much longer than it reported to process service-related benefit claims by veterans, with delays averaging more than 1.5 years in major cities. The number of veterans waiting for more than a year for their benefits jumped from 11,000 in 2009 to 245,000 by the end of 2012. Despite spending $537 million on a new computer system, the VA still process 97 percent of claims on paper.

Other

Billian’s HealthDATA finds that medical records-related costs of hospitals typically account for less than three percent of total general-service operating expenses and almost seven percent of total general-service salary expenses.

The University of Mississippi Medical Center will expand its telehealth program to improve access for smaller hospitals and clinics and will create 201 new jobs over the next three years.

Sponsor Updates

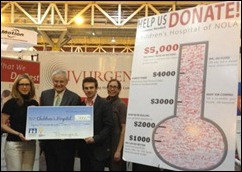

- Divurgent’s Signature Drive at HIMSS raises $5,000 for the Children’s Hospital of New Orleans.

- Aspen Valley Hospital (CO) increases front office payments and reduces payment processing administrative time by 65 percent after deploying InstaMed’s healthcare payment network.

- Hyland Software and Merge Healthcare expand their partnership to include an integrated image viewing and storage solution.

- CareTech Solutions introduces CareTech Solutions Pulse, an integrated IT monitoring service that integrates monitoring of hospital clinical, business, and ancillary applications, as well as the infrastructure on which they run.

- The Virtual Influence Planning group, Medseek’s independent consulting firm, expands its services to include patient portal adoption and marketing plans for healthcare organizations. Medseek also introduces its Influence platform, which will provide hospitals with a comprehensive view of individual patients.

- Orion Health and NexJ Systems will distribute joint capabilities and technologies, such as NexJ Connected Wellness and the Rhapsody Integration Engine.

- CCHIT certifies NextGen Ambulatory EHR version 5.8 compliant with the ONC 2014 Edition criteria and certified as a Complete EHR.

- The Advisory Board Company announces the agenda and keynote speakers for its Crimson Clinical Advantage Summit May 20-22 in Scottsdale, AZ.

- Picis announces that is annual Exchange conference will be consolidated with the Optum Provider Exchange Conference September 23 in Orlando, FL.

- Philips Healthcare introduces its IntelliSpace eCareManager 3.9 patient management software, which includes the ability for staff to get a patient population level view of data.

- The NCQA awards SuccessEHS client Scenic Bluffs Community Health Centers (WI) the highest level of recognition for its PCMH program

- CAP Professional Services and the Lab Interoperability Collaborative look at the top 10 challenges facing hospitals seeking to report lab results electronically.

- GetWellNetwork debuts myGetWellNetwork, a digital platform to help patients and providers manage recovery, chronic conditions, and preventative care online.

- Ephraim McDowell Regional Medical Center (KY) shares how Accent on Integration helped the organization integrate its Philips OBTraceVue platform with its Meditech HIS.

- Surgical Information Systems announces the availability of SIS Com Version 3.3, which includes enhanced functionality and a more streamlined look.

- Imprivata launches Cortext 2.0, its free HIPAA-compliant texting solution.

- St. Barnabas Medical Center is using Access’s e-forms and wristband bar-coding solution alongside Cerner Millenium and Siemens Invision to enhance its EMAR process.

- Visage Imaging will exhibit at the SIIM Philadelphia Regional Meeting on March 18 in Philadelphia, with Director of Solutions Architecture and Customer Experience Director Bobby Roe co-leading a roundtable session entitled “Cool Technologies in Imaging Informatics.”

- Vitera Healthcare releases a hosted version of its Medical Manager practice management platform.

- McKesson Canada’s RelayHealth aligns with QHR Technologies to integrate QHR’s Accuro EMR System with RelayHealth’s services.

- SC Magazine names Trustwave the Best Network Access Control product.

- The HealthLogix HIE platform from Certify Data Systems passes numerous Integrating the HIE profile tests at the 2013 IHE North America Connectathon.

- Nuance launches Clintegrity 360, a computer-assisted system for clinical documentation improvement and coding.

- RazorInsights integrates Patientco’s patient financial engagement billing software into its HIS system.

- MetroHealth Medical Center, an affiliate of Case Western Reserve (OH), will deploy Wolters Kluwer Health’s ProVation Order Sets as its evidence-based order set solution.

- Kareo lists the top six EHR features that small practices need.

- Ingenious Med reports a 380 percent increase in the usage of its impower mobile applications in 2012. Twenty-one percent of its licensed impower clinicians now use mobile devices.

- Deloitte interviews 12 CIOs in major health systems about the challenges of managing their IT departments.

- InstaMed projects triple-digit growth in the wake of healthcare reform and reports having processed more than $60 billion in healthcare payments as of March 2013.

- GE Healthcare is developing Guided Analytics and AutoBed applications for the Caradigm Intelligence Platform.

- AT&T CMIO Geeta Nayyar discusses mobile health and how it can provide care where needed.

- Cerner will integrate Nuance’s clinical documentation improvement technology into its Millennium EHR and RCM solutions.

- Advanced Orthopedic Center (FL) selects SRS EHR for its nine physicians.

- Access extends its relationship with Inpact LLC, a provider of online and social media communities for HIT, to include sponsorship of Siemens Healthcare Social.

- As part of its $80 million healthcare integration contract, Harris Healthcare receives authorization to deploy a solution that enables the VA and DoD to share EHRs.

- Johns Hopkins Hospital shares how LRS helped the organization simplify document management in a March 14 Webinar.

- Capario announces a three-part Webinar series called Mastering the Art of Getting Paid starting March 20.

- Covisint will feature Andras Cser with Forrester Research in a March 13 Webinar detailing the benefits of cloud-based identity and access management.

Contacts

Mr. H, Inga, Dr. Jayne, Dr. Gregg, Lt. Dan, Dr. Travis.

More news: HIStalk Practice, HIStalk Connect.

For the broader community, Neil Pappalardo was an important person within the community well beyond the impact he had on…