Weekender 7/19/19

Weekly News Recap

- Ellkay acquires X-Link.

- John Muir Health outsources IT-related functions to Optum and transfers 540 employees to the company.

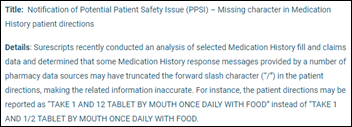

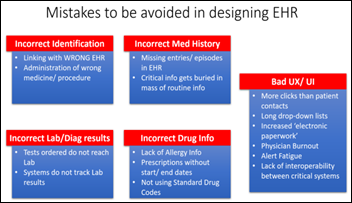

- A study finds that follow-up is often not performed for patients with poor kidney function, with EHR configuration changes recommended to close care gaps.

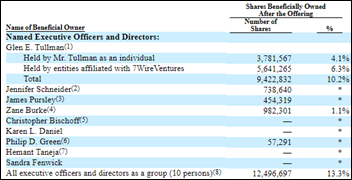

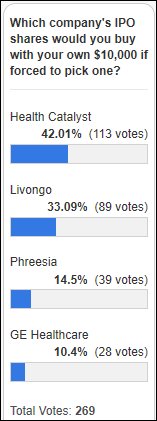

- Livongo Health’s updated IPO filing values the company at up to $2.4 billion.

- SPH Analytics acquires SA Ignite.

- Baring Private Equity Asia is reported to have edged out other bidders to acquire CitiusTech for $1 billion.

- PeaceHealth lays off 50 IT employees as it centralizes tech support.

Best Reader Comments

John Muir outsources its IT and analytical functions while Providence bought an entire consulting company to go deeper into that area. Just goes to prove that nobody knows anything! People are just throwing stuff on the wall to see what will stick. (Nobody Knows Anything)

John Mui, is looking for operational efficiencies (again in theory), so outsourcing IT and business process can make sense for them. Providence, on the other hand, is looking to increase revenue, so they bought those consulting firms to accomplish a couple of goals. For starters, they are doing custom Epic development, so once they make certain changes in the system, they will then market those changes and sell them to other customers through this new acquisition (similar to what UHS did with Crossings Health Solutions via Cerner mPages). Providence also has an innovation team that is thinking up new healthcare technologies and then will most likely uses these new firms to sell/push those to other systems. This is something we are seeing more and more with the larger IDN’s like Providence, Ascension, UHS, etc. building their own business lines and are selling those solutions to the masses. (Associate CIO)

I hope the outsource deals works out for John Muir and goes better than most outsourcing. Typically the client never REALLY gets improved operations. Keeping in mind the outsource company is for profit and has to do the same and more with less people and it typically ends up being less than desired results. You sure can’t keep people on the payroll making 500K plus. (Robert Smith)

The accuracy published of 75% is only slightly better than guessing. “Metastatic carcinoma is present in 36 whole slides”…” The dataset consists of 130 de-identified WSIs of axillary lymph node specimens.” Thus, 36/130 = 27% has carcinoma, and 73% no carcinoma. Without AI, I could guess all slides are “no carcinoma” and I’ll have an accuracy of 73%. Always perform a sanity check of the baseline accuracy of “no AI.” (AI lover)

[Virtual visit versus office visit] is more comparing Netflix to going to a theater release. You won’t experience professional sights, sounds, and touch, on the other hand, you won’t have screaming kids, catch something from someone coughing on top of you, or get your feet sticky walking through the place. (AC)

Watercooler Talk Tidbits

Readers funded the DonorsChoose teacher grant request of Ms. W in South Carolina, whose asked for art supplies for her high school classroom that closed for several weeks after flooding from two hurricanes. She reports, “It has been an unbelievable challenge recovering from the devastation due to the hurricanes and floods. Students were so excited when we received the materials, it was as if they were opening presents on Christmas morning. They have really taken an interest in demonstrating their learning through hands-on, creative projects and the materials have allowed us to easily differentiate learning and assessments. Furthermore, decorating the classroom and hallways with students’ work gives a sense of ownership and comfort to the space.”

The New York Times covers hospitals hiring “secret shoppers,” consultants who pose as patients in reporting vague symptoms to see how well employees follow procedures and practice empathy. The shoppers even have blood drawn and have some tests performed, but are trained to leave for a claimed family emergency if treatment would put them at risk. One shopper who went to the ED wearing old clothes and claimed to have no insurance found that employees didn’t introduce themselves, make eye contact, or apologize or even acknowledge issues such as blood on her arm following a draw. She returned professionally dressed and presented an insurance card and received better treatment.

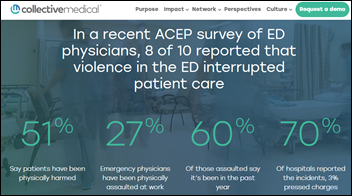

A Pennsylvania hospital locks down its ED when two rival groups continue their earlier all-day fighting in what the hospital called a “riot” at 4:30 in the afternoon. Apparently those involved were not otherwise occupied with gainful employment or academic pursuits.

Drexel University will lay off 40% of its physician group because of the impending shutdown of Hahnemann Hospital. Politics aside, presidential candidate Bernie Sanders summarized it well: “It’s insane. If you look at this thing objectively and you say that in the midst of a healthcare crisis, a hospital is being converted into a real estate opportunity in order to make some wealthy guy even more money, ignoring the healthcare needs of thousands of people, that is pretty crazy.” Although I’ll offer a more realistic assessment — the investor is just doing what investors are highly paid to do, and relying on his moral rather than his legal obligations is naive. Repeat with me in observing the obvious: people and companies do exactly whatever benefits them the most.

A man breaks his leg minutes after renting a Bird electronic scooter, racking up a $100,000 bill from Tampa General Hospital, which says it has treated 50 such injuries in the past two months. The guy’s hipster beard was probably more appropriate for the e-scooter than his brand new walker.

Huntsville Hospital brings in Asteroid, a certified service dog that can accompany patients to their procedures and comfort families in bereavement. My first thought was whether the hospital has figured out a canine billing code.

In Case You Missed It

Get Involved

- Sponsor

- Report a news item or rumor (anonymous or not)

- Sign up for email updates

- Connect on LinkedIn

- Contact Mr. H

Look, I want to support the author's message, but something is holding me back. Mr. Devarakonda hasn't said anything that…