Ed Marx, MS is CEO of Divurgent of Virginia Beach, VA.

Tell me about yourself and the company.

We’re a consulting, design, and services firm. I have been in healthcare for 30 plus years in a variety of roles, initially, as a janitor in a healthcare facility, a combat medic, an anesthesia tech, and eventually chief information officer. I led digital strategy for a few global healthcare organizations, and now find myself as CEO of this consulting firm. It has been quite a ride, and I have to give complete thanks to all my teams and organizations that helped shape who I am that allowed me this opportunity.

Divurgent has been around as a virtual company since its inception 15 years ago. It has grown year over year at a quite fantastic pace. We are privately held, which has many, many advantages, and that certainly was one of the reasons that I was interested in taking this position. We have several hundred W-2 consultants, and we purposely have made many of our consultants W-2 because we think it makes it more of a family-type atmosphere. Depending on the projects that we are undertaking, it could grow to a thousand or 1,500, but those are typically 1099 or traditional consulting roles that we add. It’s a fairly sizable, I would say mid-sized, company, but growing. It’s at a sweet spot right now, but we have quite aggressive opportunity to continue our growth.

As a first-time CEO, how do you assess and manage the company’s culture, especially since you are taking over from a founder?

It’s a very humbling opportunity. One of the things that drew me to Divurgent is the fact that they are very strong in their values, and they live them. What I love is that at the beginning of every meeting, we talk about one of the five what we call ELITE values – excellence, learning, innovation, trust, and enthusiasm — and someone volunteers to give an example of how someone on the team demonstrated those values since the last time that team met. It’s great storytelling, so that the culture continues to be embedded in the fabric of the organization.

My task is simple in that I don’t want to be the one to change that culture. I want to help that culture continue to rise to the challenge. There is a strong basis for culture. There’s a lot of storytelling involved in that culture. It’s not like I have to come in and help create or shape culture. The challenging task ahead for me, as well as the entire organization, is how do we maintain that culture as we double in size? Retaining that culture is always a tremendous challenge for organizations that grow. Because of the foundation that has been set, I think we’ll manage it, but it will definitely be a challenge.

As someone who has spent most of their career working for non-profit health systems, does it feel different running a for-profit company that provides services to health systems?

It’s different, for sure. But what I like about it is that I can bring that mindset of the C-suite of the provider side. Divurgent was already pretty much there in terms of the partnership approach that we took with clients and prospects. Given my experience, the one thing that I am bringing to the table is that I know how the C-suites analyze and determine who they want to partner with. Bringing that thinking over to the supplier side or the consulting side can really meld well. Now it’s a matter of bringing that thinking and experience that I have, understanding the provider side, but also leveraging the team I already have that is expert in consulting, creating this unique partnership and unique capability. We are bringing those two strengths together, the experience of having been in the C-suite as well as the consultative experience, and that will be our sweet spot and one of our key differentiators

How did consulting change since the pandemic started and how will it look over the next few years?

The good news for Divurgent is that it actually thrived during the pandemic. One of the reasons is that because of the agile nature of Divurgent, and being that mid-sized company and privately held, enabled Divurgent to continue with these close relationships and be super flexible on everything when it comes to terms, the nuances of contracts, sensitivity to payments, and things of that nature. Some companies that might be more traditional or more beholden to stakeholders have to go by sometimes bureaucratic methodologies that don’t allow them that sort of flexibility. It hurt them a little bit being unable to respond quite as intimately with their customers. With Divurgent, we’re just continuing in that fashion of being agile in terms of understanding the customer and working with them in whatever unique terms they have. There’s no cookie cutter approach.

That comes out in the way that we work as well. We don’t bring best practices. A lot of companies pride themselves on bringing best practices to bear, but we don’t bring best practices. We co-create best practices with those organizations that are as unique to them as the solution itself. Going back to the size and being privately held, we can take this unique, customized approach. I’ve been on this side before, where I would have presentations done for us as a C-suite member, and it was a standard slide deck that you know they used last week with some other health system, and sometimes there would still be the old name of whoever the particular consultants pitched to last time. We just don’t do that.

During the pandemic, those relationships were solidified. Our customers started to recognize the fact that we’re not doing cookie cutter, we’re not bringing other people’s best practices and forcing them on them, but we will truly co-create with them. That’s the feedback I got before I took this position. I did my homework, just like Divurgent did their homework on my myself and checking references. I called some of their references, some of my peers who I knew were Divurgent customers, and some other knowledge bases that would have some information. One of the common themes is that the way Divurgent worked — and I’m not trying to sound like a commercial, I really am not — was unique in that it was customized. That really showed itself during the pandemic and helped the company to grow during the pandemic. That’s one of the attributes or differentiators that we want to continue with.

How would you describe the key elements of digital transformation in healthcare?

It’s one of those terms now that is almost meaningless. What we’ve been talking about is not digital transformation so much as digital acceleration. Everyone is using the term digital transformation, but when you look at what’s been done in the last few years — other than the majority of healthcare organizations moving to electronic health records and some outliers with virtual care and move to the cloud — we haven’t reached the scale of transformation that we might have hoped for five years ago or even 10 years ago. I’m focused, and we are focused as a firm, on digital acceleration.

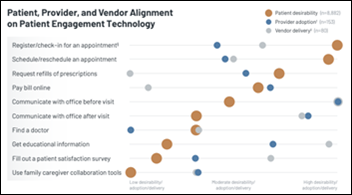

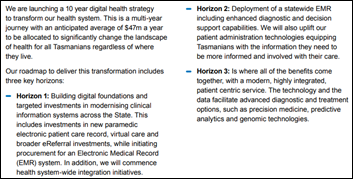

One of the basic building blocks that’s still missing — and I’ve done personal surveys with CHIME members and I’ve seen other more formal surveys — is that the majority of organizations don’t even have a strategy in place. If not a strategy, certainly not a roadmap. What we saw through the pandemic — and this was happening before the pandemic, but was really exacerbated during the pandemic – is a lot of what I would call pockets of brilliance. There would be an immediate problem, standing up virtual care would be a great example, and then you look at it now and wow, this great thing was done to help patients, help save lives, and help with clinicians. That’s a pocket of brilliance. But what we want to do now with digital acceleration is take these organizations from pockets of brilliance to enterprises of excellence. It’s not just one area that you need to be good at when it comes to digital transformation, but it’s everything, all the different services that we do.

Beginning with a strategy, having a strategy, having a roadmap that basically says, what’s your baseline, and measure it. A lot of times we talk about progress, but no one takes a baseline. It’s like, no, let’s take a snapshot now. Let’s take a baseline. Let’s find out, where do you want to go? It’s pretty simple what I’m describing, but yet less than 10% of organizations have a written, codified, approved strategy. Let’s do this baseline, let’s benchmark so we have a general understanding where you are as an organization, and then where do you want to go? Then you have a natural gap analysis that’s done.

Then you can determine not 100 different things to do, because you know what happens when you do that — nothing gets done, or a bunch of things get done with a bunch of mediocrity. Let’s take 10. The magic number is different for every organization, but let’s just say the average is 10. Let’s do 10 things that help to move the needle on that gap, so that in three years you can say, we did digital acceleration. We were here in 2022, now it’s 2025, and we measure it. And of course you are measuring all along the way so that you can make adjustments and hold the organization and the leadership accountable. It sounds simple, and it actually is, but few organizations have the resource or focus to do it.

That’s one thing that we are emphasizing with digital acceleration. Then of course, we can help with those things that might be needed to fill the gap, whether it’s a virtual care implementation or strategy or help with movement to the cloud or helping with robotic process automation, all these different elements that would be included in a digital transformation acceleration, but just aren’t being done. Or like I said, if they’re done, they’re being done in pockets of brilliance, but not enterprises of excellence. Ultimately, to get to what we’re all striving for, this amazing patient and consumer and member experience, as well as the corollary, which would be clinician experience. Oftentimes we just talk about patient experience, which is super important, but I’m a big believer in, patients come second. It’s the clinicians. It’s the staff. We have to make sure that they are not burned out so they can take care of patients, and that way, everyone wins. It’s that whole gamut from the strategy roadmap, all the way to things around virtual care, but ultimately to the consumer, member, patient, and clinician experience.

Health system CIOs commonly rose through the healthcare ranks and then took responsibility for everything that was related to technology. Health systems are now creating new C-level roles, sometimes filled by people from outside of healthcare, that have technology responsibilities. How is that changing the CIO role?

It has been a huge wake-up call in the ranks of the CIOs. To your point, a lot of CIOs were raised exclusively within healthcare. HR job descriptions would insist and reinforce this old way of thinking — you had to have 20 years of healthcare experience to become a director in a healthcare IT organization. CIOs were people within the ranks, and as a result, we got insular and accidentally shielded ourselves from all the great transformation things that were happening in other industries.

It hurt us. The response by hospital CEOs and hospital boards was, oh my gosh, we do not have the internal talent to take us to transformation and acceleration and execution. We need to go outside. We need to go to Disney. We need to go to Microsoft. We need to go to AWS. We need to go to Walmart, to CVS, to Rent-a-Center, to you name it. These are real examples that I’ve just given you. These chief digital officers who had all this experience in retail, finance, and entertainment came in, and most of them have done an amazing job. In one way, I look at it as a sad thing, because many of my peers have the skills and can reequip themselves to better understand digital in these other sectors and bring that thinking and leadership to bear. But in many cases, they haven’t, and outside influences came in.

Overall for the patient, I think it’s a net win, because at the end of the day, it’s really about the patient care and patient experience, consumer and member experience, and the clinician experience. It’s a good thing to have this external view, external influence into healthcare. I think it makes us stronger. We could have been a little bit more thoughtful about how it all happened, but it happened, and I think it’s good. I always prided myself on having at least one team member who came from outside of healthcare. I had someone from entertainment, military, or finance because it always made us stronger. The argument that they have to be in healthcare because healthcare is unique and special is not true. While we are unique and special, other people can come in from unique and special verticals and learn healthcare. We all had to learn healthcare at one point.

It’s good to have these outside influences, and like I said, it has been a net-net gain for everyone. We’ve learned so much from these individuals and these leaders that came from other industries. CIOs who are maybe more traditional should take note of this and take steps now to benefit their organization, and to benefit themselves, to make sure that they are not left out in this next wave or the current wave. Hang out with individuals from other industries, study other industries, learn more about what’s being done, and bring that to their organizations.

The pandemic allowed big health systems to get bigger by acquiring weaker community hospitals, and the remaining standalone facilities are also facing publicly traded competitors who are anxious to cherry-pick their profitable services. Can the traditional community hospital survive?

My heart and soul still are with community care. Divurgent wants to help hospitals of all kinds to not only survive, but to thrive in this new digital era. We want to help everyone. It is really important. I call it “survival of the digital-est.” It’s critical that all these hospitals, including smaller critical access hospitals and community hospitals, grab hold of this whole digital revolution that’s taking place and take action.

I’m afraid that some organizations have not moved quickly enough, or think that they might be insulated because of their location. If they are insulated today, it won’t be for very long. In the digital era, you need to embrace digital tools and all the things we already talked about related to consumerism, the clinician experience, and modern technologies to not only to deliver the highest quality of care, but do it in such an efficient way that you can afford to survive. We really want to help these organizations.

That’s part of the reason that we wrote the book on digital transformation and have another one coming out on patient experience with Mayo Clinic, Cris Ross. It’s all aimed at trying to help these organizations survive and to move from survival to thrive. It’s incumbent upon the boards of these organizations and the leadership of these organizations to understand what’s going on and take demonstrable action.

How will the company change over the next few years?

At Divurgent, we expect to double in size, but our metric is not currency. When you talk to a lot of companies, they talk about growth that they measure it in dollars and cents. Like, we are going to go from $100 million to $200 million. We are measuring our growth in the number of clients served. We want to double the number of clients served. We believe that if we serve clients and we serve them with excellence, the currency and all the other metrics will follow. Not really fixated on that, but fixated on the growth of clients. How we do that is continuing with excellence. When I did my homework and looked at KLAS ratings and talked to Divurgent customers, 100% are referenceable accounts.That’s a meaningful metric that we’re proud of and will continue with.

Another is to look at new services. We already do advisory and services, but incorporating design, and what I mean by that is this human-centric design, in everything we do. In the past, a lot of consulting and a lot of services were process-oriented, which is good, and built on technology. But what we found are shortcomings. You come in there as a consultant or advisory and you leave and you don’t really ever experience and find out later why none of the initiatives had long-lasting impact. Incorporating the sense of human centricity, human-centered design, is another differentiator that we’re bringing to the table that will help drive growth.

Digital acceleration and that whole model includes the governance piece that was never really solved by many organizations, how they prioritize and how they make effective decisions. It never included what I would call value creation and the concept of, we are going to hold not only ourselves accountable, but let’s hold, or help organizations hold, themselves accountable to doing 360-degree, closed loop investment analysis. I serve on the board of Summa Health in Akron just had the same conversation with the CFO about ensuring that with all these projects, initiatives, and use of consultants, we do these 360, closed loop value realization exercises. That basically means that a year after you came here and you said you’re going to do X, Y, Z, what was the actual performance? It doesn’t have to be with a consulting organization, but since we’re talking about Divurgent, that’s just another sense of differentiation, that we are going to hold ourselves accountable to what we partnered with the organization on.

We’re seeing a lot of M&A in the consulting business. You’re seeing some health systems buying consulting consulting firms, and you’re seeing big tech acquiring firms like Tech Mahindra with HCI. You see mid-sized players exiting the market and I think you’ll see a little bit more of that, which will provide more clarity for those who are left in that market. There’s going to be a lot of changes coming in the next several years, in terms of the number of firms that stay in the market and focus on delivering this level of value that I’m speaking about to their clients.

Comments Off on HIStalk Interviews Ed Marx, CEO, Divurgent

Fun framing using Seinfeld. Though in a piece about disrupting healthcare, it’s a little striking that patients, clinicians, and measurable…