Top News

Patrick Soon-Shiong’s NantWorks buys a controlling interest in hedge fund-owned Verity Health, which runs six California non-profit safety net hospitals previously operated by Daughters of Charity Health System under the Integrity Healthcare name.

Soon-Shiong pledged in an announcement that the company will apply “the limitless powers of collaborative science and technology to transform healthcare practices and create a more efficient, more effective health system. Medical care is local and we strongly believe that community health systems should be supported with investment, technology, and science to build next generation clinically integrated networks to drive better outcomes at a lower cost.”

Reader Comments

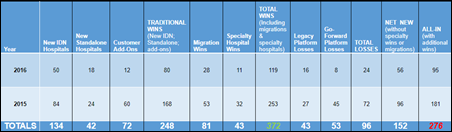

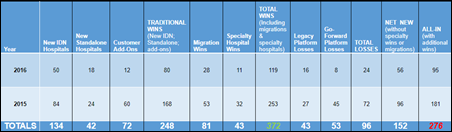

From Pithy Aside: “Re: Cerner wins/losses.Here’s the information from the 2016 and 2017 KLAS clinical market share report.” A reader previously subsetted the KLAS data in an attempt to focus on what he or she thought would be most interesting to Wall Street analysts, but the bottom line per KLAS (as commented here previously) is, “Acute wins for 2015-2016 for Cerner: 249 (this number includes 1 Soarian add on in 2015). Total Millennium losses for 2015 and 2016: 53. Cerner’s net growth is thus 196 acute hospitals for 2015 and 2016.” Certainly further segmentation by deal count vs. hospital count, organization type, bed size, accounting for multi-hospital deals like the DoD and Emerus, net-new customers vs. footprint expansions, migrations either way due to mergers, etc. could lead to further interpretation and speculation that may or may not add value. There’s also the unusual opportunity since CERN is publicly traded to simply look at the metrics Wall Street really cares about that go far beyond hospital count – revenue, bookings, and earnings, all of which reflect Cerner’s overall activities (not all of which involve hospitals) and the efficiency with which it operates its business. For that matter, share price since January 1, 2015 is the ultimate measure of company performance vs. Street expectations and the above real-time graph as I write this shows CERN (blue, up 1.1 percent) vs. the Nasdaq (green, up 29.3 percent). The reader also noted that some Soarian sites are trying to wangle out of their contracts to switch vendors claiming poor support, but I can’t say I side with them – they signed a contract for product that remains supported, and if company change of control was important to them, they should have put that – along with service level agreements if they left those out — into their contract’s terms and conditions. Weirton Hospital has sued Cerner claiming poor support, while Cerner sued PinnacleHealth for trying to walk away from its Soarian contract after signing with Epic.

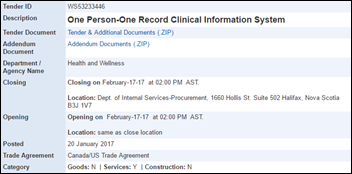

From Pinkeye: “Re: Epic. Hard to believe they didn’t bid on the Wisconsin DHS project if they have a viable behavioral health strategy. I’m also curious whether Allscripts/Netsmart bid.” Epic sent me a note after I mentioned that the company had chosen not to bid on the project, saying it wasn’t a big enough deal to interest Epic. I haven’t seen a list of the five bidders. Health IT websites created the self-serving notion that it’s cleverly-observed big news when a customer in Wisconsin or Missouri chooses Cerner or Epic, respectively, but that’s ridiculous.

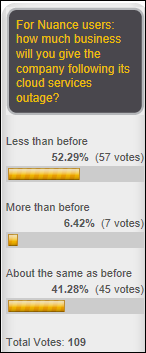

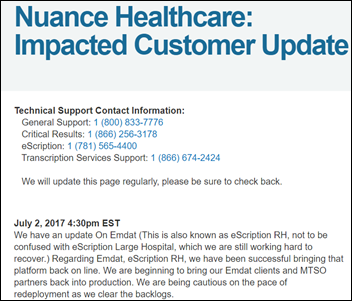

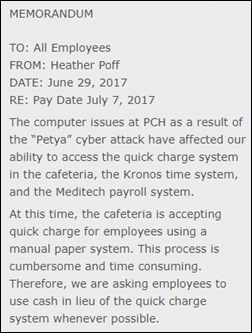

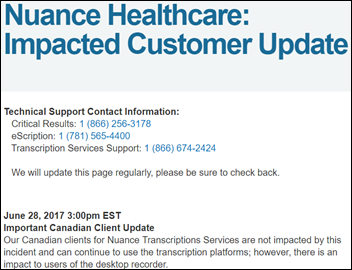

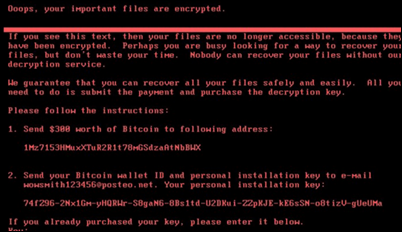

From Nuance Hospital Customer: “Re: Nuance outage. Escription staging environment testing is in process, with plans to bring the first client on board. Rebuilt speech engines. They just announced that they are in process of updating employee laptop antivirus software and installing encryption (!). Over 200K physicians are on an interim solution, but still no commitment to make clients whole — only offering clients short-term use of Dragon Medical. I can only speak for our organization, but we have had over 10 staff working around the clock since this outage to review options and stand up outside transcription service. This is very poor remediation.” Unverified, but seemingly solid since the reader emailed from their hospital account. Nuance has issued minimal public information, instead providing status updates via customer conference calls. Some systems remain offline 10 days after the initial malware incident.

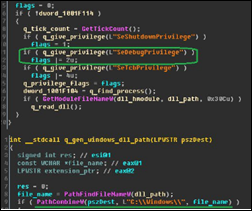

From NotPetya: “Re: Nuance outage. People are acting like they’re innocent victims of a cyberattack. Doesn’t this situation show what happens when you don’t upgrade your software? NotPetya exploits the same weakness as the May 4 outbreak and systems should have been patched.” I don’t think Nuance has confirmed that it was hit by NotPetya, but assuming that’s the case given the incident’s timing, it would seem that it had a PC running somewhere that didn’t have Microsoft’s Eternal Blue exploit patch from March 2017 (MS17-010) installed, which also protects against the WannaCry strain. However, even someone as cynical as I would be hesitant to suggest that the company was negligent given the lack of facts, instead suggesting that every organization check every PC on the network to make sure they are running updated versions of Windows and antivirus.

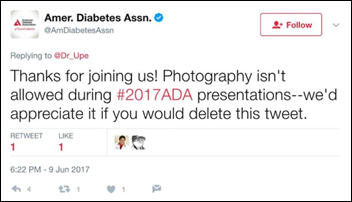

From Crank Rod: “Re: HIT influencers. What do you think of this list that a Twitter monitoring service company assembled?” I question the premise of this list (and others like it) that assumes that hyperactive Twitter users must, by definition, be influential. I’ve never heard of most of the Twitter accounts listed, follow few if any of them, and note that their Twitter activity is often dominated by attention-seeking retweets and insight-lite comments that fail to rise above the level of social media circle-jerkery. I’ve also noticed that the real-world accomplishments of the anointed Twitterati are often much more modest than their outsized social media presence would suggest and that their self-assigned labels of “disruptor” and “innovator” sometimes ring hollow given their lack of personal success within the system they claim to be qualified to disrupt (it’s perhaps harsh to say that, “those who can’t, Tweet,” but sometimes that seems to be accurate). I’m happy for those named, especially for those whose self-validation demands it, but it’s just not something I care one iota about. I doubt many CEOs and other industry leaders are anxiously waiting for the winners to be named so they can call them up for advice.

From Money In the Banana Stand: “Re: #HIT100. Is it just me, or is this just another glad-handing campaign where the social media-verse celebrates the over-tweeters, many of whom have never even worked within a health system? While I find social media to be an effective medium to share, collaborate, inform, and educate, I am increasingly annoyed as I find folks have gotten away from why we are in this industry in the first place. In fact, I find several of these individuals exclusively making a living by talking about what the industry needs to do in social media and at conferences, but have no successful business or job within the industry. I am appreciative of those who HAVE worked in the industry who share their expertise and strategic thinking, but have had just about enough of the ‘marketers’ who are just recycling marketing and self-promotion. The tipping point for me was receiving countless messages from people ‘campaigning’ for my vote. Seriously?” I received this comment several hours after writing mine above, which was triggered by a similar but different “influencer” measure. Some of those folks don’t seem to have real jobs and are light on (a) healthcare-related education; (b) work experience; and (c) accomplishments. I apply the same standard to those who produce blogs, publication articles, or conference presentations – if you’ve never worked in a position of significant responsibility in healthcare IT, it’s hard to fathom why those who have should trust your assessment or value your opinions.

From In the Beginning, There Were Delays: “Re: DoD’s MHS Genesis. The October 2016 military announcement said the pilot site go-lives would be delayed from December 2016 to June 2017. Should we assume they’re live but don’t want to brag about it with a press release?” Fairchild Air Force Base (WA) went live in February 2017. A tweet this week from the DOD says the the other pilot site, Naval Hospital Oak Harbor (WA), will go live “later this month.”

From Informatics Professor: “Re: alerting privacy officers of users accessing unneeded patient information. The example of accessing records of a patient not seen in the past six months nor scheduled for an encounter implies that the only rationale for accessing a patient chart is direct treatment. There are other circumstances in which chart access is needed, such as data retrieval and quality audits.” The original poster suggested flagging such access for manual review, which would then uncover the extenuating user circumstances. The alerting could take user role into account, perhaps raising a more vigorous flag if the credentials used to look up inactive patients were those of a nurse aide rather than a quality analyst.

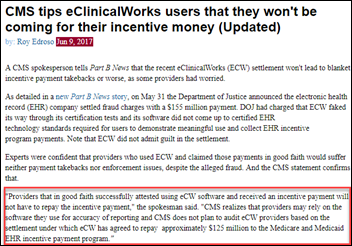

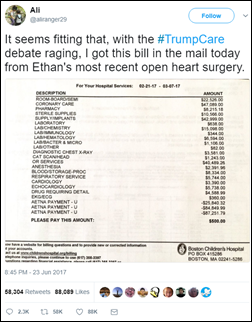

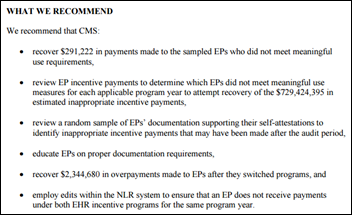

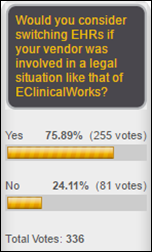

From ECW Watcher: “Re: the HIMSS-owned publication’s ‘breaking news.’ They’re a month late.” The publication ran a piece Thursday (along with breathless tweets and an email blast) indicating that CMS won’t make users of EClinicalWorks repay their incentive payments. The 12-paragraph story (nearly all background filler) contained three quoted sentences that it attributed to “a CMS spokesperson.” A competing publication ran the same information with the same quotes on June 9 (screenshot above), which also helpfully directed readers to a CMS FAQ (from months before that, but not naming ECW specifically) instead of omitting links for fear of looking less than omniscient.

HIStalk Announcements and Requests

It’s early July – do you know where your interns and first-year hospital residents are? (answer: driving your experienced doctors crazy with their inexpert questions, ordering tests and meds better suited for textbooks than a busy ED, consulting all but the most basic problems out, and requiring constant hand-holding to avoid harming patients).

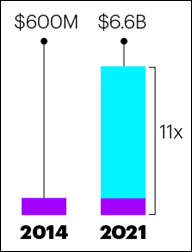

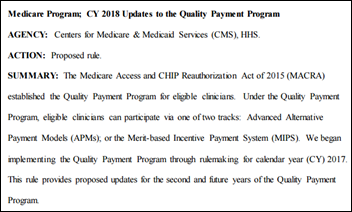

This week on HIStalk Practice: Montana clinics come under fire for lack of interoperability. Hamakua-Kohala Health rolls out Medfusion patient portal. CMS develops new QPP resources for physicians in rural and/or underserved areas. This year’s digital health investments will likely make 2017 a record-breaking year. Physicians – no matter their type of employer – are still frustrated with EHRs. Carepostcard launches to help patients thank, find compassionate providers.

Webinars

July 11 (Tuesday) 1:00 ET. “Your Data Migration Questions Answered: Ask the Expert Q&A Panel.” Sponsored by Galen Healthcare Solutions. Presenters: Julia Snapp, manager of professional services, Galen Healthcare Solutions; Tyler Suacci, principal technical consultant, Galen Healthcare Solutions. This webcast will give attendees who are considering or in the process of replacing and/or transitioning EHRs the ability to ask questions of our experts. Our moderators have extensive experience in data migration efforts, having supported over 250+ projects, and migration of 40MM+ patient records and 7K+ providers. They will be available to answer questions surrounding changes in workflows, items to consider when migrating data, knowing what to migrate vs. archive, etc.

Previous webinars are on our YouTube channel. Contact Lorre for information on webinar services.

Acquisitions, Funding, Business, and Stock

Home monitoring technology vendor VRI acquires competitor Healthcom.

Sales

In Ireland, Saolta University Health Group chooses the Evolve clinical document management system of Northern Island-based Kainos.

Dialysis clinic operator Fresenius Medical Care North America licenses Forward Health Group’s population health management system.

Announcements and Implementations

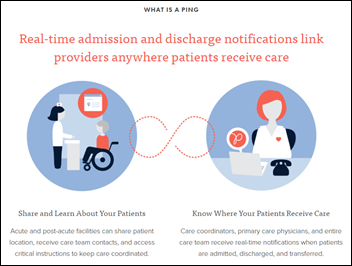

Patient engagement app vendor Fitango Health will use InterSystems HealthShare Connect to develop a post-discharge action plan platform.

Minnesota-based Treatment.com announces its Merlin artificial intelligence platform for diagnosis and treatment.

FirstHealth of the Carolinas (NC) goes live on Epic. CIO Dave Dillehunt is leftmost in the above photo.

Baylor Scott & White Health – Grapevine (TX) goes live on Pulsara, a smartphone-based app that allows first responders who are transporting potential stroke patients to coordinate with the ED on the way to the hospital.

Eisenhower Medical Center (CA) goes live on Epic, apparently replacing McKesson Horizon Clinicals it chose in 2007.

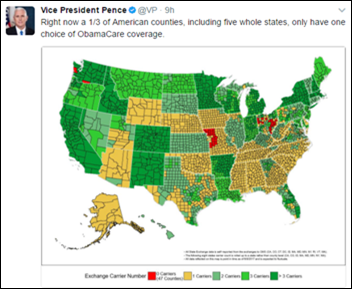

Government and Politics

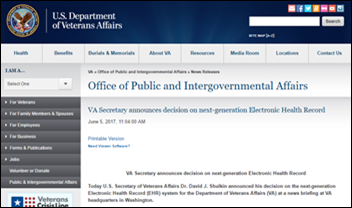

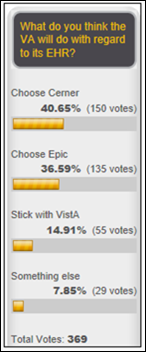

Politico suggests that the VA’s abrupt announcement that it will implement Cerner under a no-bid contract was influenced by the White House’s Office of American Innovation, run by presidential son-in-law Jared Kushner. VA Secretary David Shulkin met with Kushner’s team, but says the decision was made independently.

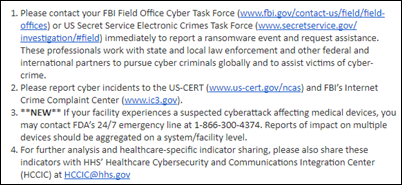

Privacy and Security

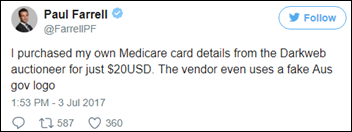

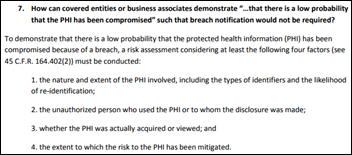

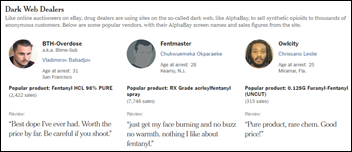

In Australia, a professor says he’s not convinced the country’s health system is ready for digitization following news that the Medicare card details of all Australians are listed for sale on the Dark Web. He notes that the government’s systems use somewhat primitive security measures, as well as the fact that the information is also stored on provider systems with varying degrees of security. He’s especially worried since the government’s centralized medical record is operated under an opt-in model that will change to opt-out in 2018. The professor advocates the “100 points” identity model as used for firearm permit applicants, in which many forms of ID can be presented as long as their weighted security value adds up to at least 100.

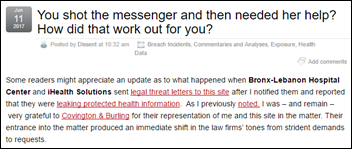

In England, the Information Commissioner’s Office chastises Royal Free NHS Foundation Trust for inappropriately providing patient information to Google-owned DeepMind Health without their consent, requiring the trust to align its procedures with law, complete a privacy assessment, and commission an audit of its DeepMind trial project.

Speaking of DeepMind Health, the hired independent review of the company’s activities finds that “the digital revolution has largely bypassed the NHS” as doctors use Snapchat to insecurely share patient photos and NHS holds “the dubious title of being the world’s largest purchaser of fax machines.” It notes that the original, much-criticized agreement with Royal Free Hospital contained a “lack of clarity” that has since been corrected in a new agreement and recommends that DeepMind cooperate fully with the ICO’s recommendations. Panel members also voted to have DeepMind Health pay them an honorarium instead of donating their time for free.

A Cisco investigation finds that the Ukraine-based tax software company whose updates were used to globally propagate the recent NotPetya malware attack had not updated its servers since 2013, resulting in at least three penetrations in the past three months. Police raided the office and seized its servers, with the unintended consequence that customers who are required to use its software are now sharing older versions of it via Google Drive and Dropbox links, exposing them to potentially booby-trapped copies.

Other

A team from Marine Corps Base Quantico develops Infrascanner, a portable infrared device that allows detection of intracranial hematomas on the battlefield, replacing the old system of a paper-based evaluation form and potentially avoiding evacuation for unnecessary CT scans.

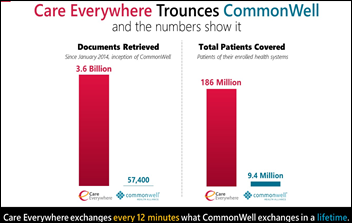

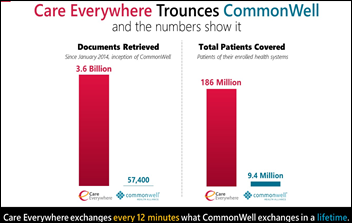

Epic’s non-marketing department is getting bolder about calling out CommonWell, I noticed, with the company noting on its website that, “Care Everywhere exchanges every 12 minutes what CommonWell exchanges in a lifetime.”

A New York Times report about low-quality nursing homes concludes that stricter oversight (fines and seldom-enacted threats to halt CMS payments) don’t seem to deter them since they just keep operating with poor metrics. The lawyer of a resident who is suing one of them says fines are just a cost of doing business for their large-corporation owners, especially since federal budget cuts allow only 88 nursing homes to be labeled as “special focus” even though regulators recommend such scrutiny for 435 facilities.

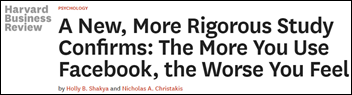

I missed this originally, so maybe it’s appropriate given the pandering for social media influencer votes: a study finds that people who use Facebook more extensively feel worse about themselves. Previous studies found that excessive Facebook use detracts from face-to-face relationships, reduces meaningful engagement, and erodes self esteem, but the new study additionally found that real-world social networks were positively associated with well-being while Facebook use was associated with negative well-being, particularly in mental health. Interestingly, time on the site was more predictive of negative impact than the level of Facebook activity (liking, posting, and clicking). The authors conclude,

Exposure to the carefully curated images from others’ lives leads to negative self-comparison, and the sheer quantity of social media interaction may detract from more meaningful real-life experiences. What seems quite clear, however, is that online social interactions are no substitute for the real thing.

Sponsor Updates

- Aprima customer Mt. Olive Family Medicine Center wins the 2017 NCMGMA Practice of the Year Award.

- Visage Imaging releases an update for its Ease mobile app that adds support for video and encounters-based workflow.

- Besler Consulting releases a new podcast, “How medical scribing is utilized at the point of care.”

- CoverMyMeds will exhibit at McKesson IdeaShare 2017 July 12-16 in New Orleans.

- EClinicalWorks will exhibit at the 2017 FSASC Annual Conference & Trade Show July 12-13 in Orlando.

- FormFast publishes a new case study featuring Riverside Community Hospital.

- InterSystems will exhibit at the Population Health Exchange July 10-12 in Colorado Springs, CO.

Blog Posts

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne, Lt. Dan.

More news: HIStalk Practice, HIStalk Connect.

Get HIStalk updates. Send news or rumors.

Contact us.

Today's post contains the phoenixes rising from the ashes of the post COVID telehealth era. There's two things that destroy…