News 1/28/26

Top News

Bloomberg reports that the valuation of prior authorization technology vendor Tandem Technology has reached $1 billion, with an anticipated $100 million in new funding.

Tandem founder and CEO Sahir Jaggi was previously a director at insurance company Oscar Health.

HIStalk Announcements and Requests

It’s that time of year when LinkedIn is flooded with graphics posted by proud show-uppers. The HIMSS ones are also piling up. I’m only slightly annoyed at pitches by scheduled presenters who are trying to drum up attendance, but just being in the convention center is not newsworthy. It won’t be long before the “influencers” start posting their mandatory ViVE-fawning posts (three before, three during, three after) to pay for their free badge and accompanying sense of self-importance.

Sponsored Events and Resources

Live Webinar: February 18 (Wednesday) 2 ET. “From Blind Spots to Insights: Gaining Real-Time Visibility into Healthcare Risk.” Sponsor: CloudWave. Presenters: Jacob Wheeler, MBA, director of sales engineering, CloudWave; Mike Donahue, chief operating officer, CloudWave. Resilience starts with the ability to see clearly, across every endpoint, cloud workload, user, and clinical system. Join CloudWave’s cybersecurity leaders for an in-depth session on how real-time visibility transforms your ability to detect threats early, respond decisively, and strengthen resilience across the care ecosystem. Attendees will learn the practical steps that hospitals can take to move from reactive defense to resilient action.

Publication: HIStalk’s Guide to ViVE 2026 lists the activities of sponsors at the conference.

Contact Lorre to have your resource listed.

People

HURC names Kevin Coloton, MPT, MBA (Reveleer) CEO.

Elissa Baker, RN (American Telemedicine Association) joins Nesa as president and chief clinical officer.

MedeAnalytics names David Figueredo (Experian) chief innovation officer.

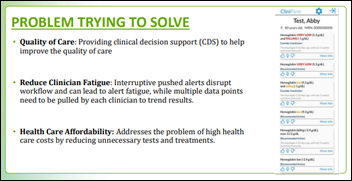

Nicholas Testa, MD (CommonSpirit Health) joins Sentact as chief clinical officer.

Sevaro Health names Carl Dugart (Medically Home) CTO and Vineet Agrawal, MBA (DocSpera) head of growth.

Artera promotes Tom McIntyre, MS, MBA to president, Michael Jensen to CFO, Zach Wood, MBA to chief product and strategy officer, and Emily Coy to VP of communications and integrated marketing.

Dartmouth Health hires Randa Perkins, MD, MBA (Moffitt Cancer Center) as CHIO.

Announcements and Implementations

Qure.ai secures a multi-million dollar Gates Foundation grant to develop AI-powered point-of-care ultrasound tools that are aimed at detecting tuberculosis and pneumonia in low-resource settings. The project also includes building an open, multimodal data platform to support global lung health research and deployment at scale. The company’s products are being used by 4,800 sites in 105 countries.

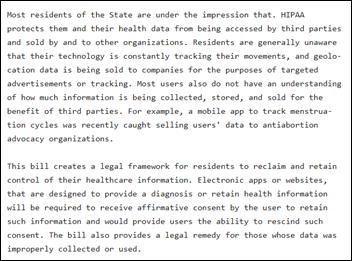

Health Gorilla says that the lawsuit that Epic Systems and several health systems filed against it contains unfounded allegations about the company’s role in data exchange. Health Gorilla says that it suspended the disputed connections of some of its clients and accuses Epic of using litigation to stifle competition in interoperability. Health Gorilla says that it operates in conformance with all laws and requirements and accuses Epic of using litigation as a weapon so it can “monetize clinical data exchanges for their own benefit.” An Epic spokesperson provided this statement:

Health Gorilla enabled their customers to sell identifiable patient medical records to class-action law firms without patients’ consent or health systems’ knowledge. They had an obligation to protect patients’ intimate health information. Instead, they violated the privacy of hundreds of thousands of people. Epic and health systems together filed this lawsuit to hold Health Gorilla and other bad actors accountable and to stop further abuse and misuse of patients’ sensitive information.

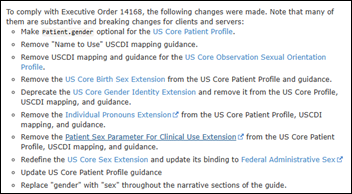

Midwives at some NHS hospitals that use Epic are given the option to record the gender identity, sexual orientation, and pronouns of newborns, but according to a midwife quoted in The Times, lack a dedicated field to record biological sex in the same workflow. An executive of a sex rights charity criticized the configuration, saying, “The concept of babies having a gender identity is farcical, whereas a baby’s sex is essential medical information,” and argued that some trusts have prioritized ideological preferences over clinical clarity. A spokesperson for the One Devon Electronic Patient Record project says that any claims that Epic requires information about the gender identity or sexual orientation of newborns are incorrect, and the only mandatory entries are date of birth and legal sex. Epic has not publicly commented on the article.

Government and Politics

The VA Office of Inspector General’s annual report lists information systems and innovation among the top five management and performance challenges facing the department, particularly highlighting its beleaguered EHR modernization efforts. The Oracle Health-based program will restart this April at four sites in Michigan.

Other

The Connecticut College of Emergency Physicians develops a public dashboard that displays ER boarding trends across hospitals throughout the state to gain insight into ED overcrowding. State lawmakers passed a law in 2023 that requires hospitals to annually report their boarding data through 2029.

Nassau University Medical Center sues seven former executives, including its CIO, alleging that they received $1 million in improper payouts when they resigned in May and later refused to give the money back. Many of the hospital’s executives quit after the state took over the financially struggling hospital’s board. The hospital filed a $10 million lawsuit against the former hospital CEO who authorized the payouts. Her name is Meg Ryan, should you have a surplus of “When Harry Met Sally” Katz’s Delicatessen scene bon mots.

Sponsor Updates

- Black Book Research publishes its Trust Framework, a formal standard that defines how the firm designs research programs, benchmarks performance, and recognizes high-performing healthcare technology and services providers.

- Optimum Healthcare IT posts a new white paper titled “From Vendor to Vital Partner.”

- Cardamom is recognized as the “#1 Best Place to Work” in the Madison area by Madison Magazine.

Blog Posts

- A Guide to the Use of AI in Healthcare: Deploying a Realistic Approach (Med Tech Solutions)

- Health system size impacts AI privacy and security concerns (Wolters Kluwer Health)

- The reality of cyberthreats: Why preparing for a breach is your best defense (Altera Digital Health)

- Advancing Rural Health Transformation: Reflections from a JPM Health Week Roundtable (Arcadia)

- AI Voice Agents in Healthcare: Inbound vs. Outbound (Artera)

- Looking back, leaping forward: Healthcare AI predictions for 2026 (Cardamom)

- JPM 2026 Takeaways: Cybersecurity in Healthcare PE Diligence (Clearwater)

- What 14 Ironmans, 50+ Marathons, and 30 Years in Healthcare IT Have Taught Me About Leadership (Divurgent)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Follow on X, Bluesky, and LinkedIn.

Sponsorship information.

Contact us.

Today's post contains the phoenixes rising from the ashes of the post COVID telehealth era. There's two things that destroy…