HIStalk Interviews Yann Beaullan-Thong, CEO, Vindicet

Yann Beaullan-Thong is CEO and founder of Vindicet.

Give me some background about yourself and about the company.

I’m the founder and CEO of Vindicet. We started the company in 2009. Prior to that, I was the vice president of e-business at Aetna for a division called Intellihealth. It was the first public healthcare website prior to WebMD.

My intention when I started the company was to create a software company that would provide affordable, process-oriented solutions to providers. In 2009, I met Dr. John Votto, CEO at Hospital for Special Care and a thought leader for long-term acute care hospitals. I was asked to provide a system to make the referral process more efficient.

As we started to build a patient referral tool, I took the bet that bundle payments and ACOs will be here to stay and will need systems to support these new business models. We morphed our referral tool into a coordination tool to manage the patient through the continuum of care.

Who does the company compete with?

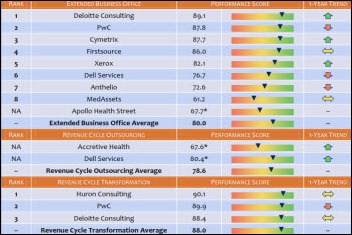

Indirectly, we can compete with a lot of other players, like Curaspan, Cerner or Allscripts. The patient management process, the referral process, the compliance process , the admission and discharge process are supported by many vendors. They are part of the problem — too many vendors supporting different processes at the facility level.

We are the only system that can support all these processes for the ACO or enterprise health system level using one platform. We are able to provide a safe transition care tool using a light Enterprise Resource Planning approach.

Describe the referral process as it exists and how you think it will look under the new models of care.

Today with a fee-for-service payment, each facility operates as an island. Referrals are no more than a discharge to home or a post-care facility. Moving forward with ACOs, the referral is becoming a central component. The financial compensation will be tied to the overall outcomes. Tracking the patient through the entire continuum of care and managing the coordination of care between the different providers will be essential to optimizing outcomes.

Let’s assume that a patient comes in for congestive heart failure and they are a Medicare patient. We know that out of 10 patients, five to six might will end up into a post-care facility. Suddenly everybody has to be very well aware of how well they’re going through the entire episode. Not just from the acute side, but when they are discharged to a long-term acute care and then moved into an inpatient rehab center and finally discharged home under the supervision of a home health agency.

Under a bundled payment model, you’re going to be responsible for that whole episode. Under this coming model, absolutely nobody is prepared to deal with this new challenge.

Initially, we designed a referral system for standalone post-care facilities. Through the years, we modified it to become a multi-facility transitional and coordination care system. Our unique approach allows us to integrate the enterprise coordination process with patient management and compliance reporting.

Do you see new companies starting to try to do what you’re already doing?

There are a lot of companies that are coming to the space, but we are about 18 months ahead. We have been approached by some large companies, very large payers who are looking into the ACO space.

I am looking to make the coordination of care more efficient between providers, including primary care physicians. I would say that the problem I’m trying to resolve is transitional care. An EMR is not solving that problem. An EMR is designed to provide care at the delivery point. It’s not designed to manage care across providers.

It’s interesting, because when I started the company about three years ago, a lot of people were asking me to build an EMR. My answer was, “There’s plenty of EMRs. The last thing you need is another one.”

Also, talking to CEOs and CFOs, I often hear, “OK, now that we have an EMR, we need to integrate with the ambulatory care services and post-care facilities.” And in the same breath, they will say, “We are running out of money with this EMR project.” Literally people are looking at each other around the room and saying, “How are we going to do this? How are we going to pay for it?”

Either you build what I call islands — EMR for post care, EMR for ambulatory care, and for acute care — and spend a ton of money to add the bridges. Or, let’s look into a system that will allow us to have one view of the patients across the continuum. That’s when I come in with my poor man’s solution.

Do you think providers believe that HIEs will provide that capability or that interoperability is the answer? Are they beginning to realize that just talking to other systems may not be enough?

Executives are starting to realize that it’s not as easy as it sounds to integrate legacy systems. HIEs don’t address the process issues. Also, I’ve noticed a trend of information overload. It is not just pulling the information, but making it relevant and usable.

The other riddles that need to be solved when we’re talking about the HIEs — besides the exchange of information — is integrated process. You’d have to integrate various processes if you’re going to go through a longitudinal-type of continuum of care. It’s not just tracking the information at each point of care with different providers. You need a seamless process on how you can move a patient from one place to the other.

Do you think providers are ready not only technologically, but as you said process-wise, to be able to function effectively in that kind of environment?

I’ll try to give you a response that is apolitical. I’m absolutely convinced in my fiber that as a country, if we don’t resolve our healthcare problem, we will go bankrupt. We’re already at 16 percent of GDP.

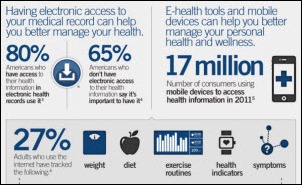

If you’re going to do reimbursement based on outcome, which is where the industry is going (the Kaiser model), we are going to need to collect a lot of data and use key performance indicators to increase efficiency. We are already there.

I just built a CMS data quality tool for 17 long-term acute care hospitals where they had to report outcome within 24 hours for discharges and within four days when it comes to admissions,. They need to report outcomes to the government in order to avoid the 2 percent penalties.

Moving forward, the government is going to ask for more data. Collecting data is a very expensive business. Healthcare systems out there are struggling to implement an EMR system, and now we are asking them to track outcomes through the different providers. Most of providers have no funding left following an EMR implementation, and now we want them to fund projects to track patients across the continuum.

I guess hospitals aren’t happy when they have to come to you, then?

They’re not, but I came up with a value proposition that makes the solution affordable. A lot of clients tell me, “How do you make a living with the way you’re selling it?” I say, “Don’t worry. I’m OK.” I moved away from the licensing per bed to unlimited number of users. It’s time as an industry to think out of the box and come up with solutions that are affordable.

Will other vendors get that model of following a long-term strategy rather than just charging the absolute most they can?

I think they will have to. One of the reasons why I believe that system is going to do well is transparency. I truly believe that transparency will exist in healthcare. I come from a payer and they’re probably not the most transparent players, but they have the tools to become more transparent.

They are data-driven companies. I learned one thing. If you want to be efficient, you need to change your mindset from being non-profit to a mindset of better outcomes in order to stay in business. You need to be transparent. You need to be transparent in front of the patient. You need to be transparent with physicians. I think as an industry, it’s time we start to be transparent. If we do not become transparent, we’re going to go broke, period. It cannot stay the way it is.

I think there’s a movement out there toward change. All of us recognize that there’s need for a change, and I think the change will come from the outside. I always say when an industry has a problem, the answer is not within. Usually the guys that start to find the answer are guys that come from other industries.

Any concluding thoughts?

As an industry, in healthcare, we need to change our mindset from a non-profit mindset to what I’m calling for-profit, where we’re going to be more accountable. To be more accountable, you need to collect data. To collect data, you need to build systems that implement new processes. I envision healthcare facilities being managed like a Walmart by the minute to keep costs down.

When I go to see CFOs in hospitals, they manage their business by quarter or a year ahead. There’s a need to manage your business by the minute. To get there, we need to start to collect data. Not just clinical data, but financial data and administrative data .We need to create key performance indicators, or KPIs. If you don’t run the business according to KPIs, there’s no way in the world that you’re going to change the way you are operating.

The government is probably going to make people more accountable and switch from fee-for-service to pay-for-performance. However, we’re a long way from being efficient. I see government mandating more and more data collection for compliance. As an industry, that’s where we’re going. Whether you’re from the left or the right doesn’t matter. Accountability is the buzzword. I think it’s going to force the entire industry to learn to do more with fewer resources.

Move your quotes to where they should be and it's no longer politics-in-the-blog, but instead a fact that's true at…