News 10/5/22

Top News

UnitedHealth finalizes its $7.8 billion acquisition of Change Healthcare, which it has merged with its Optum business. Change Healthcare has requested that Nasdaq de-list its stock from the exchange.

Reader Comments

From Apoagathos: “Re: CHI Catholic Health Initiatives. Looks like they were the victim of a ransomware attack yesterday.” CommonSpirit Health, CHI’s parent company, experienced an IT security incident Monday that impacted some of CHI’s facilities. CHI took some of its systems offline, including Epic.

Webinars

October 12 (Wednesday) 1 ET. “In Praise of the Problem-Oriented Medical Record (POMR).” Sponsor: Intelligent Medical Objects. Presenters: Amanda Heidemann, MD, CMIO, KeyCare; Amber Sieja, MD, senior medical director of informatics, UCHealth and Ambulatory Services; Jim Thompson, MD, physician informaticist, IMO. The problem-oriented medical record – initially developed in the 1960s by Lawrence Weed, MD – brought important structure to paper charting, and in particular, the problem list. Yet, today, the tool that was once the gold standard for organizing and making sense of patient history is often cluttered and unmanageable. Fortunately, tools and strategies exist to help make the problem list more meaningful, helping to synthesize patient data, highlight insights, and support patient care. The expert panel will share their experiences with POMR, including documentation practices and tools to improve workflows and efficiency, the impact of POMR and charting on the overall health of a patient, and the challenges and obstacles clinicians face when practicing POMR and charting and how they can be overcome.

October 18 (Tuesday) 2 ET. “Patient Payment Trends 2022: Learn All The Secrets.” Sponsor: Mend. Presenter: Matt McBride, MBA, co-founder and CEO, Mend. Many industries offer frictionless payments, but healthcare still sends paper bills to patients who are demanding modern conveniences. This webinar will review consumer sentiment on healthcare payments, recent changes to the Telephone Consumer Protection Act that create opportunities for new patient financial engagement, and new tactics to collect more payments faster from patients.

Previous webinars are on our YouTube channel. Contact Lorre to present your own.

Acquisitions, Funding, Business, and Stock

CTG acquires Eleviant Tech, a digital transformation company specializing in mobile, cloud, robotic process automation, and AI across multiple verticals including healthcare.

People

ChartSpan names Nic Erickson (Anthem) VP of patient enrollment and clinical operations.

Appalachian Regional Healthcare (KY) promotes VP of IT and CTO Mike Roberts to the additional role of CISO.

Jeff Silverman (Qualifacts) joins AccessOne as its first chief revenue officer.

Announcements and Implementations

Harnett Health (NC) switches from Meditech to Epic as part of its affiliation with Cape Fear Valley Health.

Government and Politics

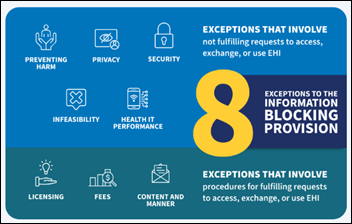

ONC launches a dedicated information blocking webpage ahead of the October 6 information-sharing compliance deadline. It will host virtual office hours on October 6 and 27 to help healthcare stakeholders better understand information sharing under ONC’s information-blocking regulations.

Other

Five months into the role, Cerebral CEO David Mou, MD shares several things the online mental healthcare company is doing in light of federal and media scrutiny around its prescribing, marketing, and patient identity verification practices:

- Expanding internal infrastructure and safeguards to prioritize the most vulnerable patients, especially those at risk for suicide.

- Improving patient ID verification protocols and software to ensure information is accurate and that treatment isn’t offered to minors.

- Reallocating resources from marketing to clinical quality efforts.

- Establishing a Quality Commission of outside experts to conduct performance reviews.

STAT reports that Epic now recommends that its sepsis prediction model be trained on a hospital’s own data before clinical use, and that the company has changed its definition of sepsis onset to a more commonly accepted standard. Epic’s model came under scrutiny earlier this year when a study in JAMA Internal Medicine found that it did not retroactively identify two-thirds of sepsis patients.

Sponsor Updates

- The Ascom US team participates in the Great Cycle Challenge to help beat kids’ cancer.

- Azara Healthcare integrates FindHelp’s social services referral and reporting tool with its Azara DRVS and Care Connect solutions.

- CHIME releases a new Leader2Leader Podcast featuring Oracle Cerner Chief Health Officer Nasim Afsar, MD “Advancing Health Equity.”

- Clinical Architecture EVP Carol Macumber receives the HL7’s 2022 W. Edward Hammond, PhD, Volunteer of the Year Award.

- Wolters Kluwer Health updates its Ovid medical research platform with two new, curated research collections – the Public Health Advantage collection and the Evidence-Based Health collection.

- Baker Tilly publishes its “Healthcare M&A Update H1 2022.”

- Southeast Kansas Mental Health Center upgrades its adoption of Netsmart’s CareFabric platform in support of it becoming a Certified Community Behavioral Health Clinic.

Blog Posts

- AHUG 2022: Impressions of User Group Meetings (Agfa HealthCare)

- Determining the MS-DRG – Clinical Documentation Improvement (AGS Health)

- Build vs. buy and the capabilities that matter in healthcare IT (Arcadia)

- Hospital-at-home as a care delivery model (Baker Tilly)

- A 988 IT Infrastructure Conversation with Bamboo Health’s Carol Tsang (Bamboo Health)

- Physician opinion: Preparing for the changing role of the practicing physician (Bravado Health)

- By Initiating Pas, Providers Can Give Pharmacists Time with Patients (CoverMyMeds)

- Fear, Uncertainty, and Doubt: The Promise of Cloud Computing in Healthcare (CTG)

- Data Standardization and APIs Can Help Pave the Way Toward Data-Driven Healthcare (Diameter Health)

- The Importance of Data Integration is Front-Page News (Dimensional Insight)

- 6 Tips for Becoming a Great Mentor (Divurgent)

- Back to School – for Your Practice, Too! (EClinicalWorks)

- Leader to Leader: A Data Revolution in a Consumer-First World (Clearsense)

- The Exponential Savings Potential for ACO Participants (ChartSpan)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

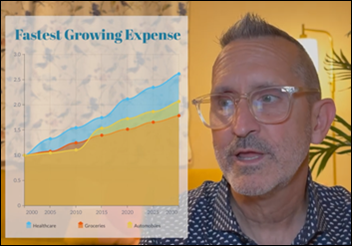

Fun framing using Seinfeld. Though in a piece about disrupting healthcare, it’s a little striking that patients, clinicians, and measurable…