EPtalk by Dr. Jayne 4/27/23

Lately, it seems like my travel is never uneventful. The trip home from HIMSS added to my recent adventures.

I scored my usual exit row seat and everything went normally during the emergency briefing. However, we had a delay on the tarmac and one of the passengers in the exit row in front of me started asking “have we left yet?” followed by chanting “let’s go, guys, let’s go, guys” over and over before ultimately quieting down. After we reached altitude, though, his behavior became more erratic and he was bothering the passengers next to him while asking over and over if we had taken off yet.

The flight attendants were on top of it, arriving in a group to invite the passenger to move to a seat in the back of the plane near the galley. He acted a bit disoriented, but was able to follow instructions, although the lead flight attendant had to tell him several times to stand up, grab his backpack, and follow them. As he passed by my row, there was a strong smell of alcohol, which made me wonder whether he chugged his drink at the gate to comply with the rules to keep alcohol in the terminal or whether there was something medical going on.

It was a short flight and the police were happy to meet us upon landing and escort the gentleman to an alternative destination, but I hope he was OK. I’ve got a few more flights planned for the next three months and I’d really like to have just one where nothing noteworthy happens.

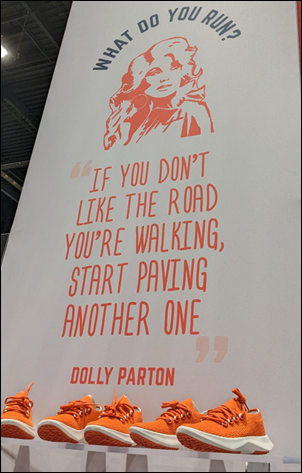

While I was flying, a couple of readers sent me some pics on the last day of HIMSS:

Biofourmis had custom branded sneakers. Thanks to a reader for sending this picture along.

Spa Girl says she saw these in a shop on the Magnificent Mile and thinks I need these for my next beach trip. They are undeniably cute, but probably not the most practical for travel. I could see wearing them around the house with a plush robe, however, in the mode of a Hollywood starlet.

As long as the Wi-Fi works properly, I’ve found that I’m pretty productive on the plane. While cleaning up email, I spotted this article about the ongoing debate about policies that require workers to return to the office. The piece mentions a bizarre call where Clearlink CEO James Clarke questions his own employees’ ability to manage work/life balance. Apparently, there has been some confusion within the company over the last couple of months as to whether employees would be asked to return to the office or whether they had been hired under the assumption of a remote-first culture. The first group of employees asked to return include those who live within 50 miles of the company’s Utah headquarters.

During a company town hall meeting to explain the changes, Clarke went on a rant about employees that had not used their laptops for a month, which is as much a management issue as it is an employee issue in my book. Did those employees’ supervisors not notice that they weren’t working, or was Clarke just making this up? He went on to ask employees to increase productivity by “30 to 50 times” normal and challenged employees to outwork him. He went further to praise an employee who had gotten rid of the family pet as a result of the change to in-person work.

Not wanting to exclude anyone in his unhinged speech, he also criticized working mothers specifically and working parents in general, saying “only the rarest of full-time caregivers can also be productive and full-time employees at the same time.” Sounds like it’s time for the HR department to provide some education and the company’s executive leadership to consider an alternative direction.

Another article that caught my eye was about a golf cart accident at Wake Forest Baptist hospital in North Carolina. The tragic crash resulted in the death of a patient and injuries to the cart’s two other occupants. The cart had been used to transport patients and visitors between the facility and parking structures. An investigation is underway, but I hope it will prompt other facilities to look at how they’re using different modes of transportation on campuses. No one wears a seat belt on a golf cart, and in the event of a sudden stop or a collision, it’s not a lot different than being on a motorcycle as far as being ejected is concerned, except that you’re probably not wearing a helmet. The articles I saw didn’t specify whether the fatally injured party was a rider or was struck by the cart. My sympathies go out to the family of the deceased and those involved in the incident who will be forever impacted.

A recent article in JMIR Human Factors looked at the use of speech recognition technology in the exam room. This wasn’t the fancy AI-driven kind of speech recognition, but rather the old school dictation-style voice recognition approach that many of us have used in our careers. In the study, physicians completed the Assessment and Plan portions of the patient’s after-visit summary while still in the exam room with the patient. The summary was then printed and a survey performed. Compared to “usual care” without an in-room dictation, patients felt that providers were better at addressing patient concerns and felt that they better understood the providers’ advice. The authors concluded that patients have a positive perception of speech recognition use in the exam room.

I first saw this approach in probably 2011 or 2012, while shadowing one of the Oklahoma Family Physician of the Year recipients. He dictated every visit in the presence of the patient and gave them the chance to ask questions, and it had been part of his routine for years. It’s difficult to believe that more than a decade has gone by without more people using this fairly straightforward strategy.

As a clinical informaticist, I see plenty of examples of clinicians and their teams struggling to adopt strategies that have been proven to improve efficiency and reduce documentation burden. Nearly every health system I’ve worked with has a super-user program and many also have robust physician champion programs. However, there are always physicians who don’t want to take advantage of those options. I see people who will do the same inefficient workflows over and over because they don’t want to take an hour or two to personalize EHR features or save their own default Review of Systems or Exam templates. I see providers manually typing differential diagnosis paragraphs that they could save and use as a base for future notes when seeing common conditions. They say they’re too busy to save them as quick phrases, but I would argue that they’re too busy to not take the time to make their future lives easier. I’m not sure what the answer is or how to motivate some of the more resistant providers, but I’m open to ideas.

What good ideas can be found in your bag of EHR optimization tricks? Leave a comment or email me.

Email Dr. Jayne.

Fun framing using Seinfeld. Though in a piece about disrupting healthcare, it’s a little striking that patients, clinicians, and measurable…