Top News

Chatbot-based virtual care company K Health raises $59 million in a funding round led by Cedars-Sinai, bringing its total raised to $325 million.

The company’s primary care service offers unlimited text-based visits, remote annual wellness visits, chronic condition management, prescription management, and urgent care services for $49 per month for residents of all states except Alaska and Hawaii.

Cedars-Sinai will offer K Health’s AI-powered app to its patients in California by the end of the year, integrated with Epic and using the health system’s clinicians.

K Health also sells its technology to payers through Hydrogen Health, which it launched with Anthem (now Elevance) and investment firm Blackstone in 2021.

Reader Comments

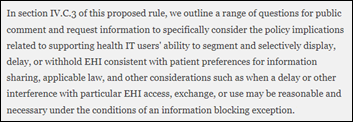

From Frumious Bandersnatch: “Re: data segmentation. How can you program something that allows a patient to decide after the fact that they want something hidden in their medical record? You can’t just uproot a tree whose roots are interlaced with other trees.” Kevin Baumlin, MD says that ONC’s proposal to require clinicians to redact medical records data elements when a patient requests involves “legalizing tampering with the medical record” that could prove harmful in that patient’s future encounters. He cites examples of patients hiding opioid use or a history of depression. I’ll side with a brilliant reader who says the only practical implementation of the well-intentioned rule would be if patients serve as their own data intermediary, obtaining a copy of their summary as a file that they could edit before sharing. I’m rarely in the “blockchain could fix everything” camp, but perhaps some sort of versioning and permissioning could be involved. I’ll make this the topic of this weekend’s poll. It’s an interesting question — the patient can choose to divulge as much or as little of their history as they want during an in-person encounter, so should that control carry over into digital records? Should providers trust data that the patient may have selectively edited? Perhaps as with redaction, deletions could be obscured but noted to alert the clinician that they are not seeing a complete record. Or, you could get really creative and allow the patient to insert their own notes to explain. But the big challenge is probably propagation across multiple provider data copies – I ask my psychiatrist to hide depression details, so should copies in the EHRs of my PCP, surgeon, and hospital reflect that request or would I need to make individual requests? It would be more manageable if everything flowed through a single HIE or service, but the issue is complex, just like trying to correct EHR entries that have propagated all over the place.

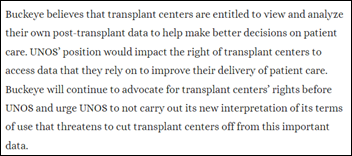

From Eric: “Re: transplant dispute. Thought you would find this interesting.” The non-profit United Network for Organ Sharing (UNOS) — which oversees the entire US transplant system — and organ screening firm Buckeye Transplant Services will take their data dispute to arbitration. Buckeye’s automated tool extracts transplant data directly from hospitals, which UNOS says is unauthorized use of information that only UNOS can provide. UNOS has threatened to lock Buckeye out of its DonorNet organ clearinghouse, which would put Buckeye out of business and force its 63 hospital customers to perform their own screening. The federal government announced in March that it would break up the organ transplant monopoly of UNOS, whose most recent financial report indicates $75 million in annual revenue.

From Anon E. Mous: “Re: Legacy Health financial issues. They have shown sound financial management and avoided excessive spending and vanity projects and navigated the COVID years with care and compassion in the shadow of behemoth Providence. This could be a bellwether for similar systems in the Pacific Northwest.” Six-hospital Legacy, which is losing $10 million per month, will sell its lab operations to LabCorp in hopes of hitting lender-mandated financial metrics.

From IPC: “Re: Walgreens. The recent earnings call suggests why it previously acquired a majority stake in VillageMD. Maybe they should start branding themselves as ‘pharma-centered care.’” The US healthcare division of Walgreens lost $113 million in the quarter, which it blames on the underperformance of VillageMD and CityMD due to a mild flu season and soft market demand. It also notes an 83% drop in COVID vaccinations and a steep slide in COVID test sales. The company will close 450 stores and lay off 10% of its corporate workforce. IPC’s observation comes from an earnings call comment that 50% of patients who are seen in a co-located VillageMD clinic go next door to get their prescriptions filled at Walgreens, and each clinic generates 40 additional prescriptions per day, with associated profit for the drugstore. WBA shares have lost 22% in the past 12 months versus the Nasdaq’s 24% gain.

HIStalk Announcements and Requests

Mr. H here, reporting back refreshed after several days away on vacation and happy that Jenn’s solo coverage rendered my presence optional anyway. I’m catching up, so remind me if I owe you something.

Webinars

July 26 (Wednesday) 1 ET. “Lessons We’ve Learned Since Launching our Cancer Prevention Program.” Sponsor: Volpara Health. Presenter: Albert Bonnema, MD, MPH chief medical information officer, Kettering Health System; Chris Yuppa, product owner for oncology services and cancer prevention, Kettering Health System. Kettering’s IT department has played a critical role in providing an EHR-driven framework to bring cancer risk assessment and individual prevention plans to more than 90,000 patients. Primary care, OB/GYN, oncology, and imaging providers are now able to assess the hereditary, genetic, and lifestyle factors that affect the risk of developing lung, breast, ovarian, colon, and prostate cancer in any patient encounter. Learn how Kettering brings together people, processes, and technology to be more proactive in the fight against cancer and where its cancer prevention program is headed next.

July 27 (Thursday) noon ET. “Why You Shouldn’t Wait to Use Generative AI.” Sponsor: Orbita. Presenter: Bill Rogers, co-founder, president, and chairman, Orbita. The advent of generative AI tools truly represents a paradigm shift. And while some healthcare leaders embrace the transformation, others are hesitant. Invest 20 minutes to learn why you shouldn’t wait. When combined with natural language processing, workflow automation, and conversational dialogs, generative AI can help leaders address a raft of challenges: from over-extended staff, to the rising demand for self-service tools, to delivering secure information to key stakeholders. You will learn where AI delivers the greatest value for providers and life sciences, how it can solve critical challenges faced by healthcare leaders, and how Orbita has integrated generative AI into its conversational platform so healthcare leaders can leverage its full capabilities safely and securely.

July 27 (Thursday) 2 ET. “Denial Prevention 101: How to stop denials from the start.” Sponsor: Waystar. Presenter: Crystal Ewing, director of product management, Waystar. There’s a reason denial prevention is prominent everywhere in healthcare RCM. Denials reduce cash flow, drive down revenue, and negatively impact the patient and staff experience. More than half of front-end denials don’t have to happen, but, once they do, that money is gone. It’s a pretty compelling reason to take some time now to do some preventative care on your revenue cycle. This webinar will help you optimize your front end to stop denials at the start. We’ll explore the importance of not only having the right data, but having it right where staff need it, when they need it.

Previous webinars are on our YouTube channel. Contact Lorre to present or promote your own.

Acquisitions, Funding, Business, and Stock

Medication supply chain technology company Bluesight, which renamed itself from Kit Check in December 2022, will use a strategic growth investment from Thoma Bravo in its acquisition of drug diversion analytics vendor Medacist.

DocBuddy, which offers an EHR workflow solution, raises $1.8 million in a seed funding round.

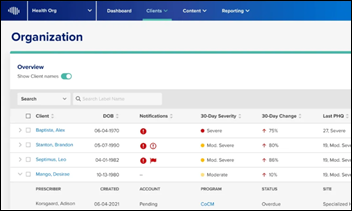

Behavioral health technology vendor NeuroFlow acquires Capital Solution Design, whose measurement-based care solutions are used by the VA.

UnitedHealth Group reports Q2 results: revenue up 16%, adjusted EPS $6.14 versus $5.99, beating Wall Street expectations for both. Its Optum unit saw revenues increase 25% to $56.3 billion.

Sales

- Northwell Health selects Aidoc’s AI operating system for triage, quantification, and coordination of acute care across 17 of its hospitals in New York.

- Get Well announces eight new smart patient room projects to support construction initiatives in the US, Kuwait, and New Zealand.

People

Medical coding automation vendor Fathom hires Enoch Shih, MS, MBA (Gusto) as COO.

RLDatix hires Frank Manzella, JD, MBA (Availity) as EVP of global corporate development.

Steve Aspling (Millennia) joins CorroHealth as regional VP of business development.

Trove Health hires Anthony Leon (InteropShop) as VP of growth.

Todd Johnson (SomaLogic) joins Abundant Venture Partners as CEO of the venture studio.

Matthew Kull, MBA (Cleveland Clinic) joins Inova Health System as chief information and digital officer.

Announcements and Implementations

Pediatric Cardiology Center of Oregon implements EClinicalWorks and its Prisma health information search tool.

Medhost will offer Availity’s eligibility and claim verification features to its hospital customers.

The Connected Health Initiative and Duke Margolis Center for Health Policy will host “AI and the Future of Digital Healthcare” on September 26 at the National Press Club in Washington, DC. Panel proposals are due August 1.

Teladoc Health will integrate Nuance DAX into its Teladoc Health Solo platform.

Government and Politics

The GAO seeks nominations for appointments to the Health Information Technology Advisory Committee.

Other

A fascinating report titled “How Private Equity Raided Safety Net Hospitals” looks at PE-backed safety net hospital operator Pipeline Health. It notes that similar to what happened with the now-closed Hahnemann University Hospital, PE firms are breaking promises they make to the community and to regulators in favor of maximizing profit (shocking, I know). Their strategies include monetizing the real estate, expanding unwisely, laying off employees, applying bankruptcies strategically, and closing hospitals. All but one of the eight hospitals that Pipeline has owned earned a CMS star rating of two of a possible five, while one earned three stars. It sold Weiss Memorial Hospital’s parking lot to a real estate developer for $10 million to build luxury apartments.

Sponsor Updates

- The results of eight studies involving the use of Linus Health’s digital cognitive assessment solutions will be presented at the 2023 Alzheimer’s Association International Conference.

- Ronin Chief Scientific Officer Christine Swisher, PhD joins the Coalition for Health AI.

- Medhost and Availity partner to offer Medhost partner hospitals a suite of eligibility and claim verification features.

- Meditech joins the KLAS Arch Collaborative.

- Artera publishes a case study, “Altura Participates in Call-to-Text Pilot Program.”

- Fortified Health Security publishes its 2023 Mid-Year Horizon Report on cybersecurity challenges.

- Baker Tilly releases a new Healthy Outcomes Podcast, “Improving healthcare delivery through employee experience and patient engagement.”

- Nordic publishes a video titled “The Download: Cyber strategies to optimize net new technologies.”

- Bamboo Health will exhibit at the NCHA Annual Summer Meeting July 19-21 in Williamsburg, VA.

- Ronin publishes an article in Nature on its Comparative insights model that delivers predictive insights to empower clinicians to reduce ED visits.

- CereCore releases a new podcast, “CIO on Innovation and Mobile Adoption: ‘Keep Your Eye on Operations.’”

Blog Posts

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

Today's post contains the phoenixes rising from the ashes of the post COVID telehealth era. There's two things that destroy…