Sagnik Bhattacharya, MS is CEO of Rhapsody of Boston, MA.

Tell me about yourself and the company.

My background IS in computer science, and I started off as a software developer. I moved into product leadership roles and general management. Through the course of my career, I’ve been fascinated by healthcare and user workflows and have spent hundreds of hours shadowing clinicians, understanding how our healthcare policies and incentives work, how technology works, and how we can bring it all together. That has motivated me throughout my career. I spent a number of years on the EHR side of things.

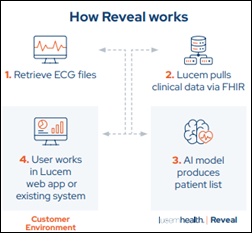

That journey has led me to my current role as the CEO of Rhapsody. Rhapsody is a technology platform that enables interoperability across healthcare systems, with the goal being digital health adoption. There are so many digital health solutions, and if they aren’t integrated into workflows, they won’t work. We help enable that. We serve both providers and health systems, which is about half our business, and a lot of the digital health companies — hardware, software, AI, or what have you – that have a need to integrate their solutions with clinical data.

We are a global company. We serve customers in 22 countries and growing with our technology.

How have the interoperability needs of hospitals and health systems changed as they run their businesses differently?

First and foremost, interoperability has become a broader term than eight or 10 years ago when it started as point-of-care interoperability. When a patient is going from physician to physician or to the emergency room, how does their record follow them? Now it’s much broader. You have systems that interact with the patient virtually and physically, so how do they all talk to each other?

With respect to the changing climate, there’s consolidation happening on the provider side. On the other hand, there is also a lot of proliferation of digital health solutions that is happening at around the same time.

When any kind of M&A happens, part of the thesis is that you’re going to get economies of scale, because you will have consolidation of your IT vendors and your IT stack. In healthcare, though, that that sometimes takes a little bit of time. Almost paradoxically, in the early part post-M&A, you actually have more systems to manage, to make talk to each other, and to interoperate, than you originally thought about. It takes three or four years post-M&A before system consolidation and EHR consolidation really starts to take effect, when there’s a lot more energy and effort that goes into integration and interoperability of systems.

How is the healthcare technology market shifting?

So many healthcare technology companies out there, big and small, are trying to essentially make their solutions be available to providers. They are doing some very cool, innovative things.

A universal challenge is, how do you make yourself accessible available to the end users in their workflows? That challenge is growing, unfortunately, because on the IT teams that we work with on the hospital and health system side, they are working on tight margins. Their budgets are being cut. In fact, many of the CIOs that I’ve spoken with recently said that they are spending more time with their CFOs than they ever have.

There’s this tension right now between digital health adoption, innovation, AI adoption, at the same time, having tighter and tighter IT budgets. How we make those two things happen at the same time is a bigger challenge now than it has ever been.

ONC said in the early days of interoperability discussions that it would create innovation and new business models. Did that play out as expected?

It’s a bit of a mixed bag. The market has stabilized a lot more, where you have to be focused on the value and ROI that you are driving for your customers, whether it’s your provider, the patient, or whoever your stakeholder is. Interoperability is just part of it. I don’t think interoperability is a goal in and of itself. Better patient care, digital health adoption because you are going to get better patient engagement and so forth, is driving a lot of the conversation.

Then the interoperability part, along with some of the other cases. Can you integrate with my core systems? Are you secure? Do you match my security standards? Those are things that are really more about, can you do that? You have to convince people that you know how to do that. But those are not necessarily decision-making criteria that people are using to say, are you going to deliver value to me?

In the interoperability space, as happens with any kind of hype cycle, there’s always a lot of buzz. Some of that was driven by regulatory interoperability needs.

The way I see it, and the way we see it, is that interoperability is more about enabling others to do the work that they are trying to do. Interoperability is not a goal onto itself.

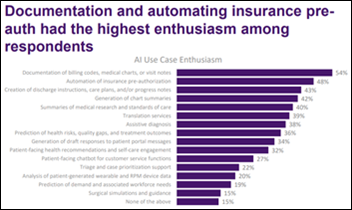

How well do the major EHR vendors support workflow integration? And related to that, will companies that offer AI solutions need to overcome that issue?

Let me break it up into maybe two parts in terms of integration with the EHRs. The first part is data integration. Can you seamlessly exchange the data that you need to, at the time that you need to? Most of the EHRs are doing a fairly good job of that. It’s more about making sure that you’re picking the right tool for the job, whether it’s EHR vendor APIs, FHIR, HL7, or whatever it is. With the data integration aspect of it, as long as you know what you’re doing, you can do that with every EHR.

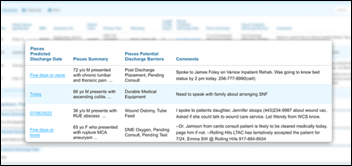

The second part is workflow integration. Let’s say that you are an AI company that has insights about the patient — a risk score, insights that from care gaps, and so forth. You can push that into the EHR. There are ways to do it. But then there is the second part around the workflow change management. How do you enable physicians, nurses, or whoever the right actor is to act on that information, to really take action? That’s where the rest of the challenge lies. Some of it is on the EHR side, but a lot of that is on the workflow change management side.

Physicians already have too much on their plate to react to, in terms of information overload. Having more information available to them to act on is a barrier, quite frankly. The work to be done, and the innovation that needs to happen, is thinking about clever ways to do that in workflow integration without causing additional burden for the end users. EHR vendors, digital health providers, and AI companies that are providing these solutions need to work together on this, coming up with ways to reduce end user burdens while enabling them to act on that information.

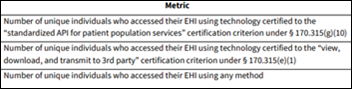

Early discussions around APIs involved issues around user cost and data security. Have those challenges been resolved?

On the security side, there is a security part and a privacy part. On the technical security side, a lot of advancements are being made. I would say that all the technical concerns are solvable and people have become very aware of those things.

On the privacy side, there are still open questions around whether patients know where their data is going and how we can make sure that we have the right guardrails in place for the appropriate use of the patient data with the right level of transparency and accountability. There are still some open questions around that.

On the business models around APIs, we are seeing that evolve over time. I think there are probably three ways to do it. You can have a transaction-based model, where the more times you use the API, the more you pay. There is a data-based model, where you essentially monetize the data that is flowing through the pipes. There’s also a software-based model, where it’s not about how much you use an API or how much data you’re consuming, but you license the software or the appliance and that’s what you pay for.

There is still a little bit of tension in terms of the right model from a business perspective. My personal belief is that over time, it will gravitate towards the third model, where you are essentially licensing the software or using the software to either call APIs or exchange data. It can’t be as much of a system where the amount of usage or amount of data flowing across is tied to the business, because that creates disincentive for greater interoperability.

What are the opportunities and challenges of TEFCA?

A lot that is still TBD, and time will tell. I have served on the board of Carequality for a number of years, so I am relatively familiar with what’s going on. A lot of the insider talk around that is probably not as relevant or on the radar of most clinical end users. In the near term, TEFCA will probably be a bit of a non -factor for most providers. It will mostly replicate a lot of the work that national non-profit efforts like Carequality and CommonWell have done.

The potential for TEFCA over the next three to four years would be to enable some additional use cases, such as for payment and operation, which will allow not just provider-to-provider and patient access, but also allow data to seamlessly flow between payers and providers and other non -treatment stakeholders for the patient. That’s when TEFCA could start to have a bigger impact. But it will take a few years to get there. The second part of that is a little bit more of a risk.

Part of TEFCA is the QHINs that are being formed and will keep forming over the next year or two. For some of the larger QHINs where this is not their primary business, they will do fine. But there will be a business model question that will come up for the smaller QHINs because you ultimately need a sustainable business model. It’s a hyper-competitive QHIN model where 80% of the market might be rendered by the EHR vendors. There probably won’t be enough business for the rest of the QHINs to justify a full business model based on that alone. The value-added services that you are trying to build on top of that will be key.

When the HITECH Act came about back in 2010 and 2011, health information exchanges were a big thing, A lot of those health information exchanges are operational today and successful because they had a business model that went beyond just the initial push that they got from the government. I think something similar is will play out here. The QHINs that are successful in the longer term will have solid business models that go beyond just the basics.

What lessons did you learn from your many years at Epic?

I lived in Madison, Wisconsin for 16 years, and lesson number one is to always support the Green Bay Packers on Sundays. That is in my bones and will be a forever thing.

Epic was a wonderful learning ground with the sheer wealth of knowledge that you assimilate on the healthcare side. It’s just amazing. I wouldn’t have been able to get that anywhere else. Judy is a remarkable person and a remarkable leader. She has an orthogonal way of thinking that I really have appreciated.

My time there influenced how I think about leadership, which is to hire really smart people and give them responsibility and autonomy early on and watch them thrive. Culture is key and putting the customer first always, even when it’s difficult or inconvenient, and keeping your promises. A lot of those cultural aspects have been really ingrained not just through me, but a lot of the Epic alumni that are out there in the industry.

Over time, the other thing that comes from my Epic upbringing and also from my time in healthcare and healthcare technology is the importance of focus and thinking long term. Those are really important, because in the typical hype cycle, there is some buzz going on every two or three years. It is so important to stick to it and focus on doing what you believe in so that you eventually get to the goal. To Judy’s credit, she has done that exceptionally well.

What will be important to the company’s strategy over the next three or four years?

First and foremost, it’s focus. We are going to single-mindedly focus on how to build a technology platform to make interoperability easier across the board for healthcare. Not just in the US, but globally. We often end up talking about US-related interoperability challenges, but this is a global problem, and we aim to be focused on solving that. That is what we will focus on. This is not a side business for us. We are not trying to build EHRs or CRM systems or what have you. We will just be focused on this.

Our approach will be technology first. How do we use technology to make sure that we are making things better and better over time? A good analogy from years past would be Cisco. It was a networking company and still is, and then over time, they kept improving technology and then they added more and more things to help their customers around that core. That’s how I see our trajectory.

On the software and product side of it, we want to build generalizable software and make it flexible so that our customers don’t have to buy point solutions for different things. Customers shouldn’t need to buy different things for APIs, FHIR, and something else. We want to be more. We can create generalizable software that can fit all needs.

Last but certainly not the least is to just stay focused on the customer. We take a lot of pride in our customer satisfaction and our KLAS scores and so on. That is something that we will forever hang on to.

Interoperability is a broader problem than it seems. A given hospital might have 200 systems that need to talk to each other, if not more. Sometimes these systems are within the hospital’s four walls and sometimes they are outside. A huge amount of effort goes into making all of that happen. The work of Carequality, CommonWell, and TEFCA is probably just 2% of interoperability and data exchange. I would encourage everyone to think about interoperability more broadly and how to make sure that all parts of the healthcare system have the data that they need to deliver the value that they are supposed to deliver.

Comments Off on HIStalk Interviews Sagnik Bhattacharya, CEO, Rhapsody

Fun framing using Seinfeld. Though in a piece about disrupting healthcare, it’s a little striking that patients, clinicians, and measurable…