Jon Phillips is founder and managing director of Healthcare Growth Partners.

Explain what you do. I don’t really understand it except I figure it’s lucrative.

We are an investment bank focused on healthcare technology and services. What we do is analogous to being a real estate agent for companies where we help companies sell themselves, or we help companies buy other companies.

So a good bellwether of how busy that market is would be how often your phone rings. Are you finding that it’s a lot busier now than it was?

What’s interesting is that it is a lot busier now, although the best bellwether is still the number of deals that actually get done. One thing that’s just a fact of life in the mergers and acquisitions business is that when you start a process, you don’t always finish it.

What you see are a lot of situations where companies decide to sell themselves and they don’t get a buyer for reason A, B, or C. It could be that the price that the market thinks that they’re worth isn’t what they think they’re worth and so they decide to wait. Or, it could be that they just don’t get interest at all. Or, it could be that they decide they’d rather do something different — that maybe they’d rather raise money instead of selling themselves, go buy something.

The key challenge in terms of this business is getting things to the finish line. What you’re seeing in the market as a whole is a significant uptick in terms of the number of transactions getting done as compared to a year ago or two years ago, both in terms of the number of deals and the value of those deals.

Where we sit right now is that there are more deals trying to get done than deals that have gotten done, and so you have a lot of folks who haven’t been able to get things done and there’s some interesting dynamics that go along with that.

Do you think it’s because companies that are trying to sell are seeing a top in the market and figure, “Hey, now’s my chance, although I’ll keep going if it doesn’t work out” or do you think they’re desperate, like, “I’ve got to do it now or it’s never going to happen?”

Early in the year, a lot of those were driven by the fact that healthcare mergers and acquisitions activity emerged faster than other sectors. What you saw was a lot of individual shareholders or private equity firms or venture firms looking to sell companies because healthcare was a hot area. Healthcare IT in particular was especially hot, and so you saw a lot of books come out early in the year. Early in the year was driven by, “Hey, the market is hot, and it’s getting hotter. Let’s go out and get a good value for our business.”

Later on in the year, what you started seeing is a little bit of a different trend, where you have some folks who are pulling the trigger on an exit because of tax-related concerns. There are absolutely companies out there that have decided to sell because their sense is that capital gains tax rates are going to go up next year.

Even if capital gains tax rates don’t go up next year — if there’s some type of an extension of the tax breaks — capital gains rates will go up at some point down the road. That does have some impact on decision-making, because even just a five percentage point increase in the tax rate, if you’re doing a $100 million deal, that’s potentially $5 million of more money that you’re paying to the government on January 1 as compared to December 31. That’s been another driver.

The other thing that you’re starting to see — and I still think it’s an early phase of this — but you’re starting to see this phenomenon that I thought we would see a while ago. Companies that are somewhat weaker, that aren’t growing as quickly or aren’t growing at all, or don’t have as strong of a product set and product capability — some of those companies are finally saying. “You know what? Either this market is moving, it’s not moving fast enough, or we’re not moving fast enough in terms of our internal growth to really dig our way out of our current predicament, so we’re going to sell because it’s probably not going to get any better.”

That’s something I think we’re going to see more of, because the way that I characterize the M&A market right now is it’s really kind of a world of haves and have-nots, if you will. Normally what you see in terms of valuation multiples — the multiple of revenue or the multiple of earnings for which a company sells — normally you’ll have a normal distribution of that. If the median multiple is 10 times EBITDA, then you’ll have a bunch of deals happening close to 10 times EBITDA, you’ll have a few deals happening at 15 times EBITDA, and a few deals happening at five times EBITDA.

Where the market is right now is much more in kind of a bimodal distribution. You have a some deals happening at very high multiples, and you have a bunch of deals happening at much lower multiples. You don’t have a lot going on in the middle. I think as this M&A market continues to mature and as the cycle continues, I think you’ll see more activity in the middle. You’ll see more kind of eight to 10 times EBITDA deals happening, but right now, it’s really at the extremes.

I would assume that the number of deals on the high end probably has always been the same. Does that mean more people are unloading for less than they expected or less than historically has been the case?

There are certainly a few more deals on the high end than over the last couple of years at least, but it does mean that more people are unloading at the low end.

Some of that comes back to putting yourself in an investor’s shoes, where you’re an investor in a company that is $3 million in revenue, and you put money in it maybe five years ago, maybe seven years ago. Just to use hospitals as an example, although it would apply to the physician software, it would apply to payer software in 2008, when the hospital spending really froze because of the capital markets early in the year in terms of the auction rate securities and the lack of liquidity for hospitals, later in the year as the market downturn occurred when hospital spending slowed, then the growth source for a lot of these companies slowed down.

But coming into 2009, you had this grand stimulus package that was going to drive all this growth in healthcare IT. Well now it’s a year and a half later, and a lot of those companies that were doing $3 million in 2008 did $3 million or maybe $3.1 or $3.2 million in 2009, and did maybe a little bit more than that or are going to do a little bit more than that in 2010. But from an investor perspective, they’re saying, “How long am I going to have to wait for this market?”

While there are certain subsets that are seeing tremendous growth, my opinion just from talking to a lot of different companies out there, a lot of companies are having a tough time just getting decent growth because resources are geared toward making sure that you can get your Meaningful Use dollars. Resources that aren’t geared toward Meaningful Use dollars are severely restrained, and they’re going to be focused on those things that are going to drive the highest ROI for the hospital.

It’s very competitive for those capital dollars. As a result, demand is soft, and investors say, “Well, do I want to count on demand improving in 2011? I’m going to have to invest more. I’m going to have to wait a few more years.” Or maybe it’s not throwing up the white flag, but it’s certainly, effectively surrendering and saying, “All right, I didn’t do well on this one. I’m going to move on to the next one.”

If you look at the effect of federal money on the potential for company profitability, when do you see that peaking?

I think you’re going to see it peaking in 2012 or 2013.

Really? So you don’t think it’s here yet, so there’s still a lot of opportunity for companies to improve their bottom lines in the next couple of years?

I think there are a lot of opportunities to do that, but the problem is you have to be really disciplined leading up to that point.

Part of the challenge that you see with folks who are selling at less than optimal values is that they’ve found themselves between a rock and a hard place. They see the potential a couple years down the road, that whether they would be direct beneficiaries of the stimulus dollars or not. As those dollars flow into the system, it will create a much more favorable capital spending environment for hospitals. Maybe not much more, but at least a more favorable capital spending environment for hospitals, but you’ve got to get there.

Candidly, I’m still of the view that if you really dig into the performance of the large majority of companies out there — whether they’re selling to hospitals or physicians — I think that the reality of sales momentum is far short of the story that’s been told. Not story as in a negative thing, but kind of the potential that’s out there. I just think this market, it moves slowly. You’ve been around the market long enough.

It’s like nothing happens fast here, and while the HITECH dollars would drive all the spending, effectively what they did is they froze things for a very long time. Consultants got a ton of business over that timeframe as people tried to figure out what to do.

But now as the middle-of-the-market folks are actually implementing their plans, it still is just going to take time. In that time, you have to be really disciplined. You’ve got to figure out a way that you’re not going to be reliant on outside money to come in to fund you. You have to make sure that you can figure out a way to cash flow yourself rather than being dependent on an investor to do it because investors very likely will get impatient with your performance if you can’t show that very immediate path to profitability.

Given how slow this market, is you’ve got to be able to hunker down and make it through. Down the road, there’s a ton of money to be made here, but it’s going to take time.

Companies will need to ride the wave up now and then down again when the surge of money runs out. Do you think that’s a concern, where companies look good now but will be terrible later?

I think there’s definitely some of that. That’s one of the things that as folks are looking at investment opportunities or are looking at companies you want to line up with. You do have to be careful about that.

It comes back to if you look at what happened to the professional services space in healthcare IT leading up to Y2K and then what happened after that. You look at it and you go, “Wow. All these companies were growing like crazy, and then business fell off really quickly.”

It wasn’t all just Y2K-driven, but what it came back to was you had the combination of the outside threat went away, you had a recession that came along, and then hospitals cut back on the professional services spending. You had this very quick retrenchment that a lot of those organizations had to do. For some of the bigger ones, it was really hard to dig out of that at all because it’s one thing to grow, it’s hard to cut. I think that’s the risk that you see.

And once again, not until 2015 or beyond, but the risk that you will see is that there will be all this money flowing through the system and folks will invest on the assumption that that will be there forever. It won’t. You’ll certainly see some businesses that will really struggle at that point.

Who are the potential buyers out there, and what is it they’re looking for?

In terms of the buyers, my fundamental belief is that this is still more of a buyer’s market than a seller’s market, if you want to have kind of a general view of the market. Now in certain subsectors of the market, it’s definitely a seller’s market. You can’t just say it’s a buyer’s market across the board, but in more places than not, it’s a buyer’s market.

Before getting to who the specific buyers are, generally what buyers are going to be looking for are businesses that can grow and that are growing, and businesses that either are or can show that they can be immediately profitable. Folks really aren’t interested in spending much money on businesses that are declining in revenue or going sideways on revenue and are either just making a tiny bit of money or losing money. Those are tough things to get to the finish line, and the value that you’re likely to see in situations like that will tend to be that you’re not going to get great valuation multiples.

Where you’re going to see the really big valuation multiples are going to be in situations where the business is growing, they’re making money, there’s significant growth left for them to go after, and then you’ll see some of these well-capitalized strategic buyers stepping in and making a play. The case examples on that really come back to you look at the deals that Ingenix has done over the last few months, and obviously varying multiples in terms of what they paid for things. But they’ve certainly been willing to pay more aggressively for businesses that they feel they can use their existing infrastructure — their existing customer reach — to generate substantial incremental value. Ingenix absolutely is going to continue to be a significant buyer. Emdeon is going to be a significant buyer.

You look at the McKesson / US Oncology deal. Very interesting in terms of how that changes the axis of that company a little bit beyond where they’ve ever sat before. In organizations like that, you’re going to see substantial increased acquisition activity because they can afford to look at a lot of different things and they’ll be able to pick and choose those deals that make the most sense for them.

I think, realistically, all of the large — whether it’s a diversified healthcare entity like a McKesson, or a specific healthcare IT company like an Allscripts — I think you’re just going to see a lot of acquisition activity on an ongoing basis because there are a lot of companies that want to sell and I’m not going to say there’s a very short list of buyers, but it’s not a huge list of buyers. The pure healthcare IT- and healthcare-focused companies are going to be able to pick and choose and pick those things that are going to drive the most value for them.

I think you’re going to see more folks coming into healthcare from outside of the space. Traditional software players are absolutely going to continue to increase their presence in healthcare. You’ll see traditional services players increasing their presence in healthcare.

Then, alongside all those groups, you’re going to see the private equity universe, whether bio guys or growth equity investors. You’re going to see them looking at healthcare technology and services as well because at the end of the day, it’s a market that healthcare as a whole is going to be growing in 2-3-times GDP over the foreseeable future. Healthcare technology and services will be growing faster than that. So if you get a business that is just growing at the market rate, it’s a nice business. If you get a business that can grow faster than that market rate, it could be a great business.

I think there’s a pretty broad universe of buyers right now. The problem is that buyers are picky because they’re getting to see a lot of different things, so they can afford to be picky.

In the past, the big money came from outsiders who didn’t know the market very well and got taken to the cleaners by buying something that industry folks would have thought was puzzling. Would you agree that if there’s big money to be made, it’s probably going to be somebody who just wants to buy a foothold in healthcare and doesn’t really understand the positioning of a specific company?

I think that’s one of the ways. The “stupid money” coming in is something that has been around healthcare forever. I don’t think that goes away. I actually think the folks who can stand to make the most money and make the best returns, in my opinion, are ones where you can make a very simple case. Some of this comes back to the case that can be made for somebody coming into healthcare from outside of healthcare.

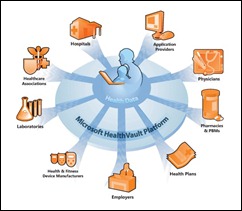

But if you think about healthcare IT at its most basic level; you have, just round numbers, 6,000 hospitals. You have anywhere between 600,000 and 800,000 physicians and thousands of other care providers in this space. Just think about the provider universe and think about how fragmented that provider universe is and how hard it is to have a footprint that touches more than a fraction of that provider universe.

In my opinion, where folks will get the best exit multiple — where they’ll get paid the highest multiple for their business — and where the acquirers will make the most money on that are situations where you have an acquirer who has really broad reach and you have a seller — a target — who has a great product that is getting traction on its own, but will get a lot more traction if it can just access that acquirer’s distribution network.

Those are the situations where, honestly, if you look at the financial models, acquirers can afford to pay a lot. They can afford to pay what may seem to be irrational prices because the return that they get is incredible.

You go back to my favorite case study on that is the McKesson acquisition of ALI way back when. They hit the market just right. They bought a great company with a great product. They paid a huge number for it, but it really worked out for them and they made a mint on it because they could increase the price. They rolled it out to their customer base and it’s been a great outcome for them.

I think you look at some of the other deals that have happened over the last 10-15 years in the space and those are generally the deals that are the best outcome for everybody — that you have something where it’s a great product, a great capability, a great solution that gets acquired by someone who has a customer base that’s already interested in that solution. You put the two together and they get to take the market by storm. The sellers made a lot of money when they sold, and the buyers make a lot of money on being able to sell that product to their customers.

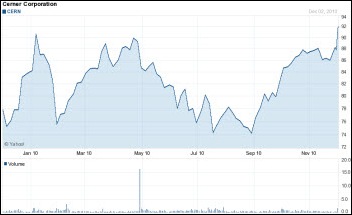

Sounds like it’s time for Oracle to buy Cerner. What do you think?

I don’t know about that.

You know Oracle wants in. They’ve got to buy something. They have so much cash that surely they want to be in healthcare.

They definitely want to be in healthcare, and I think you certainly can make a case that they’d buy Cerner. I actually think if they were trying to really mix it up, the angle that somebody would take — and once again, I know Epic’s not for sale and Meditech’s not for sale and eClinicalWorks isn’t for sale — but the concept of a big outsider coming in and picking up one of those folks would be the really big game-changer. They’d have to pay a huge number and maybe there’s not a number that’s big enough, but that could be a huge game changer.

But you’re right. From Oracle’s perspective, they did pick up Phase Forward, which makes them not the 800-pound gorilla, but the 2,000-pound gorilla in the clinical trial software space. But they certainly can’t sit here and look at the hospital market and the physician market and say, “Well, we’re not going to touch that.” I mean, there’s too much potential spend there for them to overlook it. The question is whether Oracle and folks like them, whether they decide to take a big jump or a little jump.

Interestingly, if you look at what historically works the best for folks entering the space, generally the big jumps have been tough. You think about McKesson/HBO. You think about Siemens/SMS, GE/IDX. You run down the really big deals and they haven’t worked out that well as compared to some of the ones where there have been much, much smaller plays. They’ve generally worked out a lot better.

If you had Larry Ellison’s wallet, how much would you be willing to spend on Epic?

That’s a great question. I would be willing to spend if I had his wallet — and I don’t have his balance sheet in front of me — but if I had his wallet, I’d be willing to pay a huge number for Epic because I think that in doing that, you’re effectively locking up a lot of the market for a long time to come. You go in and you say, “Well, what are the biggest hospitals in the United States worth from an IT spending perspective over the next 10 years?” You’re not talking about a two-year horizon or a five-year horizon. You’re talking about a really long-term horizon just given the decision cycles on these systems, and it’s a really big number.

You didn’t give me a number, so let me give you mine and you tell me if it’s too high or too low. I was thinking between $5 and $10 billion.

I actually would have said, without knowing exactly where Epic’s numbers are, $5 to $7 billion.

Of course that means you’ve got to have a seller.

Now honestly, I think that Judy and her team would still probably say no. I’d be surprised if somebody hasn’t come to Epic and offered them an absolutely tremendous number. But from Epic’s perspective — and I think this is part of the issue you’d see with a lot of folks out there — that’s not why they’re doing it. It’s not to just throw a bunch of cash in the bank.

I think if they felt that doing something like that would allow them to do a significantly better job of serving their customers, I think they’d do it and I think maybe they’d even do it for a much more reasonable price. I think that’s the take with Epic. That’s not the reason that they’re in the game.

Give me a handful of companies that most people haven’t heard of that you like.

As I look at the market, I think that there are a couple things that are going to be really, really important. The most interesting area for me really, circles around cost containment and quality management. What it gets back to is the fundamental challenge that we have as a healthcare system is that we have no control over cost and we’ve got, effectively, a fee-for-service model. We have a piecework model.

As we roll forward in healthcare broadly, we’re going to run into situations where those new approaches to care delivery and to care management and case management. Those companies are going to have a chance to build a tremendous amount of value.

There are a number of companies that are focused on — some people call it physician analytics, and some people call it the quality infrastructure. Some of these guys are thinking about it as local HIEs, but technology platforms that allow for capturing information from disparate sources and analyzing that information and deriving useful, actionable outputs from that information. That for me is a huge opportunity. The challenge that you see is that a lot of companies that play in that space are coming at it from very different angles.

I haven’t come across a company that I’d say wow, they’ve really got it. Some folks are coming at it from the HIE angle, some people are coming at it from the payer angle, some folks are coming at it from a clinical trials angle, but you haven’t had somebody who comes out and says well, here’s an infrastructure that it’s truly going to support — whether it’s called an ACO or whatever the buzzword of the day is that’s used to describe that — but here’s an infrastructure that’s going to allow for integrating disparate data sets. In flagging issues with patients getting the right intervention and then monitoring the results, those types of things are going to be huge.

One of the other areas that I get really excited about is the home monitoring space. Home monitoring has been just a backwater in healthcare for such a long time because the reimbursement models haven’t been there to support it. Now what you’re seeing is the beginning of a trend toward coming up with new ways to go about monitoring patients when they’re in a home environment.

Honestly, once again it’s reimbursement-driven because people are fast-forwarding to when they’re not going to get paid for the 30-day readmits and saying, “All right, how are we going to keep these people out of the hospital?” Well, there are these tools that are out there that have been well proven that if you’re doing the right types of monitoring at home, you can keep people out of the hospital. Well, that’s getting pretty exciting.

Area one, it’s not interoperability, it’s really interoperable analytics. Area two is home monitoring.

I still get intrigued by the fact that I think there are a lot of opportunities in just niche-y areas that the big guys don’t necessarily focus on. Even in areas where the big guys do focus, you have the opportunity to build real expertise and just own a sub-segment.

You look at folks like Curaspan out there, in terms of the discharge management, and you look at TeleTracking in terms of the patient flow solutions. Folks like that that just pick what they’re going to do and they do it really well and just stick to their knitting and build up. Those are pretty exciting. I think most folks have probably heard of those guys, but that’s really exciting.

I know a lot of people disagree with me on this one, but I still come back to I think there’s still opportunity for — whether you call them best-of-breed or departmental solutions — I still think there are opportunities within hospitals for non-enterprise vendors. Now, do I think there’s an opportunity in a hospital for a non-enterprise vendor that has one function that’s a very narrow function? Probably not. If you just have a software product that handles valet parking at the hospital, yeah, you’re probably at risk for somebody taking you out.

But if you have a suite around access management that you could go in and you’re better than the access management capabilities of the hospital’s enterprise vendor and you have enough functionality that you’re not just a one-trick pony, there’s real opportunity for that.

I think you will see a consolidation in terms of the number of vendors because you don’t want to have 200 vendors out there. You want to have a manageable amount. The key is if you want to play in the hospital market and you’re not an enterprise guy, you’ve just got to figure out how to get big enough and add enough capability that you’re one of the surviving vendors. That’s pretty exciting to me. I think it’s an area where there haven’t been a lot of folks focusing on it, and I think some companies can really take some interesting steps there.

Last question. You get one-sentence answers.Give me three predictions on anything related to healthcare IT.

Prediction #1 is that the M&A market in healthcare IT will be very strong in late 2010 and through 2011, and then will fall off significantly in 2012.

Prediction #2 is that by the end of 2011, there will be multiple deals north of a billion dollars in the space, which would be a big disconnect from history that generally, there’s one of those deals every couple years. But before the end of 2011, there will be multiple large deals.

The third prediction would be that the actual payout for stimulus funds will be a fraction of the total potential amount.

It's nice when Epic takes on patent trolls and other bad actors in the industry. They do great when they…