Linda Peitzman MD is chief medical informatics officer of Wolters Kluwer Health.

Tell me about your job and the company.

Wolters Kluwer is a large company that started as publishing of information. It now creates software and information to help with workflow and decision support in the verticals of tax accounting, legal, and health to help the professionals in those areas with their decisions and information needs.

I’m with the healthcare division. I’m a physician who worked for a long time as a full-time practicing clinician trying to figure out ways to solve problems and make things go better and help the systems that I was using.

I got myself involved in the IT side way back and started working with ProVation Medical. I came into Wolters Kluwer through the acquisition of ProVation Medical. Since that time, I have been working with the health division and spending most of my time with the Clinical Solutions Group at Wolters Kluwer Health, which provides workflow software, information, and decision support at the point of care for healthcare professionals.

You’ve worked a lot with order sets, which early on were just collections of commonly used paper orders that somebody keyed in to a CPOE system. What’s the state of the art in the use of order sets today and what’s coming in the future?

That’s a big question. There are a lot of things going on with order sets, for many reasons. There’s a lot of regulatory and other pressure to implement CPOE systems, so there’s a lot of work effort being focused on order sets.

As you say, they’ve been around for a long time because they help doctors with time and efficiency, and they’ve been around in paper form. But one of the big problems has always been once you get all those orders set out there, how do you maintain them? How do you make sure they are evidence based? How do you make sure they’re driving the right behavior in terms of quality patient care?

Some of the things that are going on right now with order sets include the use of tools to help with all of those things. To help with the complex governance process in your organization, to go through all of the review, the review of the evidence, the review of the order sets, the agreement upon what should be done at that hospital and in that organization, making sure it’s consistent with the hospital’s formulary and the types of tests and drugs they think should be ordered for that condition. Then I’m making sure that gets into the CPOE system and is used by the clinicians at the point of care.

All of that depends upon the processes and tools that an organization has and the culture that an organization has. A lot of it depends upon the capabilities as well of the CPOE system that the hospital happens to use.

It seems like hospitals generally struggle with the whole idea of evidence-based process, like formularies or trying to consolidate their medical devices into the most cost-effective ones. Everybody likes the concept of evidence-based order sets, but hospitals don’t seem to be ready for them yet. Do you think that’s the case?

I don’t know that that’s the case. I think that most hospitals really want to use evidence-based medicine. It’s just complicated to maintain that, to know exactly what’s going on in the literature, to make sure that you keep everything current. I think it’s also complicated sometimes in the culture of an organization to go through the process of review by all the people that need to do that and then get it done in a timely fashion.

There’s a lot of tools out there to help organizations with that now. I think that some of the regulatory and payment pressures are focusing hospitals in certain areas and certain medical conditions, to make sure they are doing certain things for that care of patients that are consistent with evidence as well.

I think that just about every hospital is focused on evidenced-based medicine, particularly with order sets, at least in some areas. That’s why they’re doing what they’re doing – to provide the best care they can for their patients.

Efforts are being made to put clinical content in the clinical workflows, such as with the Infobutton standard. What changes do you think we’ll see in the next few years to make clinical content more available when it’s needed and to make it more specific to the clinical situation at hand?

I think there are a lot of things happening. A lot of groups that are working on experimenting with getting the right information at the right time. Alerts are popping up all the time when you’ve seen it a hundred times has really been discouraging for some clinicians. They haven’t really done as much as people thought initially they might do.

There are other things that have really been successful, like some things in the background in terms of drug information and drug interactions. drug dosage, and getting the right medications dispensed. Some things have been really successful. I think the work continues to try to figure out how you get the right nugget of information into the clinician’s hand at the time that they are thinking about it and deciding what to do.

There are a lot of forms of clinical decision support. One of them is an order set. Having the right order set when you’re admitting the patient and you have to be using an order set anyway. Having the right information there that really takes you through the workflow and helps you make the right decisions that’s helpful. Having really smart rules and alerts than can be configured to provide benefit, but not get in a clinician’s way.

That’s a real hard nut to crack, but a lot of people are working on it. Even having smart documentation, when you’re documenting something and going to the next step of deciding what the next thing to do is, being able to walk you on the right path.

There’s a lot of work going on. The technology is starting to evolve to allow some of that. If an EMR now has the capability of sending out to a clinical decision support system information about the patient that is very specific, then the information sent back can be much more specific and can be more focused right on what the clinician might want to know instead of having more broad-based alert that might be more of an annoyance than a help. As those things continue to evolve and more and more EMR systems have those capabilities, I think organizations like Wolters Kluwer and others can help provide more focused information right at the right time into that workflow.

We have a group called the Innovation Lab. It’s partnering with several organizations looking at just that. How can we get clinical information right at the right point of care into the workflow of a clinician when they have to be ordering or when they are opening a problem, a record of a patient if that patient isn’t on a critical medication that is called for by virtue of the fact that they have these six conditions and they’re already on these other two drugs? Can there be a really smart alert that says hey, have you thought about this, and maybe a link to the supporting evidence to show the clinician?

There’s a lot of work going on. I don’t think anyone has solved the problem completely by any means, but it’s really exciting to think that we could help clinicians make decisions at the right time in the point of care.

Going back maybe 20 years ago, you had publishers of journals you put on your shelf, but early electronic order entry systems that didn’t look at clinical content at all. Those systems were happy to just get an order entered and routed correctly. Is there still a lot of work to be done to take all that information that’s in almost limitless supply in research and publications and turn it into something that can be used at the bedside?

I think it’s an almost impossible task for an organization like a healthcare provider organization by themselves to accomplish that. Clinical information is said to be doubling every three to five years, and unfortunately my brain isn’t growing at that rate — just the task of managing all that and sorting through the literature.

Part of our organization has a group of clinicians on the UpToDate team does that for their product, sorting through hundreds of the journals every month to try to identify the real changes in practice. By partnering with organizations where we can separate the wheat from the chaff and provide the real nuggets of clinical information as to what might really matter in terms of changing practice and then do work to try to figure out how to get that information into the hands of the clinician at the right time in the point of care, it can really help.

There’s so much going on and so many things published to be able to identify, first of all, what has changed? What really matters to my practice or the practice at the hospital? And now that we know that, where are the order sets that matter? How do I update them? Where are all the education pieces that I need for the physician? How are the patient education materials and how do I update them? As we were talking about before, I think maintenance of evidence-based practice is the big thing we need to solve. I think there’s a lot of people working on tools to help organizations with that.

The company’s doing some work to support Meaningful Use requirements. Can you describe that?

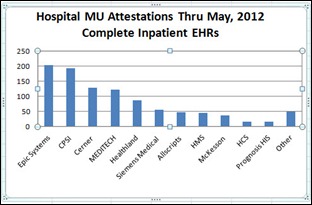

Meaningful Use requirements include quite a few different things. In this first phase, you need to be able to be report on certain measures. That requires certain systems in place that you have purchased, and you have to show that you’re using them in a meaningful way. We have a wide variety of products, including one that is a documentation product that helps to document and report some of those measures. In a broader sense, all of our products and other organizations’ products that are working in clinical decision support are trying to help support hospitals in the work they’re doing.

One of the things that they’re really focused on right now is Meaningful Use and core measures. In all of our product lines from our order sets to our other types of clinical decision support, we try to point out the areas that matter for those things. For instance, in our order sets, we have quality indicators with each order set that show what the CMS measures are or Joint Commission or other kinds of areas that would matter for regulatory organizations for this particular order set or this particular condition. We try to help tie the works that hospitals are doing for things like Meaningful Use into other product lines.

We are trying to assist organizations with implementation of CPOE systems, which is one of the things that they are working on doing towards that goal by providing the tools to help them come to consensus with their order sets, release their order sets, and then also provide some integration into their CPOE system so they can go live with CPOE and meet their measures of providing orders in the CPOE environment for things like Meaningful Use.

You mentioned that you were involved with ProVation before it was acquired. That’s a product that basically owns the gastroenterology market, a very specialized product. Will the idea of having specific documentation products for specialties continue or will the market push specialists toward standard products whose weaknesses they’ll have to live with?

We started in GI, in gastroenterology, but ProVation MD expands many other specialties for documentation. We have products in cardiology, cath lab, echo, nuclear, and surgical areas such as general surgery, plastic, ENT, eye, OB/GYN, and a variety of other surgical sub-specialties, orthopedics, and pulmonology as well. We span most clinical procedural specialties with ProVation MD. That’s used in a variety of specialty areas to allow people to document and report on procedures in those areas, including in the cath lab, echo, cardiac, etc.

However, in a more general way, I would say that there are pressures on both sides. There are pressures to try to get one system to do as much as you can, because if you are working on the IT side of a hospital, you don’t want to have thousands and thousands of systems that you have to maintain and integrate and update and keep current with each other.

On the other hand, I think it’s becoming more and more clear that standard EMRs are not going to be the providers of everything for a hospital IT environment in terms of particularly current information and content and sometimes even very specific workflows for clinicians. I do think that there will be partnerships with the EMR systems that are the systems in place that are storing that patient record and information and workflow software providers that can join together to meet the needs of the various clinicians in the various workflows they need to complete.

However, the problem has been integration and ability to pass information back and forth. Also ease of use, in terms of having a provider needing to go from one system to the other. There’s a lot of pressure now on trying to make sure that there’s adequate integration involved and that an end user does not have to know that they’re in one system vs. the other – they can just do their work and then all the information can go to the right system and go to the EMR to be stored and viewed as the patient’s record. I think there’s a lot of work going on there.

I do not believe that any one system is going to solve all the needs, for many reasons. One is because there is just huge tasks involved with understanding which workflow involves different clinicians and managing all that clinical information that’s happening in all of those clinical specialty areas.

That acquisition of ProVation is interesting, but I’m not sure most people realize how long the list of other Wolters Kluwer acquisitions is. There was also UpToDate, Lexi-Comp, Pharmacy One Source, and even a joint venture in China. What’s the company’s strategy?

The ones you mentioned are all within the Clinical Solutions business unit of Wolters Kluwer Health. That’s the group that is working at the point of care to provide workflow software and content solutions for clinical decision support for healthcare professionals.

We have a variety of products, from providing the answers to the clinicians with a product like UpToDate, providing tools to manage order sets like the Provation Order Sets product, and clinical documentation with ProVation MD. With the acquisition of Pharmacy One Source, also are working in the areas of the workflow of the clinical pharmacist and in surveillance. We now have tools available to help hospitals with real-time surveillance, looking for patients that might have indications that they need something done. For instance, watching for earlier signs of sepsis to make sure that the hospital can intervene in appropriate time and help provide morbidity and mortality associated with that. Many other things as well, including antimicrobial stewardship.

We also have a lot of drug information products. Lexi-Comp, Facts & Comparisons, and the database of Medi-Span, which does alerts and reminders and drug-drug interactions, etc. for drugs used in the clinical setting. Each of those products represents a form of clinical decision support and help to the hospital environment.

But what we are really working on is looking across them and trying to find ways to do two things at a very high level. One is to integrate those products together in ways that are helpful to our customers that have more than one of them. UpToDate information is embedded inside of order sets, and if you have both products, there are ease of use issues across order sets and UpToDate that help the clinicians and helped the hospitals. We do that with many of our products. We try to integrate, so we have UpToDate patient educational materials inside of ProVation MD and other things such as that.

At the second level, what we’re working on trying to do is to really look at the problems, the current problems that our hospital and clinical customers are having, and say what can we do, not just with one individual product, but maybe with pieces of products and with our expertise from those product lines to bring them together in a new way to try to solve those problems?

As I mentioned earlier, we have a group called the Innovation Lab at Clinical Solutions that has a steering team that represents the clinicians and informaticists and technical folks across all of those products that we just mentioned. We are a partner with hospital systems to try to solve very specific problems and are taking to the pieces of both content and technology to try to come to bear on problems that hospitals are having in new ways.

We are working now in the area of mobile devices to help with early detection of sepsis. We are looking at providing, as I said earlier, ways to get nuggets of clinical decision support into a clinician’s hand at the right time and the workflow, which will be in EMR setting, through APIs and other things. We’re really excited about that and have quite a few hospital partners that are working with us to try to solve some of their problems in that way.

The old Internet saying was that “content is king.” Does the content piece get enough recognition when people talk about EMRs and Meaningful Use and how these products will actually deliver the benefit they’re supposed to?

People that are focused on one side or the other tend to have less of an understanding of the technical versus the content side. I believe it’s both. If you don’t have the right content and have the capabilities of understanding all of the changes in clinical practice and sorting through all the literature and making sure you keep your order sets current with evidence-based medicine, then you’re not doing your patients or your organization a service.

On the other hand, if you don’t have am EMR or a CPOE system that allows ease of use for the physician to be able to order something, or even has capabilities of being able to override things and be able to say why and track why are certain things were not ordered, you really can’t provide the best care. You also can’t measure what you’re doing well enough to be able to go back and improve it in a continuous improvement cycle.

Content is king, because without the content, without knowing what you should do for patients, it’s hard to do it. On the other hand, if you don’t have systems and a workflow on place that makes that easy to use for a clinician and then can track what’s actually been done so you can improve it, then it’s also a really next to impossible as well. Both things have to continue to improve, and the ability to manage the content and get it into the workflow of the technologies is what really it has to happen. There are a lot of things being done towards that goal now, but there’s a lot of work that remains to be done.

Do you have any concluding thoughts?

It’s a really exciting time right now in healthcare IT for many reasons. It’s also a very frustrating time for people on the front lines in healthcare IT. There are so many pressures both currently and coming down the pipe, from switching from ICD-9 to ICD-10 and Meaningful Use and core measures and value- based purchasing and ACO pressures. Trying to manage all that and figure out what to do first and how to best accomplish it and still have systems that are maintainable and manageable in your hospitals is a really overwhelming task.

There are tons of opportunities. There are tons of ways we can help make things more efficient and improve patient care. There’s just so much going on right now that sometimes it can be a little overwhelming. That gives organizations like mine an opportunity to try to identify what those top priorities are for our customers and try to help solve them in a variety of innovative and unique ways.

I initially questioned the profile's authenticity because all of the headshots in the profile are clearly generated or enhanced by…