Top News

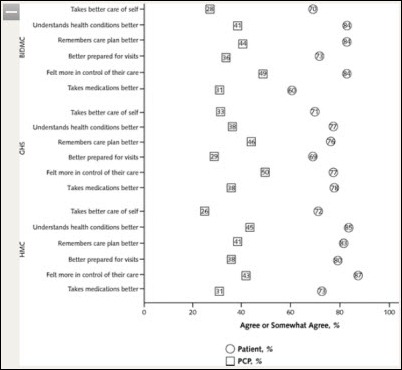

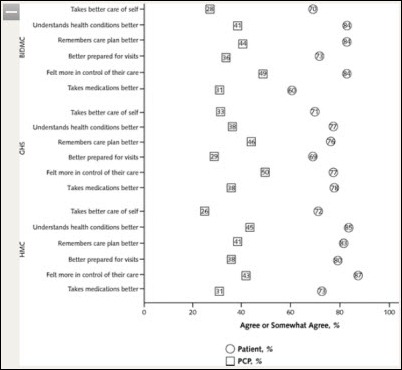

Patients say they are better equipped to help manage their own medical conditions when physicians give them access to their visit notes, according to the year-long OpenNotes study published in Annals of Internal Medicine. Ninety-nine percent of patients at the three participating hospitals who responded to the survey said they wanted the project to continue. None of the participating physicians elected to end their participation at the study’s conclusion — they were less enthusiastic about the patient benefits, but found that allowing patients to review their notes didn’t require any additional time or effort on their part. Responses to the potential benefits in the graphic above are indicated by circles (patients) and squares (physicians).

Reader Comments

From Jedi Knight: “Re: EHR adoption numbers. Has anyone pointed out that ONC and CDC are tracking very different numbers? They are showing 58 and 39 percent, respectively.”

From Start and Stop Again: “Re: Nuance. How do you think 3M feels with Nuance acquiring QuadraMed’s Quantim and JATA, who clearly compete with 3M? This has to signal the end of Nuance’s Computer-Assisted Physician Documentation announced last February in a partnership with 3M. Does Nuance think it can stitch the pieces of two dusty companies into Frankenstein?” Unverified.

From Familiar with the Transaction: “Re: McKesson acquiring MED3OOO. It’s a good fit. MCK gets the InteGreat EHR, which has a lot of functionality including a data warehouse and integration with Medicomp’s Quippe. They get instant market share in specialty revenue cycle management such as lab, emergency, and ambulance billing. They get a new market in full management of multispecialty groups, and ACO market opportunity from someone further down the path than they were. Not to mention that they take out a competitor and pick up a decent client base.”

From What, Me Worry?: “Re: West Penn Allegheny downtime. Patient care was not affected – we rely on meaningfully used paper.” West Penn’s servers went down Tuesday morning after a power surge, forcing the hospital to use paper backups. Some systems were up eight hours later and others were expected to come online overnight. It’s not much of an EHR pitch when a hospital claims that being without the computer didn’t really make any difference in patient care. That’s probably more of a PR observation rather than a medical one, though.

From THB: “Re: Allscripts. Are the reports that the company is putting itself up for sale accurate? After your hard day at work, here I am asking you to validate more information, i.e. do more work.” Bloomberg News claimed Friday that Allscripts talked to several private equity firms before engaging Citigroup to explore its options, but neither company would confirm. Shares have risen 11 percent since then, which might be meaningless since (a) the original rumor may have been planted by someone anxious to sell their shares, which is always possible; (b) the rumor may be incorrect; or (c) the rumor may be correct, but may not result in any decisive action. Reasons that going private makes sense: (a) the company’s shares tanked and haven’t recovered after an ugly day in April in which the company fired its board chair, saw three other board members quit in protest, announced the departure of its CFO, and reported lower earnings and guidance; (b) the company conceded to demands by a large shareholder to add its three candidates to the Allscripts board, and those new directors may be influencing the discussion of strategic alternatives; (c) the critical Q3 earnings numbers will be announced in November, and if they aren’t looking so good, this would be the time to plan an escape route from the bloodbath that’s likely to follow; and (d) the stock has fared so poorly in a generally good market that any major strategic changes might be better conducted outside of Wall Street’s baleful glare. My answer, then, is that I have no idea if the rumor is true, but I suspect that it is, and even that wouldn’t mean much until Allscripts decides what it wants to do.

HIStalk Announcements and Requests

My new iPhone 5 arrived last Friday and I am happy to report I have successfully made the migration. It’s definitely faster, the camera is better, it’s lighter, and I like the bigger screen. The battery life, however, does not seem any better than the iPhone 4 and actually seems worse, if that is possible. Maybe the battery life is longer in standby mode, but not when you are using all the cool new features. I also checked out the new maps utility and was amused that my “hospitals” search presented me with an option for “The Shoe Hospital” and for an animal hospital, but no traditional hospitals. It did find more choices when I searched “hospital” (singular), however. An “emergency room” search found a few urgent care centers, but missed the three closest me and didn’t find any ERs attached to a hospital. Good luck with that issue, Mr. Cook.

My new iPhone 5 arrived last Friday and I am happy to report I have successfully made the migration. It’s definitely faster, the camera is better, it’s lighter, and I like the bigger screen. The battery life, however, does not seem any better than the iPhone 4 and actually seems worse, if that is possible. Maybe the battery life is longer in standby mode, but not when you are using all the cool new features. I also checked out the new maps utility and was amused that my “hospitals” search presented me with an option for “The Shoe Hospital” and for an animal hospital, but no traditional hospitals. It did find more choices when I searched “hospital” (singular), however. An “emergency room” search found a few urgent care centers, but missed the three closest me and didn’t find any ERs attached to a hospital. Good luck with that issue, Mr. Cook.

Acquisitions, Funding, Business, and Stock

Tenet Healthcare subsidiary Conifer Health Solutions will acquire InforMed Health Care Solutions, an information management and services company.

Ontario-based Kallo, Inc. enters into a $2 million stock purchase agreement with Kodiak Capital Group. The company offers EMR, PACS, and medical device connectivity solutions.

Nuance acquires JA Thomas and Associates, which offers clinical documentation improvement programs. Obviously Nuance is interested in clinical documentation and the ICD-10 transition given the September 27 announcement that it had acquired QuadraMed’s HIM solutions (coding, compliance, computer-assisted coding, abstracting, record and document management, workflow, and clinical documentation integrity) and its acquisition earlier this year of Transcend, which offered transcription and clinical documentation (including the documentation and charge capture solutions of Salar, which Transcend acquired last summer).

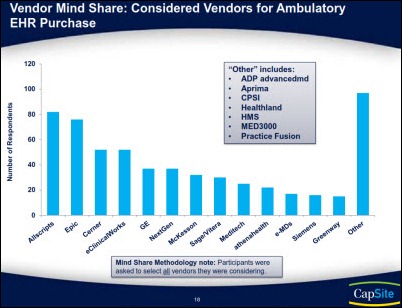

HIMSS acquires CapSite, which offers a vendor database that includes actual pricing and contract information as well as research services that HIMSS will fold into HIMSS Analytics. It will be interesting to see how HIMSS balances the confidentiality desires of its vendor members against CapSite’s detailed and vendor-specific pricing and contracting information. My speculation is that it will go away, replaced by aggregated non-identifiable vendor information. And as I tweeted when the news was announced, that means that HIMSS is now an inadvertent HIStalk sponsor, which Inga pounced on with great glee.

In one of the oddest healthcare transactions in recent memory, The Washington Post Co. buys a majority stake in a hospice and home health service, obviously desperate for further non-media diversification as its Kaplan education cash cow dries up after the government reins in for-profit colleges.

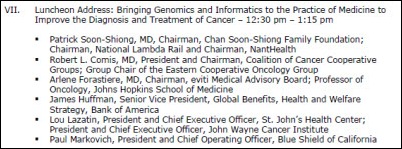

Healthcare billionaire Patrick Soon-Shiong announces a deal between his NantHealth company and Blue Shield of California, which will work with St. John’s Health Center in Santa Monica, CA to roll out healthcare breakthroughs and personalized medicine. He will present the news to a Bipartisan Policy Center conference in Washington, DC on Wednesday, starting with an invitation-only 8:00 a.m. small-group breakfast session and then a larger session later in the morning. He’ll be joined in the session covering the use of supercomputer-powered genomic medicine by Senator Bill Frist; J. Michael McGinnis of the IOM; the president of Blue Shield of California; the top medical executives from AT&T, Verizon, and Caremark; and several academics.

Sales

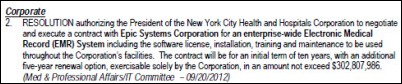

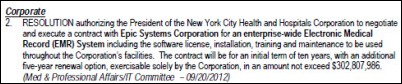

The board of New York City Health and Hospitals Corporation approves execution of a ten-year, $303 million contract to implement Epic throughout the entire corporation. I believe the incumbent was QuadraMed Affinity, although it’s been a long time since I’ve thought about HHC. Cerner and Allscripts were the losing bidders and Allscripts has formally protested the award to Epic, which I would assume means HHC passed on the lower bid by Allscripts, which isn’t at all unusual when prospects get Epic fever. I assume the only difference from the usual hospital decision is that HHC is a government entity, so there’s someone to complain to. UPDATE: readers tell me the product HHC is running is QuadraMed CPR, the former HDS Ulticare / Per Se Patient1 / Misys CPR that they bought from HDS in the early 1990s and used in all inpatient, outpatient, and ancillary areas. It won them a Davies Award in 2006.

Baton Rouge General Medical Center (LA) chooses RelayHealth for its enterprise HIE.

The 77-physician Optimal Radiology selects McKesson Revenue Management Solutions for billing, reporting, and collections.

Faxton St. Luke’s Healthcare (NY) adds the Surgical Information System anesthesia information management system to its Allscripts Sunrise Surgery perioperative system.

The US Coast Guard awards Lockheed Martin a $2.3 million contract to develop a mobile interface to its Epic-powered EHR.

People

Device integration provider Nuvon appoints Christopher Gatti (Living Strategies) CEO and Stephen Spencer (Advantis Medical) VP of sales and marketing. Cathleen Asch will transition from CEO to EVP of strategic initiatives and remain on Nuvon’s board.

Jo Ann Rooney (DoD – above) and Robert Mills (ACS/Xerox) join Huron Consulting Group’s healthcare practice as managing directors.

The Military Health System names David Bowen (FAA) CIO.

University of Buffalo School of Medicine names Peter Winkelstein, MD as executive director of the school’s Institute for Healthcare Informatics. He is also CMIO of UB/MD.

Impact Advisors hires C. Lydon Neumann (Accenture) as VP.

Health Care DataWorks names founder Jyoti Kamal, PhD as president. She was previously deputy CIO and director for the information warehouse at The Ohio State University Wexner Medical Center.

Aspirus names Todd Richardson (Deaconess Health System) as CIO.

Jonathan Grau (AMIA) joins National Quality Forum as senior director of stakeholder collaboration.

Florence Chang is promoted to EVP of MultiCare Health System (WA). She was previously SVP of clinical support services and CIO.

Announcements and Implementations

WakeMed Health & Hospitals (NC) implements the Philips eICU remote critical care monitoring technology.

AHIMA awards the University of Wisconsin Hospital and Clinics the Grace Award for demonstrating effective and innovative approaches in using health information to deliver high quality healthcare.

Healthland will integrate Health Language’s terminology platform to support ICD-10 readiness and terminology standardization.

UnitedHealthcare commits $20 million to help 11 critical access hospitals in California improve their technology, including the addition of EHRs.

Partners HealthCare pledges to award Massachusetts community health centers $90 million over the next 15 years to upgrade technology and make other infrastructure improvements.

CORHIO announces that all six northern Colorado hospitals are connected to the HIE.

UPMC, Oracle, IBM, Informatica, and dbMotion will create a $100 million data warehouse that combines clinical, financial, administrative, and genomic information for analytics and predictive modeling applications.

Orion Health awards Cognosante a contract to provide integration and identity management for the first stage of the Massachusetts Statewide HIE program.

MModal makes available its Catalyst for Quality solution for clinical documentation.

North Carolina Healthcare Information & Communications Alliance offers a Vendor Management Policy Template that addresses HITECH requirements for business associate agreements. It’s free to NCHICA members, $50 otherwise.

A study published in the Journal of Clinical Epidemiology finds that DynaMed is ranked highest of 10 online clinical resources based on timeliness, breadth of coverage, and quality of supporting evidence.

CTG signs an Epic implementation contract with an unnamed five-hospital IDN.

The city of Billings, MT goes live with an ONC-funded and Dossia-powered pilot project to give its employees the ability to view and manage their electronic health information.

Dolbey announces the VoiceBox recording system that tags physician dictation so that the completed transcription can be inserted into the correct location of the EMR.

Verizon announces a cloud and data center infrastructure for storing and sharing PHI. Unlike non-healthcare cloud providers, Verizon will sign a business associate agreement that meets HIPAA requirements.

VersaSuite announces that its 8.0 product has earned pre-market CCHIT ED certification. VersaSuite is certified for both inpatient and ambulatory use, a distinction it says only two companies have achieved.

Government and Politics

Medicare initiates two ACA-legislated programs that target quality of care and readmission rates in hospitals. The Hospital Value-Based Purchasing Program allows the government to pay hospitals bonuses if they meet high performance standards on certain quality measures, while the Hospital Readmissions Reduction Program enables Medicare to reduce reimbursements up to one percent for hospitals with high readmission rates.

ONC announces a goal of helping 1,000 critical access hospitals achieve Meaningful Use by the end of 2014.

ONC releases a consumer-focused video on the benefits of electronic medical records, with cameos by Todd Park, Don Berwick, Farzad Mostashari, David Blumenthal, and others.

Innovation and Research

Kaiser Permanente researchers find that the use of an EHR improved drug therapy and follow-up monitoring of Type 2 diabetics, as well as improved the patients’ glycemic and lipid control.

Health Nuts Media launches a crowdfunding campaign, hoping to raise $90,000 to develop an asthma education app for children. Rewards are offered for various donation levels, with a $50 contribution earning a copy of the app, a “Wall of Fame” credit, coloring pages, a poster, recognition in the app, and a tote bag.

Technology

CalHealth prepares to launch MD Mouse, a device that measures pressure information when a finger is slid inside a cuff that folds out from the middle section of the mouse.

Other

The Census Bureau says adults under age 65 made an average of 3.9 visits to physicians in 2010, down from 4.8 visits in 2001. Possible explanations: more uninsured, fewer physicians, higher patient costs, innovation that allows providers to accomplish more in a single visits, and more meds available without a prescription.

Cerner expects over 10,000 attendees from 21 countries at its 27th annual Cerner Health Conference next week in Kansas City.

An Irish pediatric surgeon is found guilty of poor professional performance after a 2010 error in which the wrong mouth surgery was performed on a baby. The doctor correctly ordered an upper lingual frenulectomy in his patient notes, but an administrator entering the procedure into the hospital’s computer system said the only option it gave him was “tongue-tie.” He chose that option, it printed on the OR list, and the surgeons performed that operation. They chairman of the inquiry committee said he was satisfied with the decision even though the committee had concerns about the OR scheduling and coding systems.

Weird News Andy is amused that a study finds that tickling rats after inducing a stroke appears to prevent paralysis and sensory deficits, possibly by forcing a rerouting of blood through unblocked veins. Playing music seems to work equally well, leading to the “it may not help, but it can’t hurt” recommendation that when someone is suspected of having a stroke, squeeze their hand and talk to them. WNA is also amused at the prospect of giving the rats warfarin as a stroke treatment, which usually is dosed in much larger quantities in the form of rat poison.

WNA cheers this story with a hearty “Hear, hear.” Doctors at Johns Hopkins successfully create a new ear for a woman who lost the original to cancer. They grew the new ear under the skin of her arm until it was ready to be attached.

Strange: a veteran sues the VA for $10 million, claiming that a nurse packed his groin with ice for 19 hours following his genital surgery, causing frostbite that required reconstructive surgery.

Sponsor Updates

- Elsevier launches its nationwide ClinicalKey Experience Tour, an all-day outdoor event at hospitals and academic centers to promote its ClinicalKey clinical reference tool.

- Iatric Systems offers an October 11 webcast on Meaningful Use Stage 2 featuring Beth Israel Deaconess Medical Center CIO John Halamka, MD.

- Michigan Orthopaedic Institute (MI) selects the SRS EHR for its 17 providers.

- Intelligent InSites announces members of its Healthcare Advisory Board.

- Collom and Carney Clinic Association (TX) selects MModal Fluency Direct to voice-enable its EHR.

- Cynergis Tek CEO Mac McMillan achieves the Fellow of HIMSS designation in recognition of his advancement of privacy and security within healthcare.

- Balsam Healthcare Corporation (Saudi Arabia) licenses First Databank’s Middle East Drug Knowledge solution for integration with the OASIS HMIS system. FDB also releases new customizable alert categories within its FCB AlertSpace alert management system.

- Delta Health Technologies selects ZirMed as a preferred business partner to provide RCM solutions to homecare providers.

- McKesson hosts its 25th Health Solutions Conference next week in Orlando.

- Gregg Mohrmann and Mark Van Kooy, MD of Aspen Advisors will lead sessions at this week’s New Jersey HIMSS/Delaware Valley HIMSS joint annual conference.

A Report from athenahealth’s “More Disruption Please: The CEO Retreat”

By Jonathan Baran, Co-Founder and CEO, Healthfinch

Athenahealth’s recent "More Disruption Please" event brought together 50 CEOs of health IT companies and their investors to the Point Lookout Resort in Maine (a resort that athenahealth bought for $7.7M… a steal!). Each CEO was given their own private log cabin to stay in (or to sleep off late nights with Jonathan Bush). The purpose of the meeting was for athenahealth and these newer, innovative HIT companies to get to know and learn from each other.

Any time you get to spend time with Jonathan Bush, you never know what to expect. He did not disappoint, as he began at eight in the morning by impersonating Ali G, telling everyone how athenahealth gets "ka-ching and da bling for doing the right thing!" A couple of more presentations followed, including one by Marty Anderson, who asked how innovation can come from the top-down when "the healthcare industry is a giant cartel."

Then the fun began as 30 CEOs gave two-minute pitches, with five finalists promised a ten-minute presentation to 2,500 of athenahealth’s users. We (Healthfinch) were selected as one of the five finalists, along with iTriage, Entrada, Epion, and Wellframe. In a smart market research move, athenahealth then asked their customers to vote on which company’s product they would most like to see integrated with athenahealth. Ultimately, our scrappy startup from Madison, Wisconsin took second place to Aetna’s iTriage.

Jonathan Bush’s final display of how to "keep it real even when you’re CEO of a publicly traded company" began when he gave us a lesson on how to build a successful business model. Jonathan, like every other EMR CEO, drew inspiration from the “Saturday Night Live” skit, "D— in a Box." He gave us all the following instructions:

- Get a box (find a pile of work that users hate and suck at).

- Cut a hole in the box (figure out how to break into the market).

- Put your junk in the box (bring your secret sauce to the market).

I couldn’t say it any better myself.

Athenahealth also discussed more of their plans for their entire "More Disruption Please" program, the smartest move being their recognition that the biggest challenge in bringing innovation to market (and thus allowing small companies to flourish) is in the distribution channel. That’s why athenahealth is promising to bring the top innovations to their customers by rapidly scaling interesting products and innovations to their entire user base.

Time will tell if athenahealth can live up to its grand plans to become the information backbone of the health system, but their program (and their conference) seem to indicate they are on the right track.

Contacts

Mr. H, Inga, Dr. Jayne, Dr. Gregg.

More news: HIStalk Practice, HIStalk Mobile.

Merry Christmas and a Happy New Year to the HIStalk crowd. I wish you the joys of the season!