Top News

The HIT Policy Committee approves multiple recommendations presented by the FDA Safety and Innovation Act (FDASIA) Workgroup, including:

- HIT should not be subject to FDA premarket requirements except when it constitutes medical device accessories or involves certain forms of high-risk CDS, such as computer-aided diagnostics. EHRs, decision support algorithms, and HIE software may be subject to regulation.

- Vendors should be required to list products that are considered to represent potential risk.

- Post-market surveillance of HIT should include reporting from users and vendors and also include post-implementation testing.

The committee also called for adoption of existing standards and creating new standards to address specific areas, including HIE. The recommendations now go to the FDA, ONC, and FCC, which are expected to release a proposal for public comment early next year.

Reader Comments

From Dr. Loredana: “Re: male vs. female physician compensation. A study found that women docs spend more time with patients. Therefore, they see fewer patients and thus make less money. Physicians’ time should be valued and addressed just like any other resource in healthcare. It is finite and scarce and we only have 24 hours in the day like anybody else.” A quick Google search uncovered a number of studies indicating that female physicians spend an average of 10 to 50 percent more time with patients than their male counterparts. Now I am curious if there are any studies tying outcomes with time spent per patient encounter.

From Dr. Loredana: “Re: male vs. female physician compensation. A study found that women docs spend more time with patients. Therefore, they see fewer patients and thus make less money. Physicians’ time should be valued and addressed just like any other resource in healthcare. It is finite and scarce and we only have 24 hours in the day like anybody else.” A quick Google search uncovered a number of studies indicating that female physicians spend an average of 10 to 50 percent more time with patients than their male counterparts. Now I am curious if there are any studies tying outcomes with time spent per patient encounter.

From Tallman Letters: “Re: consulting firms and vendors. I’m turning to you, our most trusted source! Which healthcare consulting firms or vendors are most qualified to (a) provide technical consulting to providers about what technical architecture they should use; (b) build a healthcare data model; and (c) implement the tech architecture for full EDW/BI? Keep up the great and amusing work you do for us all!” I’m turn to my most trusted source – readers. Please leave a comment with your thoughts for TL.

HIStalk Announcements and Requests

Some of this week’s highlights from HIStalk Practice include: athenahealth reveals development plans for its recently purchased Arsenal complex, including walking and biking paths, an incubator for HIT startups, and a beer garden. Minnesota State Fair visitors are given coupons for free healthcare e-visits. More than half of all medical students use tablets as part of their medical training. The IT administrator at an orthopedic practice accesses a physician’s electronic signature to forge prescriptions. Dr. Gregg discusses the darker side of vendor-provider relationships, including Practice Fusion’s opt-out policy for sending patients emails that appear to come from providers (I also share my view.) Thanks for reading.

Some of this week’s highlights from HIStalk Practice include: athenahealth reveals development plans for its recently purchased Arsenal complex, including walking and biking paths, an incubator for HIT startups, and a beer garden. Minnesota State Fair visitors are given coupons for free healthcare e-visits. More than half of all medical students use tablets as part of their medical training. The IT administrator at an orthopedic practice accesses a physician’s electronic signature to forge prescriptions. Dr. Gregg discusses the darker side of vendor-provider relationships, including Practice Fusion’s opt-out policy for sending patients emails that appear to come from providers (I also share my view.) Thanks for reading.

On the Jobs Board: Healthcare Customer Advocate, Clinical Applications Consultant, Project Manager.

Acquisitions, Funding, Business, and Stock

Agilum Healthcare raises $1.43 million in a debt offering.

Teladoc acquires fellow telemedicine services provider Consult A Doctor for an undisclosed amount.

SAIC announces Q2 results: revenue down 12 percent, EPS $0.13 vs. $0.32, missing expectations and cutting its 2014 outlook. Its health an engineering segment did better, but only because of the recently acquired maxIT Healthcare. SAIC plans to split itself into two companies, with its national security, health, and engineering operations to be moved to a new company called Leidos, with headquarters in Reston, VA. Healthcare is the smallest of the three operations with 6,000 employees.

Sales

Tenet’s Saint Louis University Hospital selects iSirona’s device connectivity solution.

Pekin Hospital (IL) selects Interbit Data’s NetSafe business continuance and downtime protection software.

The VA awards AMC Health a five-year, $28.8 million contract to provide telehealth solutions and services.

Mt. Washington Pediatric Hospital (MD) contracts with HealthCare Anytime for its Enterprise Patient Portal Suite.

Community Medical Centers (CA) selects Infor Cloverleaf.

People

Cerner promotes Zane Burke from EVP of the company’s client organization to president. Neal Patterson, who covered the president role since former President Trace Devanny left in 2010, will retain the titles of chairman and CEO. Cerner says that Burke’s promotion does not represent a formal succession plan announcement.

HIT consulting firm Meditology Services names Michael Flynt (Workday) VP of sales.

Patient engagement portal provide Omedix appoints Shay Pausa (ChiKiiTV/Magnet) CEO.

Caradigm appoints Joel Ratnasothy, MD (Fujitsu) as medical director for Europe, the Middle East, and Africa.

Anil Chakravarthy (Symantec) joins Informatica as EVP/chief product officer.

Diane Cecchettini, RN, president and CEO of MultiCare Health System (WA), announces her retirement next year. She served as a flight nurse in Vietnam, was a troop commander in Desert Storm, was president of the Washington State Hospital Association from 2005 to 2007, and won several IT awards.

Marc Donovan (World Wide Technologies) joins Nexus as sales director for the company’s connected healthcare practice.

Announcements and Implementations

Virginia Hospital Center will invest five to $10 million to consolidate its 100-plus employed physicians into one multi-specialty group and migrate the currently separate practices to eClinicalWorks.

Cerner will integrate Elsevier’s CPM CarePoints and InOrder evidence-based content solutions into its PowerChart EHR.

Artemis Health Group will add Health Language’s clinical language management tools from Wolters Kluwer Health into the Artemis OB/GYN EHR, PM, and patient engagement solutions.

Carolinas HealthCare System will use aggregated claims and clinical data from Verisk Health to analyze and manage population health.

Castle Medical Center and Hawaii Pacific Healthcare will join Health eNet, Hawaii’s statewide HIE.

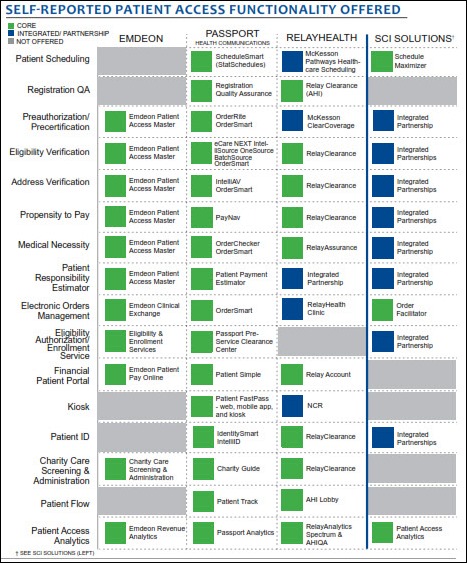

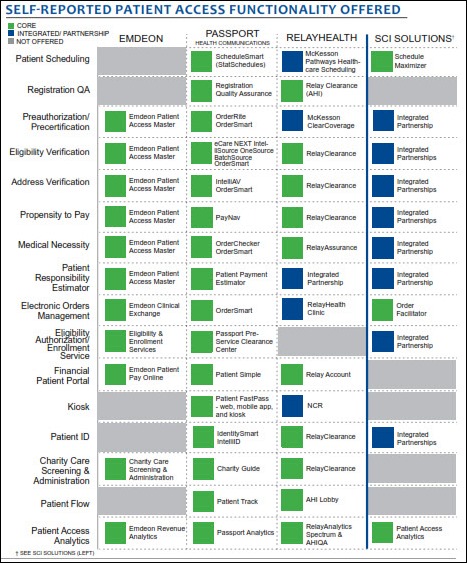

A new KLAS report on enterprise patient access finds that best-of-breed solutions are common, with the most important functions to users being calculation of estimated patient responsibility, eligibility verification, and preauthorization.

HealthTech’s YourCareCommunity.Com v1 earns ONC-ACB certification as a modular EHR.

Intelligent InSites adds integration with HyGreen’s hand hygiene monitoring system to warn workers who haven’t washed their hands.

The UHC alliance announces plans for an automated program that will extract clinical and administrative information from the IT systems of its members and transfer it to UHC for benchmarking. NYU Langone Medical Center and Cleveland Clinic will be the first adopters, with the system expected to be available to all UHC members by the end of 2013.

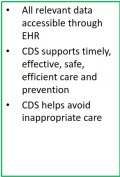

NextGen Healthcare client Willamette Valley Providers Health Authority (OR) deploys a clinical decision support tool developed by the Clinical Decision Support Consortium that takes a request for CDS from NextGen Ambulatory EHR, delivers it to an enterprise clinical rules service at Partners HealthCare for analysis, and immediately returns recommendations within the NextGen application. The “cool” factor here: community-based physicians can access CDS data from a large academic medical center across the county and retrieve recommendations at the point of care. The Consortium aims to establish nationwide consistencies for CDS recommendations and is comprised of members from provider organizations and EHR vendors, including Partners and NextGen.

Government and Politics

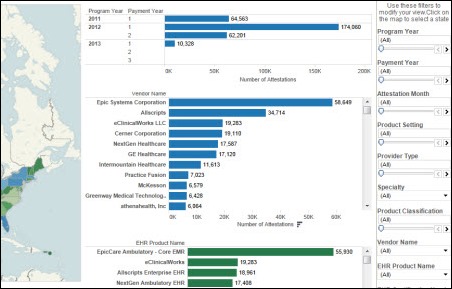

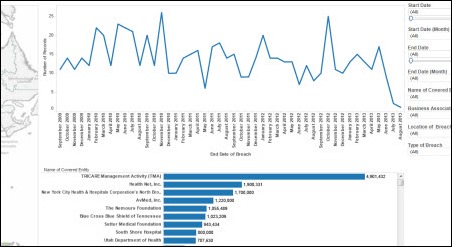

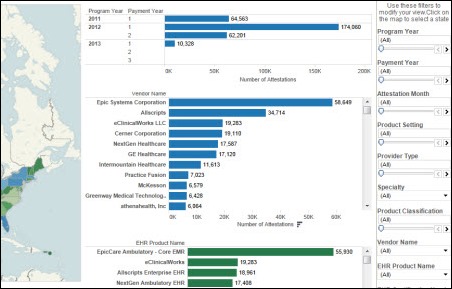

Brian Norris of Social Health Insights LLC created a cool visualization page for Meaningful Use attestation data using tools from Tableau Software.

Innovation and Research

GE, Under Armour, and the National Football League launch the GE NFL Health Health Challenge, which will award prizes of up to $10 million for concussion-related solutions that can include technologies to detect and measure brain injury.

Palomar Health expands its Google Glass incubator Glassomics to include smart watch technology in healthcare. For some background on the smart watch market, see Lt. Dan’s post on HIStalk Connect, “A Primer on the Up-and-Coming Smartwatch Market and What It Means for Healthcare.”

A Mayo Clinic study finds that data from the Fitbit activity tracker can help predict the mobility of post-op patients and help clinicians customize their care plans.

Research by the Pennsylvania Patient Safety Authority finds that EHR default values cause quite a few errors in drug doses and times, although nearly none of the errors caused patient harm.

Other

John Halamka’s five biggest CIO challenges for the next few months:

- IT requirements driven by mergers and acquisitions

- Regulatory uncertainty related to ICD-10, HIPAA Omnibus, and Meaningful Use Stage 2

- Meaningful Use Stage 2 requirements, particularly at shops like BIDMC that build their own applications

- The ability of provider organizations to keep the doors open while trying to meet all the regulatory requirements as revenue declines and risk-based reimbursement increases

- Leading in real time

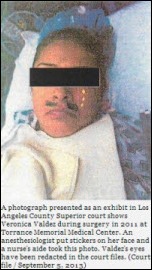

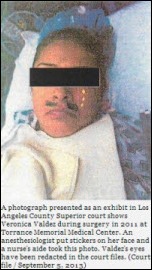

I am ashamed to admit that I found this story just a teeny bit amusing, though so pathetically wrong. A patient files a civil lawsuit against Torrance Memorial Medical Center (CA) after discovering that an anesthesiologist had decorated her face with stickers while she was unconscious during surgery. A nurse’s aide snapped a photo of the patient, who was freshly adorned with a black mustache and teardrops. The anesthesiologist and other involved employees were disciplined but not fired.

I am ashamed to admit that I found this story just a teeny bit amusing, though so pathetically wrong. A patient files a civil lawsuit against Torrance Memorial Medical Center (CA) after discovering that an anesthesiologist had decorated her face with stickers while she was unconscious during surgery. A nurse’s aide snapped a photo of the patient, who was freshly adorned with a black mustache and teardrops. The anesthesiologist and other involved employees were disciplined but not fired.

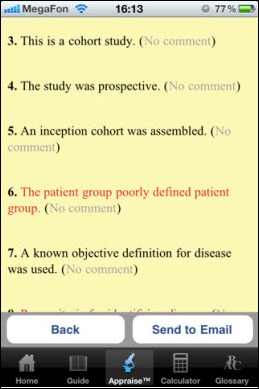

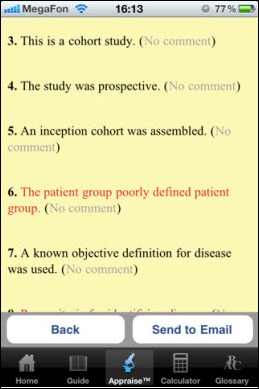

Three UK doctors face a loss of their medical licenses after allegations that they copied material from a book to create an iPhone app that helps evaluate clinical evidence. One of them faces an additional charge of posting a positive review of the app on the App Store without disclosing that he has a financial interest in it.

A Forbes article wonders if Cleveland Clinic can save its home city with its $6.2 billion in revenue, $300 million in operating income, $10.5 billion in assets, 42,000 employees, its own 141-trooper division of the state police, and now its plans to spin off for-profit companies and jump start the local economy with the Global Center for Health Innovation, scheduled to open next month with HIMSS as its largest tenant. Cleveland’s population has dropped 10 percent in the last decade and median income fell 60 percent, with its only economic bright spot being healthcare.

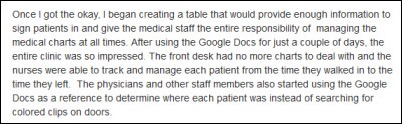

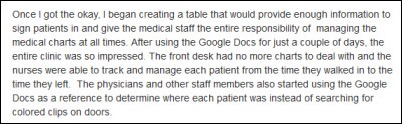

Anybody see a HIPAA problem with this pre-med student’s Google Docs-based patient tracking solution?

Cardiologist Eric Topol, MD, who is also editor-in-chief of Medscape as of February 2013, interviews Farzad Mostashari, MD. It’s good. Some snippets and factoids:

- Mostashari came to the US from Iran at 14, then went to Harvard and Yale.

- “Ninety percent, probably, of what happens in healthcare today has no basis in evidence. At the very least, I think what we owe ourselves and our patients, what we really want to do is: If we have variation, if we make a decision that is not based on the general guideline, it should be studied so that we learn something from that variation.”

- “The dream is that with every encounter, you know everything about the patient. You know everything about any medical knowledge that has ever been generated and you know everything about what is happening right now in the community where we are. Because the treatment for a sore throat is going to be different in January with the flu epidemic than it is going to be in September when asthma is peaking. So you have to bring in the 10 to the 6th power, the 10 to the 3rd power, and the 10 to the zero in that encounter. Whatever you do generates and goes back to teaching everybody else what is going on in the community, what is going on in medicine, and contributes to this patient’s knowledge. Right now my visit doesn’t even contribute to my next visit.”

- On $37 billion in HITECH incentives: “I think doctors would say that they earn it. No one gives out anything.”

- Mostashari and US CTO Todd Park roomed together when they moved to Washington, DC four years ago in July, sharing a small apartment with no air conditioning.

- On the jokes that ONC stands for “Office of No Christmas” because of the push to get the work done. “That is what it felt like — that there is this incredible urgency. You have a day, a week, a month, and pretty soon the opportunity to make a difference is gone.”

- “Meaningful Use, it is a tool. Take that certification, take that decision support, take that quality measurement. Don’t have quality measurement done to you or say, ‘I am going to be paid and judged based on quality. I can’t control that.’ What you can do is make it meaningful; take the tools and make them meaningful. Help your staff make the tools meaningful.”

- “We are going to solve this path that we have been on towards unsustainable cost growth. One out of every $5 spent in this country is being spent on healthcare. It is just amazing, and it is not sustainable. It is not sustainable for people, for families, for businesses, for state governments, for federal governments. It is not sustainable for anybody. We are going to solve that. I think we are going to solve it not by cutting people back, not by saying ‘You can’t get that,’ but by delivering better care. I really believe that.”

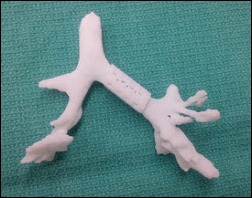

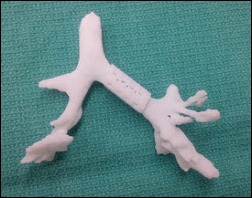

Weird News Andy thinks it’s cool that a University of Michigan 3D-printed lung splint saved a child’s life. The surgeon says he hand-carves such devices when necessary, but he can’t match the accuracy or speed of the computer.

Sponsor Updates

- Forrester Research names Ping Identity a leader in its identity and access management report.

- EDCO creates a video explaining its point-of-care medical records scanning process.

- Truven Health Analytics releases ActionOI Practice Insights, which allows hospitals and practices to compare productivity, costs, and utilization.

- ZirMed partners with EHR Integration Services to provide Allscripts PM and GE Centricity Group Management customers integration with ZirMed’s RCM, clinical communications, and analytics solutions.

- Kareo tops Black Book’s list of Top 20 Seamless Software Vendors for EHR, Practice Management, and RCM.

- NYC REACH, the REC for New York City, assigns Aprima the Medical Meaningful Use Champion status in its vendor recognition program.

- Medseek reports that 10 healthcare organizations are using its Empower enterprise patient portal and another 11 will go live in the next six months.

- Paul Taylor, MD, CMIO of Wellcentive, outlines the performance and improvement part of the Health Care Network Maturity Model.

- Vitera hosts a September 25 webinar on preparing for the PCMH transformation.

- An SiS blog post lists the “Top 6 Things Anesthesia Providers Should Know When Evaluating AIMS.”

- GetWellNetwork shares data from its healthcare system customers that demonstrate the relationship between patient engagement and improvements in patient satisfaction, quality and safety, and finance and operations.

EPtalk by Dr. Jayne

I wrote last week about a Wall Street Journal Health Blog piece. It referenced a survey about what motivates doctors as they make care decisions. More than half felt physicians want to do what’s best for the patient, where the choices of “fear of lawsuit” and “business / financial considerations” each received 21 percent of the response.

Since I covered fear of lawsuits already, let’s talk a little bit more about financial considerations. It’s easy to see a response of “business / financial considerations” and assume that means “what’s in the provider’s best financial interest.” I don’t think the vast majority of clinicians think that way. If we were constructing this survey, we’d have more granular choices. One of the main things I think about (after discussing the clinical appropriateness of a proposed procedure, treatment, or test) is whether there is a way to pay for the test. It was bad enough when all I had to worry about was whether the patient had insurance that would cover it, but today it’s so much more complicated. It doesn’t do any good to recommend a treatment if there is no way the patient can receive it due to financial constraints.

First, we have to think about whether the patient even has insurance coverage or not. If they do, is this symptom or condition related to anything pre-existing that may or may not be covered? If not, do I need to contact the payer for an authorization? How difficult is it to obtain the authorization? Are there tests, documents, or examples of trials of therapies that have to be provided for a medical review board to determine coverage? Does the payer have arcane rules that have been grandfathered into the plan regardless of recent legislation to ensure services are covered?

Should the authorization be obtained, are there limits on where I can send the patient? Does the patient have geographic or transportation issues that would make it more feasible (economically or otherwise) to do it at one facility over another? Does the patient have religious preferences that are in conflict with the mission of the preferred facility? Do I have to write a letter to explain the distress it would cause if allowances can’t be made for a non-preferred facility?

The next consideration is that even though the patient may have insurance and the procedure may be authorized, the out of pocket cost for the patient may be more than he or she can bear. Those under high-deductible plans are electing to defer care to the end of the year in hopes that they will meet their deductibles by then. If it’s a preventive service, we may have the opposite time shift: some plans have yearly aggregate limits on preventive services, so if they’ve already met the limit for the year, they may elect to push it to the next calendar year. Regardless of the kind of coverage, we have to know whether the patient can afford the patient portion of the cost, whether it’s a deductible, co-pay, co-insurance, or something else.

Let’s say the patient does not have insurance coverage. We have to think through whether the patient qualifies for any public assistance programs and if so, how long it would take to become enrolled vs. how acute the need for the test / treatment / procedure might be. If they don’t qualify for public assistance, are there any grant programs? Are there public health resources? Is there a hospital or imaging center doing a free outreach program? If not, do I have any colleagues in my hip pocket who would be willing to perform the procedure with a payment plan or under other medical hardship arrangements? Does the facility make allowances for self-pay patients and do they allow them to negotiate price? If so, what is a reasonable price? Where can the patient get more information?

Once we get through figuring out if we can proceed and how we’re going to pay for it, can the patient afford to take off work to have surgery, complete treatment, etc.? Is he or she covered by the Family and Medical Leave Act? Does he or she have to wait until they are eligible for coverage? Is there a short-term disability policy in place, and if not, does the patient have enough vacation time or other resources to be able to be off work? Or does he or she have to take the time off unpaid? Are there other family dynamics or barriers to care, such as who will take care of small children while the patient is in treatment? (Remember assessing barriers to care is part of being a patient-centered medical home and participating in pay-for-performance and accountable care initiatives. Believe it or not, worrying about the patient’s childcare arrangements has become our problem.)

If you’re not a provider, are you exhausted just reading this? I know I am. The absolute last thing to cross my mind in these situations is whether my practice will make any money ordering the intervention. Looking at the costs in the office for clerks, paper pushing and administrative shenanigans, multiple phone calls, faxes, the patient’s time, and my time to work through all of this, we’ve already lost money before the order even leaves the EHR. When you think about it this way, I’m surprised that business and financial considerations didn’t rank higher in the survey because it seems they’ve become part of nearly every clinical decision we make.

Maybe elements like this roll up under the attempt to do the right thing for the patient. Or maybe the average person taking the survey didn’t think about all these different factors. This wasn’t really a scientific survey, but I bet if you wanted to create one, the qualitative researchers would have a field day. I’d enjoy seeing the comparison between a survey of the general population vs. a survey of healthcare providers.

What do you think motivates doctors as they make care decisions? Email me.

Contacts

Mr. H, Inga, Dr. Jayne, Dr. Gregg, Lt. Dan, Dr. Travis.

More news: HIStalk Practice, HIStalk Connect.

The story from Jimmy reminds me of this tweet: https://x.com/ChrisJBakke/status/1935687863980716338?lang=en