Nora Lissy, RN, MBA is director of healthcare for Dimensional Insight of Burlington, MA.

Tell me about yourself and the company.

I’ve been a registered nurse for over 30 years. I started out as a clinician, with the majority of my time spent in the emergency room. I then got interested in hospital operations and working with the operational folks and leadership. As healthcare evolved, I evolved with it and got into analytics, understanding numbers and outcomes. I used Dimensional Insight’s system in three different organizations in three different roles and found that I loved what I was able to do with it. I came on board with the company in 2013. I help organizations understand their information, their data, and to get the right data to the right people so that they can act upon it.

Do health systems underuse nurses and other clinicians in using data to make decisions?

Yes. Our president likes to talk about the “data gene,” which some people have and some don’t. Every organization definitely has pearls — not only nurses, but lab and rad techs who actually understand the global picture. There’s always one person in every department where everybody knows that if you need an answer, you go to them. Those people are usually data-driven to begin with, just naturally.They do get underutilized, or shall I say mis-utilized. They have their regular job, and then when they have a chance, we’ll have them do reports and stuff like that for us. But some very strong care providers are also analytical and would be helpful in pushing forward the analytics process.

BI and analytics tools triggered a buying frenzy. What was the result?

Like you said, it was a frenzy. Everyone felt like they had to get it. Many people are influenced by pretty pictures, or they go down a path and they’ve got someone who’s caught their interest.

What I’ve noticed in working with customers and in the literature is that sometimes customers take on too much. BI is a journey. When an organization tries to do 15 projects at the same time, it’s inevitable that none of them will get finished. A project gets started. Then it’s like, OK, this is cool, we can use that same tactic over here. They start big project B before finishing big project A, with the same people working on both. Now you’ve pulled them in two different directions and nothing gets finished.

The successful ones that I’ve seen have stayed within the guidelines of their strategic plan. Some people feel it takes too long to get that done, but you need to have a plan, a path you’re going down. Not just say, “We’ve got BI and we can do everything.” Every tool can, but you have take the steps and do it and close the loop before you go to the next one.

I’ve worked in organizations that had four or five BI tools, so they had four or five reporting teams. They still had the same problem — my BI tool says this, your BI tool says that. They never really got together and said, what do we say as an organization?

Does BI get the credit way down the line when the decisions it influenced finally produces positive, measurable results?

I think so. What I’ve seen is that there’s a big fervor at first. Everybody gets it, they see stuff, and they go wow. But a BI install suddenly provides access to a lot of information. That’s the other “aha” that gets you. We have all this data and we don’t know what to do with it. We had none, now we have too much. How do we core it down to what’s going to be meaningful to us?

That’s where I think the BI tool can come into play, to help us focus on what we need to focus on because we have so much out there. Healthcare is just loaded with data, and more comes in every day. We want to use these complex business rules and these algorithms, but we could have obtained the same answer if we had just used a quicker approach.

Health systems have all this new data, multiple teams, and a mix of acquired health systems and practices using different systems and different terminologies, plus trying to decide whether to centralize the analytics function. Do these factors make it tougher to do analytics right?

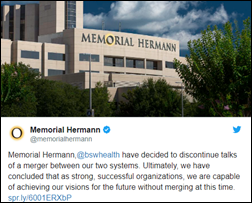

Absolutely. It’s an absolute challenge, everything you just said. You might have a hospital organization that has been using an embedded BI tool for years. Then all of a sudden they acquire, or they’ve been acquired. They decide that they don’t want A, or they really want B. Then you have to go through a conversion of what they’ve done. Aside from just the acquisition process, you have to work on linking and cross-walking different EMRs or even the same EMR implemented with different approaches.

I’ve worked in two organizations that had four or five reporting teams. We were chasing our tails. Who do you believe? Who has the loudest voice this month or with this leadership? The people who really need the BI, the operational and front-line people, throw up their hands and say, “I don’t even know what I’m getting any more, so I don’t even care.” You look at who is using the BI and there’s little utilization. The people we’re trying to help don’t even get all the information they need because there are too many competing answers.

I find that the best success is when you bring in not only stakeholders, which is your leadership, but also the people that you’re expecting this data to help. They need to be a part of the process. You can’t just put this together and say, here you go, you’re on your own, take it and run with it. You have to bring them into the process so that they understand the value they’re getting. It’s one thing bringing a BI tool in, but what’s the value I’m going to get from it? Is it just one more report that I have to go through, or will it give me value and make my day better?

My experience is that the people who use analytics the most are department managers and directors instead of C-level executives who don’t even have computers on their desk. Should the C-suite be involved or pay more attention to what data is available and how it’s being used?

I would say that over the last two or three years, I’m seeing more and more C-suite involvement. I have a couple of customers that if the information isn’t available when the CEO comes to work, he or she is calling and saying, where are my numbers? So I am seeing more senior suite involvement.

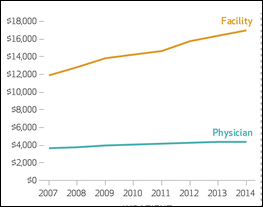

There are two types of BI – the “how are we doing” numbers for the C suite and then the operational things, which are near and dear to my heart. The things that I had to do as a clinician or as a manager of clinicians. The things that I needed to arm them with. We can give that to them. Before, we would have to go through 15 reports to try to figure it out. It’s making their life easier.

There are so many rules and regulations coming out in healthcare. I have to remember to dot my I and cross my T. Maybe if I had a queue list to tell me that these are the three things I have to worry about, that would make my life easier.

It’s like anything else you do in life. It’s a daunting task if you have a room full of garbage and you have to decide where to start. You have to pick at it and say, I know I’m going to keep the stuff over there. That’s one fewer thing I have to worry about. From a BI perspective on the operational side, they see their page with their three things and they’re all green and they’re good. If one is red, they have to go focus on that. It’s helping them get through their day-to-day operational side.

We haven’t quite gotten the value from BI because healthcare and the operational side of things are complex. When I say operational, I’m thinking about your clinical folks. Was the assessment done in 24 hours? When was the last time case management saw these patients? There are standing operating procedures that are in place that if something goes wrong, we might stop and take a look at it. But generally speaking, it just goes along day by day until the holes in the Swiss cheese line up and you realize you should have been seeing this. But life’s busy in the hospital. We need to provide actionable information to the day-to-day providers so they can prevent the harm.

What new data elements are available for that alerting and trending analysis and how are they being used to impact individual patient care instead of just giving executives a stoplight report?

It’s more the capacity of how BI itself is evolving and how data is being pulled. The old world of BI was SQL queries. Now you’re getting into columnar databases that allow for a faster retrieval and for more data to be viewed at one time. That technology allows you to cipher through millions of rows of data.

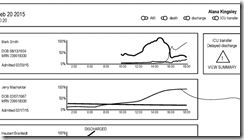

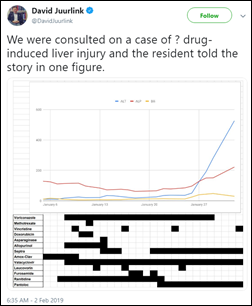

Think about it from a lab perspective. When I was at a healthcare organization in North Carolina, I worked with a clinical pharmacist to identify the five or six high-risk drugs that they wanted to have insight into. Then we got a tickler every time the lab values changed. We added the information to their hourly census, so that when the lab values came in and the patient was on this particular medication, they would see the trend before it got to a critical point. They would see that it’s been rising for the last two days by 0.2 percent each time, so we had better keep an eye on it.

It becomes more useful with the ability to visualize and manage more data at one time. I have another organization whose pharmacists use it to look at critical medications. They bring in over 40 million rows of data to use their work queues to improve their movement from IV antibiotics to PO antibiotics so they can lower cost, improve patient care, and hopefully get the patients out of the hospital sooner than later.

The BI approach uses technology to highlight exceptions to the defined desired values, while the machine language approach would be to throw a lot of data at the system to identify new problems or opportunities that humans have missed. How do those approaches co-exist?

Machine learning has a way to go, in my opinion. Someone still has to feed that machine some kind of algorithm, and it has to know what it’s looking for. Some are more sophisticated and can do patterning and I think that will become invaluable over time. It’s not mature yet, where physicians believe that it shows them what they expect. But it will be an invaluable asset as it continues to grow and as we continue to understand how all the data fits together.

Why have we stopped hearing the most overused term on the planet, “big data?”

Because everything is big data. It was just a catch phrase. I don’t know where it started, and then all of a sudden, it just went away and no one is even saying it any more. This may sound ignorant, but it’s the same thing when we talk about AI and machine learning. What do we mean by AI and machine learning? What concept do people have of that? What are the developer’s concepts? What do its potential users think? It raises the same kind of question as the term big data.

Do you have any final thoughts?

I really enjoy what I do now because I get to work within my passion in using analytics to help providers — who need it more than anybody else – and to help the operational folks with their daily operational process that is very difficult. There’s a lot of expectation that the people on the front line will get things done, remember all these rules, and do all these things. As we move forward in analytics, we will hopefully be able to make that life easier for them and help them focus on getting back to taking care of the patient.

Comments Off on HIStalk Interviews Nora Lissy, Director of Healthcare, Dimensional Insight

I generally follow AP Stylebook style guidelines: Do not use all-capital-letter names unless the letters are individually pronounced: BMW. Others…