Top News

Vera Whole Health, which offers healthcare navigation, care coordination and coaching to its members, will acquire navigation technology vendor Castlight Health for $370 million in cash, representing a 25% premium to Castlight’s share price.

Castlight customer Anthem will make an investment in the combined company.

Vera Whole Health’s president and CEO is Ryan Schmid, MBA, who founded the company in 2007 while operating a non-profit fitness center.

CSLT went public in March 2014 with a first-day trading pop of 149% as shares closed at $38.85. They were at $1.63 prior to the acquisition announcement.

Reader Comments

From Optum Employee 1160: “Re: Optum-owned remote patient monitoring vendor VivifyHealth. CEO, chairman, and founder Eric Rock is out, replaced by Optum Technology CMIO Alejandro Reti, MD, MBA. The CTO and COO have also left.” Unverified. I’ve reached out to the company.

HIStalk Announcements and Requests

I mention below the deaths of two health IT pioneers who were also pathologists, reminding me of the outsized contributions of experts in laboratory medicine, pharmacy, and radiology in the history of clinical IT. Those folks who worked in the relative solitude of hospital basements far from patients, especially pathologists, were involved in more patient-benefitting technology projects than anyone, often running rogue operations involving under-desk servers to avoid being shut down by old-school, command-and-control MIS/DP departments who focused on the care and feeding of billing mainframes. It is interesting that companies like Cerner and Meditech got their start with laboratory information systems, while Epic didn’t roll out Beaker until late in the game (presumably to avoid the heavily-regulated environment of labs, Elizabeth Holmes notwithstanding).

I took advantage of holiday slack time to upgrade my laptop to Windows 11, with no problems or noteworthy improvements to report.

Webinars

None scheduled soon. Previous webinars are on our YouTube channel. Contact Lorre to present your own.

Acquisitions, Funding, Business, and Stock

Employer healthcare payment vendor Nomi Health acquires employer benefits analytics platform vendor Artemis Health for $200 million. Both companies are headquartered in the Salt Lake City area.

Digital health technology vendor Babylon acquires health kiosk vendor Higi. Higi has raised $91 million, most recently in a May 2020 Series B round that was led by Babylon. London-based Babylon went public on the Nasdaq via a SPAC merger in November 2021. Share have since dropped 42%, valuing the company at $2.6 billion.

Life sciences real-world evidence vendor Aetion acquires Replica Analytics, which generates privacy-protected copies of real world data. Price was not disclosed, but Replica has raised just $1 million and reports just a handful of employees. CEO Khaled El Emam, PhD is a scientist Children’s Hospital of Eastern Ontario Research Institute and director of its laboratory that studies the identifiability of health information and how to measure it.

Axios reports that IBM is once again trying to find a buyer for IBM Watson Health at a rumored price of more than $1 billion.

Federal IT contractor Octo acquires B3 Group, which offers low code/no-code software development and holds a $686 million contract to develop the VA’s Digital Transformation Center.

Sales

- Seattle Children’s will implement AdaptX’s EHR-powered Mission Control Center for care management.

People

Healthcare information distribution and business continuity vendor Interbit Data hires industry long-timer Steve McDonald, MBA (Impact Advisors) as president.

Oncology systems vendor Flatiron Health hires Stephanie Reisinger (Allscripts Veradigm) as SVP/GM of real-world evidence.

Ronald Weinstein, MD, a hospital pathologist who developed the concept of telepathology in the 1980s and led the Arizona Telemedicine Program at the University of Arizona in Tucson for 25 years, dies at 83.

Industry pioneer Sidney Goldblatt, MD died Monday at 87 in Johnstown, PA. The hospital pathologist and entrepreneur founded Sunquest Information Systems in Tucson, AZ in 1979, took it public, and sold the company to Misys in 2001. He then founded precision medicine company Goldblatt Systems, genomics testing firm MolecularDx, and forensic science center ForensicDx.

Announcements and Implementations

PointClickCare and Sound Physicians will offer a long-term and post-acute care virtual health solution.

Alternate site infusion vendor Option Care Health will provide connectivity via the CommonWell Health Alliance in partnership with WellSky.

A surgeon’s letter to the editor of the BMJ notes that while Theranos news stories are focusing on Elizabeth Holmes being found guilty of investor fraud, some of the company ‘s hundreds of employees must have known that its technology was issuing erroneous patient lab results, and those complicit folks have likely found related jobs elsewhere.

A report reviews the telehealth regulations of individual states, evaluating best practices such as:

- Not requiring an initial in-person visit.

- Recognizing all remote care and monitoring modalities.

- Allowing providers to serve patients in other states.

- Allowing licensed, non-physician providers to provide services via telehealth.

- Allowing nurse practitioners to practice without physician supervision.

- Not imposing mandates that all services be covered since outcomes vary by service type.

- Not requiring telehealth services to be paid at the same rate as in-person visits.

- Supporting licensure compacts that allow providers to provide services in multiple states without high cost and laborious application requirements.

- Not allowing health systems to charge facility fees for telehealth.

Massachusetts Health Quality Partners President and CEO Barbra Rabson, MPH observes that surveys show that patients are a lot happier with their telehealth visits than their providers. Patients save the sometimes full-day effort that is required to show up for a 10-minute provider visit, but providers are less enthused because it’s a different experience from their training, they were thrown into telehealth with no transition in the pandemic’s early days, and telehealth quality varies based on organizational practices. An MHQP group recommends creating mode-appropriate triaging guidelines, measuring and comparing physician satisfaction across modalities, asking providers about their technical support needs, promoting community and workplace sites for patients to have telehealth visits, and studying barriers to patient use.

Former White House health advisors say in a JAMA Viewpoint article that the “zero COVID” vaccine-centric strategy is not valid and a new US strategy is needed to move from crisis to control in exiting “a perpetual state of emergency” to recognition that the virus is likely to remain endemic. They recommend recognizing that COVID-19 is one of several respiratory viruses whose risk should be aggregated (instead of ignoring older ones like flu and RSV) with a focus on hospitalizations and deaths. They also call out the need to develop a real-time, digital public health infrastructure that links respiratory viral infections to hospitalization, deaths, outcomes, and immunizations from local, state, and national public health units, health systems, laboratories, and universities. In this and two other JAMA articles, the six former White House health advisors also call on universal access to low-cost testing, N95 masks, and oral COVID treatments; next-generation vaccines that address variants or are delivered nasally or via skin patch; and continued research to develop of a universal coronavirus vaccine. They also express support for an electronic vaccine certification platform. One of the physicians says that the White House has not invested enough in tests, treatments, and public health protections, concluding that, “No one wants to face up to the reality. You can pay for it with prevention, as we’ve outlined, or you can pay for it on the back end, which is the American way.”

Government and Politics

The White House Office of Science and Technology Policy issues an RFI that seeks information about how digital health technologies are being used, or could be used, to transform community health, individual wellness, and health equity. The request is part of OSTP’s Community Connected Health initiative.

Privacy and Security

Ciox Health notifies 32 health systems that an unauthorized person accessed the email account of one of its employees last summer and may have downloaded emails and attachments that contained limited patient information. The company says the attack appears to have been intended to collect email addresses to launch phishing attacks unrelated to Ciox.

Patient portal vendor QRS is accused in a class action lawsuit of failing to adequately secure its systems in an August cyberattack that involved 320,000 patients. One lawsuit participant says he believes that his information was sold on the dark web since his bank account and credit card were hit with unauthorized charges and he was targeted by robocall scams.

Other

Cerner co-founder Cliff Illig is interviewed by former Cerner President Donald Trigg in a new episode of the latter’s podcast that covers health IT entrepreneurship (it was recorded before the Oracle acquisition announcement, so perhaps a follow-up is indicated). All three Cerner founders grew up in families of kitchen-table businesspeople and saw in the early 1970s how computers were starting to be used by businesses, then started selling custom built problem-solving software in a half-dozen industries, with healthcare being on the list of industries they knew nothing about until a medical lab engaged them. Illig says Cerner sought venture capital because they needed credibility, not money, then were reasonably pushed by the VCs into going public as a liquidity event. He says that entrepreneurs shouldn’t be scared of complexity, which is common in healthcare, because you can figure it out by breaking it down into pieces. He says Neal Patterson was the most biased toward action of any of Cerner’s leaders and had an intolerance for things taking too long, spending too much time on analysis, and studying market surveys to decide what to do. The Cerner founders said that rather than studying every possible course of action, they just picked one by “shooting real bullets” and learned from the results.

The labor union of Ontario-based London Health Sciences Centre will file a grievance against Sodexo on Friday if the contractor can’t resolve payroll problems that have been caused by the Kronos ransomware attack. The union says more than 50 of its employees haven’t received their full paycheck for a month. In a related item, the Montana Nurses Association accuses Missoula’s for-profit Community Medical Center of illegally underpaying its nurses an average of $1,000 for work hours that they recorded manually during the Kronos downtime. Kronos has not been able to provide a resolution date for the the December 11 ransomware attack on its private cloud solutions.

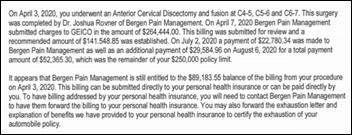

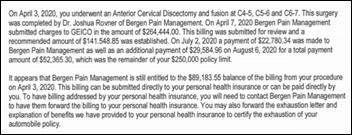

Another quirk in the quirky US healthcare non-system: a man whose injury from being hit by another driver requires major surgery learns the hard way that an auto policy’s personal injury protection is the primary medical payer in auto accidents. The hospital and surgeon billed $700,000 (Medicare would have paid $29,500) and his auto insurance’s PIP coverage was limited to $250,000. Not only that, auto insurers often have no network or negotiated discounts, so patients end up being out-of-network and are subject to paying full list price. He owes $89,000 despite having bought the maximum PIP coverage and carrying health insurance.

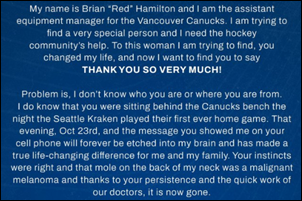

A defibrillator delivered by drone helps save the life of a 71-year-old man in Sweden who went into cardiac arrest while shoveling snow in his driveway. A physician who was driving to the hospital saw the collapsed man, started CPR, and called Sweden’s equivalent of 911, which dispatched an Everdrone-delivered defibrillator that the doctor used to resuscitate him. The drones can also be used to deliver naloxone, EpiPens, and other medical devices.

Sponsor Updates

- Cerner associates donate 646 toys to local charities during its virtual toy drive.

- A recent Meditech podcast features First Databank Director of Product Management Anna Dover, “How Genomics will Revolutionize Healthcare in the Next Decade.”

- Konza has earned the Validated Data Stream designation in the NCQA’s new Data Aggregator Validation program.

- Meditech publishes a new case study, “KDMC gives back 100+ hours to nurses with Meditech Expanse Patient Care.”

- PM360 recognizes OptimizeRx’s evidence-based physician engagement solution as one of the most innovate life sciences products of 2021.

The following HIStalk sponsors have achieved top rankings in Black Book Market Research’s latest cybersecurity survey:

- Security advisors & consultants: Clearwater

- Compliance & risk management solution: Clearwater

- Outsourcing & security network managed services: Fortified Health Security

- Secure communications platforms: physician practices: PerfectServe

- Secure communications platforms: hospitals & health systems: Spok

Blog Posts

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

There was a time when my company went through multiple rebrands. These were relatively minor shifts, but completely unnecessary. It…