Curbside Consult with Dr. Jayne 10/24/22

I’ve used a GPS watch to track my hikes and other travels for almost a decade. Recently, some of the features on my trusty Garmin Forerunner 25 have become erratic and had me looking for an upgrade. I’ve had it for seven years and it has served me well, but I was annoyed after the GPS went rogue a couple of times and the sleep tracker started showing the same pattern whether the watch was on my wrist or on the bathroom counter.

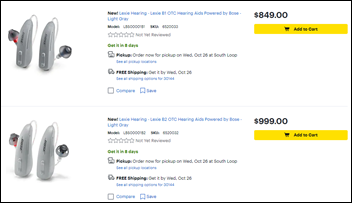

After extensive troubleshooting with Garmin, they couldn’t come up with a remedy and offered me a discount, but only if I stayed within the Forerunner line. I wasn’t thrilled with the options and had been casually looking at other models when a friend clued me in to a sale, spurring me to make a decision.

Wearables hold an interesting place in the hearts and minds of patients. I have plenty of friends that are obsessed with “closing the ring” on their Apple watches to the point where they are almost a servant to the technology. I’ve taken care of patients who take their daily activity tracking data seriously, to the point of messaging their physicians asking about what the slightest blip in their numbers might mean.

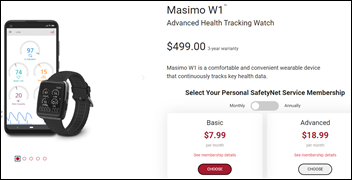

I’m not training for half marathons anymore, so I don’t need a lot of the training or coaching features that are out there. I wanted something with decent battery life, both as a watch and in GPS mode, as well as something that looks a little more stylish and a lot less rubbery than my current device. I settled on a watch from the Garmin Venu line.

Garmin’s packaging has become more streamlined since my last purchase. However, the setup process was considerably more complicated. Although I already had the Garmin Connect app on my phone, I couldn’t get it to pair with the watch and had to update the app. It still didn’t work, so I thought I would set up the watch manually then try the Bluetooth piece later.

Garmin is apparently confused about sex versus gender and how biological sex is more aligned with physiologic parameters than gender and only gave a choice of two genders. I picked the stereotypical pink icon with the ponytail, but hope someone at Garmin gets educated about the difference between sex and gender.

The next step was trying to set the watch via the GPS, which didn’t work. I’m assuming the GPS wasn’t working well inside my house, but since you’re supposed to have the device plugged in with the USB cable and charging while you do this, I was just following the directions. I’m not sure how many people have USB ports in their driveways.

I also ran across the menstrual tracking option on the device, which I promptly turned off. Most people don’t realize that HIPAA does not protect this kind of data when it’s being sent to an organization that is not a HIPAA-covered entity, and especially given the political climate, I have no plans to share that via a wearable.

During this process, the watch fell on the floor no less than three times due to the short USB cord that was connected to my floor-dwelling PC, coupled with the fact that it hooks perpendicularly into the back of the watch, making it unable to be placed flat on a surface.

The next step was to apply a system update to my phone, which for some reason took several hours. I tried several more times to get it to connect without any luck. Ultimately, I used Garmin Express to connect it directly to the PC, after which it forced a firmware upgrade to the watch. I was hopeful that would do the trick, but it didn’t. However, while the watch was connected to the PC, I was able to connect it to my wifi network, so at least that was something.

After disconnecting the watch, I had to take care of some household tasks and noticed that the watch wasn’t counting steps. It was counting heart rate and respirations, which I find less useful, and not doing the one task that was most important to me. After lots of fussing about with the menus, I tried a system setting to see what version the firmware was on, and it said that an update was needed. I tried to connect it back to the PC, but it wouldn’t pick up, and after plugging it in and unplugging it way too many times, it finally connected and the Garmin Express software showed that despite the recent status of “update complete,” three more updates were now needed.

Each time an update completed, I had to do a manual sync to get the next update to register, and also restart the watch. Meanwhile, Garmin Express kept telling me that the watch wasn’t connected, while the watch showed that it was.

I was asked no less than three times during the process to set up wifi and went through the entire process to have no change in the user experience. I went back to the main Garmin Express menu and was now told that I had 37 updates available even though the previous screen had said, “You’re up to date!” There is nothing worse than a confusing user interface that doesn’t tell you what’s going on or what you really need to do.

After two more unplug-and-restart cycles, the update counter disappeared and and miraculously, over 4,000 steps appeared on my watch. There’s no way they’re legitimate considering I was only wearing the watch for a couple of trips to the laundry room and back. After some digging, I figured out that somehow the steps on my old watch had been ported onto the new watch, which was definitely unexpected.

Fast forward to nearly a week worth of intermittent attempts to connect via Bluetooth. I gave up on it. I can pair the watch to someone else’s phone and pair my phone to other devices, but can’t pair the watch to my own phone. Without the Bluetooth, you lose out on several valuable features – music, alert notification for falls or incidents, and a couple of other things. I’m still able to sync the watch with my PC like I was the previous model. I hadn’t planned to allow it to display text messages or emails, so I resigned myself to being a little retro with my connectivity. I’m hypothesizing that the battery life will be much better without the connection, but I’ll know for sure in a few more days.

It’s snazzier than my previous device. I like its subtle coloring and low profile versus the chunky black model I’ve been wearing for years. For the first couple of days, the synthetic material watch band had a particular smell to it, which probably wouldn’t mean much to the average person, but to me smelled like an operating room. Although it brought back some fond memories, I was glad when it dissipated.

Overall, I’ll give this particular Garmin a solid B. It’s better than my last one, but not as great as it could be. The price was right.

What’s your favorite wearable, and how do you like (or dislike) its features? Leave a comment or email me.

Email Dr. Jayne.

The story from Jimmy reminds me of this tweet: https://x.com/ChrisJBakke/status/1935687863980716338?lang=en