FDASIA and Healthcare’s Moon Shot Goal of ICU Safety

By Stephanie Reel

Preparing for the FDASIA panel was an energizing opportunity. It allowed me to spend a little time thoughtfully considering the role of government and the role of private industry in the future of health IT integration and interoperability. It gave me an opportunity to think a great deal about the important role ONC has played over the past few years and it made me question why we haven’t achieved some of the goals we had hoped to achieve.

As I was preparing my remarks, I reflected on the great work being done by my colleagues at Johns Hopkins and our vendor partners. We have the distinct privilege of having the Armstrong Institute at Hopkins focused on patient safety and quality, which is generously funded by Mr. Mike Armstrong, former chairman of our the Board of Trustees for Johns Hopkins Medicine. It is unequaled and a part of our fabric and our foundation. The Armstrong Institute is inspirationally led by Dr. Peter Pronovost, who is an incredibly well-respected leader in the field of patient safety, and also a trusted colleague and a good friend.

We in IT at Hopkins receive exceptional support from our leadership – truly. We also have amazingly strong partnerships with our school of medicine faculty, our nurses, and our enterprise-wide staff. I suspect we are the envy of most academic health systems. The degree of collaboration at Hopkins is stunning – in our community hospitals, physician offices, and across our academic medical centers. Our systems’ initiatives derive direct qualitative and quantitative benefit from these relationships. Our CMIO, Dr. Peter Greene, and our CNIO, Dr. Stephanie Poe, are the best of the best in their roles. The medical director of our Epic deployment, Dr. John Flynn, is a gift.

We are luckier than most. We could not do what we do without them. But despite this impressive and innovative environment, we still have significant challenges that are not unique to Hopkins.

Despite huge investments and strong commitments to Meaningful Use, we have challenges across all health IT initiatives. They aren’t new ones and they aren’t being adequately addressed by our current commitment to Meaningful Use criteria. We are still not operating in a culture adequately committed to safety and patient- and family-centered care. We are still not sufficiently focused on technologies, processes, and environments that consistently focused on doing everything in the context of what’s best for the patient.

We decided to try harder. All across Johns Hopkins Medicine, we published a set of guiding principles that guide our approach to the deployment of information technology solutions. These guiding principles reduce ambiguity and provide constancy of purpose. They drive the way we make decisions, prioritize our work, and choose among alternatives – investment alternatives, deployment alternatives, vendor alternatives, integration tactics, and deployment strategies. They provide a “true north” that promotes the culture we are hoping to create.

Our first guiding principle expects us to always do what is best for the patient. No question, no doubt, no ambiguity. We will always do what is best for the patient and for the patient’s family and care partners. We are committed to patient safety and it is palpable. This is our true north.

Our second guiding principle allows us to extend our commitment even further. We commit to also always doing what is best for the people who take care of patients. So far, we have never found this to be in conflict with our first guiding principle. We view the patient and the patient’s family as our partners. Together, we are the team. Our environment, our work flow, our processes, and our technologies need to do what is best for all members of the team and all of the partners in the process of disease prevention, prediction, and treatment.

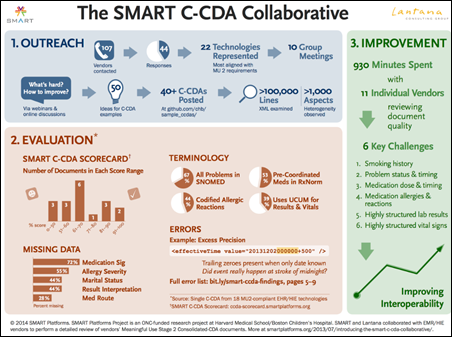

Our remaining guiding principles deal with our commitment to integration, standardization, and best practices. We know that unmanaged complexity is dangerous. We know that there are opportunities to improve our processes and our systems if we are always focused on being a learning healthcare system. We know we can achieve efficiencies and more effective solutions if we also achieve some degree of standardization and data and system integration. This is essential, critically important, and huge. It is something FDASIA (the FDA,FCC, and ONC) and the proposed Safety Center may be able to help us address.

Is this the best role for government?

Government has an important role and government has the power to convene, which is often critical. But I also feel strongly that market forces are compelling and must be tapped to help us better serve our patients and the people who care for our patients. Health systems and hospitals have tremendous purchasing power. We should ensure we define our criteria for device and system selection based upon the vendor’s commitment to integration, standardization, and collaboration around best practices. We must find a way to promote continuous learning if we are to achieve the triple aim.

We need to step up. We need to say we will not purchase devices, systems, and applications if the vendors are not fully and visibly committed to interoperability and continuous learning. This must be true for software, hardware, and medical devices. It must be true for our patients and for the people who care for our patients.

Moon shot goal

This relates my plea that we define a moon shot goal for our nation. We must commit to having the safest healthcare delivery system in the world. We should start with our intensive care units. We must ensure that our medical devices, smart pumps, ventilators, and glucometers are appropriately and safety interoperable. We must make a commitment to settle for nothing less. We must agree that we will not purchase devices or systems that do not integrate, providing a safe, well-integrated solution for our patients and for the people taking care of our patients.

Let’s decide as a nation that we will place as much emphasis on safety as we have on Meaningful Use. Or perhaps we can redefine Meaningful Use to define the criteria, goals, and objectives to be achieved to ensure that we meet our moon shot goals. We will ensure that we have the safest hospitals in the world and we will start with our ICUs, where we care for the most vulnerable patients. We might even want to start with our pediatric ICUs, where we treat the truly most vulnerable patients.

More than 10 years ago, I was given an amazing opportunity to “adopt a unit” at The Johns Hopkins Hospital as a part of a safety program invented at Hopkins by Dr. Peter Pronovost. Each member of our leadership team was provided with an opportunity to adopt an ICU. We were encouraged to work with our ICU colleagues to focus on patient safety. We were educated and trained to be “preoccupied with failure” and focused on any defects that might contribute to patient harm. We didn’t realize it at the time, but we were learning how to become a High Reliability Organization.

I learned quickly that our ICUs are noisy, chaotic, extremely busy, and not comforting places for our patients or their families. I learned that our PICU was especially noisy. Some of our patients had many devices at their bedside, nearly none of which were interoperable. They beeped, whirred, buzzed, and sent alarms – many of which were false alarms — all contributing to the noise, complexity, and feeling of chaos. They distracted our clinicians, disturbed our patients, and worried our family partners.

Most importantly, they didn’t talk to one another. So much sophisticated technology, in the busiest places in our hospitals, all capable of providing valuable data, yet not integrated – not interoperable – and sometimes not even helpful.

I realized then, and many times since I adopted the PICU, that we all deserve better. Our patients and the people who care for our patients deserve better. We must build quiet ICUs where our care team can listen and learn and where our patients can receive the care they need from clinicians who can collaborate, leveraging well-integrated solutions and fully integrated information to provide the safest possible care. Many of these principles influenced the construction of our new clinical towers that opened two years ago. Again, we are fortunate, but huge challenges remain.

What about Quality Management Systems? Are we testing and measuring quality appropriately?

In many ways, I think we may focus too much on the back end. Perhaps we focus too much on testing and not enough time leading affirmatively. A commitment to excellence – to high reliability – might lessen the complexity of our testing techniques. I am very much committed to sophisticated quality assurance testing, but it seems far better to create and promote a culture that is committed to doing it right the first time. It will also be important that we affirmatively lead our design and deployment of systems that rely only on testing our solutions.

With that in mind, I would prefer to see an additional focus or strategy that embraces High Reliability at the front end in addition to using quality management techniques. We undoubtedly need both.

As I have recently learned, most High Reliability Organizations have much in common related to this dilemma. We all operate in unforgiving environments. Mistakes will happen, defects will occur, and we need to be attentive. But we must also have aspirational goals that cause us to relentlessly focus on safety at the front end. We must remain passionate about our preoccupation with failure. We must recognize that our interventions are risky. We must have a sense of our own vulnerabilities and ensure we recognize we are ultimately responsible and accountable despite our distributed and decentralized models. We must continue to ask ourselves, “How will the next patient be harmed?” and then do everything possible to prevent harm at the front end as well as during testing. We must create a culture that causes us to think about risk at the beginning. And of course, we must be resilient, reacting appropriately when we do recognize errors, defects, or problems.

I should note that many of these ideas related to High Reliability are very well documented in Karl Weick and Kathleen Sutcliffe’s book, Managing the Unexpected. They encourage “collective mindfulness” and shared understanding of the situation they face. Their processes are centered around the five principles: a preoccupation with failure, reluctance to simplify interpretations, sensitivity to operations, commitment to resilience, and deference to expertise.

Why the moon shot goal?

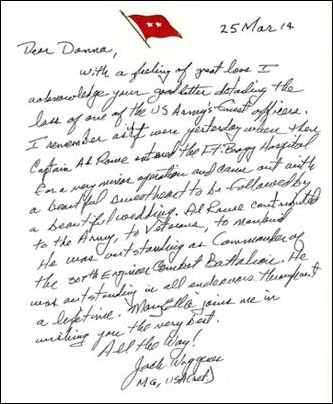

As Dr. Pronovost at Johns Hopkins Armstrong Institute often says, “Change travels at the speed of trust.” We need to learn from one another. We need to be transparent, focused, and committed to doing what is best for our patients and for the people who care for our patients. We must commit to reducing patient harm. We must improve the productivity and effectiveness of our healthcare providers. We must have faith in our future and trust our partners. We need to make a commitment to no longer expect or accept mediocrity.

From a recent study performed at the Armstrong Institute under Dr. Pronovost’s leadership, we know that patients around our country continue to die needlessly from preventable harm. Healthcare has little tangible improvement to show for its $800 billion investment in health information technology. Productivity is flat. Preventable patient harm remains the third leading cause of death in the US.

In addition, costs of care continue to consume increasingly larger and unsustainable fractions of the economy in all developed countries. While cutting payments may slightly decrease the cost per unit of service, improving productivity could more significantly deflate costs. Other industries have significantly improved productivity, largely through investments in technology and in systems engineering to obtain the maximal value from technology. Yet healthcare productivity has not improved. Our nurses respond to alarms — many of them false alarms – on average, every 94 seconds. This would be unthinkable in many other environments.

Despite my view that we must encourage market forces, we know that we have a long way to go to have an ICU that has been designed to prevent all patient harm while also reducing waste. Clinicians are often given technologies that were designed by manufacturers with limited usability testing by clinicians. These technologies often do not support the goals clinicians are trying to achieve, often hurt rather than help productivity, and have a neutral or negative impact on patient safety.

Moreover, the market has not yet integrated technologies to reduce harm. Neither regulators nor the market has applied sufficient pressure on electronic health record vendors or device manufacturers to integrate technologies to reduce harm. The market has not helped integrate systems or designed a unit that prevents all patient harm, optimizes patient outcomes and experience, and reduces waste. Hospitals continue to buy technologies that do not communicate.

It is as if Bloomberg News would have been successful if there were no standards for sharing of financial and market data. It would be unthinkable that Boeing would continue to partner with a landing gear manufacturer that refused to incorporate a signal to the cockpit informing the pilot whether the landing gear was up or down. We need the same engineering, medical, clinical trans-disciplinary collaboration expectations to ensure the same is true for healthcare.

Back to the moon shot….

An ideal ICU is possible if we decide it matters enough. If we agree to combine trans-disciplinary collaboration with broad stakeholder participation and demand authentic collaborations, we can get there in less than five years. But it won’t be trivial. It will require a public/private partnership.

The cultural and economic barriers to such collaborations are profound. Engineers and physicians use different language, apply different theories and methods, and employ different performance measures. We must take a holistic approach to create the ideal ICU and the ideal patient and family experience.

A safe, productive system is possible today. Technology is not the barrier. Let’s make it happen. Let’s have a goal for 2020 that we will have the safest ICUs (and the safest hospitals) on the planet – focused on patient- and family-centered care, disease prevention, and personalized and individualized healthcare.

Stephanie L. Reel is CIO and vice-provost for information technology at Johns Hopkins University and vice-president for information services for Johns Hopkins Medicine of Baltimore, MD.

I initially questioned the profile's authenticity because all of the headshots in the profile are clearly generated or enhanced by…