Monday Morning Update 9/25/23

Top News

Nasdaq sends Veradigm a delisting notice for failing to file financial reports, which the company says it expected and will appeal.

Veradigm expects to file the overdue reports by the end of Q4. It blames its failure to file its annual report for 2022 and the two following quarterly reports on accounting software problems.

Reader Comments

From Former Employee: “Re: ModMed. Acquired Klara last year for $135 million and has laid off 80% of the sales team. It’s an interesting story that unfolds on GlassDoor reviews.” Unverified. Specialty EHR vendor ModMed – formerly known as Modernizing Medicine – acquired the patient outreach messaging vendor Klara in February 2022. Privately held ModMed has raised a reported $400 million, none of it recently, and paid $45 million in November 2022 to resolve federal kickback charges related to referring business to a clinical lab partner.

From Interopguy: “Re: Oracle Health. Mysterious message on the end of code Developer program at Cerner, and uncertain path forward. What does this mean for app developers and for interop with Oracle Health?” The Open Developer Experience was created to help developers build apps for Millennium and HealthIntent that improve interoperability capabilities. Oracle Health developer Aaron McGinn, who appears to have had led the company’s presence with the developer community, has tagged his LinkedIn with “open to work.” Oracle moved its discussion forms to an Oracle site and users report lack of company response along with errors in the developer sandbox.

From Laminar Flow: “Re: Oracle Health. One of their recruiters says on LinkedIn that Adventist Health will end its Cerner ITWorks contract with Oracle in January 2024 and bring the IT function back in house.” The post seeks to hire people for Oracle now who will receive matching offer letters from Adventist Health. Adventist Health signed a big deal with Cerner in January 2018 to take over revenue cycle management and clinical applications, but terminated the RCM contract the following year and brought the 1,700 employees back in house, after which Cerner sold that business to R1 RCM.

HIStalk Announcements and Requests

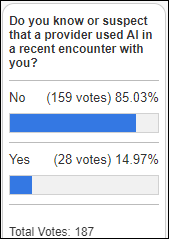

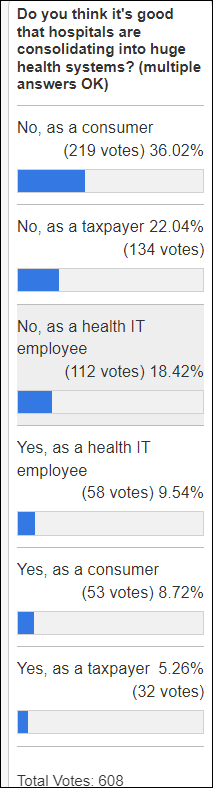

A few poll respondents know or suspect that AI was used in a recent medical encounter.

New poll to your right or here: How will technology significantly improve US healthcare in the next five years? (multiple answers OK)

I greatly enjoyed reading Brian Too’s cynically relevant comments about VC folk in general and Epic-bashing Bill Gurley specifically:

You want investor capital and lots of it. There is a pathway to this that involves self promotion, a dynamic speaking style, outrageous theories that are unconventional and controversial, and chutzpah. Above all the chutzpah! When challenged on the facts, you just say something like, “It’s only a theory,” or you cite one fact that supports your story but doesn’t actually prove it. Then you get your skeptic to do all the lengthy, boring investigation. You drive off in your fully expensed Ferrari, confident you can stay ahead of any questions. These folks are fun at parties, but they will never come within a million miles of my money.

Webinars

October 25 (Wednesday) 2 ET. “AMA: The Power of Data Completeness.” Sponsor: Particle Health. Presenters: Jason Prestinario, MSME, CEO, Particle Health; Carolyn Ward, MD, director of clinical strategy, Particle Health. Is your healthcare organization looking to drive profitability and scale quickly? Our experts will explore how comprehensive clinical data can revolutionize the health tech landscape. This engaging discussion will cover trending topics such as leveraging AI and data innovation to enhance patient care and outcomes, real-world examples of organizations leading the charge in data-driven healthcare, overcoming challenges in data completeness and interoperability, and visionary perspectives on the future of care delivery.

Previous webinars are on our YouTube channel. Contact Lorre to present or promote your own.

Acquisitions, Funding, Business, and Stock

The Federal Trade Commission sues US Anesthesia Partners and its private equity minority share owner, claiming that the companies executed an anti-competitive scheme to consolidate anesthesiology practices in Texas to drive up prices and profits. Legal experts say the action is notable because FTC included the private equity investor and not just the company itself in its lawsuit, potentially signaling a new type of federal scrutiny of healthcare.

People

Arrowhead Regional Medical Center (CA) hires CMIO consultant John Brill, MD as chief medical officer.

Announcements and Implementations

AMIA announces the winners of its 2023 Signature Awards:

- Donald A.B. Lindberg Award for Innovation in Informatics — Noémie Elhadad, PhD, associate professor and chair of biomedical informatics, Columbia University.

- Don Eugene Detmer Award for Health Policy Contributions in Informatics — Dean Sittig, PhD, professor, UTHealth Health Science Center at Houston.

- William W. Stead Award for Thought Leadership in Informatics — Atul Butte, MD, PhD, director of the Bakar Computational Health Sciences Institute and distinguished professor, University of California, San Francisco.

- Virginia K. Saba Informatics Award — Susan Newbold, PhD, RN, director, Nursing Informatics Boot Camp.

- AMIA New Investigator Award — Yifan Peng, PhD, assistant professor of department of population health sciences, Weill Cornell Medicine.

A Health Affairs article calls for healthcare ownership transparency so that patients will know if their physician practice is owned by – and perhaps likely to have their clinical judgment influence by — a private equity firm, insurer, health system, Amazon, or a conglomerate such as CVS Health or UnitedHealth. They also call for location transparency to support site-neutral payments, ending the practice of hospitals buying practices or ambulatory centers and then billing higher hospital prices using the parent facility’s provider number and thus preventing the payer from determining where services were provided.

CHIME offers a webinar to prepare potential ViVE 2024 speakers for submitting applications. The call for track speakers closes at the end of October.

Other

The Federal Trade Commission cracks down on the deceptive marketing claims of health influencers, one of them “The Liver King,” who claimed $100 million in annual sales of supplements to accompany his raw meat diet, which generated a net worth of $310 million. He later admitted that his ripped appearance was actually due to taking $11,000 worth of steroids each month, which is not exactly shocking since he sounds a lot like ‘roid rager Danny Bonaduce.

Marginally healthcare relevant, but interesting for a slow news day. Wired covers the “obituary pirates” who scrape death details from funeral home websites, create low-quality videos of themselves reading the deceased’s write-up, then use search engine optimization on the person’s name to draw in people who then hear about their death in the cheesiest possible way while being served ads. As has been noted, death is the ultimate total addressable market.

Sponsor Updates

- EClinicalWorks releases a new podcast, “Unlocking Reporting Capabilities in EBO.”

- NeuroFlow publishes a new case study, “Magellan Healthcare Expands Real-World Impact of DCBT, While Improving Member Access & Engagement.”

- Nordic releases a new Designing for Health Podcast, “Interview with Tricia Baird, MD.”

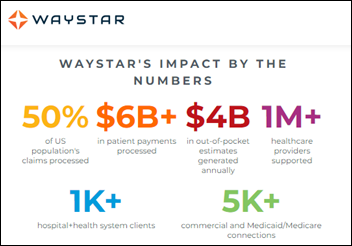

- Waystar will exhibit at the NJ & Metro Philadelphia HFMA Annual Institute September 27-29

- Wolters Kluwer nominates NextGen Healthcare President and CEO David Sides to its supervisory board.

Blog Posts

- Meditech’s Traverse Exchange Canada network advances health information sharing (Meditech)

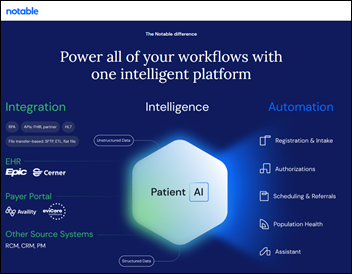

- Conversational AI for healthcare is a significant step beyond the chatbot, here’s why (Notable)

- 10 Questions to Ask Autonomous Medical Coding Vendors (Nym Health)

- Fighting Opioid Addiction – One Life at a Time (Netsmart)

- Want to improve patient safety? Up your EHR’s usability (Nordic)

- Three Ways to Prove ServiceNow ROI (Optimum Healthcare IT)

- PLD Is Not Enough: Next-Best-Action HCP Engagement Needs the Patient (OptimizeRx)

- Solving the Top Healthcare Transfer Center Challenges (PerfectServe)

- 4 best practices for boosting your HCAHPS scores (Spok)

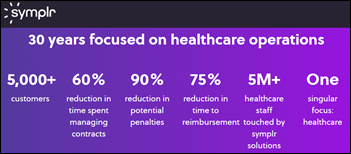

- Is Your Provider Data Getting Lost in Your Master Data Management? (Symplr)

- Your complete guide to Meditech Expanse (Tegria)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

Thank you for the mention, Dr. Jayne — we appreciate the callout, the kind words and learning more about the…