Healthcare data sucks - that song turned my Friday to Friyay!!! Gave me the much needed boost to get through…

Monday Morning Update 4/30/12

Given the significant Allscripts news and opinion, I’ve moved that into its own section at the bottom. That will make it easier for readers who don’t really care about that topic to skip it. I’m assuming the interest is out there, however, given that HIStalk had 9,600 visits and 17,000 page views on Friday, above normal.

From Bignurse: “Re: [vendor name omitted.] An absolute disaster in our state. No customer support is available. Lawsuits are being prepared. Meanwhile, patient care is at risk from systems that are crashing. I feel badly for laid-off employees, but every more alarming is customers facing the specter of systems going down forever. They need help!” I’ve left off the vendor’s name to offer a suggestion. Hopefully someone has complained formally to the vendor from at least one of those sites. Send me a copy of that document and I’ll run it here with any company response. That’s not only more fair to the company, but more useful to readers who really don’t know what’s going on.

From Susan: “Re: overall size of the healthcare IT market. Any estimates of total money spent annually by hospitals or clinics?” Maybe someone knows the answer to this question, which sounds like something Epic would ask on its famous employment test.

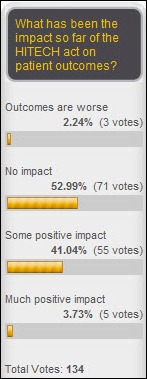

HITECH’s impact on patient outcomes has been modest, respondents seem to be saying. New poll to your right: if you had $100K to invest in the stock of one healthcare IT vendor, which would you choose?

Listening: the fresh and very well produced first album of Electric Guest, some LA kids cranking out a delightfully catchy mix of pop, soul, and electronic dance music that would be great for driving as long as you can control your in-seat gyrating better than I can. The low bass notes of the opening song are so strong out of my PC’s subwoofer that my Diet Coke with Lime can is vibrating across my desk like the quarterback in a 1970s electric football game. I’ve played the CD three times in a row, which is unusual for me.

Vince’s HIS-tory this time around covers the history of an innovative but trouble-prone input device that required creating an intentionally poor user interface to hide its design flaws: the typewriter.

The Minneapolis-St. Paul newspaper finds that two executives of Fairview Health Services, which is taking heat for allowing Accretive Health to strong-arm its patients into paying for ED and other medical services upfront, have connections to the company. The son of Fairview’s CEO is an Accretive employee, while the son of its physician group CEO is also an Accretive employee and helped it implement aggressive collection policies. In addition, the physician group CEO was found to be a shareholder in Accretive. The fallout from Tuesday’s national press about the tactics was dramatic: by Friday, Fairview had severed all relationships with Accretive. In addition, Fairview’s board held an emergency meeting from which its CEO was excluded, but he apparently emerged with the organization’s support. The biggest question is whether it was legal for Fairview to give Accretive full access to its patient records for collection purposes. Nearly overlooked in all the debate is that Ascension Health was Accretive’s original customer and owns a sizeable chunk of the company. Accretive’s market cap after its 61% share price drop (!!) over the past month is $919 million, with Ascension Health’s equity worth $72 million.

Nuance closes on its acquisition of medical transcription vendor Transcend Services.

The local business journal covers the recent Epic go-live at 206-bed Greenwich Hospital (CT), part of Yale New Haven Health System. The hospital spent $25 million ($121K per bed), according to the article, which gives the entire system’s cost as $250 million.

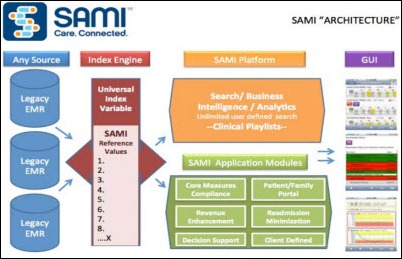

Yale New Haven is also mentioned as using the SAMI system from local startup MyCare, LLC, a product described as having capabilities for EMR searching, alerting, a rules engine, and analytics.

Harvard Business School healthcare expert Regina Herzlinger says accountable care organizations and patient-centered medical homes will go down in flames just like the 1990s capitated HMOs that preceded them, with the key problems being (a) inefficient EMRs, (b) awkward team culture, and (c) challenges in developing public health insurance exchanges. Instead, she advocates a focused factory model, where instead of providers taking on whatever problems cross their doorstep, they focus on particular health conditions, such as diabetes. She’s written such books as Market Driven Health Care and Who Killed Health Care? She blames today’s healthcare mess on hospitals consolidating to eliminate competition, bureaucratic insurance companies with wildly overpaid CEOs, and federal government meddling.

Weird News Andy’s joke: How do you make a Phillips screwdriver? Mix vodka with milk of magnesia (cue rim shot). That’s to celebrate this story, in which a Kentucky woman is suing her dentist, claiming she needed abdominal surgery to remove a screwdriver he dropped down her throat while repairing her dentures.

Allscripts

From Stock Boy: “Re: Allscripts. This was a when, not an if. HCIT rollups never work. The coup could have gone either way – one vote and it could have been Tullman’s blood running through the Merchandise Mart. Investors are also afraid that another shoe will drop, like whether Lee Shapiro survives or even wants to. Clients have been angry – I’ve heard that Tullman is personally banned from several high-profile Eclipsys sites. The timing of Davis’s resignation could not be worse, and naming his new firm would have eliminated one piece of missing information. Investors hate uncertainty, so the stock is likely dead money for six months. They will be doing a ‘sum of parts’ valuation. Maybe a private equity leveraged buyout would work, but it would be tough. Allscripts is in third or fourth place, but it’s still a big market, and if I invested in this sector, I’d be a buyer of MDRX. Glen is a talented CEO and can sell water to a drowning man. He’s one of the most aggressive and competitive, but within an ethical framework, I’d be disinclined to bet against him.”

From MDRX Mole Army Private: “Re: Allscripts. HIStalk access is being blocked at the Raleigh office. Good thing I have a smart phone!” Unverified and pointless in any case since I’m pretty sure employees have a variety of ways to access an unfiltered Internet on their own.

Allscripts shares closed at $10.30 on Friday, down 36% on 20 times normal trading volume as Nasdaq’s second-biggest percentage loser for the day. Market cap dropped over a billion dollars, and Glen Tullman’s wallet was $5 million lighter at dinner than it was at breakfast. Not to mention that Glen’s frequent verbal sparring partner Jonathan Bush’s athenahealth now has a bigger market cap than Allscripts ($2.61 billion vs. $1.96 billion).

My reaction to Friday’s events:

- During the investor conference call, Glen’s performance hit extremes of negativity and optimism at a time when he desperately needed to inspire confidence as the last man standing. He went into graphic, pathological detail about all of the company’s significant problems. When asked tough questions by the analysts on the earnings call, however, he trotted out unconvincing cheery optimism that those problems would be quick to solve. That’s when he actually answered what was asked instead of reciting unrelated positive factoids about Agile development methodology. If I were grading his performance, I’d go with a C minus (with demerits to whoever should have been coaching him better, not just during the call, but in overall transparency given that last quarter’s conference call was rosy.) It just seemed to lack conviction, glossed over the apparent gravity of the situation, and seemed to be scripted into trying to convince everybody that these issues all came up in one quarter and would require just one quarter to fix.

- I was surprised that MDRX shares didn’t regain some of their losses by end of day Friday, especially since Nasdaq closed up for the day. Stocks often regain huge opening losses after the bad news is digested, the company’s fundamentals are re-examined, and overreaction seems likely in hindsight. in this case, the initial negative reaction stood for the most part and the dead cat didn’t bounce much.

- The biggest problem Allscripts now has isn’t the sales organization or the loss of board members, but rather the now-public record of executive upheaval and share meltdown. Hospital CIOs look first at the KLAS ratings and client roster when evaluating a vendor, but hospital CFOs go straight to the stock pages, and what they’ll find there may cause them to unholster their veto stamp. I’ve been in the room several times when that exact event occurred with other companies.

- Allscripts is raising consulting prices, pushing harder for customers to buy more of those services, and being more aggressive in cross-selling. Sometimes those tactics provide a bottom line boost, sometimes they just annoy prospects into inflating the company’s “nickel and dime” KLAS scores or even push them to choose another vendor.

- If you were a hospital swimming against the populist tide and considering Sunrise instead of Millennium or Epic, you might question whether the dismissal of all of the former Eclipsys board members and the disagreement over the company’s direction was a signal that Sunrise isn’t the company’s focus. I didn’t get that impression at all from the conference call since Sunrise was most of the conversation, but some might make that inference (and you can bet competing salespeople will be making sure their mutual prospects consider it.)

- The company has good opportunity to make its board stronger with some non-Eclipsys people. The former board members of Eclipsys were hardly a model of success, mostly known for approving questionable and ultimately failed acquisitions and finally finding a willing buyer for the company after years of shopping it around with no takers. Maybe they wanted to stick with the old Eclipsys ways, or perhaps Allscripts felt misled by what it found after it bought the company.

- Glen has said repeatedly that integration between the company’s ambulatory and inpatient EMRs would be basically a slam dunk that would send Epic fleeing for cover. Now the word is that, according to the customers who were supposed to benefit from that integration, Allscripts failed. That seems to indicate that nobody was actually talking to those customers (a massive mistake when you’ve got North Shore-LIJ to keep happy no matter what it takes.) Meanwhile, the Epic train keeps rolling over everything in its path, and all of this news just gives it a little bit more steam that it doesn’t need.

- Glen may think that losing John Gomez wasn’t a big deal, but it seems that most of the challenges Glen listed were related to development – high costs, poor delivery, and an apparently stripped down Sunrise integration plan that clearly fell short of expectations. Glen is a big-picture salesman, so every time he talks we hear about how smoothly the integration will happen, how easy it will be to juggle a barnyard full of EMRs and keep them all current with regulatory changes, and how well Sunrise can compete with Epic because Epic is 30 years old and not an “open” system like Sunrise (one might suspect that his definition of that term is anything but technical.) It’s going to take more than a company full of Glens to make that happen, no matter how you reorganize the sales force.

- The company had outsourced some of its technology work, sending some programming to India and turning over hosting management to third parties. Given that it apparently didn’t develop good integration specs for Sunrise, what does that leave as its core competency?

- The drop in share price sets the clock back three years, before HITECH and the Eclipsys acquisition. In fact, share price is less today than at the company’s 1999 IPO ($10.30 vs. $16.00).

- It will be interesting to see if the vultures swoop in to buy now-cheap shares to the point they can force the company to put itself up for sale, hoping to make a quick buck on the flip. That would be the worst possible outcome for everybody except the money-lenders.

- The same day that Allscripts was trying (and mostly failing) to ease concerns about its debacle, Cerner put up huge numbers and Epic was announced as having beaten both companies in a pivotal two-trust selection process in the UK. Not only did Allscripts lose absolute ground, it lost even more relative ground against its most significant inpatient competition that many feel was already insurmountable.

- No matter what explanations are provided, the casual observer might conclude that Glen staged a coup that cost the company four board members and its CFO at the worst possible time. Those boardroom discussions must have been particularly acrimonious given that the parties involved, all of whom hold Allscripts stock, were willing to torch the share price and possibly damage the company irreparably by going public with their spat.

- Was Jim Cramer a genius for urging investors to get out of Allscripts and into Cerner a month ago, or a fool for shamelessly pitching it and fawning over Glen Tullman for the four years prior to that? Had you bought and sold when he suggested, you would have made around 30% over 3.5 years, whereas buying Cerner upfront instead would have more than tripled your money over the same period.

- The biggest unknown: could a different CEO or ownership improve the situation? Eclipsys wasn’t selling much of anything before the acquisition; there’s little hope that Sunrise can do anything more than catch the occasional crumb dropped by Epic or Cerner; the company doesn’t have very much non-US business; it offers too many legacy EMRs that will require significant ongoing investment and face ever-stiffer competition on price; the market is rapidly changing as providers chase the ACO and population management dream (rightly or wrongly; and the HITECH tailwinds have died down considerably.

- As a counterpoint, Allscripts remains a large and profitable company; company fundamentals will make it attractive again once the embarrassment wears off and things settle down; its practices are apparently entirely honest and ethical; Glen Tullman proved himself a stock market and finance master in wresting control from the clueless overlords at Misys; he gets to pick his own loyal board members to replace the dearly departed and apparently less-loyal members; and the industry sector may be changing but it’s not going to go away. Long-timers will remember at least a couple of times that Cerner shares tanked on similar news, only to come roaring back.

- Expectations are now lowered and the gloves can come off. All the bad news is out there and already priced into the stock’s current (low) value, so now’s the time to make all the tough decisions that nobody wants to make when a company is riding high. Write down all the bad investments, retire badly aging products, fire the underperformers, show some competitive fire and frankness instead of Teflon Barbie-like reassurances that the sky isn’t falling when it clearly is, and decide exactly what it is that Allscripts wants to be when it grows up other than a collection of mismatched businesses that got thrown together primarily because they were struggling individually.

Here’s the five-year share performance of Allscripts (blue), the Nasdaq (green), and Cerner (red). A $10,000 investment in May 2007 would be worth $28,700 today (Cerner), $11,980 (Nasdaq index), and $4,350 (Allscripts).

I interviewed Glen Tullman and Phil Pead about the Allscripts-Eclipsys merger the day before it was announced, asking them to give me the criteria to judge their performance two years afterward (September 2012). Here’s what Phil Pead said:

From a shareholder perspective, I would like to see you grow the top line and prove your earnings per share leverage over that period. If I was a client, I would grade you by the integration between the product solutions to make this a great experience for their hospital and ambulatory environments so that the two came together. If you were looking at it from the employees, I would want to say that the next few years will be some of the most exciting with all the new opportunities they have to plan.

If you’re an Allscripts customer, tell me what all this news means to you. Please use your real name and employer with the confidence that I will absolutely not allow you to be identified in any way, but I need to be sure I’m getting legitimate information and not an Allscripts competitor trying to pile on (it happens). I’ve heard from investors and employees, but the real unknown is what Allscripts customers think about what’s happening.

“The local business journal covers the recent Epic go-live at 206-bed Greenwich Hospital (CT), part of Yale New Haven Health System.

Why did I think that Epic only sold to 300-350 bed hospitals? No?

Am I nervous about this turn of events? Absolutely! As CIO at client smack in the middle of Allscripts implementation, I am very concerned. I spoke with them first thing Friday morning and was reassured of their commitment to this product and to integration of ambulatory and inpatient systems. Based upon what we went through in the selection process we really don’t have another choice. I am going to do whatever it takes to support Allscripts and be their cheerleader. My hospital needs me to be, my community needs me to be, and whether they know it or not, our patients need me to be. Does that mean that I didn’t have some explaining to do to the exec team and to the board on Friday? Not at all, I was on the very hot seat but we will continue to move forward, be in constant communication with our partner Allscripts and make the best of this challenging situation. I happen to be a member of a 12 step recovery group and I will just say that some awesome new 12 step meetings have been created over silly resentments between to leaders of the meeting. I hope not only that Allscripts comes out of this stronger, but that Phil gets his group together and starts another meeting so to speak and innovates for the sake of HIT.

As a user of Sunrise, the comment by the Barclay’s analyst on The Reuters news wire is accurate. Never before have my patients been in such jeopardy. The hospital admin is in bed with Allscripts mitigating the voices of the doctors. This user unfriendly system complete with spelling errors (can not find the medication) and innumerable defects should be deinstalled, NOW.

Epic’s size requirements are for the system & Yale-New Haven has a 1000 beds.

I doubt their size requirement applies to academics anyhow though. Same with children’s hospitals.

Re: From Bignurse: “Re: [vendor name omitted.] An absolute disaster in our state. No customer support is available. Lawsuits are being prepared. Meanwhile, patient care is at risk from systems that are crashing.

This is very disconcerting. Do my reporting suggestions come into play as posted in the bottom portion of my post here?

@RustBeltFan: The answer probably lies in “part of Yale New Haven Health System” – it is a single entity with a single system. Individual hospitals are implemented as part of the whole, they are not treated as separate customers.

Regina Herzlinger like many pundits who are in the business of getting paid for having opinions needs to always say controversial things – otherwise the gravy train ends when you’re quiet. The ACO horse is out of the barn and whether they actually take that form or something slightly different, providers are taking on risk and yes, like any other industry that transformed, consolidation is accelerating. The provider side of healthcare is the most fragmented and poorly managed – anyone selling products to hospitals knows that – currently easy pickings for payers, vendors, etc. I think you’ll see a new breed of virtual, for-profit Kaisers that go toe-to-toe with payers, pharma and most of all the government.

Regarding the size of healthcare IT : The current figure doing the rounds in the C-suites is healthcare spends 2-3 percent of the operating budget on IT as apposed to banks that spend 10%. However I think there are some big caveats to that number. I suspect its higher.

I was approached to apply for the VP position at Allscripts that would be responsible full-time for the NS-LIJ account. Very happy right now that I passed on that and, assuming they found someone to take it, feel sorry for that person right about now.

Funny that Pead’s bio is still up, although they have unlinked it.

http://www.allscripts.com/en/company/about-us/leadership/bio-pead.html

Chloe Says:

Never before have my patients been in such jeopardy.

…

This user unfriendly system complete with spelling errors (can not find the medication) and innumerable defects should be deinstalled, NOW.

Deinstalling NOW will hardly make your patients safer. And not to defend Allscripts, but the spelling errors are almost certainly the responsibility of your IT shop, not the vendor.

MIMD: I followed your link and my anti-virus software blocked a “Blackhole Exloit Kit” threat from that page. You should find a new link to that material or consider not posting it to discussion boards for a while. In the meantime, Mr. H, I would consider removing that link.

Link to SEC filing by an Allscripts investor (Healthcor Management)

http://services.corporate-ir.net/SEC.Enhanced/SecCapsule.aspx?c=112727&fid=8152621

Re: From MDRX Mole Army Private: “Re: Allscripts. HIStalk access is being blocked at the Raleigh office. Good thing I have a smart phone!” Unverified and pointless in any case since I’m pretty sure employees have a variety of ways to access an unfiltered Internet on their own.

I disagree – shutting off HISTalk demonstrates the desperation of the management team; it’s the principal behind it. Allscripts was pro-HISTalk until this news broke…

For the official record, Histalk is certainly NOT blocked in the Allscripts Malvern, PA offices. Honestly, I don’t think our management is that desperate or petty. Moreover, as Mr. H already stated–what would be the point? Our leaders have far bigger fish to fry. For my part at least, it’s business as usual here. I, for one, have faith in Glenn Tullman and wouldn’t bet against him. We’ve already seen pretty steady improvements in our culture since we went from Eclipsys to Allscripts.

We currently have Allscripts ED and EPSI. No worries on this side of the fence. My issues with Allscripts (and I have some) are not impacted by last week’s events. I’ve been in this business too long to worry about this at this point in the game.

Management dramas notwithstanding, it’s a good system that, like all systems, needs to improve and evolve on both technical and user experience levels. My main concern is that John Gomez leaving may have exposed an aversion to what might be seen as disruptive advances in integration and that might reflect poorly on future technical advances. As Chloe demonstrates above, it’s a complex system. It has good functionality but the presentation and user education must be carefully managed to mitigate providers’ fears of patient danger and harm. Some of Sunrise’s competitors don’t allow customization and I’m guessing that looks increasingly like a good bet from the C-suites. Whether it would be seen as such from the user workstations is not as clear, though maybe a definite future-state, in this environment of uncertainty and stress, is preferable to unlimited customization.

I’ve worked with Sunrise since 2002 when .net turned to .not and we eventually went live with 3.04. If Epic has any organizational advantage over Allscripts I think it lies in being privately owned and being run by software people, not corporate people. John Gomez was a software person.

Glen Tullman is a cool guy and it’s hard not to like him. Maybe he just wanted to buy some stock back cheap, you know?

This is being blown way out of proportion. Pead’s tenure as chairman of the board was set to expire in June – he was to be COB for 2 years. In that 2 years, he has done nothing to improve the Allscripts brand, and has essentially been an empty chair collecting millions. Time for this and his other corporate stiff friends to retire and let Tullman do his job.

I’m CEO of an organization supporting over 1,000 small office private practice physicians working with several different hospital organizations. We are using allscripts EHR and related products, and have recently brought in the outsourcing (former Eclipsys) side to help us as well. Glen’s vision makes sense to us, is delivered at a price point that works, and the events of last week have not changed our perspective. We have had issues with the pace of development and integration of the EHR and related products, so the fact that Allscripts is investing serious money in software integration and is slowing down on acquisitions is very good news. We wish Glen and his team godspeed in their integration activity, as it will help our physicians have a better experience, and in the long run enable them to stay independent and yet compete with the monolithic closed systems that are currently expanding.