The New Yorker cartoon of Readers Write articles.

News 3/1/24

Top News

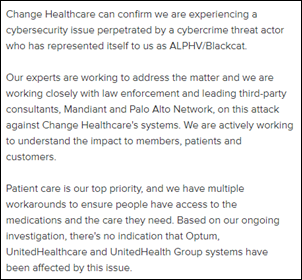

A ransomware group claims that its cyberattack against Change Healthcare yielded 8 terabytes of data from every provider that sends data to Change, including medical records, insurance records, and data from active military service members. The group quickly removed its post, raising speculation that the company might be negotiating a ransom payment.

CommonWell uses Change technology and has disabled its network as a precaution.

Meanwhile, the American Hospital Association asks HHS for help with the Change Healthcare attack, requesting better communication and transparency from Change, help with payments that will be delayed, pausing of citations related to wait times, enforcement discretion for the lack of ability to create good faith estimates, and added flexibility in e-prescribing regulations.

MGMA lists the problems its medical group members are experiencing due to the Change Healthcare disruption:

- Claims cannot be submitted.

- Prior authorization requests cannot be submitted.

- Patient eligibility can’t be checked.

- Health plan payments cannot be received.

- Prescriptions and lab orders cannot be transmitted electronically.

- Medical groups don’t carry reserves year-over-year due to tax consequences, so they are running short on working capital due to their inability to bill and be paid.

Reader Comments

From EHRMusing: “Re: Epic. I’m interested in your thoughts on this article that examines whether it’s a monopoly.” The Forbes article – which was pretty good except for spelling Judy Faulkner’s name wrong – makes these points:

- Epic holds a 36% market share of US hospitals, short of the usual monopoly definition of 50%.

- The company’s aggressive IP protections, such as non-competes and controlling who can work on a client’s Epic team, could be construed as monopolistic behavior.

- Epic increases third-party costs by limiting developer access, and controls access to its ecosystem via its new Showroom third-party marketplace.

- The nature of buying Epic gives more influence to health system CIOs and thus Epic.

- Epic pre-empts competition by announcing products before their release and by publishing a “Products You Can Replace With Epic” guide.

- Epic plays a positive role in filtering “innovation noise” from flaky startups, gives health systems a single point of contact, and has been around for 45 years with no involvement by outside investors.

- The article didn’t mention other important monopoly factors – a high barrier to entry, the ability to set prices above competitive levels, and lack of substitutes, all of which apply to Epic.

- My opinion is that the IP concerns are valid, but otherwise Epic grew because if offers a better product for the academic health systems where it enjoys a high market share. Monopolistic behavior requires intention, and I don’t think Epic intentionally stifles competition in unsavory ways. The market voluntarily accepted its offerings as superior, and if CIOs preferred Epic because of the cool factor and future job prospects, that’s not Epic’s fault.

- Most amazing to me is that the fresh-from-college kids that Epic sends to prestigious health systems earn the full attention of C-level executives who buy into Epic’s way of running health systems, which is either a tribute to Epic or a criticism of those highly paid executives who let a software vendor tell them how to run their business.

From HisTalk2Fan: “Re: Teladoc results. Any comments? Do you think the company will survive long term?” My thoughts:

- TDOC shares are down 46% since the company’s IPO in mid-2015, and even worse, are down 95% over the past three years. Share price dropped 25% on the most recent earnings report, with the company blaming macroeconomic conditions rather than its own missteps. Shares in competitor Amwell have tanked equally dramatically, suggesting that the problem is that virtual visit demand didn’t stick once the pandemic eased.

- The company has reported just one profitable quarter in 32 earnings reports.

- Everybody knows that the company wildly overpaid for Livongo in October 2020, as experienced investor Glen Tullman hypnotized Teladoc CEO Jason Gorevic – who had no CEO experience prior to Teladoc – into buying Livongo for a staggering $18.5 billion, stoking Gorevic’s ambition to become a mini-Glen level industry player in a swing (and a miss) for the fences. Teladoc announced vague plans to spend the proceeds of temporarily popular COVID virtual visits to expand beyond telehealth, which based on dramatically falling telehealth demand, might have been the right idea, but certainly the wrong execution.

- Gorevic somehow kept his job and at least provided the overhyped healthcare startup market with a cautionary tale about irrational exuberance. Teladoc filed a $13.7 billion loss from the acquisition just two years later, and the company’s bragging about its $37 billion value has quieted down now that the whole package is worth just $2.5 billion.

- Meanwhile, last week’s earnings report showed a 46% fall in telehealth visits as Gorevic warned of a well-penetrated market and low single-digit growth for US virtual care products. He also announced plans to expand into weight management and pediatrics while characterizing its virtual care business as a “very stable asset” despite obvious evidence to the contrary.

- BetterHelp, which was about the only good news for the company in previous quarters, failed to meet expectations for revenue and margins.

- I assume the company will survive in some form, but its heyday – if it ever had one – is long past, and they are left with rounds of cost-cutting and trying to shoo away the circling vultures.

From Nomenclaturist: “Re: health system mergers. Why do you usually call them acquisitions?” A merger implies that two companies will combine to do business as a newly formed company, which is rarely the case with health systems. If Health System A and Health System B announce that they will merge and will operate under the Health System A name, then I assume that Health System A is the acquirer and the “merger of equals” characterization is to avoid making the acquired system feel inferior (which they obviously are or they wouldn’t be selling out). I also look to see which company provides the CEO and if one of the health systems will assume the liabilities of the other.

HIStalk Announcements and Requests

I’ve been away and mostly offline for several days, and the fact that you didn’t notice is a tribute to Jenn, who happily follows my doggedly exacting but sometimes quirky writing rules so that the “product” does not vary in my absence. It was fun to enjoy HIStalk as a reader and to find nothing to second guess about the news items she chose or the way she worded them. In fact, Jenn could probably have outdone me today since I’m recovering from a bug.

This is the final call for sponsors to tell me about their HIMSS24 plans for my guide.

Some folks seem surprised that Billy Idol was good at ViVE. Not me, since I saw him years ago when House of Blues Las Vegas comped me a ticket to his show when I was scouting for HIStalkapalooza there. I figured that the spiky, sneering, nearly septuagenarian Billy hadn’t made waves in 40 years and even then in the now-defunct genre of angry Brit punk, but he put on a good show to a self-selected audience who prefer listening to music from their college-aged years.

Webinars

None scheduled soon. Previous webinars are on our YouTube channel. Contact Lorre to present or promote your own.

Acquisitions, Funding, Business, and Stock

The Washington Post says that since Amazon’s acquisition of One Medical — the parent company of Medicare-focused Iora Health, which operates in nine metro areas – the business now known as One Medical Seniors has shortened appointments, laid off clinicians, pushed virtual visits to reduce in-person ones, and eliminated much of Iora’s legendary personal interaction and care coordination, all under the usual corporate excuse-making as necessary to “position One Medical for long-term, sustainable success.” The report also notes that Amazon will be challenged to scale One Medical by offering Prime members a discount because of the its limited geographic coverage. The company has implemented a call center and AI chatbot triage to manage an increased number of telehealth visits. Business Insider reported a couple of weeks ago that Amazon has talked about spinning off the former Iora Health business to reduce One Medical’s projected loss of $342 million this year.

Columbus-based Redi Health, which offers digital pharma support to patients with chronic conditions, raises $14 million in Series B funding. Co-founder and CEO Luke Buchanan came from CoverMyMeds.

Healthcare interoperability vendor Moxe Health receives $25 million in growth capital. CEO Dan Wilson founded the company in 2012 after several years at Epic.

Northwell Health announces plans to acquire Nuvance Health, which would create a 28-hospital system with $18 billion in annual revenue.

The federal government launches an antitrust investigation into UnitedHealth Group, with an apparent focus on the relationship between its insurance business and the healthcare services business of its subsidiary Optum, which is the largest employer of physicians in the US. The justice department previously challenged the company’s $13 billion acquisition of Change Healthcare in 2022, but lost. Change Healthcare’s ransomware attack that has brought US healthcare to its knees is making a good case for the feds.

Online vanity drug prescribing company Hims & Hers Health reports Q4 results: revenue up 65%, EPS $0.01 versus –$0.05, becoming on of the first digital health companies (if that’s what you call it) to show a profit. The company says that new services for weight loss, mental health, and dermatology could each deliver $100 million in revenue starting next year. The company seems excited about the launch of its compounded Hard Mints chewable version of erectile dysfunction drugs.

People

Rhapsody hires Jitin Asnaani, MBA (Health Gorilla) as chief product officer.

Beth Gall (Mantra Health) joins Rainfall Health as VP of sales.

Mark Gee (WellSky) joins Medecision as chief revenue officer.

Former Estes Park Health (CO) CIO Gary Hall, who retired in September 2023, is running for town mayor.

Announcements and Implementations

The Sequoia Project and HL7 will collaborate to accelerate the adoption of FHIR standards in the US. Their initial focus will be on:

- Scalable registration, authorization, and authentication.

- Interoperable digital identity and patient matching.

- Hybrid / intermediary exchange.

- Consent at scale.

Highmark Health will use Epic’s Payer Platform running on Google Cloud to glean insights that can be used to inform consumers of the next best actions. The company says that more than half of its 7 million members are attributed to an Epic-using provider, allowing it to close care gaps automatically.

Several health systems and vendors begin beta testing Hippocratic AI’s healthcare-built LLM, with priority areas being chronic care management, post-discharge follow-up, social determinants of health surveys, health risk assessments, and pre-operative outreach. I was amused to see that the company’s dozen unlabeled photos of healthcare professionals are almost certainly generated by AI in the “dogfooding” style, as verified by Is It AI that places the AI-generated odds at 99.27%.

Keysight announces an AI/ML network validation and optimization solution.

Elsevier Health launches ClinicalKey AI, which provides clinicians with a personalized conversational search interface for medical literature that incorporates patient context and provides linked citations.

A study finds that 58% of the NeuroFlow users who were flagged via NLP as as having possible suicidal ideation would not have been identified otherwise.

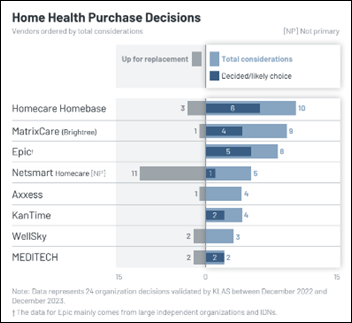

A new KLAS report on home health technology finds that Homecare Homebase has a wide lead in market share, but Netsmart, WellSky, and ResMed have good market share among mostly smaller clients. Most often considered are Homecare Homebase, MatrixCare, and Epic.

Privacy and Security

The White House issues an executive order to protect the sensitive personal data of Americans – including personal health and genomic data — from “exploitation by countries of concern.” It focuses on commercial data brokers that can sell information to other countries, potentially raising privacy, counterintelligence, and blackmail concerns.

Other

The American Prospect describes what happened when Steward Health acquired Rockledge Regional Medical Center (FL):

- The CEO of Wuesthoff Health System, the two-hospital nonprofit that owned Rockledge, sold out to Health Management Associates, which earned his C-suite a $10.6 million golden parachute, after which the hospital was then sold to Community Health Systems and then sold again to Steward, who used money from the medical properties trust that bought Steward’s real estate.

- Steward immediately sold the hospital’s hospice center and home health business and outsourced entire departments.

- Nurses report that the hospital runs short of medical supplies and has had medical equipment repossessed. The hospital has been sued by dozens of vendors for non-payment.

- Five of the hospital’s nine elevators have been out of service for a year.

- The company balked at paying exterminators $1 million to remove 5,000 bats from the facility whose guano backed up hospital sinks and pipes.

- Steward stopped showing up at legal proceedings after the Boston paper noted that the company was $1.4 billion in the red when founder and CEO Ralph de la Torre bought himself a $40 million yacht and the Globe exposed the flight records of the company-owned jet that showed trips to Corfu, Santorini, and Antigua.

- Despite all of its problems, the hospital passed its Joint Commission survey and earned an A grade from the Leapfrog Group. Former employees said that the only thing Steward is good at is hiding problems from inspectors.

- Negative company news hasn’t been run in Florida, leading some to predict that the chain is trying to morph into a Florida-only system as state legislators look the other way and lean on news outlets to do the same.

Sponsor Updates

- Censinet publishes its “2024 Healthcare Cybersecurity Benchmarking Study.”

- Lucem Health incorporates Ryght’s generative AI capabilities into its AI SolutionOps platform.

- Arcadia releases its next-generation data platform powered by an open lakehouse architecture.

- Odessa General Surgery Robotics (TX) adds Sunoh.ai medical AI scribe capabilities to its EClinicalWorks EHR.

- Symplr releases the results of its “State of Healthcare Supply Chain Survey.”

- HealthMark Group adds Credo Health’s PreDx record retrieval technology to its Request Manager medical records software.

- AvaSure selects Oracle Cloud to power its AI-enabled virtual care platform.

- Black Book Research’s latest analysis recognizes Netsmart as the top-performing provider in geriatric medicine EHR and practice management software.

- Net Health publishes findings from a new study, “What’s Delaying Advanced Analytics Adoption in Healthcare?”

- FinThrive releases a new episode of its Healthcare Rethink Podcast, “Take a Deep Breath … Virtual Healthcare is Here!”

- Healthcare IT Leaders CEO Ben Hilmes will chair the Kansas City Light the Night Corporate Walk in support of the Leukemia & Lymphoma Society.

- Inovalon will exhibit at Rise National March 17-19 in Nashville.

- Konza National Network publishes its 2023 Annual Impact Report.

- Medhost releases a new customer testimonial featuring Freestone Medical Center in Texas.

- Meditech announces that the Rotherham Hospital is at the forefront of patient data-sharing with the integration of GP Connect.

- MRO will exhibit at the Minnesota HFMA’s HLAMN Winter Conference March 5-6 in St. Paul.

Blog Posts

- An untapped opportunity for today’s telehealth developers: Clinical content (Wolters Kluwer Health)

- Change Healthcare (Optum) Outage FAQs (Experity)

- Medicaid Waivers by State: Findhelp and New York (Findhelp)

- Navigating the Healthcare Staffing Shortage with People-First Technology (FinThrive)

- Prioritize Your Contact Center Cybersecurity Methods (Five9)

- We Answered “The Healthcare AI Question No One Wants to Answer” (Lucem Health)

- The push and the pull: an interoperability update (Meditech)

- Extend the Reach of Your Hospital’s EHR with Clinical Communication and Collaboration (Mobile Heartbeat)

- Unlocking Specialty EHRs: Take a User-Centric Approach to Wound Care (Net Health)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

My large provider organization is moving away from Cerner to Epic in all markets. The fact is, no one in senior leadership believes there’s any other viable product on the market for large hospitals, especially since Oracle now owns Cerner and because no other player on the market can offer the integration and level of support that Epic can. It’s a monopoly in practical terms, if not in technical terms (yet).

What is Meditech’s largest install? Could they ever move upmarket?

HCA is their largest customer. Avera is a big regional center as well. Meditech might have big foreign installs but that’s a different market.

The only way to knock the US EHR market off its trajectory is government intervention in either the IT market or the healthcare market. There’s little legislative appetite for addressing healthcare. Epic will own the acute market, it’s uninteresting to me which private equity firm will own ambulatory.

It’s tough bringing new healthcare software to market outside of the EHR giants, speaking from experience inside and outside the big vendors. The traditional healthcare IT market is frozen for the last/next decade.

I suggest the federal government aided Epic’s rapid growth by distorting the market with the financial incentives of the HITECH Act. A more meaningful measurement of Epic’s dominance is the percentage of non-military medical records its systems maintain.

There appear to be some Industrial Policy fans here who don’t appreciate my take on the HITECH Act.

Considering Epic A) wasn’t the largest EHR company at the time of the HITECH Act (since a larger company should be able to better deal with development requirements due to regulation than a smaller one), and B) was already winning plenty of sales before the Act passed (suggesting that Epic was already gaining momentum in the market), I think you need to give a bit more of an argument about how it specifically distorted the market in favor of Epic.

Or are you making the argument that the current regulatory environment makes it more difficult nowadays for start-up EHRs to wedge themselves into the market (I definitely agree with this; no idea how anyone could raise the capital needed to build a fully fledged enterprise EHR today while also waiting out the hospital sales pipeline)?

I agree that Epic’s strategy of focusing on teaching hospitals worked to its advantage once the merger & acquisition trend began to take hold. But Epic is by far the most expensive vendor in the market. Without the HITECH reimbursement money, would so many hospital c-suite executives have been willing or able to buy Epic? The distortion includes the swiftness of change that occurred in the market. One of the potential effects of a government Industrial Policy, which the HITECH Act definitely was, is the picking of winners and losers, and in this market Epic is clearly the winner.

I’ve always found this line of thinking a little odd – if the incentives induced more C-suites to pick a premium product with a premium price tag that’s entirely within the policy goals of HITECH. It’s not like the incentives would cover the entire licensing and implementation costs, these incentives always operate on the margins.

Said another way: If one company were selling a discount product with options for add-ons down the line, while Epic is offering more (at a higher price) upfront with less to add later and your pot of money is finite the HITECH act mostly functions as a catalyst of what you would have already wanted to do.

I think we’re saying the same thing, at least in part, that the market wouldn’t be the way it is without the influence of HITECH.

You might claim that HITECH accelerated Epic’s growth. That is a reasonable deduction. It was manifestly not designed to do that however.

HIS systems are not fungible, nor are they commodities. It is an entirely rational market behaviour to choose to pay a premium price, to get a premium set of functionalities. In the same way, it is rational to choose a low-cost product and accept reduced attributes.

I know Meditech extremely well and have intimate knowledge of their weaknesses. There are many, but this is not the time to go into details. Meditech also has some strengths, TBF.

If HITECH was “the reason” for Epic growing at the expense of Cerner and Meditech, why does that trend continue in the absence of HITECH? Should there not be Epic customers, abandoning the product, and going with the competition now? After all, HITECH financial incentives were the sole or primary reason for choosing Epic…

No. There are A LOT of reasons to choose to leave Meditech. Meditech can be an extremely frustrating system to support, and the users never understand (or don’t care) that it all comes back to “the Meditech way”.

HITECH wasn’t “the” reason for Epic’s success, but it made some hospitals more able to buy a Lexus, rather than settling for a Chevy. One example I know of was a $20 million dollar bid submitted by MEDITECH to one of its customers. It was rejected by a hospital that, with the certainty of a HITECH reimbursement, signed with Epic for $100 million. Even with MEDITECH’s add-ons, the total wouldn’t have approached half that amount, perhaps not even one third.

Following your assertion that HIS software is a commodity, post-HITECH Epic hit critical mass to the point where it can now be considered a Giffen good, where the more it costs the more the demand for it increases. MEDITECH is now characterized as the “you get what you pay for” system. I heard that expression myself, at a MEDITECH customer that will be converting to Epic after its affiliation with a large medical system is complete. That medical system began with the same hospital I mentioned above, and they’re now on the hook with Epic for $600 million. Undoubtedly, the organization felt Epic was the better choice for its expansionary ambitions. That cost however, according to a spokesman, is a burden on the organization.

As I stated previously, Epic’s focus on large teaching hospitals worked to its advantage. The merger and acquisition trend has been very good for Epic. Whether or not it’s good for healthcare is uncertain, with the closures of community hospitals and the desperate condition of rural Critical Access facilities.

MEDITECH’s largest customer is certainly HCA. I cannot recall encountering a facility larger than 350 beds

Meditech’s core market is small and medium-sized healthcare entities. Therefore, “largest Meditech customer” tends to be relative. I have a rule that the largest and best-known healthcare organizations, continent-wide, rarely if ever use Meditech.

I mean, to approach this from who is NOT a Meditech customer (from memory and general knowledge only, there may be errors):

Brigham & Woman’s: No

Cedars-Sinai: No

Humana: No

Intermountain: No

Johns Hopkins: No

Kaiser: No

Mass. General: IIRC, still is, but is moving away I believe?

Mayo Clinic: No

Mount Sinai: No

UCLA MC: No

UPMC: No

Vanderbilt: No

My employer is one of their larger customers. We are moving upmarket, to use your term.

I prefer not to disclose who my employer is.

MGH is Epic as part of Partners cum Mass General Brigham

The reason I hedged on Mass. General was that I remembered a news story. It was from roughly 1-5 years ago.

The gist of the story was that one of the very first Meditech customers, was migrating away from Meditech. I initially remembered this as being MGH, but upon reflection, it might have been a health system on an island off Massachusetts. Martha’s Vineyard, perhaps?

My searches to date have yielded nothing relevant.

Probably Cape Cod Hospital of Hyannis, which was Meditech’s first customer in 1971. They switched to Epic in 2020.

Cape Cod originally switched from Meditech to McKesson (https://histalk2.com/2009/08/20/news-82009/)

I wrote this answer to the question “Who will disrupt Epic’s stronghold in the electronic medical records space?” on Quora EIGHT years ago and it still holds true, other than none of the ankle-snappers have gotten anywhere. Not sure about Optum et al.

It’s the wrong question. The question should be, at what point (if any) does the current function of EMRs in big enterprises change because either the enterprises have changed or been destroyed by new market entrants? The little ankle snappers at the feet of the huge hospital systems, which are emerging in primary care, retail care, different specialties, etc, and the bigger systems focused on consumer population health (health plans for now) have a natural alliance against the big expensive inpatient hospital systems.

No one is going to beat out Epic for contracts with Partners or Kaiser, although athenahealth is starting to move in the inpatient direction with its recent acquisitions, and the cloud is hard to beat on price (see Salesforce v SAP/Siebel). But enough of those big systems are at risk in the next downturn that Epic’s customers may not be the dominant players in health care in 10-15 years. And the new entrants are going to use modern cloud based systems.

I can tell you how the story ends but I can tell you that the end of the story will answer your question.

https://www.chicagobusiness.com/health-pulse/uchicago-rush-northwestern-form-breast-cancer-network?utm_source=morning-10&utm_medium=email&utm_campaign=20240229&utm_content=article4-headline

Re: Change — maybe its a bad idea to let one company take over every aspect of healthcare delivery, for many reasons. Learn, history, repeat, something something.

Having a industry-crippling cyberattack right as the federal government launches an antitrust probe is not the best timing for UnitedHealth Group.

Epic’s “aggressive IP protections” may actually understate their position. Epic has a history of legal action against customers and consultants for sharing product documentation.

This is fiction (at least the customer part, I’m sure the company has run into bad apple consultants before). Feel free to provide facts to support your claims.

https://isthmus.com/news/cover-story/opportunity-lost-epic-noncompete-list/

“The verboten list includes giant health systems and physician groups, major health insurers, a plethora of billing services, health consultants of all sorts, not to mention seeming oddities like Little Rock Ambulance, the YWCA of Southeastern Massachusetts and the Buffalo Urban League (click here to download a PDF of the list). ”

The article goes on to discuss individual cases, like someone who was fired 5 weeks after Epic complained that the health system was in violation of the non-compete.

I have more than a couple friends who have also run up against this problem. They have had to essentially leave healthcare for a couple years so they could come back in and not get hunted down by Epic’s legal team. So, going to say that it is “well known” and it is interesting that you would say otherwise. I wonder why you would attack this as “fiction”

I reached out to one about this article and about the “gap year” and she laughed pretty hard and said it was completely true.