Neither of those sound like good news for Oracle Health. After the lofty proclamations of the last couple years. still…

News 4/12/23

Top News

A federal jury convicts three former executives of waiting room advertising company Outcome Health, which was valued at one time at over $5 billion, of several fraud charges involving inflating the number of ad impressions to advertisers and investors from 2011 to 2017.

Convicted are former executives Rishi Shah (CEO), Shradha Agarwal (president), and Brad Purdy (CFO), none of whom testified.

SEC charges are pending against the executives, along with Ashik Desai, who testified against his former bosses in the criminal trial.

Shah and Agarwal stepped down following a Wall Street Journal investigative report in 2017. They were 31 and 32 at the time. Shah owned 80% of the company, giving him a net worth of nearly $4 billion. PatientPoint acquired Outcome Health in March 2021.

Shah and Agarwal founded JumpStart Ventures in 2011, whose investments include MedCity News, CoverMyMeds, and Medpilot.

Reader Comments

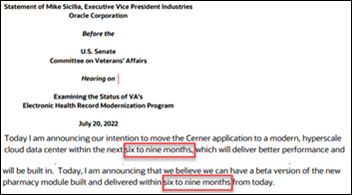

From Nikki: “Re: Oracle. I bet whoever made this proclamation is regretting it.” Oracle EVP Mike Sicilia told the US Senate Committee on Veterans’ Affairs on July 20, 2022 that the company would move the VA’s Oracle Cerner implementation to the cloud and rewrite its pharmacy module within 6-9 months. We’re at the nine-month mark and I’ve heard nothing. Maybe they’re saving the announcement for HIMSS23.

From Asclepi Us: “Re: health systems. I’ve heard that the term health system may be replaced as they get bigger and offer broader lines of business. One has said the future is ‘health platform.’” The trendy name progression has included hospital, medical center, regional medical center, health system (which patients generally dislike intensely), and health (particularly questionable given how hospitals make money). My prediction is that because the business of health is so broad and brand-obsessed that it will be like Northwell, Providence, Ascension, and others that simply choose a one-word name — sometimes by making up an eye-rolling word or painfully conjoining two actual words into one — that they hope age well. The names with the shortest shelf lives will be those where two merging entities can’t bear to see either old name disappear and settle on squeezing both names into one. Assuming I am right that one-word names will prevail, ChatGPT suggests DynaCare, Vitalia, MediVista, Zenitha, Nuviva, or Aurelia.

HIStalk Announcements and Requests

I’ve added a couple of HIStalk sponsors to my HIMSS guide.

Someone on LinkedIn reference this 2017 article, in which two reporters coined the term “broetry” to describe those overly cutesy LinkedIn posts that — with one pithy sentence per paragraph — try to pass off trite personal or business observations as being inspiring or insightful. They say the broems “read like employee handbook haikus or an E.E. Cummings motivational poster” that always finish with “some closing fortune cookie-esque takeaway.” One user speculates that the widely scorned format caters to an ADD mentality of get-to-the-point writing or perhaps is popular because it can be easily read on mobile devices. ChatGPT has since made the broet’s work easier and even more mindless.

Welcome to new HIStalk Gold Sponsor CenterX. The Madison, WI-based company delivers reliable, patient-specific pharmacy benefit data and a fully integrated prior authorization solution, allowing providers to start cost-effective therapy faster. It delivers full benefit transparency at the point of care, including up-to-date pricing information and offering alternatives to medications that require prior authorization. Its electronic prior authorization tools are integrated into the EHR and keep users in the same system, regardless of the payer or plan, without faxing, re-entering, or phone calls. More than 120,000 Epic providers have had the CenterX network added alongside their existing network or alone at no additional cost to the health system. Providers who use prescription benefit information from CenterX made changes 25% of the time to either save their patients money or avoid a PA. Also, prior authorizations dropped by 38% after CenterX ePA was implemented. Thanks to CenterX for supporting HIStalk.

Webinars

None scheduled soon. Previous webinars are on our YouTube channel. Contact Lorre to present or promote your own.

Acquisitions, Funding, Business, and Stock

Confirming earlier rumors of a sale, healthcare automation vendor Olive AI sells its payer-facing prior authorization business to health information network Availity. The acquisition includes existing Utilization Management customer contracts and an agreement to hire around 100 key Olive personnel. Olive sold off its population health management and 340b solutions in 2021, and has laid off nearly 700 employees within the last year. According to its website, Olive now focuses solely on autonomous revenue cycle services.

Twitter legally ceases to exist under that name as Elon Musk merges it into another of this companies that is called X Corp. Musk has previously tweeted his intention to turn Twitter into the “everything” X app that includes social networking, messaging, and payments. Musk and his co-founders launched the company that eventually became PayPal by merging their security software company with online financial services company X.com in 2000.

Ellkay releases LKOrbit, an end-to-end, cloud-based connectivity platform that supports laboratory ordering, results, connectivity, and access to billing information.

Sales

- Contexture, an HIE serving organizations in Arizona and Colorado, will unify its technology platforms into a single system with assistance from Health Catalyst.

- McLaren Health Care’s Karmanos Cancer Institute (MI) selects Volpara Health’s Risk Pathways risk assessment and patient management software.

- Pria will implement Health Connect Cloud technology from InterSystems, which is also an investor in the chronic care management company.

- Dayton Children’s Hospital will implement Bio-key’s PortalGuard IDaaS biometric authentication in its migration from Epic’s Hyperspace to Hyperdrive.

People

Ben Hilmes, MHA (Adventist Health) joins Healthcare IT Leaders as president.

Nate Kelly, MBA (Hospital IQ) joins ChartSwap as president.

Greenway Health hires Don Kleoppel (Cerner) as CISO.

Announcements and Implementations

WellSky announces GA of WellSky Patient, giving patients the ability to communicate with providers between visits, access virtual care, and take part in condition management programs.

Equifax, Experian, and TransUnion remove medical debt of under $500 from US consumer credit reports, adding to previous actions that removed paid-in-full medical debt immediately and that gave people 12 months instead of six to pay a medical bill before it appears on their credit report.

Moffitt Cancer Center profiles CIO Joyce Oh, who joined the organization in September 2022.

Government and Politics

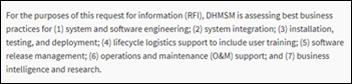

HHS and ONC issue a Notice of Proposed Rulemaking with changes to the Cures Act and ONC’s certification program. Participation in the Electronic Health Record Reporting Program would become a new Condition of Certification for certified health IT developers and several certification criteria would be revised. The unpublished version is here.

HHS OCR issues a reminder that its HIPAA and HITECH enforcement discretion ends with the expiration of the public health emergency on May 11, 2023. A significant change is that providers will no longer be able to use non-compliant technologies to conduct telehealth sessions.

Cerner Enviza and John Snow Labs will work with the FDA as part of its Sentinel drug safety initiative to develop AI solutions that extract relevant data from clinical notes within EHRs so that the agency can better understand the effects of medications on large populations. Cerner launched the Enviza business in 2020, eventually combining its provider network data with that of health data vendor Kantar Health, which it acquired for $375 million in 2021.

The Defense Health Agency begins researching a support contract for MHS Genesis as its original 10-year, $5.5 billion agreement ends in July 2025. Leidos was the prime contractor for the July 2015 contract, joined by Cerner, Accenture, and Henry Schein.

Privacy and Security

The Health Sector Cybersecurity Coordination Center within HHS alerts healthcare organizations to a growing number of distributed denial-of-service attacks. HC3 warns that the volume of invalid requests will not only slow servers down, but prevent valid requests from being processed.

Other

Vanderbilt University Medical Center’s Center for Knowledge Management develops MyKnowledgeHub, an online database of curated clinical evidence, drug information, and patient education resources for VUMC providers.

Former Propeller Health executive Chris Hogg — who left the company and started virtual primary care company Marley Medical in 2021 — analyzes the apparent demise of digital therapeutics vendor Pear Therapeutics following its filing of Chapter 11 bankruptcy:

- The early idea that software could impact clinical outcomes evolved into focusing individual market segments, with companies such as Omada, Ginger, and WellDoc.

- Implementation and delivery turned out to be the hard part. The underlying technology is only a small part of the solution.

- The grind of distribution and payment is hard and expensive.

- Companies were trying to identify their services business as technology businesses with their P&L showed otherwise.

- Commodity software was being offered a high prices – up to $500 per patient per month in Pear’s case — based on a limited number of studies, with spotty payment and questionable value of a limited service. Care delivery can’t be sold like a consumer product.

- Studies proving that tech can improve outcomes are necessary but not sufficient. Healthcare innovation usually fails to succeed due to patient acquisition, payment, and distribution.

- The path forward is to build a new care model around software to deliver end-to-end-care to produce the outcomes that create value.

Another insightful comment about Pear comes from Eric Gastfriend, founder and CEO of competitor DynamiCare Health, who calls out product cost, lack of payer coverage, and this great summary:

Unrealistic expectations. They went public last year via a SPAC at a >$1B valuation, with just $4M in revenue. Raising too much money at too high a valuation forces companies to take big risks, spending the money they’ve raised to try to quickly drive revenue / milestones in order to justify the valuation. In fact, the SPAC was largely driven by previous rounds that raised too much at too high valuations. In total, the company raised >$400M, 25% of which was in the form of debt. Once you’ve taken on debt, leases, regulatory compliance burdens (FDA for being a prescription product; SEC for being a public company), and other unavoidable costs, it makes it harder to turn the company profitable, and therefore a better strategy is to try to grow as quickly as possible to be able to raise more money. That can work until the macroeconomic / fundraising environment dries up, which is what happened for tech in late 2022.

Sponsor Updates

- AdvancedMD publishes a new e-guide, “Private Practice KPIs: 12 Data Points That Impact Revenue.”

- Agfa HealthCare publishes a new case study, “Region Midtjylland (Region Midt) celebrates their Agfa HealthCare Enterprise Imaging Go Live.”

- Nordic publishes a new episode of DocTalk, “Using data wisely: Telling the insight story.”

- Bamboo Health will exhibit at the ACMA National Conference April 21-24 in Washington, DC.

- Care.ai makes its AI-driven Smart Care Facility Platform available on Google Marketplace.

- CarePort Health publishes a new customer success snapshot featuring Legacy Health Services, “Successfully managing patient populations with help from real-time data.”

- CHIME congratulates members Cook Children’s Health Care System SVP and CIO Theresa Meadows, CHIME VP David Finn, and Intermountain Healthcare VP and CISO Erik Decker upon receiving their respective Leadership Excellence in Cybersecurity Awards from The Baldridge Foundation.

- Current Health publishes a new study, “Temporal trends in virtual care data may influence program staffing and design.”

Blog Posts

- How to manage ‘relentless’ payment denial codes (AdvancedMD)

- Part Two: Blizzards, Heat Waves, and Health Outcomes – Using Data in Response to Natural Disasters (Azara Healthcare)

- Can a Good Network Management Partnership Give Your Healthcare IT Organization New Focus? (CereCore)

- MEDHOST Invites Attendees to Learn More About Innovative Services and Solutions at HIMSS23 (Medhost)

- 10 Security Priorities for HIPAA Compliance Success (Clearwater)

- The Growing Use of ChatGPT by Hospital Staff Leads to the Inadvertent Disclosure of Patient and Technical Information (CloudWave)

- Our Top 4 ViVE 2023 Conference Takeaways (Divurgent)

- Consensus Cloud Solutions at HIMSS23 (Consensus Cloud Solutions)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

Maybe soon Microsoft will integrate ChatGPT with LinkedIn and we can use it to filter out all the humble brags and broetry in our feeds.

“Maybe [Oracle is] saving the [Pharmacy] announcement for HIMSS23.”

(Smirk!)

Yeah, I’ve got $20 that says there will be no such announcement. They will be lucky to be able to announce something at HIMSS24. And if everything doesn’t go juuussssstt right, more likely it will be for HIMSS25.

I used to be peripherally associated with a company that used the “DynaCare” moniker. However that organization was name-change happy and therefore the DynaCare name was about 3 names ago.

Likely, DynaCare is available for whoever wants it. I’d say the old DynaCare ah, dinna care!