I'd never heard of Healwell before and took a look over their offerings. Has anyone used the products? Beyond the…

News 1/26/22

Top News

Cerner lists the Golden Parachute Compensation that will be paid to its top executives if they are forced out in the Oracle acquisition:

- President and CEO David Feinberg $22 million (company tenure – less than four months)

- EVP/CFO Marc Erceg $11 million (company tenure – less than one year)

- EVP/CTO Jerome Labat – $11 million (company tenure – 19 months)

- Former Chairman and CEO Brent Shafer — $21 million

- Four other Cerner executives will potentially benefit from the change-in-control terms of their contracts.

Cerner’s SEC filing also provides a timeline of Oracle’s acquisition offer:

- Rumors of unsolicited take-private acquisition offers arose in May and June 2021.

- Cerner turned down a private equity sponsor’s request for acquisition discussion in July, an offer that was repeated and again denied in August 2021.

- Oracle made its initial inquiry on October 7 and due diligence followed.

- Oracle made a $92 per share offer on November 12.

- Cerner’s board discussed opening up the sale process to private equity buyers on November 20, but worried about long timelines, the risk of information leaking out, price uncertainty, and losing Oracle as a buyer. They also expressed concern that the deal size would require the participation of a consortium of private equity buyers that would complicate the sale process. They ruled out contacting potential strategic buyers for the same reasons plus a concern about “the potential lack of interest.”

- Cerner told Oracle that its per-share offer was too low on November 24, Oracle said it needed Cerner’s board to be specific about the price it sought, and Cerner gave a price of “the upper $90’s” on November 29.

- Oracle offered $95 on December 1. A Cerner executive was rebuffed when trying to increase the offer price, with Oracle saying its price was its “best and final offer.”

- Cerner received an email inquiry from a potential strategic buyer on December 17, but was operating under an exclusivity agreement with Oracle through December 20.

- No other potential bidders expressed interest after the Wall Street Journal reported the proposed Oracle acquisition.

- The board listed the risks of continuing to run Cerner as a standalone company as (a) competition and healthcare market challenges; (b) operating and product risks in a rapidly changing technology environment; (c) increased competition; (d) retention of key technical employees; (e) risks in government contracting; (f) hitting growth targets in foreseeable market conditions with few attractive acquisition targets to boost growth and enter new markets; (g) the risk of not hitting growth and profit targets; and (h) uncertainties around COVID-19’s impact on the company’s business.

- Terms of the merger agreement allow Cerner to consider unsolicited better offers.

Webinars

February 9 (Wednesday) 1 ET. “2022 – Industry Predictions and Medicomp Roadmap.” Sponsor: Medicomp Systems. Presenters: David Lareau, CEO, Medicomp Systems; Jay Anders, MD, chief medical officer, Medicomp Systems; Dan Gainer, CTO, Medicomp Systems. The presenters will provide an update on the health IT industry and a review of the company’s milestones and insights that it gained over the past two years. Topics will include Cures Act implications, interoperability, AI, ambient listening, telehealth-first primary care, chronic care management, and new Quippe functionality and roadmap.

Previous webinars are on our YouTube channel. Contact Lorre to present your own.

Acquisitions, Funding, Business, and Stock

Health IT company Emids acquires low-code enterprise software development and consulting firm Cloud Development Resources for an undisclosed sum.

Reimagine Care, which supports at-home cancer care with remote patient monitoring and patient-reported outcomes, raises $25 million in a Series A funding round.

Change Healthcare is considering selling some of its assets to help gain approval for its sale to UnitedHealth Group, with payment integrity business ClaimsXten being shopped at a potential $1 billion sale.

Sales

- Novant Health (NC) selects AI-powered triage and patient notification software from Aidoc.

- MarinHealth Medical Center (CA) will outsource its administrative and RCM processes to Optum.

People

Former North Carolina HHS Secretary Mandy Cohen, MD, MPH will join Aledade in March as EVP and CEO of its Care Solutions business.

Jean Boyle (Sectra) joins Intelerad as VP of global professional services.

Sue Schlichtig (NextGen Healthcare) joins Oracle as industry executive director of healthcare.

Announcements and Implementations

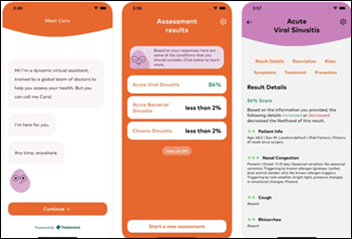

Healthcare AI app vendor Treatment launches a probability-based symptom assessment tool that it says consumers find more like seeing a doctor than Googling symptoms online.

The University of Rochester Medical Center (NY) implements pharmacy analytics from Loopback Analytics.

HSHS Good Shepherd Hospital (IL) goes live on Epic.

Government and Politics

ONC seeks public input on electronic prior authorization standards, implementation specifications, and certification criteria that could be adopted within its Health IT Certification Program. Comments are due March 25.

Other

UCSF pilots a payment program in which some providers are paid for responding to patient emails that take more than a few minutes to compose or require medical evaluation. Reimbursements from public and private payers have averaged $65 per consultation. Patients are advised when messaging providers through the patient portal if their correspondence will incur a fee. Medicare and Medicaid patients have typically not seen any extra cost, while privately-insured patients have seen co-pays between $5 and $10.

AMA and CAQH call for payers and providers to worth together to improve the accuracy of health plan provider directories, whose erroneous information frustrates patients, delays their care, and creates unexpected expenses from misstated insurance coverage.

ThedaCare makes national headlines (of the undesirable type) for suing seven of its employees to prevent them from taking jobs with nearby Ascension-owned competitor St. Elizabeth Hospital. ThedaCare accused St. Elizabeth of endangering the community by “poaching” seven of its 11 stroke team members. The employees, who said they applied to posted St. Elizabeth jobs without being recruited, said that ThedaCare declined to make counteroffers to match St. Elizabeth’s higher compensation and more attractive working hours. ThedaCare’s lawsuit failed as the new St. Elizabeth’s employees started work there Tuesday, just one day later than planned. Ascension’s legal brief is full of entertaining sarcasm, leading off with, “Your failure to prepare is not my personal emergency” and noting that St. Elizabeth’s offers similar services seven miles away, “just without the fancy designation ThedaCare appears to view as a better use of funds than paying its workers.”

Sponsor Updates

- Availity employees help Big Brothers Big Sisters of Northeast Florida collect more than 400 toys for the organization’s holiday toy drive.

- CareSignal publishes a case study titled “How OSF HealthCare Uses Deviceless Remote Patient Monitoring to Scale its Virtual Care Strategy.”

- AGS Health publishes a new white paper, “Partnering for Transformation: SCP Health Reduces Costs by 28%.”

- Arcadia publishes a new white paper, “What Drives Long-COVID? Understanding Complex Interactions with Real-World Data.”

- Bamboo Health releases a new e-book series, “CMS’ E-Notifications CoP: The Route to Compliance – Part 4.”

- CHIME releases a new Digital Health Leaders Podcast featuring Cerner Enviza Head of Global Strategy Jeremy Brody.

- Change Healthcare releases a new podcast, “A New Approach to Alcohol Treatment.”

- ChartSpan publishes a whitepaper, “Follow the Money: Medicare’s New Gold Mine is Chronic Care Management.”

- Clearwater promotes Adam Nunn, Dawn Morgenstern, and George Jackson to directors of consulting services; Wes Morris to senior director of consulting services; and Mikaela Lewis to principal consultant.

Blog Posts

- Finding the right NSV partner: What you need to know (Ability Network)

- Sunsetting support for older iOS devices (AdvancedMD)

- Meditech Dictionary Cleanup for Clinicians (and IT) (CereCore)

- Should doctors care about your address? (Nordic)

- Four Big Implications for Patients and the Prescription Journey in 2022 (ConnectiveRx)

- Take it to the Cloud (Divurgent)

- Healthcare 2022: Regulatory Trends to Look for in the Year Ahead (EClinicalWorks)

- Leveraging the Value of Virtual Care Data (EVisit)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates.

Send news or rumors.

Contact us.

If any companies need to hire a C-level, months before an acquisition, and then pay them out millions of dollars, I am a willing and able body. I’m even a diversity hire. Let’s gooooo.

I wish those golden parachutes functioned like anvils.

Good for them. But how can anyone justify this? Wonder what the paper parachutes the working employees received look like…

Re: Cerner exec compensation

Hard to accept business pushback on minimum wage increase when you see executive compensation like this.

The pushback on minimum wage increases is the result of 40 years of anti-labor media spin. It’s always funny watching on social media as middle class people tear down working class employees at fast food places when they threaten walkouts or collective bargaining. The shareholders and executives are laughing at ALL of you. Real wages for the middle class have been stagnant since Reagan was president despite insane advancements in technology and productivity over the same period. Meanwhile the upper class has steadily increased income and wealth. Workers have had to take it all on the chin through the Right to Work political movement/Koch machine/general anti-labor pendulum swing. Union busting is as popular as ever. Why did Epic disband their QA division (which was taking steps to initiate union elections), then re-establish the QA division 6 months later after the union talk had died down? Raven Software is replaying that same playbook in Madison as we speak. Why do traveling nurses get paid 3x or 4x their FTE counterparts when employers could attract more FTEs by raising wages? At some point it stops being about economics and it starts being about management demonstrating their control over labor.

I don’t fully understand why so many Americans look down on workers when they are simply asking to negotiate working conditions. People forget that hardly 100 years ago employers were literally shooting and murdering employees who tried to strike. We have become complacent and forgotten that the labor struggle doesn’t end.

I believe that all workers should negotiate working conditions, and if they have the will, to unionize – and I’m willing to bet most folks would agree; but I think it’s a bit of a stretch to say that the decline of union membership is due to media spin. Public trust in unions has been in decline since at least the days of Jimmy Hoffa, largely due to union corruption. Just last year 15 UAW union leaders, including 2 presidents, were indicted for embezzling millions.

That’s not to say unions are inherently corrupt, but it’s enough to sour the public’s opinion of them.

As for travelling nurses, the primary reason they’re paid better is because they’re temporary. That’s the case with all temporary & contract employment. While I wouldn’t be surprised if some CFOs use them to depress nursing wages, the truth is staffing needs can be unpredictable, and overstaffing for a temporary need only leads to layoffs. Of course those hospital executives could always give up a few of the millions they make every year to pay their people better (but then they might have to sell a vacation home or two).