Wayne Gillis' LinkedIn post. Neither Rehoboth McKinley or Great Falls Clinic is on Epic. Did he miss a workplace on…

Monday Morning Update 3/18/19

Top News

Change Healthcare files IPO documents for a $100 million IPO. Analysts estimate the company’s value at up to $12 billion.

The company, of which McKesson owns 70 percent with two private equity groups holding the remainder, reports adjusted net income of $281 million on $3.3 billion in revenue in 2018.

Change took on $6.1 billion in debt to create the business last year in merging the former Emdeon with McKesson’s IT business, after which McKesson was paid $1.25 billion and PE firms Blackstone and Hellman & Friedman received $1.75 billion.

Shares will trade on the Nasdaq under the symbol CHNG.

CEO Neil de Crescenzo’s 2018 compensation was $8.3 million; former CFO Al Hamood (now president of ATI Physical Therapy) was paid $13.3 million; EVP Rod O’Reilly earned $5.6 million; former sales EVP Mark Vachon was paid $6.4 million; and EVP/CIO Alex Choy’s compensation was $3 million.

The six non-employee board members were each paid cash and options worth $400,000 to $573,000.

Seventeen of the 19 company directors and executive officers are male.

HIStalk Announcements and Requests

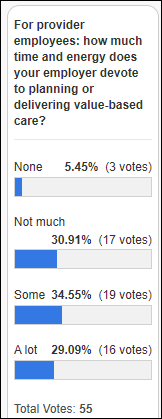

Last week’s poll is a toss-out since responses were evenly spread and few in number, so let’s move on.

New poll to your right or here, for HIMSS19 provider attendees: did you discover an interesting product or service that you will follow up on? Click the poll’s “comments” link if you vote yes to tell us what piqued your interest.

Webinars

March 27 (Wednesday) 2:00 ET. “Waiting on interoperability: What can payers and providers do to collaborate?” Sponsored by Casenet. Presenter: Amy Simpson, RN, director of clinical solutions, Casenet. A wealth of data exists to identify at-risk patients and to analyze populations, allowing every payer and provider to operate readmissions intervention and care management programs. Still, payer and provider care managers are challenged to coordinate and collaborate to improve outcomes because of the long road ahead to interoperability. Attend this webinar to learn what payers and providers can do now to share information and to coordinate their efforts to create the best healthcare journey for members and patients.

Previous webinars are on our YouTube channel. Contact Lorre for information.

Acquisitions, Funding, Business, and Stock

Mobile health evaluation company Signify Health acquires TAV Health, which offers a platform to connect community and health partners to address social determinants of health. Signify’s CEO is former Athenahealth SVP/Chief Product Officer Kyle Armbrester.

For-profit hospital operator HCA acquires a majority ownership in for-profit Galen College of Nursing, which offers instruction on five campuses and online.

People

Chris Belmont (Intelligent Retinal Imaging Systems) joins The HCI Group as EVP of strategy and operations.

ROI Healthcare Solutions hires Brent Prosser (Infor) as SVP of sales.

Announcements and Implementations

Peterson Regional Medical Center (TX) goes live on Meditech Expanse with patient accounting and supply chain help from CereCore.

Privacy and Security

Singapore’s Health Sciences Authority reports yet another healthcare-related breach in that country after discovering that one of its contractors failed to secure an online database of blood donors containing the information of 800,000 people. The website of the contractor, Secur Solutions Group, has gone offline.

Other

A large RN survey finds that a hospital’s work environment plays a big part in whether nurses are satisfied with the hospital’s EHR and how they perceive its contribution to patient care and safety.

The Canberra, Australia newspaper reviews the 40 patient safety bulletins issued to EHR users in 2018 by the Cerner project team at Queensland Health, many of related to software updates. They include problems with children’s weights, unexpected drug name changes, switching to the wrong record when multiple patient windows are open, and creation of duplicate encounters.

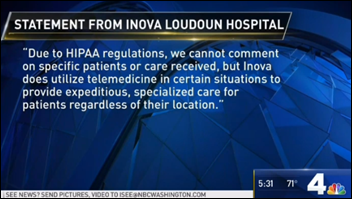

A Virginia woman complains that her dying husband had to endure a low-quality, 35-minute telemedicine encounter with an Inova psychiatrist who needed to evaluate his “do not resuscitate” request. She complained, “I hope there’s a real reflection in the medical community about the ethics of these teledoctors.”

Doctors at University of Virginia Children’s Hospital develop an IPad-based system that allows NICU babies to go home earlier, replacing a pen-and-paper and call-in system for parents to report their baby’s feedings and weight. The system sends data immediately to Epic. It was developed by Charlottesville-based Locus Health and its use has been expanded to 15 children’s hospitals. The designers are a pediatric cardiologist and his NICU pediatrician wife.

Ontario, Canada scraps a $500,000 public health vaccination reporting system and goes back to paper forms after finding problems caused by incompatibilities with physician EHRs, one of which was that the vaccine names don’t match.

The Atlantic covers the “uniquely American phenomenon” of medical debt, as 60 percent of people who file bankruptcy say medical bills played a major part. It says medical debt will probably increase as fewer people buy insurance, deductibles are raised, sales of poor-coverage junk plans increase, and out-of-network bills increase as insurers narrow their networks. The article focuses on how to negotiate a bill with a hospital:

- Ask about financial assistance, including charity care if uninsured

- Ask to be billed at the same rate Medicare pays

- Ask for a payment plan or full payment discount

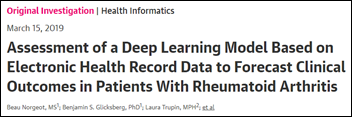

A study finds that applying deep learning to just a few hundred patient EHR records can accurately predict the outcome of chronic diseases (rheumatoid arthritis in this case). The same model then works fairly well across other hospitals. The authors believe that decision support should involve training models on aggregated patient data from multiple healthcare systems, then extending the model to other providers.

Sponsor Updates

- NextGate and Nordic will exhibit at Texas HIMSS March 25-26 in Austin.

- Clinical Computer Systems, developer of the Obix Perinatal Data System, will exhibit at the AWHONN Virginia Section Conference March 17-18 in Charlottesville.

- Flywire and Experian Health will exhibit at the HFMA Revenue Cycle Conference March 20-22 in Austin.

- Recondo Technology and MedeAnalytics partner to create a single, powerful revenue cycle management platform.

- PatientPing publishes a new case study, “Houston Methodist Coordinated Care Achieves Savings of Over $680,000 Within First Year of PatientPing Partnership.”

- PatientKeeper will exhibit at Hospital Medicine 2019 March 24-27 in National Harbor, MD.

- SymphonyRM releases a new e-book, “Competing in an Amazon World: Four-Step Action Plan for Health Systems.”

Blog Posts

- Healthcare Strategy for Patient Engagement & Patient Payments: If Hospitals Don’t Drive, Regulators Will (Loyale Healthcare)

- How this health system reduced readmission rates to meet CMS requirements (Experian Health)

- Better Patient Financial Care Requires More than Software (Patientco)

- Keep Patients Safe Through Prevention of Physician Burnout (Practice Velocity)

- How to manage bundled payments? Build a better post-acute care network (PreparedHealth)

- What can healthcare learn from Facebook’s new “privacy-focused vision for social networking?” (Redox)

- API 101 – An Introduction to APIs (Sansoro Health)

- 5 Signs You’re Not Ready to Sell Your Practice (WebPT)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates. Send news or rumors.

Contact us.

Your assessment of the Change Healthcare IPO appears to be off base.

First of all you seemingly scanned 200+ pages of their initial submission, which is complex, and does not include full information, including share price, shares offered, etc.

Second, what analysts are you referencing relative to $12 billion for a total entity value?? We can’t seem to track down any substantiating info on this valuation anywhere. Your “claim” puts the value at 4X revenues. Seems a bit strong, no matter what industry a firm may be in.

Third, the comp referenced for some of the leaders of Change appears to be misleading, Per a former colleague/friend who works there, all options are locked until multiple actions take place, and currently have a “discretionary” value of $2400, as reported in the SEC filing, until further notice. From what’s been shared, $2400/share is little more than a placeholder. You apply this value to options granted “or read the final column on the estimated exec comp page” to report the values provided.

While it’s not arguable around management structure, i think it would be beneficial to those inside and outside of the industry that you fully assessed the sec.gov posting and commented appropriately with more attention to the full detail and facts. Normally we find your posts to be pretty insightful, but you seemed to be anxious to get something posted today and your post didn’t appear to exhibit any evidence of you digging into specifics, as available via sec.gov.

Disclaimer: I don’t work for Change but do work in the securities industry….My firm is not associated to the proposed ipo.

I did exactly that — scanned the 200-page document. I don’t have the knowledge or interest to dissect it in forensic detail and the real story is the obvious one — the company has filed for an IPO. The $12 billion number (I’m not claiming it, just citing it) came from insiders and has been referenced 2,600 times per a Google search, including this original report from Reuters:

https://www.reuters.com/article/us-change-health-ipo/mckessons-change-healthcare-hires-ipo-underwriters-sources-idUSKCN1MD2TJ

The $12 billion valuation means little anyway, obviously, since it’s just a placeholder until the percentage ownership of the $100 million IPO is acknowledged and/or share trading actually starts. But expert analysis is always welcome.