Move your quotes to where they should be and it's no longer politics-in-the-blog, but instead a fact that's true at…

Monday Morning Update 12/4/17

Top News

CVS will buy Aetna for $69 billion.

Unanswered questions:

- Will the federal government approve the deal given its reluctance to allow big insurers to buy each other, especially since CVS has a strong pharmacy benefits management business in CVS Caremark and both companies have specialty pharmacy operations?

- How will CVS structure the combined companies to use its newfound vertically integrated clout?

- How will CVS’s pharmacy relationships with competing insurers be affected?

- What actions will diehard competitor Walgreens take or what acquisitions might it consider?

- Was the proposed acquisition driven by Amazon’s interest in the prescription drug and/or durable medical equipment business or will this transaction increase that interest?

HIStalk Announcements and Requests

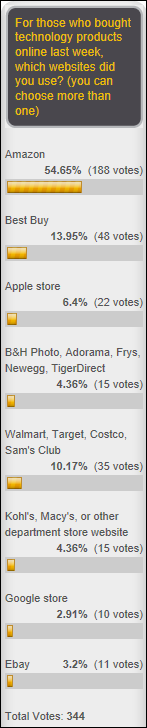

Black Friday shoppers hit Amazon hard for electronics, with Best Buy landing an anemic second and the other online retailers sucking wind.

New poll to your right or here, for male readers: do you fear that past incidents could result in a new sexual harassment claim being made against you? The poll is anonymous, as always, and your comments are welcome. Recent headlines triggered me to review my past to make sure I wasn’t forgetting something that could have been misconstrued, leading me to think that others are similarly hoping they surface no repressed memories of previous impropriety.

Next week’s poll will ask women if they’ve experienced work-related sexual harassment or assault. Note: I considered making both of these polls gender-nonspecific, but my assumption is that most of the examples are male-on-female and I didn’t want to dilute the denominator.

Thanks to the following companies that recently supported HIStalk. Click a logo for more information.

This Week in Health IT History

One year ago:

- The House passes the 21st Century Cures Act.

- A CDC study finds that the number of families struggling to pay their medical bills dropped 22 percent in five years due to an improving economy and those newly insured via the Affordable Care Act.

- Allscripts acquires Australia-based Core Medical Solutions.

- China-based investors finalize their acquisition of Lexmark and announce plans to quickly sell off its software business, including the former Perceptive Software.

Five years ago:

- “Tricorder” company Scanadu announces plans to release consumer tools for vital signs, urinalysis, and saliva testing by the end of 2013.

- Reuters reports that several private equity firms have submitted revised takeover offers for Merge Healthcare.

- Constellation Software acquires Salar from Transcend Services, which had itself been acquired by Nuance.

- Vitera closes its hardware support business.

- Athenahealth announces plans to acquire Harvard’s Arsenal on the Charles complex in Watertown, MA for $169 million.

- CDC reports that 40 percent of office-based physicians use an EHR with at least basic functionality.

Ten years ago:

- Philips announces plans to acquire medical alarm and notification vendor Emergin.

- Dennis Quaid and his wife sue Baxter Healthcare for the Cedars-Sinai heparin overdose of their newborn twins.

- Siemens announces Invision 27.

- An entrepreneur offers a $10 million prize for developing software that can map the genetic codes of 100 people in 10 days for $10,000 or less per genome.

Last Week’s Most Interesting News

- Caring Voice Coalition, a drug co-pay charity, says it will likely shut down after HHS OIG finds that it sent patient data to its drug company supporters.

- Nuance turns in better than expected quarterly results as the actual financial impact of its June malware attack was less than it projected.

- Siemens Healthineers announces plans to go public on the German market in the country’s largest IPO in 20 years.

- Athenahealh names its third CFO of 2017.

- A newly unsealed lawsuit claims that Indiana hospitals falsely attested for $300 million in Meaningful Use money by failing to promptly provide patients with copies of their medical records.

Webinars

December 5 (Tuesday) 2:00 ET. “Cornerstones of Order Set Optimization: Trusted Evidence.” Sponsored by: Wolters Kluwer. Updating order sets with new medical evidence is crucial to improving outcomes, but coordinating maintenance for hundreds of order sets with dozens of stakeholders is a huge logistical challenge. For most hospitals, managing order set content is labor intensive and the internal processes supporting it are far too inefficient. Evidence-based order sets are only as good as their content, which is why regular review and updates are essential. This webinar explores the relationship between clinical content and patient care with an eye toward building trust among the clinical staff. Plus, we will demonstrate a new evidence alignment tool that can easily incorporate the most current medical content into your order sets, regardless of format, including Cerner Power Plans and Epic SmartSets.

Previous webinars are on our YouTube channel. Contact Lorre for information.

Here’s the recording of last week’s webinar titled “Making Clinical Communications Work in Your Complex Environment,” sponsored by PatientSafe Solutions.

Acquisitions, Funding, Business, and Stock

Nashville-based data management vendor Trinisys acquires Mica Health, which offers ambulatory EHR decommissioning services. Former Mica President Mike Justice will apparently stay on as Trinisys VP of business development.

Former GE CEO Jeff Immelt made some interesting comments on a conference stage last week:

- Companies offering healthcare point solutions are in for a rough ride since door-to-door sales in healthcare take 10-15 years.

- Immelt thinks AI will influence radiology practice, but says no great companies will focus exclusively on that.

- His shortest meeting ever (at five minutes) was driving to Epic and pitching the idea of GE buying part of Epic to Judy Faulkner, who simply replied, “No. No interest.” I can’t imagine a CEO in any industry who would have the brass to tell the CEO of GE to hit the bricks.

- GE considered acquiring Cerner, but didn’t think it was worth the $2 billion figure being bandied about (the company’s market cap has since risen to $23 billion). CERN’s market cap hasn’t been that low since early 2005, so GE’s acquisition interest must have been before then but after Immelt took the CEO job upon Jack Welch’s retirement in 2000.

- Hospital CEOs are still clueless about health IT and aren’t generating ROI, with the original goal being connectivity rather than value creation. He thinks they’ll gain interest in improving patient outcomes and value.

- Immelt said companies that started venture funds “have stunk at it,” admitting that they have been “company killers.” In healthcare, of course, GE’s direct acquisitions – which weren’t usually top-rated companies in the first place – gave it the “elephants’ graveyard” moniker as the place where previously good companies go to die.

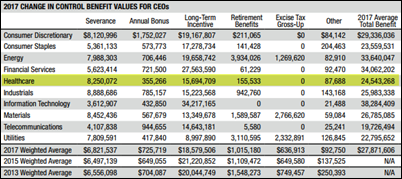

The average healthcare CEO who lost their job due to a merger or acquisition received a golden parachute of $25 million, much less than the $37 million average from a 2015 version of the same report. Dismissed trench warriors presumably were paid basically nothing for being cut loose through no fault of their own even though their need for income was probably much more acute than that of the aristocracy.

Decisions

- WellStar West Georgia Medical Center (GA) will switch from Meditech to Epic in 2018.

- St. Luke’s Hospital Cardiothoracic Surgery (MO) will switch from EClinicalWorks to Cerner Ambulatory EHR in July 2018.

These provider-reported updates are supplied by Definitive Healthcare, which offers a free trial of its powerful intelligence on hospitals, physicians, and healthcare providers.

People

New York Health + Hospitals hires Kevin Lynch (LA County Department of Health Services) as SVP/CIO.

Other

Here’s Vince’s look back 30 years at what was going on in health IT in December 1987, when George Michael’s “Faith” topped the charts and “Three Men and a Baby” foretold an epidemic of poor taste.

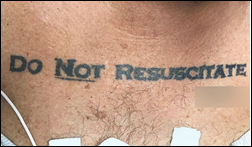

Weird News Andy titles this article “DNR, R, DNR, EXP.” A 70-year-old diabetic man with “Do Not Resuscitate” (emphasis his) tattooed on his chest shows up at a hospital ED with an elevated blood alcohol level. Doctors considered his tattooed instructions invalid and started an IV, but covered themselves by also conferring with an ethics consultant, who told them they should honor the man’s request. The doctors wrote a DNR order and eventually also located a copy he had filed with the state’s health department. Meanwhile, the man died without further intervention.

Sponsor Updates

- Deloitte names Definitive Healthcare to its Technology Fast 500 list of fastest-growing companies.

- Logicworks announces support for AWS Guard Duty, a new machine learning-based security service.

- Reaction Data publishes “Ideal Medical Imaging Trends 2017.”

- Surescripts will exhibit at the AHIP Consumer Experience & Digital Health Forum December 5-7 in Nashville.

- T-System President and CEO Roger Davis receives Dallas Magazine’s Excellence in Healthcare Award for achievement in medical technology.

- Huron releases a new video, “Transparency Empowers Healthcare Consumers.”

- Mazars USA expands its New York office with the addition of Elliot Horowitz & Company.

Blog Posts

- How to Leverage Big Data for Patient Care Management (Definitive Healthcare)

- What’s the Most Frustrating About EHRs? (Medicomp Systems)

- Introducing Patientco’s new COO, Mike Hersh (Patientco)

- Reducing Front-Desk Turnover (Navicure)

- Hospice: Hope in the Changing World of Healthcare (Netsmart)

- Save money and boost revenue with online self-service: Cincinnati Children’s Hospital case study (Experian Health)

- Giving Thanks (PatientSafe Solutions)

- Meeting MACRA’s call for care coordination through better communication (PerfectServe)

- 5 Future Marketing Trends of 2018 (Salesforce)

- The Future of Healthcare: New Obstacles and Ongoing Challenges (The SSI Group)

- The Most Legendary Doctors in Television History (Solutionreach)

- How to navigate RAPS-to-EDS revenue expectations (Verscend Technologies)

- Making interoperability a reality. (Voalte)

- 7 Tips for Secure BYOD in Healthcare (Vocera)

- 3 Benefits of a Managed SMS Provider You May Not Have Considered. (West Corp.)

- How Employee Wellness Programs can Leverage Technology (WiserTogether)

- It’s Time for a Pulmonary Hypertension Digital Revolution (ZappRx)

- Healthcare’s new era: Why administrative healthcare data is key (Conduent Health)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne, Lt. Dan.

Get HIStalk updates. Send news or rumors.

Contact us.

Given GE’s track record in buying IDx, BDM, at al, imagine how well GE could have ‘screwed-up’ Epic. Not only did Judy make the right decision for Epic, but saved alot of clients a decade of stress and consternation.

Re: GE and Epic

It was a good decision, and I’m not sure it took too much “brass”. Jack Welch has been lionized for so long that people have had some trouble seeing how he made a number of decisions that may have created some short-term profits, but over the long-term have put GE on a long, slow decline. And some, like GE Capital, that almost destroyed the company.

There was a lot to be wary about regarding Welch and GE at the time Judy had this conversation, and there’s a lot to be disgusted about today in terms of how he’s personally enriched himself at GE’s expense.

I don’t want to make the same mistake of lionizing Judy. This was probably a decision more about her not wanting to cede any control, which is an impulse that is at the heart of many mistakes that Epic makes, just as it’s at the heart of many of its better moves. She doesn’t see the future perfectly and there are some decisions she’s taken that aren’t exactly a paragon of ethics, either. This was nonetheless the right decision for Epic. GE would have wrecked the company, where at least the road that was taken gave Epic a chance to be the market leader for the past many years.

With Kevin replacing Ed Marx as an employed (rather than contracted) CIO at NYCHHC; I guess the rule that Epic sites can only hire Epic experienced CIOs is broken. LA County Healthcare (Kevin’s current employer since 2010) has been all in on Cerner for some time. Thought that rule was idiotic anyway.