Readers Write: Tax Rebate? Insurance rebate!

Tax Rebate? Insurance rebate!

By Richard Gengler

Now that tax season is in full swing and the eventual rebate is around the corner, it is an ideal time to think about another kind of rebate. This one stems from the changes in healthcare policy with the Affordable Care Act (ACA) with the increasing push of the triple aim of improved patient experience, improving the health of populations, and reducing the per capita cost of healthcare.

With the individual markets becoming the fastest-growing part of the payer sector and increasingly competitive, payers are searching for any potential leverage to obtain, retain, and grow their membership base. There is more discussion on the importance of net promoter score (NPS), whereby payers can utilize their existing members to act as promoters.

By utilizing new innovations and alternative service modalities, insurance companies are able to hit all three parts of the triple aim. Almost on a daily basis we are hearing about innovations that have greater than 90 percent user satisfaction rates and significantly having positive impact on population health at potentially a fraction of the cost.

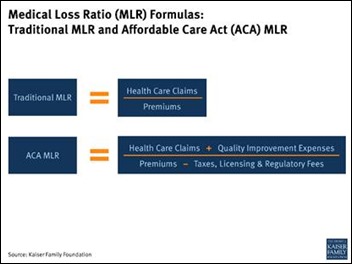

Health plans are required to have an 80 percent or 85 percent medical loss ratio (MLR), meaning that they spend this amount of the premiums they collect on medical expenses. The rest can be used for administrative, profit, and marketing. Any difference in this percentage must be refunded to the members, according to law. Great idea, but does this actually work?

Looking back to 2014, there are plentiful insurers offering rebates to their members in a wide variety of markets from individual, small group, and large group. Take, for instance, Celtic Insurance Company in Arkansas, which had $6,774,488 in rebates to its individual market. Or how about California Physicians Service ,with an astounding $21,819,095 for its small group market. In the large group market, Cigna Health and Life Insurance Company of DC sent back $5,608,359.

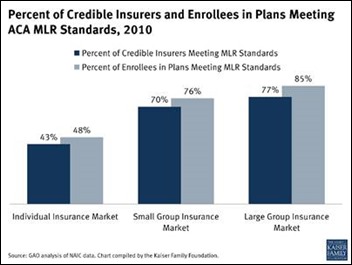

One would think this is an opportunity to fully engage and grow membership. Data from the Kaiser Family Foundation shows that many insurance companies are not meeting the medical loss ratio standards. This signals a missed opportunity.

To calculate the MLR is quite simple.

Let’s take, for instance, a population of 3 million Americans using a service that traditionally costs $1,751 per person per year. If there was an alternative service modality that is clinically equivalent for $30, this would create a savings of $1,721 and a percentage difference of 98 percent. If the premiums and other elements remain the same, this could be extrapolated out to provide bountiful rebates to the members.

Next time you are thinking about innovative strategies to increase the NPS of your members while increasing membership, think about your taxes. Your members will thank you, tell their friends, and increase your membership.

Richard Gengler is founder and CEO of Prevail Health of Chicago, IL.

Hard agree, and not just because I'm a spreadsheet nerd. Why are we all here? Isn't it in the service…